Crypto news

Cardano ecosystem tokens you should not miss: API3, LINK and COTI

API3, LINK, and COTI are all part of the Cardano ecosystem. As the Cardano ecosystem evolves, each token will see a significant level of growth. All of these tokens can increase in value, and we are going to go over each one individually. API3 (API3), Chainlink (LINK), and COTI (COTI) are all tokens that are a part of the Cardano ecosystem. We will be going over each token individually as a means of getting an indication as to how far this token can grow. Should you buy API3 (API3)? On March 24, 2022, API3 (API3) had a value of $5.16. The all-time high of API3 (API3) was on April 7, 2021, when the token reached a value of $10.30. When we go over the performance of the token throughout the previous month, API3 (API3) had its lowest point of value on February 3, when the token was worth just...

Multiplayer P2E game Mavia seeks ‘Verified by Machinations’ seal

The seal demonstrates dedication to maintaining a sustainable and healthy in-game economy The Heroes of Mavia strategy game is backed by leading exchanges Crypto.com and Binance Skrice Studios’ multi-player play-to-earn online game Heroes of Mavia has just announced an initiative towards a sustainable in-game economy as it seeks the Verified by Machinations’ seal. Heroes of Mavia is backed by crypto exchanges Crypto.com and Binance and offers players gaming actions largely rewardable by RUBY, the game’s native token. Machinations will track Mavia’s economy Gaining the Machinations seal is crucial in ensuring the viability of P2E gaming platforms, especially those built around crypto and the general Web3 space (characteristic of liquidity pools, decentralised autonom...

Ledger CEO claims that with increasing relevance Bitcoin could offer good exchange value

The Ledger chief says that Bitcoin has shown utility in situations of war beyond just Ukraine He insists the crypto utility that the Ukraine situation has shown is nothing new Ledger CEO Pascal Gauthier recently appeared on CNBC’s Squawk on the Street in an exchange that dwelt on several matters crypto and where the industry is headed. The impact of geopolitics The ongoing war resulting from the Kremlin’s incursion of Ukraine has been sort of a revelation for crypto in terms of sanction evasion and the cross-border utility of the assets. Perhaps the best illustration of this is the massive crypto donations that have been either made or pledged so far. The Ledger boss noted that even beyond Ukraine, places like Lebanon have often seen the rising utility of crypto since war often...

Portsmouth embraces Bitcoin payments for city bills

In an effort to embrace virtual money, the city of Portsmouth, New Hampshire, will allow residents to pay their bills in Bitcoin (BTC) and other cryptocurrencies. Deaglan McEachern, the city’s mayor, proposed the idea to city officials, who feel it will provide residents with more payment choices. As per a local news report from Seacoastonline on March 23, Mayor McEachern said that “there are waves of new things that will affect us in terms of our future that use the type of technology used in cryptocurrency.” He went on to say: “I want to make sure Portsmouth is not waiting around to see how this is going to affect us in the future because it’s already affecting us.” McEachern said the City Hall has learned a lot more about cryptocurrencies and blo...

Bottomed out? MINA rises 75% nine days after hitting its worst level to date

MINA, a utility token backed by a “lightweight” smart contracts platform of the same name, continued its upside move nine days after rebounding from $1.58, its lowest level to date. The coin rallied by about 75% to reach $2.75 as of March 24 as traders weighed a high-profile funding rounds involving the sale of $92 million worth of MINA tokens to Three Arrows Capital, FTX Ventures, and other venture capitalists. MINA/USD daily price chart featuring its correlation with Bitcoin. Source: TradingView An overall recovery sentiment across the crypto market also assisted in pushing MINA’s price higher, since altcoins typically move in tandem with Bitcoin (BTC). Additionally, Coinbase’s announcement on March 23 to add MINA support to its crypto exchange may have ...

Digital currencies could get a boost from the international crisis: Blackrock CEO

Larry Fink, the CEO of the world’s largest asset manager BlackRock, believes the ongoing Russia – Ukraine crisis has boosted the case for digital currencies as a tool of settlement for international transactions. In a shareholders letter, Fink noted that the ongoing war would force nations to reassess their currency dependencies which could eventually make way for a global digital payment network, reported Reuters He said the war has put an end to the globalization forces at work over the past 30 years. Fink’s observation about the boost in the digital currency market is quite spot on, as trade sanctions on Russia have already led many countries that import oil and gas from them to look for alternate payment networks beyond centralized SWIFT. India is reportedly developing a direct I...

Ethereum price breaks through $3K, but analysts warn that a retest is needed

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio. Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term. Upcoming test of $3,125 A general overview of the recent...

A$DC rocks the Aussie dollar as ANZ bank mints first AUD stablecoin

Big 4 bank ANZ has become the first Australian bank to mint an Australia dollar (AUD) pegged stablecoin named “A$DC.” But rival bank NAB also has its own stablecoin project which is expected to launch by the end of the year. ANZ is working with local regulators such as AUSTRAC and APRA to get the project signed off in a compliant manner, and has already run a test transaction on the Ethereum blockchain with its institutional partner Victor Smorgon Group, the family office tied to the billionaire Smorgon family. According to a March 24 report from the Australian Financial Review (AFR), the stablecoin will initially be rolled out for institutional clients seeking a cost-effective on-ramp for crypto investments, however it is likely to be opened up to the retail trading market in the near fut...

Charles Hoskinson cheekily admits: ‘I was wrong’ about DApp rollout

Co-founder of the Cardano blockchain Charles Hoskinson has cheekily admitted that his July 2020 forecast of the number of DApps coming to the blockchain has not yet come to fruition. Referring to his famed July 2020 tweet, Hoskinson tweeted on Mar. 23, “Remember when I predicted thousands of assets and DApps on Cardano? Well I was wrong, there are now millions of native assets issued and DApps are now in the hundreds. #SlowAndSteady.” Remember when I predicted thousands of assets and DApps on Cardano? Well I was wrong, there are now millions of native assets issued and DApps are now in the hundreds. #SlowAndSteady https://t.co/mK4So6NHa1 — Charles Hoskinson (@IOHK_Charles) March 23, 2022 However he may have misremembered his own tweet, as he had predicted back in July 2020 that by 20...

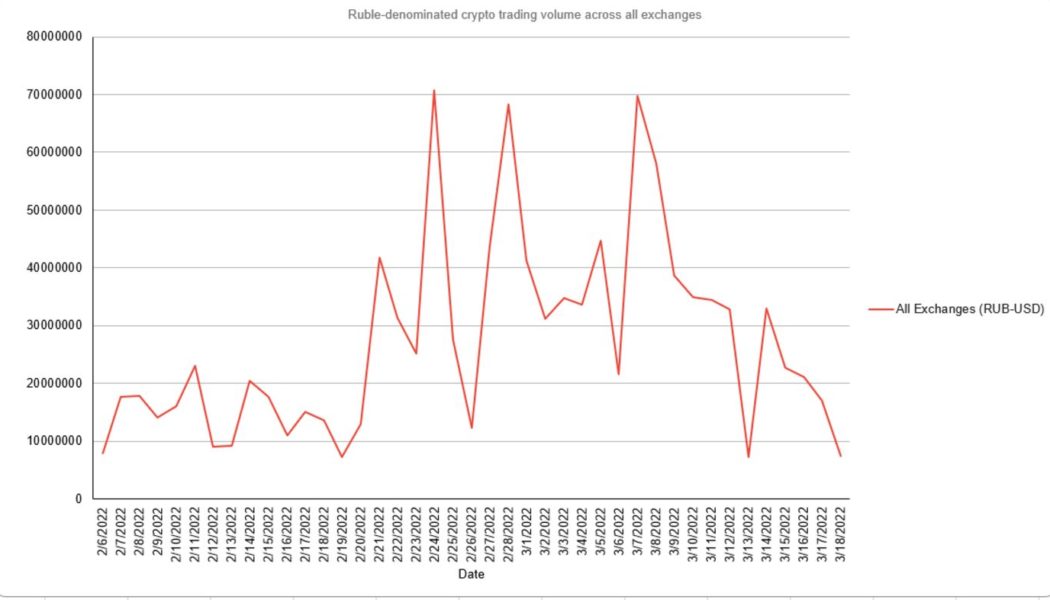

Crypto trading in rubles falls even as ECB warns again on sanctions

The President of the European Central Bank, Christine Lagarde has reiterated warnings that Russian individuals and businesses are using cryptocurrencies to skirt sanctions. However, as of March 18, daily ruble-denominated crypto trading volume was sitting at just $7.4 million, down over 50% from recent figures and a peak of $70 million on March 7, according to data from Chainalysis. This amount represents a tiny slither of the total global crypto market volume, with Bitcoin’s total daily volume generally fluctuating between $20 billion and $40 billion. In a presentation at the Bank for International Settlements Innovation Summit on Tuesday, the crypto skeptic Lagarde said that European financial authorities had seen the “volumes of rubles into stable, into cryptos, at the moment [is at] th...

Acorns brings Bitcoin exposure to its savings and investment app

Acorns users can now allocate up to a maximum of 5% of their portfolio the ProShares Bitcoin Strategy (BITO) ETF The personal finance app has plans to create room for other cryptocurrencies in the future Backed by Galaxy Digital, savings and investment firm Acorns has announced the introduction of Bitcoin exposure to its portfolio, targeting long-term investments among its users. Through a Twitter post, Acorns said that it is glad to add “Bits of Bitcoin” to diversify its portfolio. With an increased rate of exposure to crypto among fintech firms, Acorns explained that it had to offer its investors the opportunity to diversify their holdings. The company cited the ‘low correlation’ between crypto and stocks as the rationale for the decision. In contrast, though, at ...