crypto blog

NFT vending machine to make digital art more accessible at London event

Multi-chain nonfungible token (NFT) marketplace myNFT has announced it will showcase its first-ever physical NFT vending machine at this year’s NFT.London event scheduled for Nov. 2–4. The NFT platform hopes to provide an easy and accessible way for people who want to start buying and trading digital assets without needing deep knowledge of the Web3 industry. The vending machine will allow users to purchase an NFT without owning a digital wallet. Users who want to purchase an NFT through myNFT’s vending machine will need to select one of the envelopes on display, and then key in the code provided. After paying, they’ll be able to scan the QR code in the envelope, which will come with an invitation to set up a myNFT account, complete with an NFT wallet, in which they’ll receive ...

United Kingdom banks hate crypto, and that’s bad news for everyone

In 2018, the United Kingdom’s Financial Conduct Authority (FCA) wrote to the heads of the country’s biggest high street banks to emphasize the importance of due diligence when dealing with crypto businesses. That seems to have led to widespread high-risk ratings and bans on crypto-related banking, impacting both crypto businesses hoping to operate in the U.K. and investors alike. Banks are, understandably and responsibly, concerned with scams, but the current situation creates uncertainty. Crypto investors need to be able to move their money around as they like, and crypto businesses need access to payment rails for a variety of other reasons, such as paying staff and suppliers. A catch-22 that harms market competition By barring crypto businesses from accessing “mainstream” banking, organ...

Bitcoin analysts map out the key bull and bear cases for BTC’s price action

Research has detailed Bitcoin’s recent record-low volatility and, while traders expect an eventual price breakout, the Oct. 26 BTC price move to $21,000 is not yet being interpreted as confirmation that $20,000 has now become support. In a recent “The Week On-chain Newsletter,” Glassnode analysts mapped out a bull case and a bear case for BTC. According to the report, the bear case includes limited on-chain transaction activity, stagnant non-zero address growth and reduced miner profits presenting a strong Bitcoin sell-off risk, but data also shows that long-term hodlers are more determined than ever to weather the current bear market. The bull case, on the other hand, entails an increase in whale wallets, outflow from centralized exchanges and hodling by longer-term investors. Stall...

SushiSwap to create three DAOs in Panama and Cayman in business restructuring

The Sushi DAO, the decentralized autonomous organization behind crypto exchange SushiSwap, has approved a legal restructuring on Oct. 26 that creates three new decentralized entities, aiming to provide more flexibility to its operations. The proposal, which received 100% votes in favor, will create the DAO Foundation, Panamanian Foundation, and Panamanian Corporation, each serving different purposes. Among other things, the DAO Foundation will be able to administer treasury, grants and on-chain governance processes, and facilitate proposals and voting. The Panamanian Foundation will administer the existing Sushi protocol (including smart contracts related to the automated market maker/orderbook, Kashi and staking). Finally, the Panamanian Corporation will operate the graphical user interfa...

Prometheum partners with Anchorage Digital on SEC-registered alternative trading system

Prometheum Ember ATS announced the launch of its alternative trading system (ATS) on Oct. 26. The new ATS is registered by the United States Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority. Prometheum Ember ATS will offer digital asset securities trading, clearing, settlement and custody. The new ATS has partnered with Anchorage Digital Bank to help it provide its service, which is meant to “seamlessly integrate with legacy securities trading systems.” Prometheum stated that its ATS “enables institutions to trade digital asset securities under Federal Securities Laws.” It will initially support digital assets Flow, Filecoin, The Graph, Compound and Celo. Prometheum founder and co-CEO Aaron Kaplan said in a statement: “Prometheum sets ...

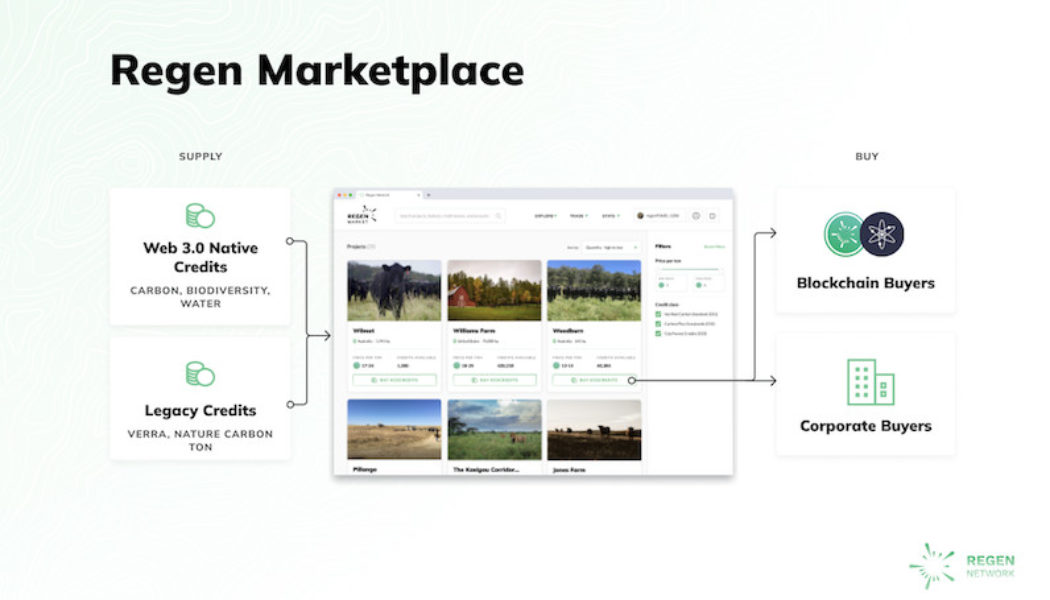

Carbon Offsetting for Blockchains & Beyond: Regen Network Launches Carbon Marketplace

California, United States, 26th October, 2022, Chainwire Regen Network Development released its marketplace application for tokenized carbon and ecological assets, Regen Marketplace. Regen Network allows carbon project developers to originate high-quality nature-based carbon credits to markets, catalyzing regenerative finance solutions to the climate crisis. Regen Marketplace takes advantage of Regen Ledger, the application-specific blockchain which brings transparency and public governance to voluntary carbon markets, built on the CosmosSDK. Regen Marketplace is a blockchain platform for the origination, governance, and exchange of tokenized ecological assets. Climate impact projects can define, manage, mint, and sell tokenized carbon and other ecological assets in the blockchain-based re...

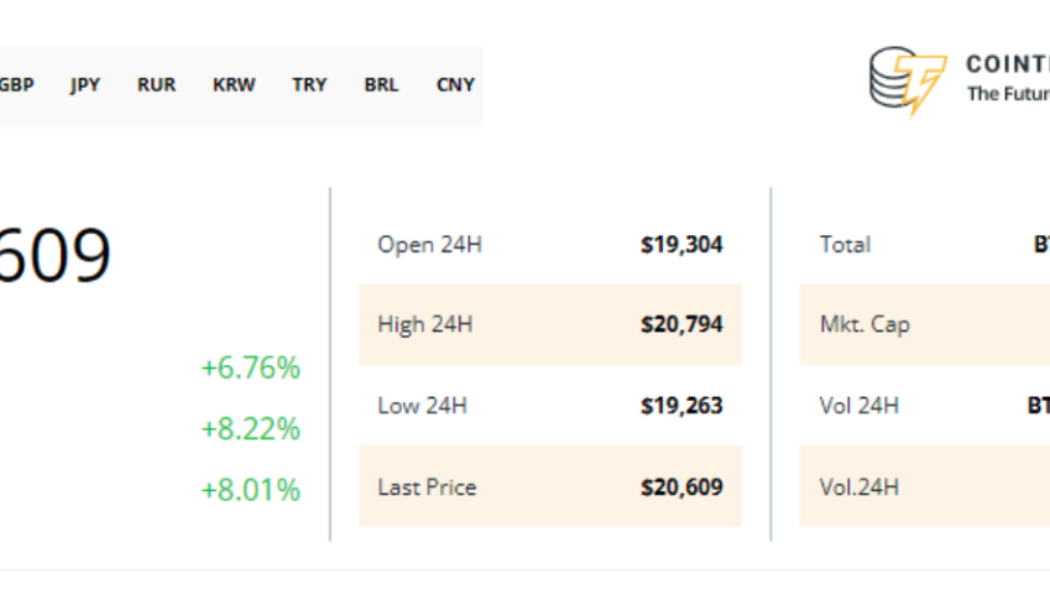

Bitcoin price reaches $21K as crypto market cap nears $1T

Bitcoin (BTC) returned to $21,000 for the first time since September after the Oct. 26 Wall Street open as buyers solidified gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls “eat” ask liquidity Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it hit local highs of $21,012 on Bitstamp. At the time of writing, the pair continued to explore territory out of reach for over six weeks. Liquidations also kept flowing, with the past 24 hours delivering $750 million in liquidated positions on Bitcoin alone, according to data from Coinglass. Cross-crypto liquidations totaled $1.43 billion, adding to what was already the highest tally in 2022 so far. Crypto liquidations chart. Source: Coinglass The impetus did not come from United States equities on ...

Report: Vast majority of blockchain energy studies ‘lack scientific rigor’

According to a new preprint conducted by researchers at the Open Universiteit, University of California Berkley, and Radboud University, the vast majority of literature on blockchain energy use from both academic and everyday sources “lacks the scientific rigor expected from a mature scientific field.” The report analyzed 128 scientific and open-source studies related to carbon emissions of blockchains such as Bitcoin. Researchers then found that an astonishing 34% of studies did not even possess an explicit research design. Meanwhile, 43% of studies did not share data, while 67% did not share source code. Finally, 79% of studies had no discussions about the reliability of external data. Several notable fallacies across studies were discovered by researchers in their analysis. ...

UK police council reports there are officers in every unit trained for crypto enforcement

The detective chief superintendent for the United Kingdom’s National Police Chiefs’ Council has said all police forces in the country have officers trained for investigations involving the enforcement and seizure of cryptocurrencies. In an Oct. 25 parliamentary debate on the U.K. Economic Crime and Corporate Transparency Bill, Andy Gould of the NPCC said that the country’s police force had the capability to address economic crimes involving crypto, but not the capacity. He reported that the authorities had used £100 million — roughly $116 million at the time of publication — over the last four years to create “cryptocurrency tactical advisers across the whole of policing.” “There are now officers in every force and every regional organised crime unit who are trained and equipped to [invest...

Is MATIC price about to double? Polygon’s Reddit hype pushes exchange balance to 9-month lows

A sharp rebound in the Polygon (MATIC) market in the last four months has increased its price by 200% when measured from its June 2022 bottom of $0.31. And now, the token is showing signs of undergoing another major market rally. MATIC exchange balance hits nine-month low Notably, the MATIC supply held by all crypto exchanges fell to 802.15 million on Oct. 26, its lowest level since January 2022. The plunge came as a part of a broader downtrend that has witnessed over 600 million MATIC leaving exchanges in the last four months, data on Santiment shows. MATIC balance on exchanges versus price. Source: Santiment A declining crypto balance across exchanges is perceived as bullish by the market since traders typically withdraw their funds from trading platforms when they want to hold the token...

Bitcoin liquidates over $1 billion as BTC price hits 6-week highs

Bitcoin (BTC) saw its highest levels since mid-September on Oct. 26 as BTC/USD approached the pivotal $21,000 mark. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bears lose big as Bitcoin climbs Data from Cointelegraph Markets Pro and TradingView showed the pair tackling $20,700 at the time of writing, up over 7% in 24 hours. What began as an assault on $20,000 continued on the day, liquidations mounting further after already sealing the biggest shorts obliteration of 2022. According to data from analytics resource Coinglass, Bitcoin alone accounted for $550 million in liquidations in the past 24 hours. $704 million in cross-crypto shorts were liquidated on Oct. 25, with the Oct. 26 tally so far standing at $275 million. Including long positions, the total was over $1 billion...