crypto blog

Unsung hero saves DeFi protocol from potential exploit: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The last week’s headline was dominated by some of the biggest hacks in DeFi. This week is redemption time for many DeFi protocols that either averted an attempted hack or got a significant chunk of their stolen funds back. The BitBTC bridge reportedly had a bug that would essentially allow an attacker to mint fake tokens on one side of the bridge and swap them for real ones. However, one Twitter user was able to foresee the vulnerability and informed the cross-bridge platform about it. The Moola Market attacker has scored about a half-million dollar “bug bounty” after choosing to return a majority of the cryptocur...

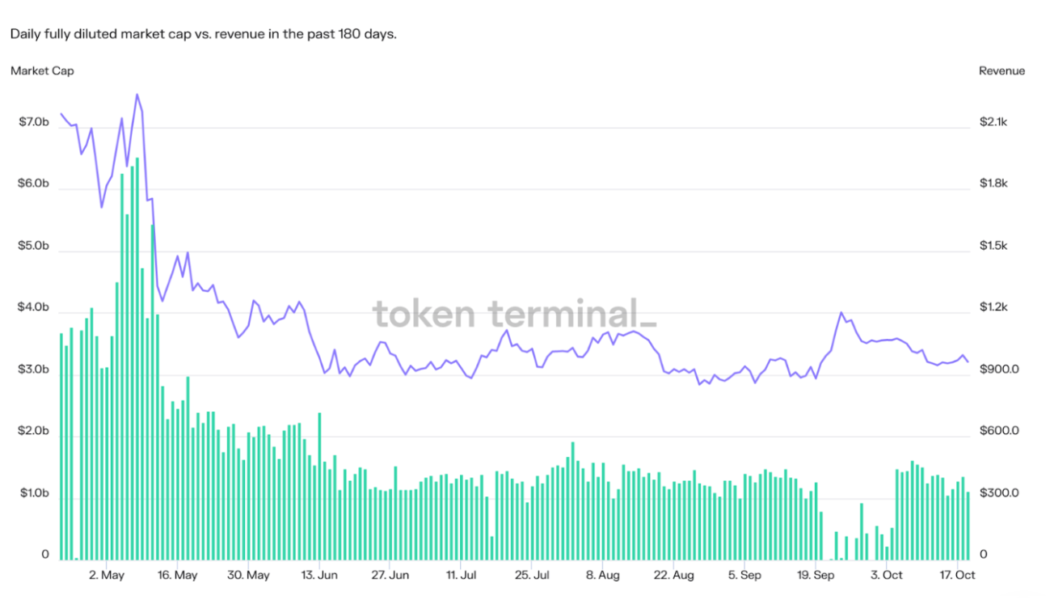

3 reasons why DeFi investors should always look before leaping

Welcome readers, and thanks for subscribing! The Altcoin Roundup newsletter is now authored by Cointelegraph’s resident newsletter writer Big Smokey. In the next few weeks, this newsletter will be renamed Crypto Market Musings, a weekly newsletter that provides ahead-of-the-curve analysis and tracks emerging trends in the crypto market. The publication date of the newsletter will remain the same, and the content will still place a heavy emphasis on the technical and fundamental analysis of cryptocurrencies from a more macro perspective in order to identify key shifts in investor sentiment and market structure. We hope you enjoy it! DeFi has a problem, pump and dumps When the bull market was in full swing, investing in decentralized finance (DeFi) tokens was like shooting fish in a ba...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...

Hong Kong unveils completed retail CBDC project that has a CBDC-backed stablecoin

The Hong Kong Monetary Authority presented its completed Aurum retail central bank digital currency (CBDC) prototype on Oct. 21. The system, developed in conjunction with the Bank for International Settlements (BIS) Innovation Hub, has a unique structure that reflects the intricacies of the existing system for issuing money in Hong Kong. Aurum consists of a wholesale interbank system and retail e-wallet. The e-wallet is created at a local bank and has a smartphone interface. A validator system prevents bank over-issuance and user double redemption. The intermediated retail CBDC is used in the e-wallets, and CBDC-backed stablecoins are used in the interbank system. The unusual CBDC-backed stablecoins digitally mirror Hong Kong’s existing currency system, in which bank notes are issued by th...

Polkadot co-founder Gavin Wood steps down as CEO of Parity

Gavin Wood, the co-founder of Polkadot, is stepping down as the CEO of blockchain infrastructure company Parity Technologies. Parity is the development company behind the Polkadot ecosystem. In a statement released on Oct 21, Wood shared that he never desired the CEO role. Although he could act as one for an interim period, it was not a position where he saw himself finding “eternal happiness.” Wood shared: “Anyone who has worked with me knows where my heart lies. I’m a thinker, coder, designer, and architect. Like many such people, I work best asynchronously.” He added: “A good CEO needs to be available to others on a far more continuous basis. They need to enjoy representing the company, both internally and externally. They need to not be bothered by large swathes of their time bec...

Global recession may last until near 2024 Bitcoin halving — Elon Musk

Bitcoin (BTC) may spend the time until its next block subsidy halving battling recession, Elon Musk suggested. In a tweet on Oct. 21, the Tesla CEO revealed his belief that the world would only exit recession in Spring 2024. Musk: Recession will “probably” stay until Q2, 2024 After the United States entered a technical recession with its Q3 GDP data, debate continues over how much worse the scenario could get. For Musk, while long predicting the United States economy would enter a recession, the likelihood of a global downturn lingering is now real. Asked on Twitter how long he considered a recession to last, the world’s richest man was noncommittal, but erred on the side of years rather than months. “Just guessing, but probably until spring of ‘24,” he wrote, having also said that “it sur...

Low hash price, soaring energy costs spell tough Q3 for Bitcoin miners

Energy problems in North America and Europe and prevailing market conditions have spelled another bleak quarter for Bitcoin (BTC) mining operators on both continents. The latest Q3 mining report from Hashrate Index has highlighted several factors that have led to a significantly lower hash price and higher cost to produce 1 BTC. Hash price is the measurement used by the industry to determine the market value per unit of hashing power. This is measured by dividing the dollar per terahash per second per day and is influenced by changes in mining difficulty and the price of BTC. As Hashrate Index reports, Bitcoin’s hash price was afforded some reprieve in the middle of Q3 as heat waves during the American summer led to a drop in hash rate, which corresponded with a slight BTC price recov...

Not like China: Hong Kong reportedly wants to legalize crypto trading

Hong Kong is taking action to regain its status as a global cryptocurrency hub by launching several legal initiatives related to the crypto industry. A city and special administrative region of China, Hong Kong is willing to distinguish its crypto regulation approach from the blanket crypto ban in mainland China. The government of Hong Kong is considering introducing its own bill to regulate crypto in its own China-free way, according to Elizabeth Wong, head of the fintech unit at the Securities and Futures Commission (SFC). One of the SFC’s initiatives is allowing retail investors to “directly invest into virtual assets,” Wong said during a panel held by InvestHK, the South China Morning Post reported on Oct. 17. Such an initiative would mark a significant shift from the SFC’s stance over...

OpenSea revises NFT rarity ranking protocol after community feedback

While giving rarity ranks to nonfungible tokens (NFTs) on a marketplace may help collectors decide on whether to purchase NFTs or not, some argue that ranking NFTs may do more harm than good. In a tweet, an NFT investor pointed out several issues surrounding OpenRarity, the new rarity ranking protocol implemented by NFT marketplace OpenSea. According to the community member, putting “rank” in the NFT listing with no mention of “rarity” anywhere could be misleading. Taking the Moonbirds NFT collection as an example, the community member argued that since the collection enabled the OpenRarity ranking protocol, it destroyed its own market-driven rarity structure, making every single NFT a “floor Moonbird.” The NFT collector also called out Kevin Rose, the CEO of Proof, the creators of M...

Government crackdowns are coming unless crypto starts self-policing

Self-regulation will be critical in governing the rapidly changing landscape of the cryptocurrency industry in order to preserve its autonomous, decentralized nature. Months after the collapse of the Terra ecosystem that propelled crypto’s market capitalization below $1 trillion, the industry is beginning the long process of rebuilding not only retail trust but also faith in itself. Current market conditions are in part due to structural weaknesses in smart contracts, models and governance processes. This is made evident by the many hacks and exploits that have taken place this year and the ballooning of projects with flawed tokenomics and that are governed through dubious operations. The implementation of stricter self-regulatory standards will be necessary for the industry to build...

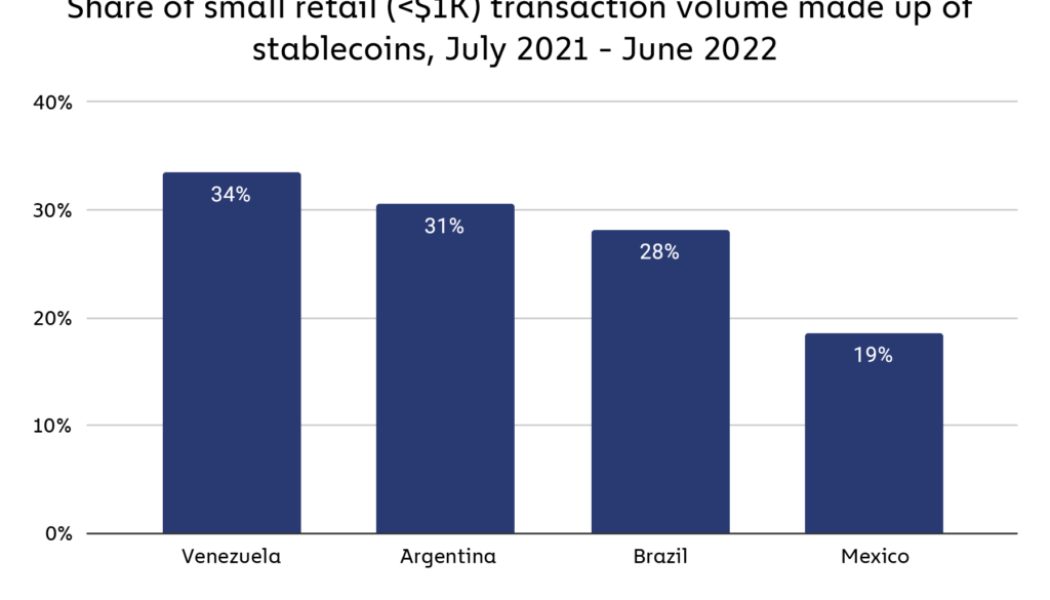

Remittances drive ‘uneven, but swift’ crypto adoption in Latin America

Remittance payments, fiat fears, and profit-chasing have been the three most significant drivers of crypto adoption in Latin America, according to a new report. The seventh-largest crypto market in the world saw the value of cryptocurrencies received by individuals rocket 40% between July 2021 to June 2022, reaching $562 billion, according to an Oct. 20 report from Chainalysis. Part of the surge was attributed to remittances, with the region’s overall remittance market estimated to have reached $150 billion in 2022. Chainalysis noted that crypto-based service adoption was “uneven, but swift.” The firm pointed to one Mexican exchange operating in the “world’s largest crypto remittance corridor” which processed over $1 billion in remittances between Mexico and the Unite...