crypto blog

Bankman-Fried ‘100%’ supports knowledge tests for retail derivatives traders

The founder and CEO of cryptocurrency exchange FTX, Sam Bankman-Fried has backed the idea of knowledge tests and disclosures to protect retail investors but said it shouldn’t just be crypto-specific. Bankman-Fried tweeted his thoughts in response to an idea floated by the Commodities Future Trading Commission (CFTC) commissioner Christy Goldsmith Romero on Oct. 15, saying the establishment of a “household retail investor” category for derivatives trading could give greater consumer protections. Romero said due to crypto, more retail investors are entering the derivatives markets and called for the CFTC to separate these investors from professional and high-net-worth individuals and have “disclosures written in a way that regular people understand or could be used when weighing ru...

Bitcoin clings to $19K as trader promises capitulation ‘will happen‘

Bitcoin (BTC) stayed rigidly tied to $19,000 into the Oct. 16 weekly close as analysts warned that volatility was long overdue. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: BTC volatility a “matter of time” Data from Cointelegraph Markets Pro and TradingView captured a lackluster weekend for BTC/USD as the pair barely moved in out-of-hours trading. After United States economic data sparked a series of characteristic fakeout events over the week, Bitcoin returned to its original position, and at the time of writing showed no signs of leaving its established range. For Michaël van de Poppe, founder and CEO of trading platform Eight, it was a question of not if, but when unpredictability would return to crypto. “Matter of time until massive volatility is going to...

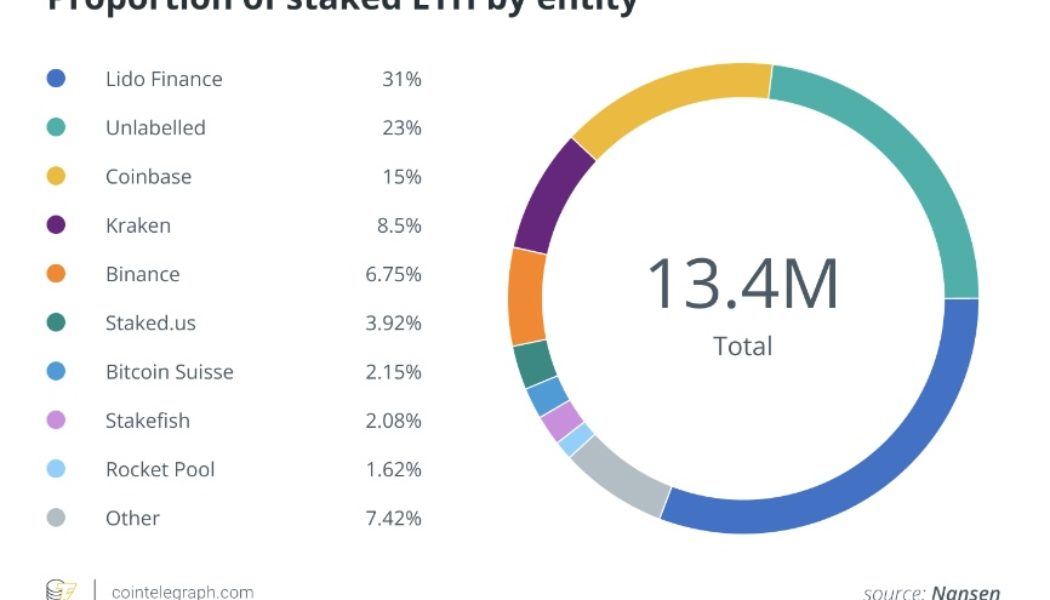

KYC to stake your ETH? It’s probably coming to the US

Over the last few years, the cryptocurrency industry has been a primary target for regulators in the United States. The legal battle between Ripple and the United States Securities and Exchange Commission (SEC), Nexo’s lawsuit with the securities regulators of eight states, and the scrutiny targeting Coinbase’s Lend program last year are only a few high-profile examples. This year, even Kim Kardashian had first-hand experience with regulatory scrutiny after agreeing to pay a $1.26 million fine for promoting the dubious crypto project EthereumMax. While Ethereum developers intended to pave the way for key network upgrades in the future, it seems like the recent Merge has further complicated matters between crypto projects and U.S. regulators. Ethereum: Too substantial for the cry...

What is automated crypto trading and how does it work?

Time waits for no one and financial markets are no exception. Especially in the uncharted territory of cryptocurrency trading, keeping up with the fast-paced changes in prices is key to success. A plethora of cryptocurrencies, a few viable trading strategies and numerous tools accessible to new traders may all cause confusion. Fortunately, technology has made it possible to automate several trading processes, including market analysis, predicting trends and order execution. This frees up more time for strategic planning and establishing a solid foundation for long-term cryptocurrency trading success. What is automated crypto trading? Automated crypto trading, sometimes called automated cryptocurrency trading, is the practice of using computer programs (crypto trading bots) to b...

Blockchain gaming adoption means more options for gamers

Over the past couple of years, games that use blockchain technology have increased their presence in the gaming industry. While there were early examples like CryptoKitties — launched in 2017 — the trend has truly gained steam, with major gaming studios even exploring the technology. At the beginning of 2022, the market capitalization of blockchain games was around $25 billion and it doesn’t seem to be decreasing anytime soon, even in the depths of a bear market. According to the analytical service DappRadar, the two most stable areas this year in the cryptocurrency market are blockchain games and nonfungible tokens (NFT), which have recently become very tightly intertwined, creating a new economic phenomenon. A striking example here is the well-known game Axie Infinity, the token price of...

Turn Cointelegraph articles into NFTs — Early access for 500 readers

Turning Cointelegraph articles into digital collectibles to preserve the crypto industry’s most memorable moments is now becoming a reality. The Cointelegraph Historical collection will allow every article ever published by the largest crypto media outlet to become mintable into nonfungible tokens (NFTs). With the help of readers, Cointelegraph seeks to create the first decentralized catalog of news that will cement the evolution of crypto onto the blockchain. The waitlist is now open, but only the first 500 readers will be able to participate in the early access that will commence at the start of November. The feature will be rolled out to everyone shortly after that, in mid-November. [embedded content] Just like NBA Top Shot tokenizes memorable moments from the world of basketb...

To HODL or have kids? The IVF Bitcoin Babies paid for with BTC profits

Hold Bitcoin till the very end or sell a little bit to start a family? For one Bitcoiner in northwest London, it was a no-brainer. Noodle (a nickname), a Brit who first heard about Bitcoin around 2012, took profits on his Bitcoin buys to pay for in vitro fertilization (IVF) treatment for his wife. He told Cointelegraph he has “no regrets,” about his decision to start a family using fiat-denominated profits from buying, holding, a then selling Bitcoin. Welcoming Noodle Jr II to this crazy world. After a tough 6 days in hospital due to unforeseen complications, Mrs Noodle and I, couldn’t be happier to bring this little hodler home! pic.twitter.com/JvlLfzABgg — Noodle ⚡️ (@NoodleNakamoto) June 14, 2022 Noodle first found out about Bitcoin at the tail end of 2012, when 1 BTC was ...

India aims to develop crypto SOPs during G20 presidency, says finance minister

The finance minister of India, Nirmala Sitharaman, revealed India’s plan to develop standard operating procedures (SOPs) for cryptocurrencies during its G20 presidency, from Dec. 1, 2022, to Nov. 30, 2023. Sitharaman has previously called for global collaboration to decide on crypto’s future and has been cautious against mainstream crypto adoption citing risks to financial stability. However, speaking to local Indian reporters on Oct. 15, she confirmed, “That (crypto) will also be part of India’s thing (agenda during G20 presidency).” The G20, or Group of Twenty, is a global forum for addressing the major issues related to the global economy. According to Sitharaman, no country can alone effectively handle or regulate crypto, adding that: “But if it’s a question of ...

The state of crypto in Western Europe: Swiss powerhouse and French unicorns

Despite the turbulence that broke out in the crypto market this summer, there is an important long-term marker that should be considered in any complex assessment — the combination of adoption and regulation. The latest report by EUBlockchain Observatory, named “EU Blockchain Ecosystem Developments,” tries to measure this combination within the European Union, combining the data on each and every member country from Portugal to Slovakia. As the original report counts more than 200 pages, Cointelegraph prepared a summary with the intent to capture the most vital information about the state of crypto and blockchain in Europe. We started from a group of countries that are usually labeled as “Western European.” Austria Numbers: 50 blockchain solution providers, $48.72 million (50 m...

Bitcoin trader predicts $18K return within days as stocks wilt post-CPI

Bitcoin (BTC) cooled near $19,200 after the Oct. 14 Wall Street open as stocks struggled to preserve their “bear trap.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: “Abandon all hope” for asset price rebound Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it came off one-week highs on the day to circle $19,300. The pair had seen intense volatility on the back of United States economic data the day prior, this sparking hundreds of millions of dollars in liquidations from both long and short positions. Now, after turning the tables and adding almost $2,000 in 24 hours, Bitcoin was again losing momentum as U.S. equities turned red on the day. At the time of writing, the S&P 500 was down 1.9%, while the Nasdaq Composite Index trad...

Crypto Biz: $43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing experimentation with blockchain technology and Crypto.com’s new European headquarters. BNY Mellon, America’s oldest bank, launches crypto services Arguably the biggest story of the week was news of another ...

Grayscale BTC Trust trades at a record 36.7% discount, but is it justified?

U.S. investors have been waiting for a Bitcoin exchange-traded fund (ETF) approval since May 2014 when the Winklevoss Bitcoin Trust filed an amendment request at the Securities and Exchange (SEC). Over the years, the SEC has rejected every applicant and the latest denial was issued to WisdomTree’s application for a spot Bitcoin ETF on Oct. 11. The SEC concluded that the offer did not have the ability “to obtain information necessary to detect, investigate, and deter fraud and market manipulation, as well as violations of exchange rules and applicable federal securities laws and rules.” Bitcoin investment trust vehicles have existed since 2013, but they have been restricted to accredited investors. Launching a spot-based BTC ETF would open the market to retail investors and a broader ...