Crypto news

Crypto-focused SPAC raises $115M in Nasdaq IPO

Aura FAT Projects Acquisition Corp. (AFARU), a special purpose acquisition company (SPAC), has closed its initial public offering (IPO) on Nasdaq and raised $115 million, focusing on crypto industry assets. The Cayman Islands-incorporated SPAC raised an impressive $100 million during its April 13 IPO, with an over-allotment of $15 million, bringing its total to $115 million, according to an announcement from the firm on Tuesday. It also has funding from sponsorships with Singapore-based financial services firms Aura Group and Fat projects. The SPAC’s website states that it has a presence in Australia, New Zealand, Singapore, Indonesia, Vietnam, Thailand, Malaysia and the Philippines. Aura FAT will target acquisitions in the blockchain sector as it has a stated interest in emerging technolo...

Brain drain: India’s crypto tax forces budding crypto projects to move

India’s 30% crypto tax came into law on March 31 and was effective April 1, despite warnings from several stakeholders about its possible ill impact on the budding crypto industry. As predicted, within just a couple of weeks of the new crypto tax law coming into effect, trading volume across major crypto exchanges dropped as much as 90%. The decline in trading activity was attributed to traders either moving their funds away from centralized crypto exchanges or adopting a holding strategy over trading. Many crypto exchanges were hoping that a crypto tax would at least offer some form of recognition to the crypto ecosystem and help them get easy access to banking services. However, the effect has been the opposite. On April 7, the National Payment Corporation of India (NPCI) issued a ...

Beanstalk Farms offers plea deal to perpetrators of $76M exploit

Beanstalk Farms, a credit-based stablecoin protocol exploited for around $76 million in crypto on April 18, has offered a bounty of 10% if the attackers return the funds. The offer was posted on the company’s Twitter and sent to the attackers via an on-chain message the following day. It proposed that the exploiters return 90% of the stolen funds to the Beanstalk Farms’ multisignature wallet. In return, the exploiters will be allowed to keep the remaining 10% as a whitehat bounty — a deal offered by platforms to reward individuals for reporting security exploits and vulnerabilities. As previously reported by Cointelegraph, the $76 million exploit, which was initially thought to be around $182 million, was not considered to be a hack, as the smart contracts and governance procedures u...

Binance.US awarded money transmitter license in Puerto Rico

Puerto Rico becomes the fourth jurisdiction in America to grant a money transmitter license to Binance.US, the American arm of the crypto exchange Binance. Other states that issued operational licenses to Binance.US include Wyoming, Connecticut and West Virginia. Binance.US was launched as a second attempt by Binance CEO Changpeng Zhao to cater to investors in the United States as the nation banned Binance’s primary operations, citing regulatory concerns. The new license from Puorto Rico further strengthens CZ’s vision “to be licensed everywhere.” According to the announcement, the money transmitter license was awarded to Binance.US by the Puerto Rico Office of the Commissioner of Financial Institutions (OCIF). While highlighting the company’s intent to obtain operational licen...

Blockchain.com co-founder thinks the EU and UK are ‘progressive’ crypto regulators

Cointelegraph reporter Joseph Hall sat down with Nicolas Cary, the co-founder and president of Blockchain.com at the Paris Blockchain Week Summit, or PBWS, last week. Cary’s other roles include founding the Blockchain Commission for Sustainable Development and co-authoring a white paper called “The Future is Decentralised” for the United Nations Development Programme. Hall and Cary discussed the regulatory landscape of the European Union and the United Kingdom, as well as Cary’s optimism for the evolution of money in the Web3 space. Cary recognized the recent “progressive” momentum of policymakers treating digital assets more seriously in the EU and in the United States, where President Joe Biden signed an executive order on cryptocurrencies l...

IMF global financial stability report sees complex roles for cryptocurrency, DeFi

According to the International Monetary Fund’s Global Financial Stability report released Tuesday, the war in Ukraine — following hard on the heels of the coronavirus pandemic — has led to a tightening of global financial conditions. Rapid changes in fintech and the uses and misuses of cryptocurrency play into the jumble of challenges facing the global economy. According to the report, the pandemic and war have led to an accelerated “cryptoization” in emerging markets due to increased speculative interest during the pandemic and then attempts to evade sanctions. Given compliance within the crypto industry, the use of cryptocurrency to evade sanctions is impractical, the report found. The use of mixers, decentralized exchanges and privacy coins may allow some circumvention, but it wou...

Framework Ventures allocates half of $400M fund to Web3 gaming

Crypto-focused venture firm Framework Ventures has raised $400 million in new funding to invest in early-stage companies across the Web3, blockchain gaming and decentralized finance (DeFi) industries. The completed raise will go towards “FVIII,” an oversubscribed fund worth $400 million, the company announced Tuesday. Approximately $200 million of that total will be allocated to the emerging blockchain gaming industry. The venture firm, which had early exposure to DeFi, now has over $1.4 billion in assets under management. Framework Ventures was an early investor in projects such as Chainlink, Aave and The Graph. Like DeFi in 2020, gaming and Web3 have been identified as the next major growth plays for the blockchain industry. Axie Infinity — a popular play-to-earn game constructed a...

Half of assessed jurisdictions don’t have ‘adequate laws and regulatory structures’ — FATF

The Financial Action Task Force, or FATF, reported that many countries, including those with virtual asset service providers (VASPs), are not in compliance with its standards on Combating the Financing of Terrorism (CFT) and Anti-Money Laundering (AML). In a report released Tuesday on the “State of Effectiveness and Compliance with the FATF Standards,” the organization said 52% of the assessed jurisdictions in 120 countries had “adequate laws and regulatory structures in place” to assess risks and verify beneficial owners of companies. In addition, the FATF reported that only 9% of countries were “substantially effective” in this area. “Countries need to prioritize their efforts and demonstrate improvements in recording, reporting and verifying information regarding legal perso...

Cointelegraph’s experts reveal their crypto portfolios | Watch now on The Market Report

On this week’s show, Cointelegraph’s resident experts reveal exactly what percentages of their portfolios are allocated to what coins and why. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they reveal their crypto portfolios. We kick things off with Bourgi, whose top holdings are BTC with 67%, ETH with 20%. No surprise there but what about the rest? It’s an interesting mix, to say the least so make sure you stick around to find out. Next, we have Yuan, whose top three holdings are 35% BTC, 28% Terra...

Solana’s STEPN hits record high as GMT price skyrockets 34,000% in over a month

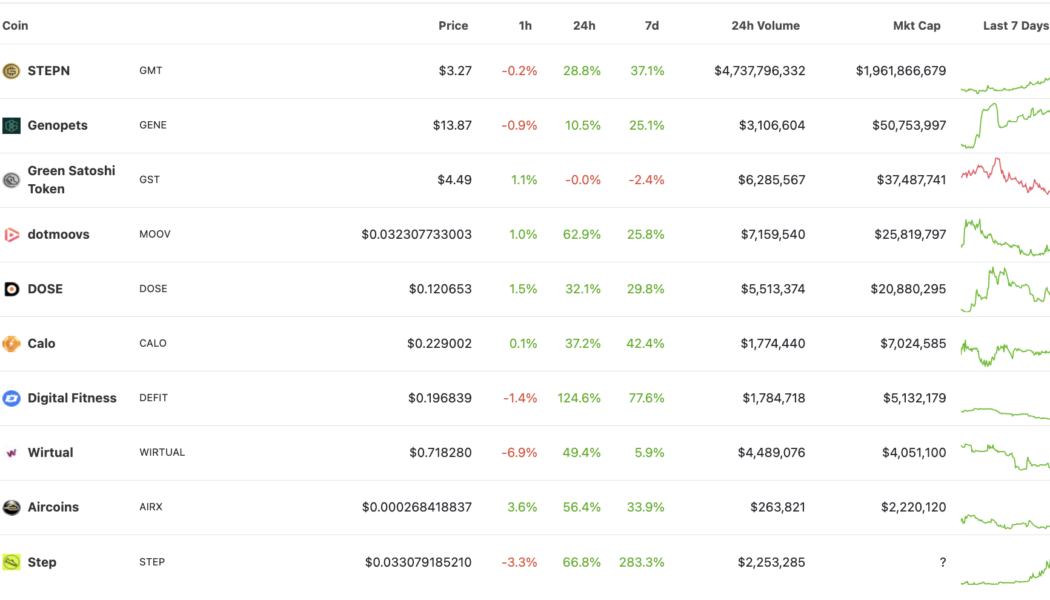

STEPN (GMT), a so-called “move-to-earn” token using the Solana (SOL) blockchain, has soared incredibly since its market debut in March. GMT’s price jumped from $0.01 on March 9 to a record high of $3.45 on April 19 — a 34,000% upside move in just 41 days (data from Binance). Its massive uptrend appeared primarily due to the hype surrounding decentralized finance (DeFi) projects that reward users in tokens for staying active. For instance, the prices of GMT and its top rivals, including Genopets (GENE) and dotmoovs (MOOV), exploded massively on a 24-hour adjusted timeframe, data on CoinGecko shows. Nonetheless, STEPN remained the most valuable move-to-earn (M2E) project, with its market capitalization closing in on $2 billion. The performance of M2E tokens featu...

Silvergate Bank revenue soar in Q1 as institutional crypto trading activity falls

On Tuesday, Silvergate Bank, a crypto-fiat gateway network designed for financial institutions, announced its results for the first quarter of 2022. During this period, its revenue and net income grew by 93% and 94% year-over-year, respectively, to $59.9 million and $24.7 million. The company is most notable for its Silvergate Exchange Network, or SEN, which facilitates U.S. dollar and euro transfers between cryptocurrency exchanges and institutional investors. Despite its growth, however, institutional interest in crypto took a significant hit in Q1 due to the ongoing bear market. As told by Silvergate, the amount of SEN transfers it facilitated decreased from $167 billion in Q1 2021 to $142 billion in Q1 2022. Simultaneously, as part of broader industry trends, Bitcoin (BTC) and Ethereum...