crypto blog

5 altcoins that could be ripe for a short-term rally if Bitcoin price holds $19K

The S&P 500 and the Nasdaq Composite fell to a new year-to-date low last week and closed the week with a loss of 1.55% and 3.11%, respectively. The scenario changed drastically on Oct. 17 after the earnings, season ramped up and a sharp policy reversal from U.K. Finance Minister Jeremy Hunt added detail to the government’s plan to fix his predecessor’s (Kwasi Kwarteng’s) fiscal package, which had triggered a record fall in the value of the GBP and a near liquidation of pension plans in the United Kingdom. At the time of writing, the Dow is up 1.78%, while the S&P 500 and Nasdaq present 2.57% and 3.26% respective gains. Meanwhile, Bitcoin (BTC) has managed to stay well above its year-to-date low showing short-term outperformance. Some analysts expect that Bit...

New allegations arise regarding Binance’s regulatory framework

On Oct. 17, a new report published by Reuters alleged that cryptocurrency exchange Binance “swerved scrutiny” from regulators in the United Kingdom and the United States. The main spearhead of the allegations arises from two supposed incidents in its operating history. First, Reuters wrote of Binance strategy executive Zoe Wei’s proposal to backdate a service agreement relating to various operations between Binance’s U.K. unit and Binance’s Cayman Islands holding company on March 11, 2020. The move allegedly allowed Binance to exempt itself from registration with the country’s Financial Conduct Authority for one year, as any firm operating before January 10, 2020, could do so before new regulations came into place. Second, Reuters reported that Harry Zhou, a Binance-affiliated entrep...

Société Générale progresses in crypto space with digital asset services registration

The French stock market regulator, the Autorité des Marchés Financiers (AMF), approved France’s Société Générale bank as a digital assets service provider (DASP) on Sept. 27. Société Générale joined international operators such as Voyager, Bitpanda, Binance and Etoro as registered DASPs. The bank did not announce its approval. Société Générale’s digitally focused Forge subsidiary was registered to provide digital assets custody, the purchase/sale of digital assets for legal tender and the trading of digital assets against other digital assets. The French bank announced in June that it was partnering with Metaco, a digital asset management and infrastructure provider, to develop its digital asset custody operations. Registration is mandatory for companies to carry out those activities...

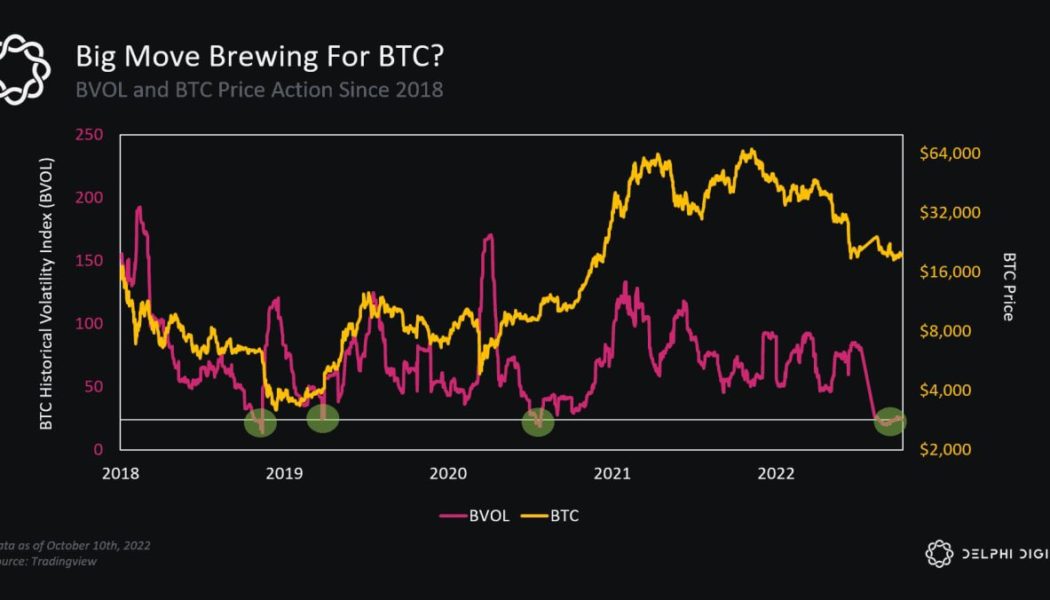

‘Get ready’ for BTC volatility — 5 things to know in Bitcoin this week

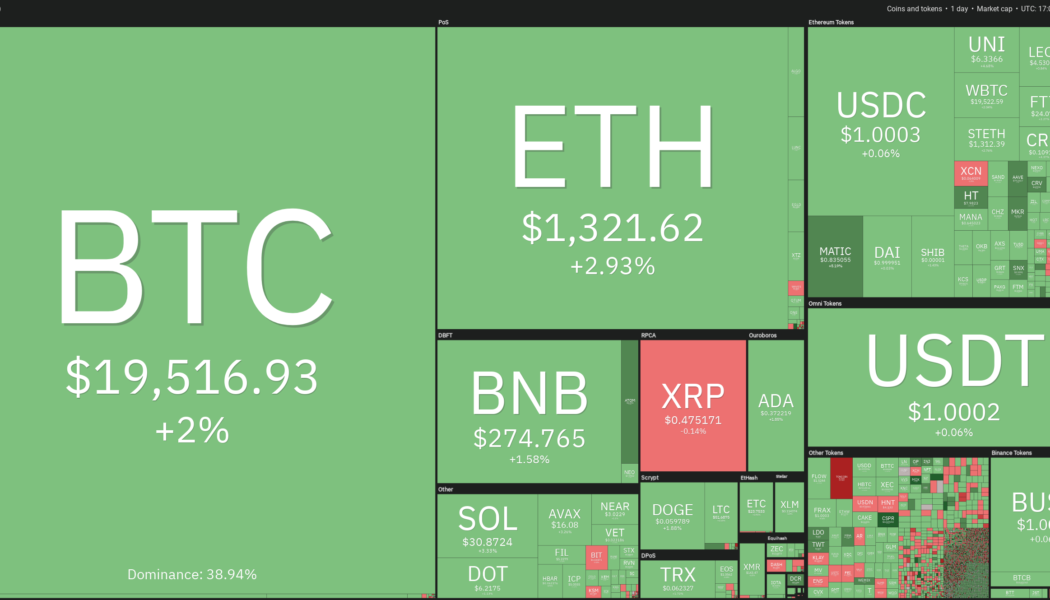

Bitcoin (BTC) starts a new week keeping everyone guessing as a tiny trading range stays in play. A non-volatile weekend continues a familiar status quo for BTC/USD, which remains just above $19,000. Despite calls for a rally and a run to lower macro lows next, the pair has yet to make a decision on a trajectory — or even signal that a breakout or breakdown is imminent. After a brief spell of excitement seen on the back of last week’s United States economic data, Bitcoin is thus back at square one — literally, as price action is now exactly where it was at the same time last week. As the market wonders what it might take to crack the range, Cointelegraph takes a look at potential catalysts in store this week. Spot price action has traders dreaming of breakout For Bitcoin traders, it is a ca...

3 signs suggesting the XRP price boom can continue in Q4 2022

XRP (XRP) has made considerable gains over the past month as traders continue to shower confidence on Ripple’s legal win against the United States Securities and Exchange Commission (SEC). For instance, the XRP price gained 25% thirty days after Ripple and the SEC filed for an immediate ruling on whether or not XRP sales violated U.S. securities laws. In comparison, Bitcoin (BTC) and Ether (ETH) are down 4% and 11% over the same period, respectively. XRP/USD versus BTC/USD and ETH/USD daily price chart. Source: TradingView Now, a flurry of indicators, ranging from on-chain to technical, hints XRP can continue its uptrend going into 2023. XRP price “bull pennant” Bull pennants are bullish continuation patterns that form as the price consolidates in a triangle-like range after...

BNB Chain responds with next steps for cross-chain security after network exploit

BNB Chain, the native blockchain of Binance Coin (BNB) and the Binance crypto exchange, has been subject to security-related developments over the last month. On Thursday, Oct. 6 the network experienced a multi-million dollar cross-chain exploit. The incident caused BNB Chain to temporarily suspend all withdrawal and deposit activity on the network. Initially, the announcement of the network outage cited “irregular activity” with an update stating it was “under maintenance.” As rumors were confirmed the CEO of Binance, Changpeng Zhao tweeted out an apology for any inconvenience to the BNB Chain community. However the suspension was brief, as the BNB Chain Team announced the network was back online early on Oct. 7, just hours after the attack. As the network regained activity its validators...

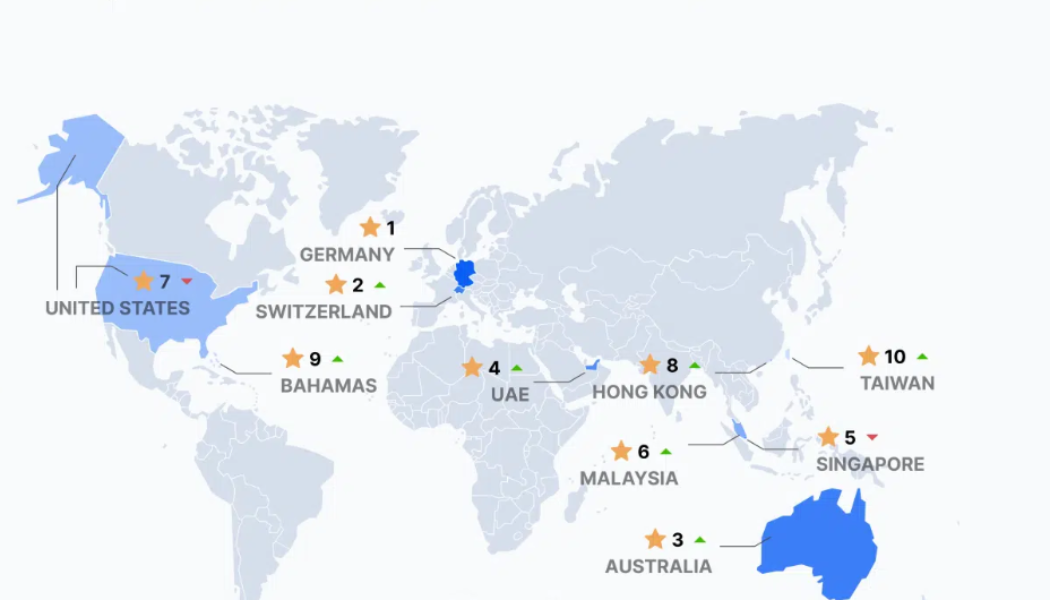

Germany leaves the US behind in top crypto economies in Q3: Report

Germany has become the most favorable crypto economy in the world in the third quarter of 2022, according to a new report. The United States, the joint top-rank holder from last quarter, fell six places to rank seventh on the top crypto economy. The crypto economy rankings compiled by Coincub looked into various factors such as favorable crypto outlook, clear crypto tax rules, more transparent regulatory communications and more to rank countries. Germany although not a tax haven, is considered one of the strongest all-around ‘traditional-tax’ crypto economies that reward long-term crypto holders. German law charges zero tax on crypto holdings of over a year. Switzerland ranked second with its positive crypto regulatory stance and is home to some of the top crypto organizations in the ...

Why crypto remittance companies are flocking to Mexico

Mexico is the second-largest recipient of remittances in the world, according to 2021 World Bank statistics. Remittances to the nation jumped to a record $5.3 billion in July, which is a 16.5% increase year-over-year compared to the same period last year. The steady growth presents myriad opportunities for fintech companies. Not surprisingly, droves of crypto companies are setting up shop in Mexico to claim a share of the burgeoning remittance market. Over the past year alone, about half a dozen crypto giants, including Coinbase, have set up operations in the country. In February, Coinbase unveiled a crypto transfer service tailored to United States-based clients looking to send crypto remittances to Mexico. The product enabled recipients in Mexico to withdraw their money in pesos. Other c...

CFTC action shows why crypto developers should get ready to leave the US

Considerable anxiety exists in the world of Web3 related to regulation and the legal status of cryptocurrency projects. It’s particularly apparent in the United States, where the Commodity Futures Trading Commission (CFTC) fueled concerns in September with an announcement that it was imposing a $250,000 fine on a decentralized autonomous organization (DAO), Ooki DAO, and its investors. The fine was particularly ominous, considering DAOs are intended to be “regulation proof.” The CFTC said in its statement on the issue that Ooki DAO’s bZeroX protocol offered illegal off-exchange trading of digital assets. The agency took issue with the fact that the founders, Tom Bean and Kyle Kistner, tried to use the existing bZeroX protocol within the DAO to put it beyond the reach of regulators. “By tra...

North Korea’s Lazarus behind years of crypto hacks in Japan: Police

Japan’s national police have pinned North Korean hacking group, Lazarus, as the organization behind several years of crypto-related cyber attacks. In the public advisory statement sent out on Oct. 14, Japan’s National Police Agency (NPA) and Financial Services Agency (FSA) sent a warning to the country’s crypto-asset businesses, asking them to stay vigilant of “phishing” attacks by the hacking groupaimed at stealing crypto assets. The advisory statement is known as “public attribution,” and according to local reports, is the fifth time in history that the government has issued such a warning. The statement warns that the hacking group uses social engineering to orchestrate phishing attacks — impersonating executives of a target company to try and bait employees into click...