Crypto news

Price analysis 4/18: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) and most major altcoins have started the new week on a soft note and the Crypto Fear and Greed Index has dropped into the “extreme fear” zone, suggesting that investors are still nervous. Bitcoin has declined about 17% year-to-date while the Nasdaq 100 has dropped about 16% during the same period, indicating a tight correlation between the two. In comparison, gold has risen more than 10% in 2022 and its 50-day correlation coefficient with Bitcoin “is around minus 0.4, the lowest since 2018,” according to journalist Colin Wu. Daily cryptocurrency market performance. Source: Coin360 Although the crypto price action has remained bearish, the declining balance of Bitcoin on the crypto exchanges indicates that long-term investors are unperturbed and continue to accumulate at...

Top crypto analyst predicts LUNA could shed up to 50%

Cred says LUNA’s market structure is showing a post fakeout reclaim He predicts that the price of the native token for Terra could slide as low as $40 A largely-followed crypto analyst has predicted that a downfall could be coming for LUNA, with a forecast that the price of the Terra-native asset could fall more than 50%. Cred, a top crypto analyst, said in a recent YouTube session that the current LUNA structure is a cause of concern and should it emulate previous patterns (a post-fakeout reclaim shown by Solana), then the recent optimistic prices shaped up into a massive a bull trap. “I’m just drawing a structure from the highest close, the December high, and then [the] weekly [candle] closed way above it. Made a new all-time high and the next weekly just bearish engulfed it… That’...

Illegal crypto miners in Iran to face stricter penalties

The government has warned illegal miners of heavier penalties to come Illicit mining of crypto affects the power availability for household and industrial use Iran is cracking the whip harder as it contends with the fact that unauthorised mining is setting a strain on the country’s energy supply. The government is set to impose legislation containing heavier punishment for those caught mining crypto assets illegally. Hitting the dodgy miners hard According to a report published by the Tehran Times on Saturday, the move is meant to avoid blackouts and punish those using subsidised electricity for illegal crypto mining operations. Fines could rise threefold, and jail time increased by up to five times. An official with the country’s Power Generation, Distribution, and Tr...

Ireland to enforce rule outlawing crypto donations to political parties

The government is working on a draft that will bar political parties from taking donations in cryptocurrency The ban represents efforts by the country to counter cyber-interference from Russia Fear of cyber-interference in Irish elections from Moscow has pushed the government of Ireland to ban political parties from accepting crypto donations. It is also understood that the government is looking to impose other measures such as regulations to curb the spreading of false information via social platforms as part of the new political integrity rules. This will be enforced by a new commission that would have the authority to regulate online electoral information upon its establishment. The parties shall further be required to comply with...

Iran to stiffen penalties for illegal use of subsidized energy in crypto mining

The Iranian government will increase penalties for the use of subsidized energy in crypto mining. The move marks another step in the tightening of mining regulation in the country that had faced energy shortages in recent years. On April 16, the Tehran Times reported, citing the country’s Power Generation, Distribution, and Transmission company, that the government plans to drastically increase the fines rates for the mining operators who use subsidized electricity. The company’s representative Mohammad Khodadadi Bohlouli specified: “Any use of subsidized electricity, intended for households, industrial, agricultural and commercial subscribers, for mining cryptocurrency is prohibited.” According to Bohlouli, the fines for the use of subsidized energy in mining will rise by...

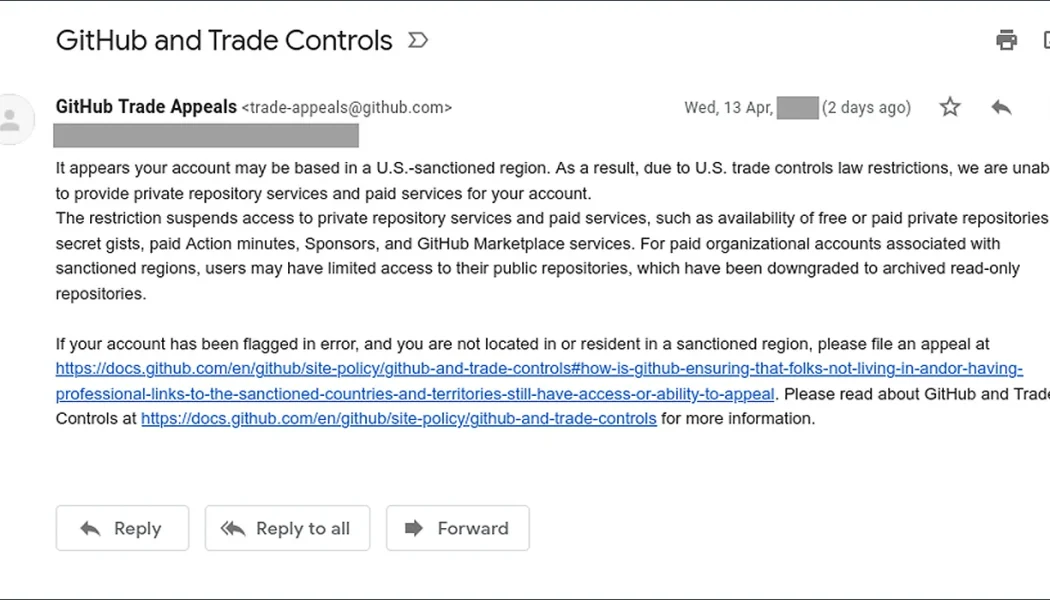

Github suspends accounts of Russian developers linked to sanctioned firms

Major developer platform Github has reportedly blocked more than a dozen accounts of Russian developer’s associated with organizations sanctioned by the United States government. The sanctioned accounts include some of the largest banks in Russia: Sberbank and Alfa-Bank, as well as individual developers with links to the sanctioned firms. However, many individual accounts with no links or ties to sanctioned firms were also blocked in the process, Researcher Sergey Bobrov, who reportedly has no links to any such firm, reported that his account was suspended on April 15 and then immediately restored. My github account is unlocked, thanks everyone. The ban was related to the sanctions imposed on my previous employer. — Sergey Bobrov (@Black2Fan) April 15, 2022 Another individ...

Myspace founder predicts blockchain gaming to be ‘dominant place’ for socializing

While many gamers are critical of blockchain-based gaming, Myspace co-founder Chris DeWolfe believes adoption is on the way as the business model inherently provides players more control over their in-game experiences. DeWolfe, who is now the CEO of game development firm Jam City, told Cointelegraph that “the quality of the game and how developers interact and engage with players to set expectations” could eventually change the perception of skeptics. Jam City founder and CEO Chris DeWolfe. Source: Jamcity.com The former Myspace CEO also compared the advent of Web3 gaming to the early days of Web2. According to DeWolfe, many analysts were skeptical of the viability of Web2 advertising and business models: “They also weren’t sure about the quality of user-generated content and if it w...

Is asymmetric information driving crypto’s wild price swings?

It has long been believed that investors possessing inside knowledge help drive cryptocurrencies’ price volatility, and a number of academic papers have been published on this topic. This is why Coinbase’s intention to regularly publish in advance a catalog of tokens being assessed for listing on its prominent trading platform is noteworthy. Coinbase’s plans, announced in an April 11 blog along with 50 crypto projects “under consideration” for Q2 2022, could help tamp down the pervasive speculation that surrounds small-cap tokens. Meanwhile, this can help alleviate industry concerns about “information asymmetry,” which typically occurs when one party to a transaction — a seller, for instance — is much better informed than another transactional party, such as a buyer. Last week’s pre-...

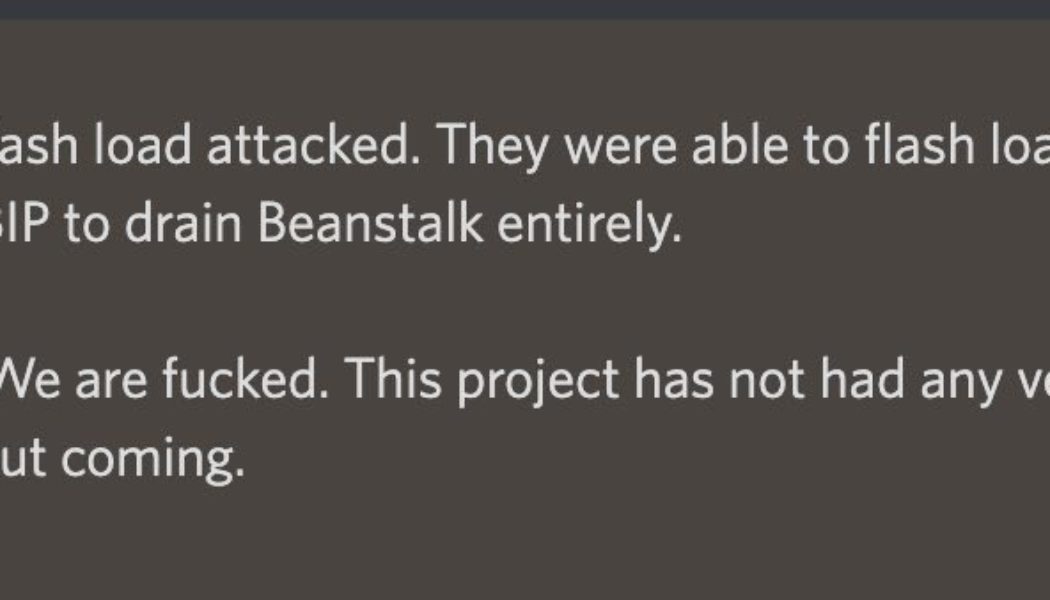

Beanstalk Farms loses $182M in DeFi governance exploit

Credit-based stablecoin protocol Beanstalk Farms lost all of its $182 million collateral from a security breach caused by two sinister governance proposals and a flash loan attack. The problem for the protocol was seeded by suspicious governance proposals BIP-18 and BIP-19 issued on April 16 by the exploiter that asked for the protocol to donate funds to Ukraine. However, those proposals had a malicious rider attached to them which ultimately created the sinkhole of funds from the protocol according to smart contract auditor BlockSec. This latest security breach of a decentralized finance (DeFi) protocol took place at 12:24 pm UTC. At that time, the exploiter took out $1 billion in flash loans from the AAVE (AAVE) protocol denominated in DAI (DAI), USD Coin (USDC), and Tether (USDT) stable...

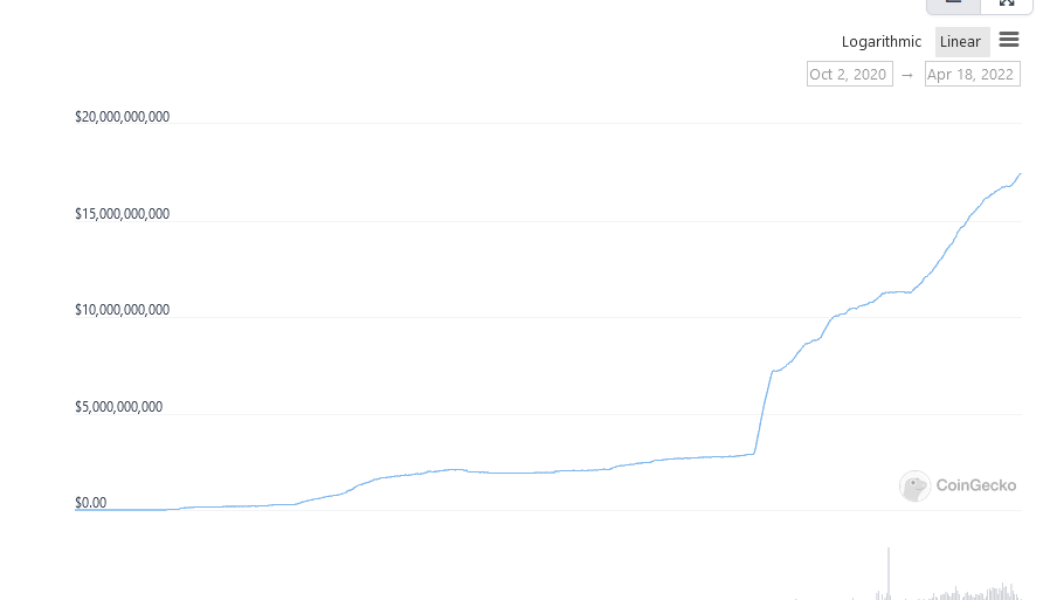

Terra’s UST flips BUSD to become third-largest stablecoin

The Terra (LUNA) blockchain’s algorithmic stablecoin Terra USD (UST) has flipped Binance USD (BUSD) to become the third-largest stablecoin on the market. UST is a USD-pegged stablecoin that was launched in September 2020. Its minting mechanism requires a user to burn a reserve asset such as LUNA to mint an equivalent amount of UST. According to Coingecko, UST’s total market capitalization has surged 15% over the past 30 days to sit at roughly $17.5 billion at the time of writing. The figure currently places UST as the third-largest stablecoin after it flipped BUSD with a slightly lower market cap of $17.46 billion. The asset now trailing only behind industry giants Tether (USDT) at $82.8 billion, and USD Coin (USDC) at $50 billion, however, the gap is quite substantial at this stage. The d...