Crypto news

Cardano Foundation and The University of Zurich expand academic blockchain research

Non-profit organization Cardano Foundation has announced a three-year collaboration with the Blockchain Center of the University of Zurich (UZH BCC) to further research initiatives and explore blockchain education development. Through the partnership, the foundation will work with the Blockchain and Distributed Ledger Technologies (BDLT) Group at the University of Zurich to explore research topics like the efficacy of consensus protocols and analyze attack vectors specific to Ouroboros, among many others. The University of Zurich. Source: www.uzh.ch According to Cardano Foundation CEO Frederik Gregaard, the partnership allows the foundation to provide information to UZH BCC to expand the university’s knowledge of the Cardano platform and at the same time, further develop ...

Ledger launches NFT-focused hardware wallet Nano S Plus

Ledger, a major supplier of hardware wallets designed for secure storage of cryptocurrencies like Bitcoin (BTC), is launching a brand new wallet specializing in nonfungible tokens (NFTs). The new product, called Ledger Nano S Plus, is the next generation to the original Nano iteration released in 2016, and is designed with NFT collectors’ needs in mind, Ledger announced to Cointelegraph on Tuesday. The new Ledger Nano S Plus is the sixth hardware wallet produced by Ledger since the company introduced its first wallet HW1 back in 2015, the company’s chief experience officer Ian Rogers told Cointelegraph. The product is also the first hardware wallet that Ledger has released since the debut of the Ledger Nano X in 2019. The Nano S Plus combined with the recent support of “clear signing...

More than three-quarters of central banks considering a CBDC: research

More than 80% of central banks are interested in launching a Central Bank Digital Currency (CBDC) or have already done so according to research conducted by accounting firm PwC. The second annual Global CBDC Index report released on Monday, April 4, measures a central bank’s level of maturity in deploying its own digital currency. The report also included an overview of stablecoins for the first time. Haydn Jones, Blockchain and Crypto Specialist at PwC U.K. stated in the report that “over 80% of central banks are considering launching a CBDC or have already done so.” The report ranks both retail CBDCs, ones that are issued for use by the general public, and wholesale CBDCs for use by financial institutions holding with the central bank, out of 100. Retail CBDCs have reached a greate...

Crypto venture capital firms see surging assets under management

Venture capital (VC) firms focused on Web3 projects and crypto businesses are accumulating billions of dollars worth of assets under management as more capital is injected into the sector. The assets under management figure for Web3 and crypto investment firm Paradigm has recently been revealed. Filings show that the firm has $13.2 billion in assets, a growth of 343% compared to the $2.98 billion reported in a filing in December 2020. The filings were reviewed by business journalist Eric Newcomer. Writing for his newsletter, he looked at recent applications with the U.S. Securities and Exchange Commission (SEC) for some of the biggest venture capital firms in the Web3 and crypto sectors. To be registered as an “investment advisor,” these firms must disclose their regulatory assets under ma...

Gryphon and Sphere 3D merger scrapped but carbon-neutral mining continues

Despite the canceled merger between Gryphon Digital Mining and Sphere 3D, the two firms still intend on building out carbon-neutral Bitcoin mining operations. An April 4 joint statement from the two crypto mining companies revealed that scrapping the merger was a mutual decision “due to changing market conditions, the passage of time, and the relative financial positions of the companies.” The cancellation will apparently not stop either company from moving forward with plans on building carbon-neutral Bitcoin (BTC) mining facilities. The merger was announced last June and would have seen the two companies become one under the Gryphon name. It also would have made Gryphon a publicly-traded company by virtue of the fact that Canada-based Sphere 3D is already trading under the ANY ticker on ...

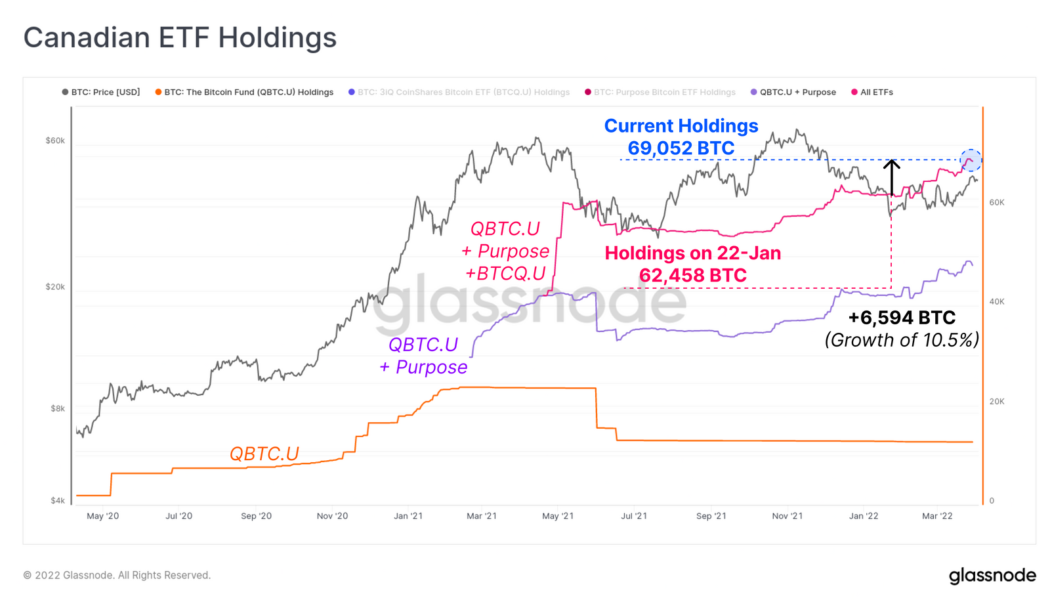

Inflows to Canadian Bitcoin ETFs hit all-time high: Glassnode

Canadian Bitcoin exchange-traded fund (ETF) holdings have increased to all-time highs according to recent research, and spot-based products are leading the way. Canadian Bitcoin ETFs have increased their holdings by 6,594 Bitcoin (BTC) since January to reach an all-time high of 69,052 total BTC held. The Purpose Bitcoin ETF saw the biggest increase in holdings over that time period with a net growth of 18.7% to 35,000 BTC, according to Glassnode. An ETF is an exchange-traded fund that allows investors to speculate on the price of an asset without having to hold any themselves. The Purpose Bitcoin ETF, a spot Bitcoin ETF, currently has about $1.68 billion in assets under management. No such spot Bitcoin ETF is currently available in the U.S. but the metrics show that investors are hung...

In the US, public-private state associations form networks of support for crypto businesses

When you think of a crypto-friendly U.S. state, Washington is hardly the first to come to mind. Yet, a lot has been happening on the ground in the Pacific Northwest lately. Washington Governor Jay Inslee signed a bill, SB5544, into law on March 30. The new legislation creates a working group of seven state officials and eight trade association leaders to examine “various potential applications of and policies for blockchain technology” and report to the governor in December 2023. Republican state Senator Sharon Brown, one of the sponsors of the legislation, said, “By creating the Washington Blockchain Work Group, we are sending a clear message that Washington is ready to start working with the private sector to advance this technology for the benefit of all Washington residents, empl...

Intergovernmental Panel on Climate Change calls cryptocurrency CO2 emissions a ‘growing concern’

The United Nations arm aimed at assessing the science related to climate change, the Intergovernmental Panel on Climate Change, or IPCC, has named crypto among technologies that may require greater energy demands. According to a report released on Monday, the IPCC said cryptocurrencies, as part of the infrastructure around data centers and information technology systems related to blockchain, had the potential to be a “major global source” of carbon dioxide emissions. The group said that estimated CO2 emissions between 2010 and 2019 suggested there was only a 50% probability of limiting the rise of the average temperature of Earth by 1.5°C, based on the remaining carbon budget from 2020. “The energy requirements of cryptocurrencies is also a growing concern, although considerable unce...

Signs of Bitcoin accumulation suggest BTC’s dip to $45K will be short-lived

The cryptocurrency market rally that began on April 1 ran into tough resistance on April 4, sparking a market-wide pullback during the afternoon session after exhausted bulls were overwhelmed by bears who managed to push Bitcoin (BTC) below $45,200. Data from Cointelegraph Markets Pro and TradingView shows that once the afternoon sell-off broke below support at $46,000, the price of BTC hit a daily low of $45,133 before buyers emerged to bid it back above $45,700. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for Bitcoin and what could be in store moving forward in April. Flipping resistance into support April 4’s weakness on the Bitcoin chart was spotted early by crypto trader and pseudonymous Twitter user ShardiB2, wh...

SEC chair: retail crypto investors should be protected

Gary Gensler, chair of the United States Securities and Exchange Commission, said the agency’s protections that apply to investors of traditional assets should extend to those in the crypto market. In prepared remarks released Monday for the Penn Law Capital Markets Association Annual Conference, Gensler said he had requested SEC staff to explore getting crypto platforms registered, having them subject to the same regulatory framework as exchanges. In addition, the SEC chair said the agency’s staff could be working towards addressing regulatory clarity in the crypto space by considering how to register platforms “where the trading of securities and non-securities is intertwined” and whether retail crypto investors should be afforded the same protections as those in traditional markets. “Cr...

Bitcoin leads altcoins in setting up for a positive Q2

Ethereum has been consolidating around $3,500 for the last 24 hours ETH and ADA are gaining from imminent updates coming to the respective networks Recent days have seen Bitcoin enjoy a reasonable upswing in prices, carrying with it several other altcoins. The Satoshi coin has gained approximately 11% over the last two weeks and largely maintained above $45k. According to data by Coingecko, the world’s leading digital asset touched $44,347 on April 1, the lowest price level it has seen in the last week. Bitcoin was last seen changing hands at $46,160. The recent uptrend is a culmination of growth that has been building since mid-March. In the early days of last month, Bitcoin slumped, falling from $41,770 on March 1 to $39k support on March 6. Afterward, it started making signif...