Crypto news

Best BNB Chain tokens you can get on April 7: BSW, XIDO and FXS

Biswap (BSW), Xido Finance (XIDO) and Frax Share (FXS) are all BNB Chain tokens. Each token has showcased high levels of growth. All of these tokens can increase in value going forward. Biswap (BSW), Xido Finance (XIDO) and Frax Share (FXS) are all part of the BNB Chain. Today, we are going to go over each token individually to see how far they can grow. Should you buy Biswap (BSW)? On April 7, 2022, Biswap (BSW) had a value of $1.3472. The all-time high value of Biswap (BSW) was on December 8, 2021, when the token reached a value of $2.10. When we go over the performance of the token throughout the previous month, Biswap (BSW) had its lowest point on March 14 at $0.2839. The token’s highest point of value was on March 21, when it increased to $1.0941. Here, we can see th...

The Philippines’ top payment provider adds crypto to its mobile app

Philippines-based major fintech company PayMaya has reportedly launched a new cryptocurrency feature on its app, following in the footsteps of PayPal, Venmo and others. According to TechInAsia, PayMaya users will be able to trade, purchase, and spend digital assets using their accounts. This is also part of PayMaya’s aim to offer a comprehensive crypto package for anybody interested in entering the market. With the new feature, PayMaya intends to make it simpler for Filipinos to learn about and use cryptocurrencies, as per the report. Furthermore, it will eliminate the necessity for users to register with cryptocurrency exchanges, create a crypto wallet, and go through other KYC hoops. PayMaya is the Philippines’ largest provider of digital payments. It’s also a virtual m...

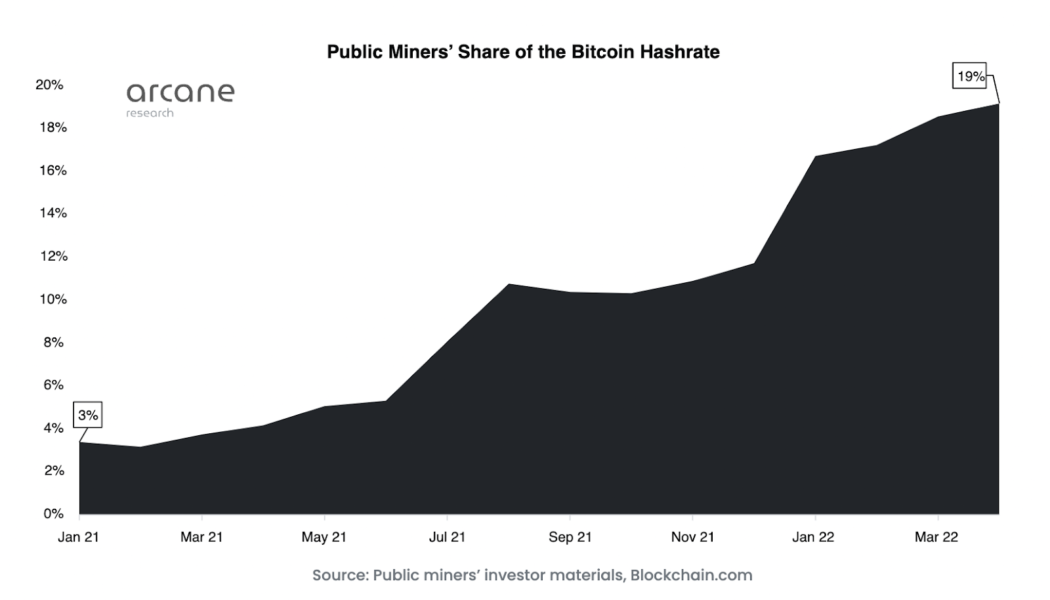

One-fifth of global Bitcoin hash rate is now controlled by listed companies

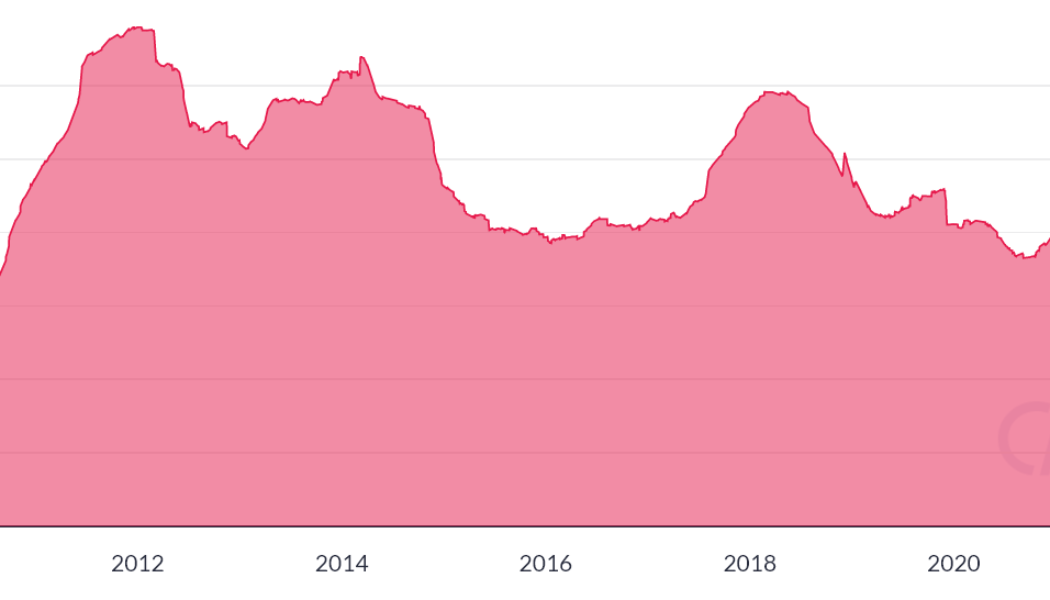

A recent report has shown that nearly one-fifth of the total share of Bitcoin’s (BTC) hash rate now belongs to publicly-listed mining companies. The report, published by Arcane Research, details that publicly-listed Bitcoin mining companies now account for 19% of Bitcoin’s total hash rate, growing considerably from a mere 3% in January l. Public miner’s share of BTC hash rate The term hash rate refers to the total computing power used by a miner’s computing equipment to confirm a transaction. A higher hash rate ensures increased protection against double-spending attacks, which is the process of reversing BTC transactions over the blockchain by contributing to at least 51% of the BTC hash rate. While there were only a small number of public mining companies at the beginning ...

Bitcoin bulls may have to wait until 2024 for next BTC price ‘rocket stage’

Bitcoin (BTC) may track sideways for another two years before reigniting its bull run, new data argues. In a tweet on April 6, veteran trader Peter Brandt highlighted historical patterns suggesting that hodlers will have to wait until 2024 for their next moonshot. 8 months down, 25 to go? Bitcoin has surprised analysts with its performance over the past year, as the highly anticipated “blow-off” top in Q4 2021 was much lower than expected. After BTC/USD lost over 50% of those modest new all-time highs, the debate around the relationship of price to Bitcoin’s four-year halving cycles changed. The market, as Cointelegraph reported, was used to a macro price top coming once per four-year cycle, specifically the year after each of Bitcoin’s block subsidy halving events....

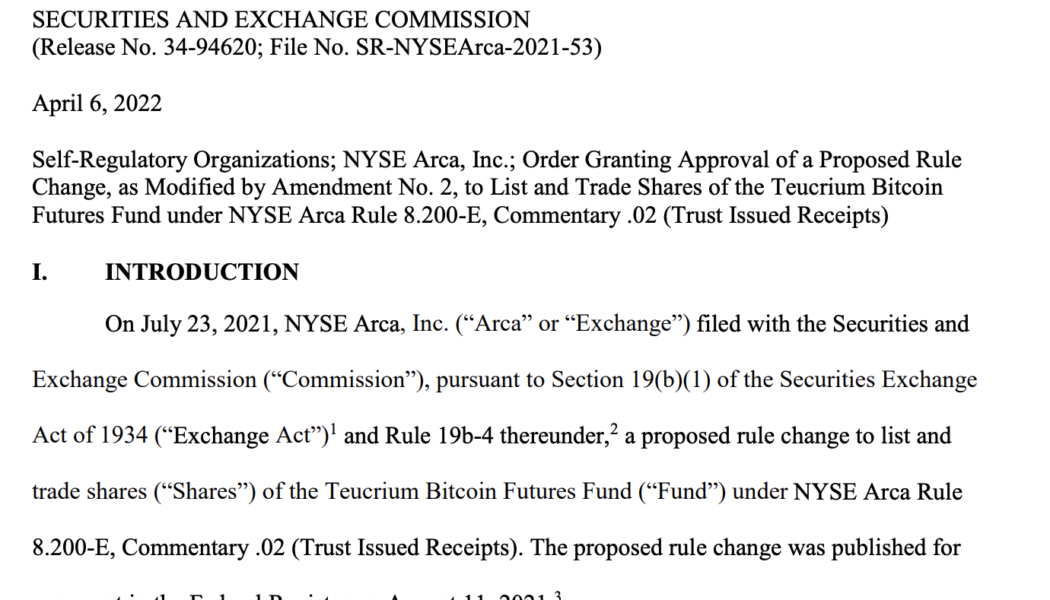

Grayscale CEO pleads Bitcoin spot ETF as SEC backs third BTC Futures ETF

Institutional investors rejoice, there is one more way to gain exposure to Bitcoin (BTC). The United States Securities and Exchange Commission (SEC) announced overnight the approval of a fourth Bitcoin futures exchange-traded fund (ETF). Fund group Teucrium is behind the most recently approved Bitcoin Futures ETF. The ETF joins a growing number of approved futures ETFs, complementing ProShares, Valkyrie, and VanEck Bitcoin Futures ETFs. The SEC filing for the Teucrium ETF. Source: SEC.gov Every Bitcoin spot ETF has been rejected to date, however, for one invested observer, the way in which the approval was made could be a boon for expectant spot investors. The plot thickens on the path to $GBTC’s spot #Bitcoin #ETF conversion… — Sonnenshein (@Sonnenshein) April 7, 2022 In a Tweet thread, G...

Toomey drafts bill to exempt stablecoins from securities regulations

Republican Senator Pat Toomey, the ranking member for the Senate Banking Committee, has drafted a bill proposing a regulatory framework for stablecoins in the United States. According to a draft released Wednesday, the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act, abbreviated as the Stablecoin TRUST Act, proposed that the digital assets be identified as “payment stablecoins” — a convertible virtual currency used as a medium of exchange that can be redeemed for fiat by the issuer. Critically, the bill proposed that such offerings should be exempt from securities regulations by amending existing laws to ensure the definition of “security” does not include a payment stablecoin. The legislation also proposed that stablecoin issuers — which would include national t...

Why the Bitcoin ‘mid-halving’ price slump will play out differently this time

Some analysts believe the four-year market cycle is changing and that the halving schedule may no longer determine cyclical conditions as Bitcoin closes in on the mid point between halvings. The halving is when the amount of Bitcoin (BTC) rewards issued per new block mined is reduced by half. The next halving will happen around May 5, 2024, andl reduce block rewards to 3.125 BTC. According to author @Alerzio on the Santiment blog on April 4, “the important resistance on the way is $50K.” The blog stated that breaking this level by or around the next mid-halving on April 11 would cast off many doubts as to the possibility that the traditional market cycle has been broken. “If the price (stabilizes) above this level, then we can give more credit to the thesis that says: ‘this cycle is differ...

Gemini, Chainalysis and 11 others join Crypto Market Integrity Coalition

The Crypto Market Integrity Coalition, an organization founded two months ago by 17 cryptocurrency exchanges, firms and industry associations worldwide, announced 13 new members have joined. The group is centered around a pledge endorsed by members’ CEOs or chief compliance officers that (among other things): “We will integrate principles that uphold Market Integrity and Market Efficiency into our operations and business strategy.” The coalition, or CMIC, was spearheaded by market surveillance firm Solidus Labs. “To enable the promise of crypto and DeFi, we must as an industry be vocal about our commitment to address and mitigate the risks,” Solidus Labs vice president of regulatory affairs Kathy Kraninger said in an introductory video. Membership is open to all industry participants...

Sushi and Synthetix get the boot in Grayscale DeFi fund rebalancing

Digital asset management firm Grayscale, has added three new cryptocurrency assets across three main investment funds, while removing two other assets from its Decentralized Finance Fund as part of this year’s first quarterly rebalance. Grayscale removed tokens from crypto-derivatives decentralized exchange Synthetix (SNX), and decentralized exchange SushiSwap (SUSHI), from its DeFi fund after the two crypto assets failed to meet the required minimum market capitalization. No other cryptocurrencies were removed during the rebalancing. Grayscale’s DeFi fund, which was launched in July last year, currently holds approximately $8 million in assets. The digital assets remaining in the DeFi fund after the quarterly rebalance include Uniswap (UNI), Aave (AAVE), Curve (CRV), MakerDAO (MKR),...

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

Sweden’s central bank completes second phase of e-krona testing

The Swedish central bank’s digital currency project, a proposed CBDC, known as the e-krona has successfully finished its second phase of trials. According to Riksbank, the nation’s central bank, the asset is now technically ready to be integrated into banking networks and facilitate transactions. During the second phase of the e-krona pilot project — which began in February 2021 — the CBDC was investigated on the matter of its technical ability to function within the country’s existing digital banking infrastructure. Participating banks included Handelsbanken and Tietoevry. The report indicated that the e-krona could indeed be successfully exchanged for fiat money and used in transactions, both online and offline. This phase of testing also brought legal clarity to the project ...