crypto blog

Cosmos Hub postpones vote date following white paper revision

An updated version of the Cosmos Hub white paper went live on October 29, with the community now set to vote on the document. According to the project, concerns related to the issuance model of Cosmos (ATOM) were addressed in the new revision, among other issues. The paper’s first version was published in September, proposing a redesigned Hub focused on strengthening interoperability and security, along with key changes to its token, with a new issuance model aiming to strike a better balance between ecosystem growth and interchain adoption, “while still preserving the security afforded by the original regime,” according to the white paper. Community members raised concerns about the token’s newly proposed issuance model by Sam Hart, strategy lead of the Cosmos Hub, cl...

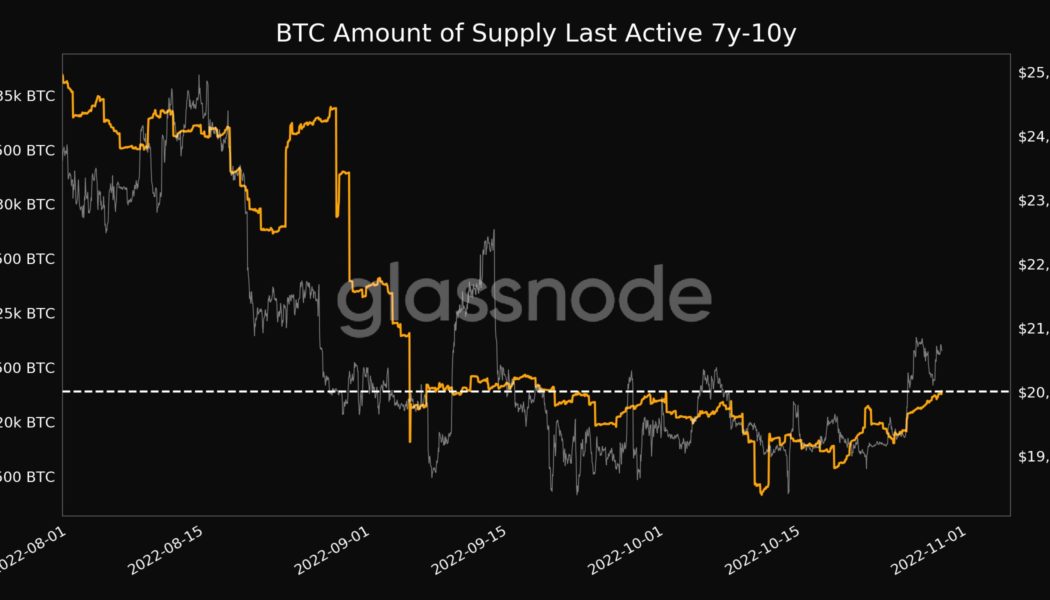

Bitcoin metric warns of $21K profit-taking as decade-old BTC wakes up

Bitcoin (BTC) asleep for up to a decade is waking up this week as BTC price action sees six-week highs. Data from on-chain analytics firm Glassnode shows some of the oldest “dormant” Bitcoin returning to circulation. BTC trends out of hibernation As BTC/USD stages something of a comeback in the second half of October, hodlers are changing their behavior after a year-long bear market. According to Glassnode, the number of Bitcoin previously stationary in their wallet for 7-10 years but not active again reached a one-month high on Oct. 29. This is in fact the latest in a series of such highs, with the previous one seen on Oct. 1. BTC amount of supply last active 7-10 years ago chart. Source: Glassnode/ Twitter Further numbers reveal that the unspent transaction outputs (UTXOs) in profit reac...

Dogecoin price rallies 150% in 4 days, but DOGE now most ‘overbought’ since April 2021

The Dogecoin (DOGE) price rally extended further on Oct. 29 in hopes that the cryptocurrency would get a major boost from Elon Musk’s Twitter acquisition. Elon Musk boosts Dogecoin price again Dogecoin price jumped by nearly 75% to reach $0.146 on Oct. 29, the biggest daily gain since April 2021. DOGE/USD daily price chart. Source: TradingView Notably, the meme-coin’s massive intraday rally came as a part of a broader uptrend that started earlier this week on Oct. 25. In total, DOGE’s price gained 150% during the Oct. 25-29 price rally. The surge was also accompanied by a decent increase in its daily trading volumes. That coincided with a spike in the number of DOGE transactions exceeding $100,000, according to Santiment. Both indicators sugges a growing demand for Dogeco...

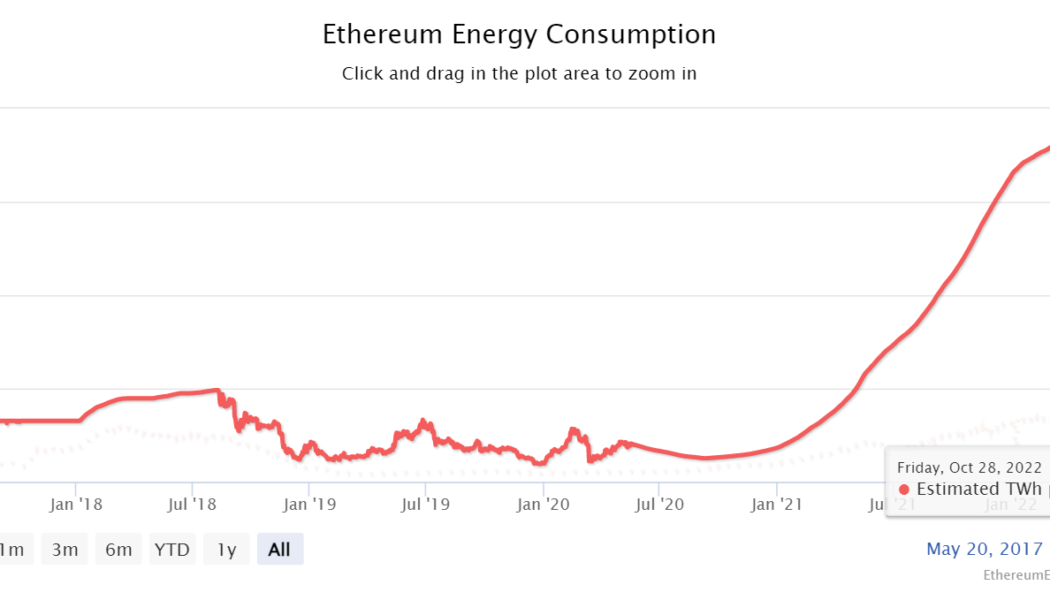

The Merge brings down Ethereum’s network power consumption by over 99.9%

The Merge, which is considered one of the most significant blockchain upgrades on Ethereum (ETH) to date, brought down the network’s energy consumption by 99.9% immediately. On Sept. 15, the Ethereum blockchain migrated from proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism in an effort to transition into a green blockchain. What followed was an immediate and steep drop in total energy consumption of the Ethereum network. The Ethereum Energy Consumption Index. Source: digiconomist.net Before the Merge upgrade, in 2022, the energy consumption of Ethereum ranged between 46.31 terawatt hour (TWh) per year to 93.98 TWh per year. The lowest energy consumption for Ethereum was recorded on Dec. 26, 2019, at 4.75 TWh per year. The estimated annual energy consumption in TWh/yr ...

Bitcoin hits new 6-week high as Ethereum liquidates $240M more shorts

Bitcoin (BTC) attempted to retake $21,000 on Oct. 29 as weekend trading began on a strong footing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar lurks as BTC price rebounds Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it rebounded overnight to local highs of $21,078 on Bitstamp — enough to clinch new six-week highs. The pair had seen a consolidatory phase ensue after its first trip to the $21,000 mark, the first time it had traded above $21,000 since Sep. 13. The subsequent retracement was modest in character, Bitcoin not even testing $20,000 before reversing higher once more. The end of the Wall Street trading week saw BTC price action follow United States equities, the S&P 500 and Nasdaq Composite Index finishing Oct. 28 up 2.5% and 2.9...

How to earn passive crypto income with Ethereum?

The cryptocurrency market is incredibly volatile, which can be both good and bad for investors and traders. Volatility creates opportunities for making profits, but it can also lead to losses. Passive income strategies, however, could be handy in offsetting these losses. Passive income strategies offer investors and traders opportunities to earn profits, even during challenging market conditions such as bear markets. For those investing in Ether (ETH), or any crypto in general, earning passive crypto income provides a way to cover market crashes and downturns. Hodling used to be the primary way to earn interest on one’s crypto assets. But, with the rise of decentralized finance (DeFi) protocols, there are now many ways to earn interest on Ether and DeFi protocols. This article is a g...

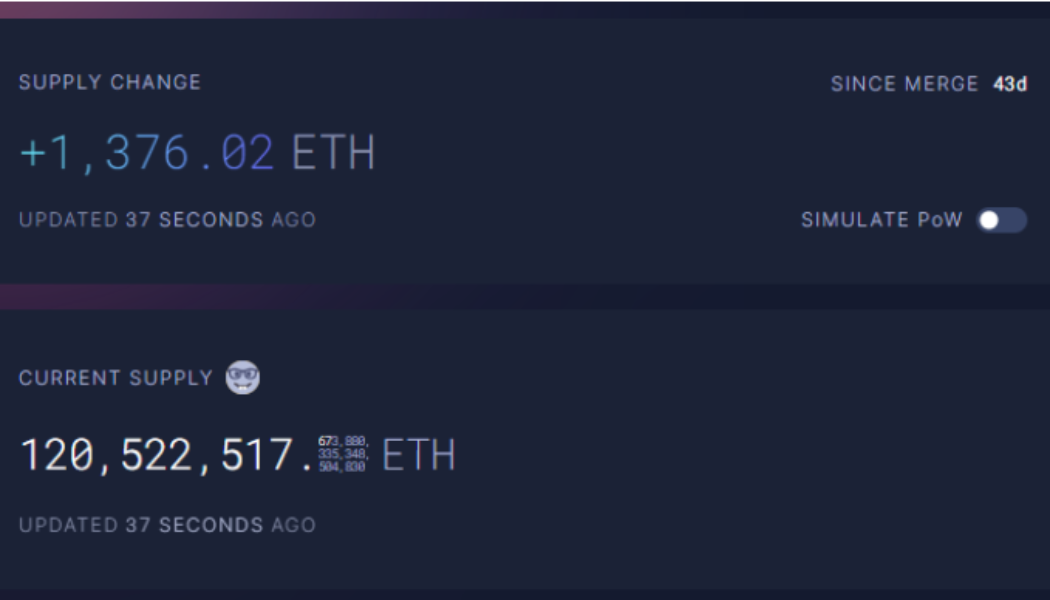

Here is why strong post-Merge fundamentals could benefit Ethereum price

The shift of the Ethereum blockchain to a proof-of-stake (PoS) protocol opened new opportunities for developers and investors to explore, including the burning of Ether (ETH). Now, Ethereum transactions are validated through staking rather than mining. Staking impacts the supply and price dynamics of Ether in ways that are different than mining. Staking is expected to create deflationary pressure on Ether, as opposed to mining, which induces inflationary pressure. The increase in the total amount of funds locked in Ethereum contracts could also push ETH’s price up in the long term, as it affects one of the fundamental forces that determine its price: supply. The percentage of newly issued Ether versus burned Ether has increased by 1,164.06 ETH since the Merge. This means that sin...

Compound pauses 4 tokens to avoid price manipulation: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. After the Mango Markets exploit last week, Compound protocol paused the supply of four tokens as lending collateral to protect it against any price manipulation. Crypto staking protocol Freeway said one of its trading strategies “appears to have failed,” forcing the firm to halt services earlier this week. October continues to be dominated by DeFi hacks as another DeFi lockup protocol, Team Finance, lost $14.5 million during contract migration, despite an audit clearance. MakerDAO community voted to approve the custody of $1.6 billion USD Coin (USDC) with the institutional brokerage platform Coinbase Prime. The to...

UK Prime Minister Rishi Sunak’s win was a victory for crypto

A former investment banker turned savvy politician, Rishi Sunak has had an incredibly prolific career in just a short period of time. At only 42, he has served as a member of the United Kingdom’s Parliament, chief secretary to the treasury and chancellor of the exchequer — and now, he’s starting his tenure as prime minister. As the youngest PM to take office in the U.K. in more than 200 years, Sunak has something else in common with his millennial peers: He is a crypto enthusiast. In fact, as a recent Bank of America survey found, “Younger investors are choosing to allocate significantly more of their portfolios to crypto” than their older counterparts. Additionally, those in the 21–42 age bracket are “more likely to believe crypto offers the greatest opportunities for growth” and al...

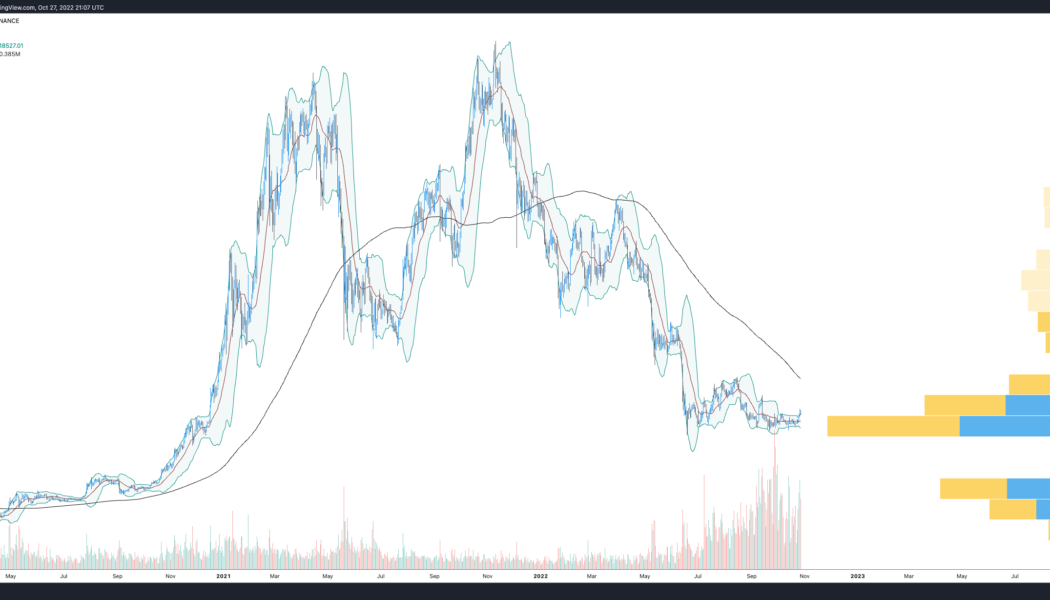

Bitcoin price broke out this week, but has the trend changed?

Welcome readers, and thanks for subscribing! The Altcoin Roundup newsletter is now authored by Cointelegraph’s resident newsletter writer Big Smokey. In the next few weeks, this newsletter will be renamed Crypto Market Musings, a weekly newsletter that provides ahead-of-the-curve analysis and tracks emerging trends in the crypto market. The publication date of the newsletter will remain the same, and the content will still place a heavy emphasis on the technical and fundamental analysis of cryptocurrencies from a more macro perspective in order to identify key shifts in investor sentiment and market structure. We hope you enjoy it! Time to go long? This week, Bitcoin’s (BTC) price has perked up, with a surge to $21,000 on Oct. 26. This led a handful of traders to proclaim that the bo...