Crypto news

What the media is missing about decentralized autonomous organizations

The New York Times: “Reality Intrudes on a Utopian Crypto Vision.” Bloomberg: “The Next Crypto Bust May Be Spelled D-A-O.” The Guardian: “Are blockchain-based DAOs really a utopian revolution in the making?” Seemingly every week, another old-guard media outlet echoes the talking points of defenders of the status quo financial system who fear and distrust the economic opportunities that will be unlocked through the power of decentralized autonomous organizations (DAOs). While publications are right to recognize the unsurprising early growing pains of DAOs, this sort of hand-wringing misses the forest for the trees when it comes to the impact of DAOs. Rather than simply being a “utopian” experiment, DAOs are a crucial tool in the development of a new decentralized financial (DeFi) system tha...

Axie Infinity hacked for $612M, OpenSea expands support to Solana, EU’s unhosted wallet regulations cause a stir: Hodler’s Digest, March 27-April 2

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Crypto industry fires back after EU vote to block ‘unhosted’ wallets The cryptocurrency industry has fired back at the European Parliament, the legislative arm of the European Union, voting in favor of stringent crypto regulations relating to ”unhosted” private wallets. The guidelines would require crypto service providers to verify the identity of every individual using an unhosted wallet that interacts with them, while any transaction greater than 1,000 euros would need to be reported to authorities.&n...

Is Bitcoin a hedge against inflation?

Putting money in store of value investments like gold, real estate, stocks and crypto helps curb inflation. As cash loses purchasing power over time, keeping cash leads to people losing their savings. This has prompted people to put their money in store of value investments such as gold, real estate, stocks and, now, crypto. Will Bitcoin protect against inflation has been a question in the town ever since. To be held as a store for value, an asset should be able to hold its purchasing power over time. In other words, it should increase in value or at least remain stable. Key properties associated with such assets are scarcity, accessibility and durability. Gold as a hedge against inflation During past inflationary periods, gold has had a mixed track record. In the 1980s, there were times w...

Crypto assets for liquid democracy: The future of public finance

Power historically shifts from governments to people. Democracy is the product of revolution and disruptive innovation by those who abhor the elitism of aristocracy and monarchy, who fear the single-mindedness of theocracy, and who see the impracticability of communism. More than ever before, governments represent fairer and more trustless social contracts. How do we merge the rule of law with “code is law,” and can we have both? As we behold the unstoppable force of decentralization, we must acknowledge the following: mass communication, intercontinental travel, widespread literacy, internet proliferation, pro-democracy movement, and the emergence of gig economies. Liquid taxation: Individual control, instant gratification, real-time impact The problem with taxation is the adversarial ten...

Solana jumps past key selloff junction: SOL price eyes $150 in April

Solana (SOL) jumped past a critical resistance level that had limited its recovery attempts during the November 2021-March 2022 price correction multiple times, thus raising hopes of more upside in April. Solana flips key resistance to support To recap, SOL’s price underwent extreme pullbacks upon testing its multi-month downward sloping trendline in recent history. For instance, the SOL/USD pair dropped by 60% two months after retracing from the said resistance level in December 2021. Similarly, it had fallen by over 40% in a similar retracement move led by a selloff near the trendline in November 2021. SOL/USD daily price chart. Source: TradingView But Solana flipped the resistance trendline as support (S/R flip) after breaking above it on March 30, accompanied by a rise in trading...

Record music streaming profits highlight how NFTs will empower content creators

The music sector hit record revenues at $25.9 billion in 2021, which amounts to an 18.5% growth from 2020, according to IFPI’s “Global Music Report.” Of these nearly $26 billion, streaming drove the bulk of the growth, with a 24.3% increase relative to 2020. These patterns constitute great news for the emerging class of NFT musicians and highlight the demand for audio and video content. Even if the way that streaming is done changes — moving from centralized platforms, like Spotify to decentralized NFT marketplaces — streaming is here to stay. The rise in streaming is part of a broader transformation in media and entertainment towards digital content — print media is quickly fading. Digital media began replacing print media years ago with profound effects on the sector. Economists find tha...

Indonesia’s cryptocurrency community in 2022: An overview

Crypto is the next big thing in Indonesia. According to the Ministry of Trade, transactions for currencies like Bitcoin (BTC) grew over 14 times from a total of 60 trillion rupiahs ($4.1 billion) in 2020 to a total of 859 trillion rupiahs ($59.83 billion) in 2021. It’s getting to the point where crypto is becoming more popular than traditional stock. Vice Minister of Trade Jerry Sambuaga stated that more than 11 million Indonesians bought or sold crypto in 2021. In comparison, according to the Indonesian Central Securities Depository, the total number of portfolio investors — indicated by the number of single investor identities — reached 7.35 million in 2021. Even so, 11 million crypto investors is still only about 4% of Indonesia’s total population, meaning there’s still plenty of room t...

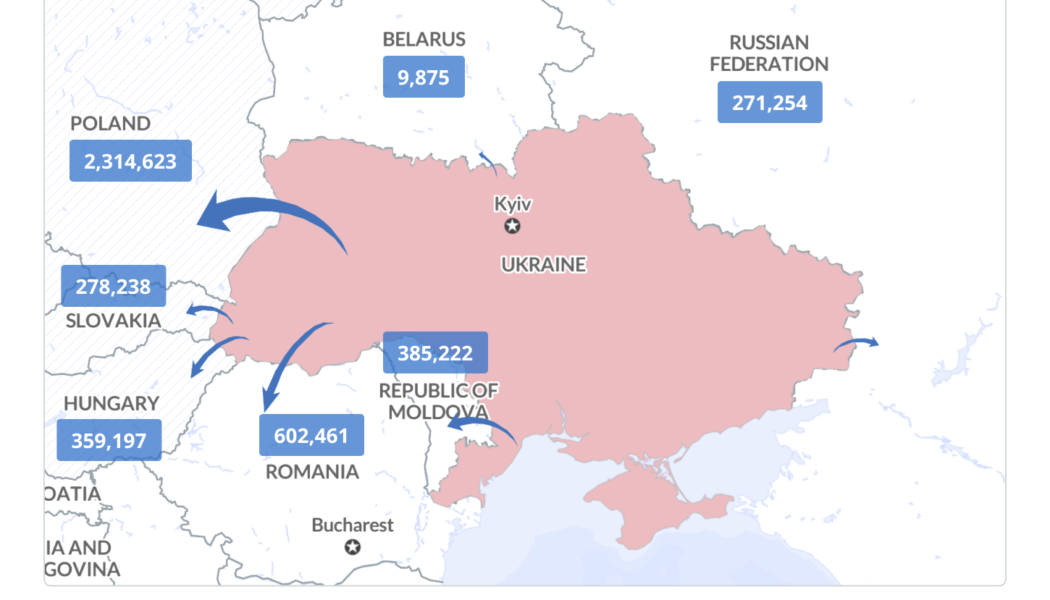

The world has synchronized on Russian crypto sanctions

In her monthly Expert Take column, Selva Ozelli, an international tax attorney and CPA, covers the intersection between emerging technologies and sustainability, and provides the latest developments around taxes, AML/CFT regulations and legal issues affecting crypto and blockchain. According to the United Nations High Commissioner for Refugees, also known as the UN Refugee Agency, nearly 4 million Ukrainians have fled their homes since bombs began falling and bullets started flying on Feb. 24, with most heading to neighboring Central European countries. At the same time, people around the world have sent over $100 million in crypto donations to support Ukraine, according to Alex Bornyakov, deputy minister of digital transformation. This necessitated Ukrainian President Volodymyr Zelenskyy ...

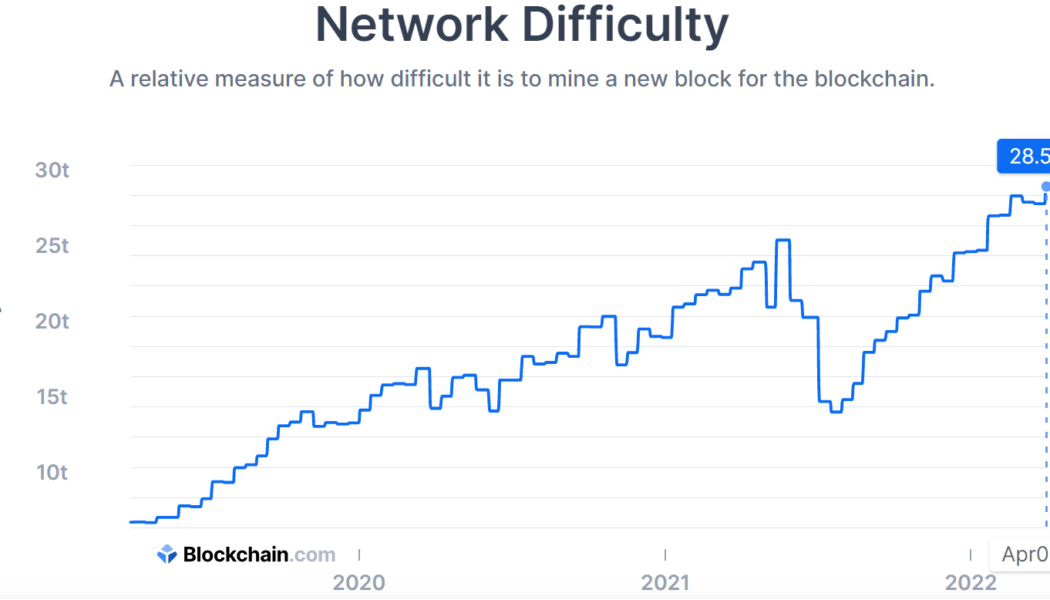

Bitcoin network difficulty reaches all-time high as miners pursue 2M BTC

Just when the Bitcoin (BTC) miners helped release the 19th millionth BTC in circulation on Friday, the BTC network’s mining difficulty reciprocated by reaching an all-time high of 28.587 trillion. Bitcoin’s network difficulty correlates to the computational power required to mine BTC blocks, which currently demands an estimated hash rate of 201.84 exahash per second (EH/s), according to data from Blockchain.com. Bitcoin network difficulty. Source: Blockchain.com Supporting the spike in the network difficulty, Bitcoin’s hash rate maintained a stronghold throughout the year while breaking into an all-time high of 248.11 EH/s on Feb. 13. Bitcoin hash rate over the past three years. Source: Blockchain.com A higher hash rate ensures resilience against double-spending attacks, which is the...

Bitcoin regains yearly open as trader says $50K next week ‘might be likely’

Bitcoin (BTC) consolidated above the 2022 yearly open on April 2 after a return to form briefly saw bulls reclaim $47,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price holds “crucial” long-term support Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $46,600 Saturday on the back of a clear bounce at long-term support. The pair had dipped to lows of around $44,300 Friday, these nonetheless shortlived as positive sentiment took control into the Wall Street open. For Cointelegraph contributor Michaël van de Poppe, with intent to retain newly flipped support confirmed, the odds were on for an attack on $50,000. “Crucial area held up for Bitcoin, in which continuation upwards seems likely,” he summarized to Twitter...

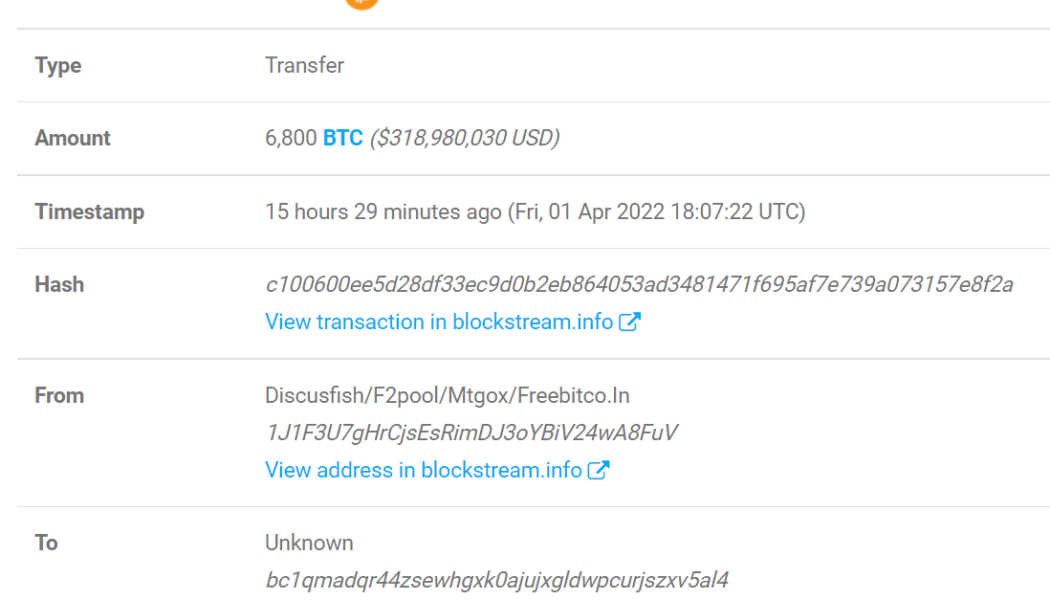

Mt. Gox wallet transfers 6,800 BTC as ex-CEO plans to redistribute $6B

A cold wallet belonging to the infamous Bitcoin (BTC) exchange Mt. Gox transferred 6,800 BTC to an unknown wallet just days after the former CEO Mark Karpeles revealed plans to redistribute BTC worth $6 billion to its creditors. Mt. Gox was a Tokyo-based Bitcoin exchange that shut down in Feb. 2014 after a hack that compromised 850,000 BTC. In a recent interview, Karpeles disclosed that the exchange had roughly 200,000 BTC in possession during the company’s closure, out of which the trustee sold roughly 50,000 BTC for $600 million in the past. According to Karpeles, the remaining 150,000 BTC currently held by Mt. Gox has grown in value over the years — and is worth over $6 billion. After this revelation, the former CEO confirmed plans to redistribute the money and settle scores with ...