Crypto news

The state of Web3: Community talks about opportunities around the world

Delegates at the Binance Blockchain Week talked about their Web3 stories and the growth of Web3 opportunities within their local communities. The recent conference brought crypto community members from all over the world to share their passions, meet like-minded people, learn from keynote speeches by community leaders, and share their perspectives on the state of Web3. One of the topics people showed interest in was the growing demand for Web3 talent. As the internet is evolving from Web2 into Web3, reports show that the demand for talent within the Web3 space is rapidly increasing and there are lots of opportunities popping up within the industry. While statistics are very important, insights directly from the people who are witnessing the transformation of the industry are just as ...

44% of Germans motivated to invest in crypto, believe it’s the future of finance

On March 24, cryptocurrency exchange KuCoin released a report duped ‘Into The Cryptoverse 2022 Germany Report’ that showed at least 44% of Germans are interested in investing in crypto since they want to be part of the future of finance. The report basically explored the rate of cryptocurrency adoption in Germany and how the local population was getting involved in the decentralized industry. The report gave crucial insight into how the adoption of clear rules for cryptocurrencies in 2013 by Germany had affected cryptocurrency adoption rates in the country. Germany was the first country to recognize Bitcoin as a ‘unit of value’ and that it could be classified as a ‘financial instrument.’ Impact of crypto legal regulation in Germany The ongoing advancement of legal regulation for the decent...

Bank of Japan official calls for G7 nations to adopt common crypto regulations

A senior official from the Bank of Japan (BOJ) has warned G7 nations that a common framework for regulating digital currencies needs to be put in place as quickly as possible. G7 refers to the Group of Seven, an inter-governmental political forum made up of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. The statement comes in response to the continued conflict between Russia and Ukraine, as cryptocurrencies and their potential applications for skirting economic sanctions falls under increasing scrutiny. The head of the BOJ’s payment systems department, Kazushige Kamiyama, told Reuters that using stablecoins makes it very easy to “create an individual global settlement system,” which would in turn make it easier for nation states to evade more t...

Crypto industry fires back after EU vote to block ‘unhosted’ wallets

The crypto industry has reacted strongly against a EU Parliament committee voting in favor of a regulatory package for tighter know-your-customer (KYC) and anti-money laundering (AML) rules for ”unhosted” private wallets. The new guidelines would require crypto service providers — most commonly exchanges — to verify the identity of every individual behind an unhosted wallet that interacts with them, while any transaction greater than 1,000 Euros ($1,100) would need to be reported to authorities. Coinbase CEO Brian Armstrong vented his frustrations against the move via Twitter, as he drew comparisons with fiat to highlight the absurdity of reporting and verifying a 1,000 Euro transaction: “Imagine if the EU required your bank to report you to the authorities every time you paid your rent me...

Michael Saylor: Financial markets are ‘not quite ready’ for Bitcoin bonds

MicroStrategy CEO and Bitcoin permabull, Michael Saylor believes that traditional financial markets aren’t quite ready for Bitcoin-backed bonds. Saylor told Bloomberg on Tuesday, that he’d love to see the day come where Bitcoin-backed bonds are sold like mortgage-backed securities, but warned that, “the market is not quite ready for that right now. The next best idea was a term loan from a major bank.” MacroStrategy, a subsidiary of @MicroStrategy, has closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase #bitcoin. $MSTR $SIhttps://t.co/QYw2ZgeE3U — Michael Saylor⚡️ (@saylor) March 29, 2022 The remarks come two days after MicroStrategy’s (MSTR) Bitcoin-specific subsidiary MacroStrategy, announced that it had taken out a $205 million Bitcoin-...

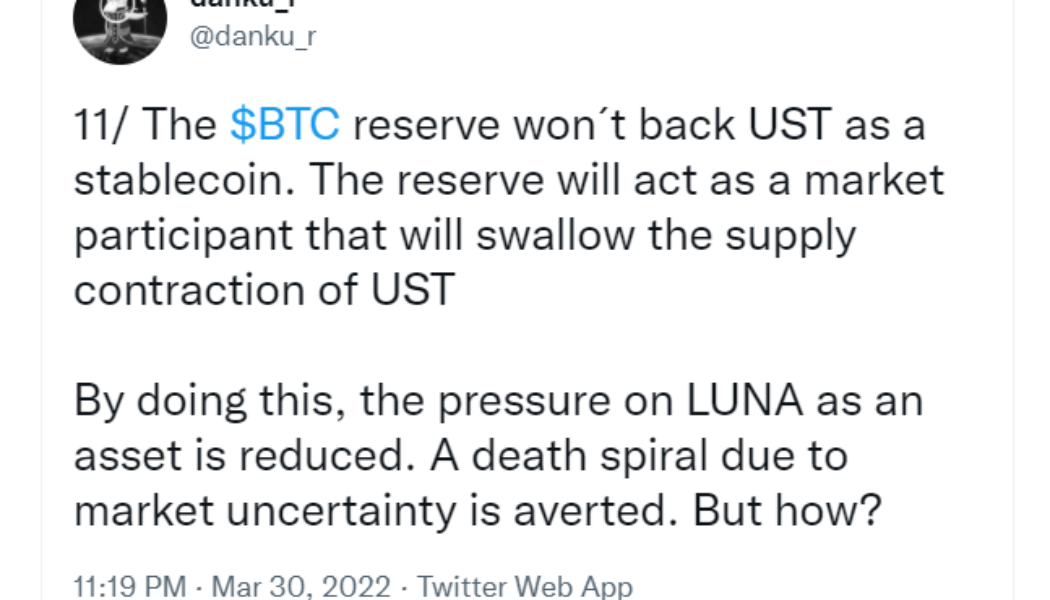

Terra founder reveals what will happen to UST if Bitcoin price crashes

Terraform Labs CEO Do Kwon has conceded that a crash in the price of Bitcoin would be “negative” for the stability of the UST stablecoin, but that he expects Bitcoin to go up. Terraform Labs is the entity behind the Terra (LUNA) blockchain platform which plans on buying a total of $3 billion in Bitcoin as a reserve for the UST stablecoin. Kwon made the comments in an interview on the Unchained podcast on Mar. 29. Host Laura Shin asked Kwon what the short term implications of holding so much BTC will be for the stability of UST. Kwon said “the worst case would be if we were buying Bitcoin and a crash happens six months later, and it’s correlated with a massive fall in demand for UST” which would be, as he modestly put it, “negative.” However, that scenario isn’t keeping him up at nigh...

‘The cryptocurrency world will help in this war’: Kuna CLO breaks down Ukraine’s digital asset law

While many parts of Ukraine are still facing threats from Russia’s military, some residents, industry leaders and government officials are turning to digital assets for help in relocating people, funding humanitarian aid projects and getting supplies to its own soldiers. On Feb. 17, exactly one week before Russian forces began their attack on Ukraine, the country’s legislature adopted the “On Virtual Assets” bill. Ukrainian President Volodymyr Zelenskyy later signed the bill into law, establishing a legal framework for Ukraine to operate a regulated crypto market. Ganna Voievodina, chief legal officer of Ukraine-based crypto exchange Kuna and one of the bill’s authors, told Cointelegraph that the ramifications of the legislation came at a critical time when the country needed legal a...

Chiliz launches public testnet for its new layer-1 blockchain

Digital asset sporting project Chiliz has announced the launch of the Scoville testnet for the newly established layer-1 blockchain network Chiliz Chain 2.0, also known as CC2. CC2 will seek to advance the Web3 capabilities of high-profile sporting and entertainment firms to create nonfungible tokens (NFTs) and fan tokens, construct decentralized finance (DeFi) applications and play-to-earn (P2E) games, as well as implement a range of programms and services for their community. Founded in 2018 and headquartered in Malta, Chiliz has established itself as the leading digital asset for sporting engagement, with their native token, CHZ serving as the primary currency within the fan-orientated Socios.com platform. Providing specific details on the process of stakeholder approval, as well a...

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

New SEC guidance on accounting and disclosures rankles Commissioner Peirce

U.S. companies that safeguard their clients’ crypto-assets received new accounting guidance Thursday in the form of a Securities and Exchange Commission, or SEC, Staff Accounting Bulletin. The guidance got a strong response from SEC commissioner Hester Peirce, a steadfast crypto advocate. Staff Accounting Bulletin 121 noted the high technological, legal and regulatory risks associated with the custody of crypto-assets, relative to traditional assets. Those risks impact the operations and financial condition of companies such as Coinbase, PayPal and Robinhood, which safeguard users’ crypto-assets and allow the users to trade them on their platforms. For this reason, companies are advised to list their users’ assets on their books as liabilities as well as assets at their fair value at initi...

Why Bitcoin is ready to make a break for $50K

A dive into fundamentals, on-chain data and technical analysis for Bitcoin Why $50K could be in the crosshairs And… some Colombian meteorology Approach As I write this, I am sitting in a coffee shop in Medellin, Colombia. We are in the midst of rainy season, and there is a thunderstorm roaring outside. I’ve never heard thunder this loud, I can actually feel it. It’s a storm you don’t see too often, like the 50 year storm in the movie Point Break. Or, more importantly, like the one we are currently seeing for Bitcoin (can we call it the $50K storm? Someone needs to pitch this to Keanu Reeves). I like to separate my eggs into three baskets when assessing Bitcoin. First, there’s the macro angle. Secondly, there is on-chain data. Finally, you can get your pen and ruler out and dive i...

Blockchain.com’s valuation hits $14BN following newly reported raise

The exchange has completed four financing rounds since the start of 2021 Blockchain.com has a customer base of 37 million users and has processed more than $1 trillion in transactions UK-based cryptocurrency exchange Blockchain.com has reportedly concluded a funding round led by one of its previous investors, Lightspeed Ventures Partners, as per a Thursday report from Bloomberg. Independent investment management firm Baillie Gifford had heavy involvement in the raise, which comes at a $14 billion market valuation – more than double the valuation during the previous financing round completed by the exchange. The report didn’t feature details of the sum raised, and neither party involved has made any official communication. In addition to running a platform for trading crypto ass...