Crypto news

Solana ecosystem tokens worth keeping an eye on: LINK, WAVES, GRT and AUDIO

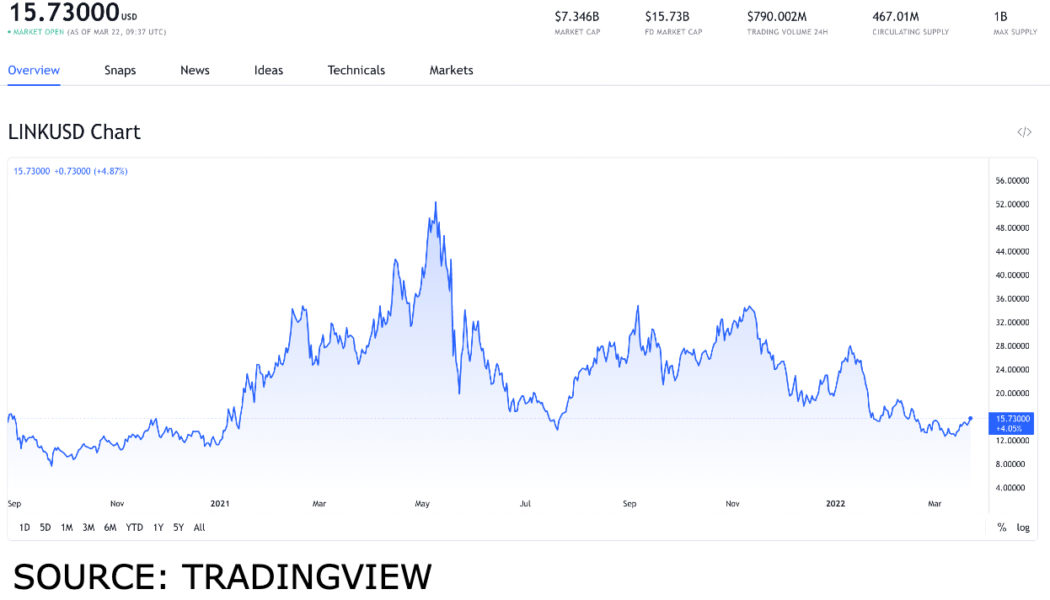

LINK, WAVES, GRT, and AUDIO are all a part of the Solana ecosystem of tokens. These are selected due to their historical growth and potential for future growth. All of these tokens can grow in value by the end of March 2022. Chainlink (LINK), Waves (WAVES), The Graph (GRT), and Audius (AUDIO) are all tokens that are a part of the Solana ecosystem. If you are curious about which tokens to buy and you want to dive deeper within the Solana ecosystem, these are your go-to options. Should you buy Chainlink (LINK)? On March 22, 2022, Chainlink (LINK) had a value of $15.73. When we go over the all-time high point of value of the token, Chainlink (LINK) had its highest point of value on May 10, 2021, when it reached a value of $52.70. As we move on to the performance the token showcase...

Evidence doesn’t back claims of Russia using crypto to evade sanctions, says Chainalysis CEO

Chainalysis chief Jonathan Levin has said there’s no evidence of ‘systemic’ use of crypto to skirt sanctions The CEO also explained how Chainalysis’ recently-released sanctions compliance tools enable businesses to screen for interaction with sanctioned addresses Amid the ongoing invasion of Ukraine by the Kremlin, the question of whether cryptocurrencies could be used to evade economic sanctions has been up for debate. Blockchain tracking and analytics firm Chainalysis CEO and co-founder Jonathan Levin has given his opinion on the matter in a recent interview with Bloomberg Technology. Levin spoke to Emily Chang and Sonali Basak about the new free sanctions screening tools recently announced by Chainalysis. He explained that the tools are meant to help organisations and businesses ensure ...

CBDC payments infrastructure project involving four central banks concludes

The project has created prototypes to model international transactions settlement via multiple CBDCs There remain concerns over who should transact on the platform, how to create a trusted payment system across governments, and how to deploy the platform despite varying regulations Last September, the Bank of International Settlements’ (BIS) Innovation Hub led the Monetary Authority of Singapore, the South African Reserve Bank, the Reserve Bank of Australia, and Bank Negara Malaysia in an initiative to prototype-test the use of CBDCs in settling cross-border transactions. The aim was to establish whether these government-controlled tokens can be vehicles enabling inexpensive transactions across the said countries. Today, the four central banks have confirmed in a released report that...

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

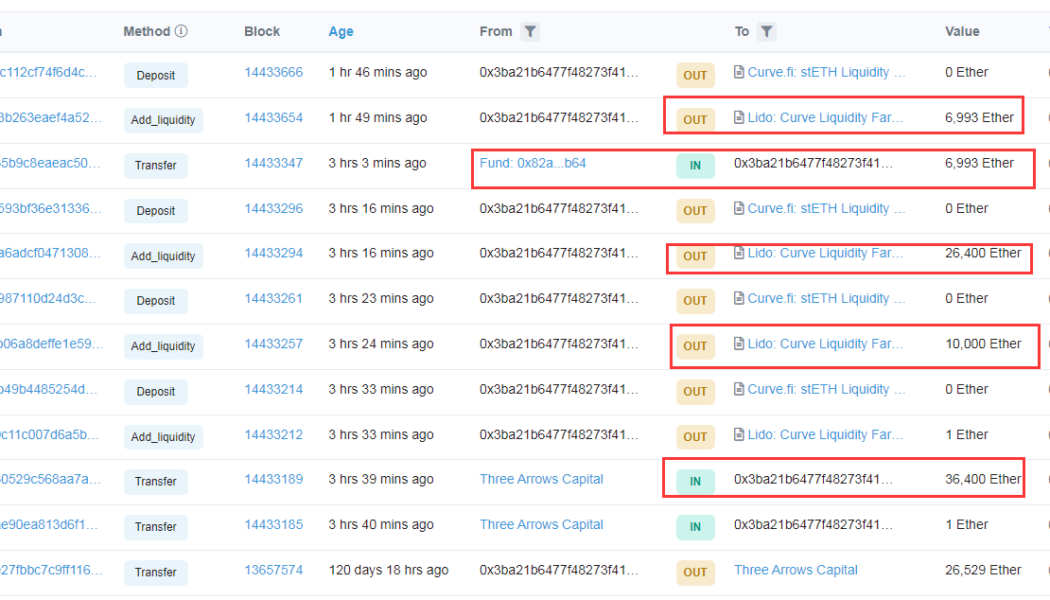

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

US exceptionalism could be tested as digital assets find footing worldwide — Sheila Warren

Sheila Warren, CEO of the Crypto Council for Innovation and former head of data, blockchain and digital assets at the World Economic Forum, said the digital yuan may present certain challenges for the United States. However, regulators and lawmakers may want consider how to encourage digital innovation, as China is already “massively tech forward” for its residents. Speaking to Cointelegraph during Austin’s SXSW festival, Warren said that though she believed China’s digital yuan was unlikely to significantly affect retail payments in the United States, the adoption of the technology surrounding it could impact the dollar’s global dominance. The CCI CEO added that the Federal Reserve could make a “strong move” in preserving the dollar’s role by introducing a central ...

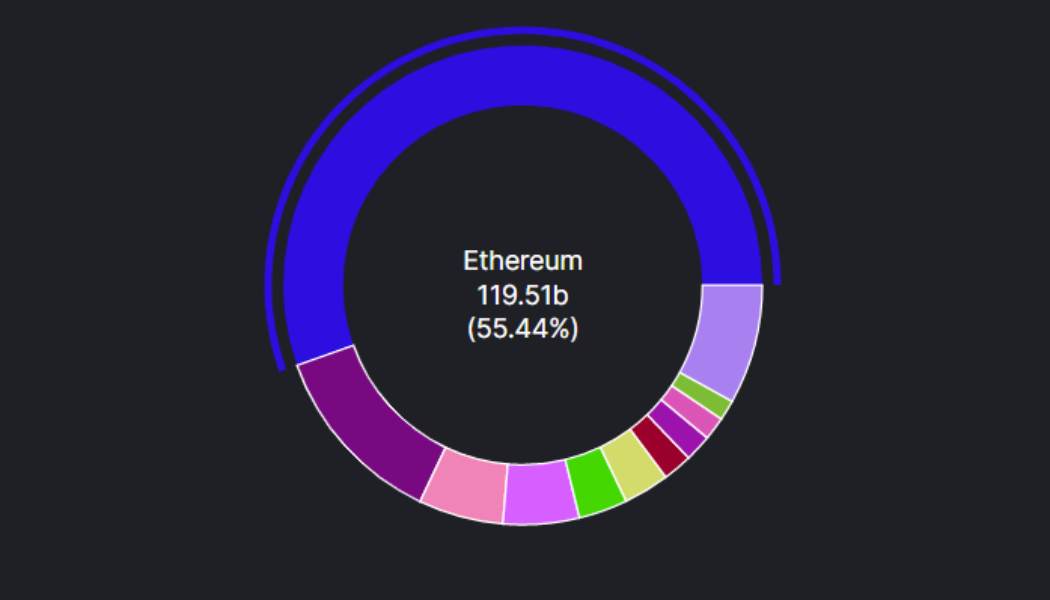

Grayscale launches smart contract fund for Ethereum competitors

Digital asset manager Grayscale Investments has unveiled a new cryptocurrency fund dedicated to smart contract platforms excluding Ethereum, underscoring growing investor appetite for alternative blockchain networks. The Grayscale Smart Contract Platform Ex-Ethereum Fund, also known by the ticker symbol GSCPxE, is the company’s 18th investment product. The fund will provide exposure to seven smart contract platforms at the following weightings: Cardano (ADA): 24.63% Solana (SOL): 24.27% Avalanche (AVAX): 16.96% Polkadot (DOT): 16.16% Polygon (MATIC): 9.65% Algorand (ALGO): 4.27% Stellar (XLM): 4.06% Grayscale said the new fund is now open for daily subscription by accredited investors. Ethereum’s dominance as the premier smart contract platform is being challenged by competitors that...

Bitcoin Cash and Ethereum Classic up double digits as 24-hour trading volume eclipses $100 BN

Ethereum has cleared resistance at $3,000 on Tuesday morning Other top altcoins including ADA, DOT, and XRP are trading in the green as well The majority of top cryptocurrencies appear to be gaining ground on Tuesday with the total market capital peaking above $2 trillion. Bitcoin price shot up to a multi-week high of $43,116 in the early Asian trading hours, CoinMarketCap data shows. Although the OG crypto has retreated to around $42,470 as of this writing, it is still trading in the green – up approximately 3% in the last 24 hours. Ether price crossed $3,00o on the strength of the sharp overnight ascent, touching a five-week high of $3,040. Market data further shows that ETH’s 24 hr trading volume has swelled by almost 42% to $19.688 billion. Bitcoin Cash and Ethereum Classic leading gai...

Crypto ads ‘red alert’ escalates as the ASA sends an enforcement notice

The list of firms that received the ASA’s enforcement notice includes past offenders The served firms have until May 2 to review their ads and ensure they comply with the outlined rules The Advertising Standards Authority (ASA) has issued a notice to 50 companies offering crypto services in the UK, demanding that they review their crypto advertisements by May 2, else they risk facing more decisive action. Following a crypto ad red alert notice it issued last November, the ASA is on a path of enforcing an industry-wide crackdown. The watchdog considers it necessary to fight against the “misleading and irresponsible” advertisements around crypto products. “Crypto has exploded in popularity in recent years. We’re concerned that people might be enticed...

FTX Ventures bets $100M on financial services firm Dave

FTX.US will be the official crypto partner of Dave as part of the sealed strategic partnership The exchange will also guide the firm’s entry into the digital assets space Crypto exchange FTX via its venture capital arm FTX Ventures has invested $100 million into Dave, a mobile banking company. This goes along with the ongoing payment industry’s wave towards a focus on systems that support crypto products. Even firms such as MasterCard and Visa that have previously dealt with legacy payment systems have launched initiatives to facilitate payments via crypto assets. PayPal and its Venmo platform added support for crypto last year, while JackDorsey’s Cash App allows US users (bar New York) to send BTC via the Lightning Network. FTX.US will help Dave enter the digital asset s...

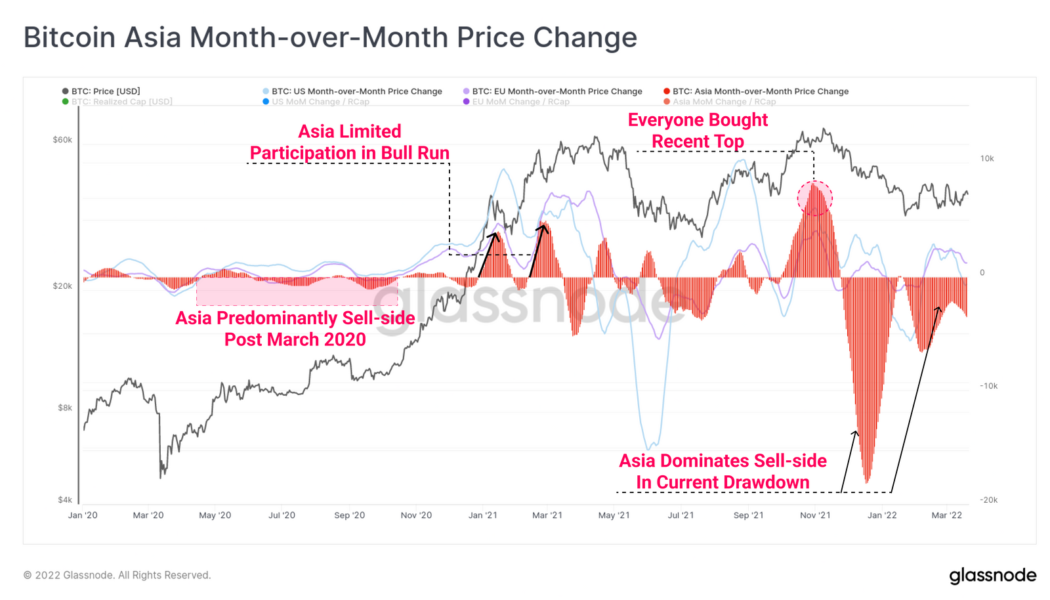

Crypto market selling pressure remains Asia dominated: Glassnode

The Bitcoin network’s on-chain activity still appears to be in a bear market as U.S. and E.U. buyers are struggling to stay ahead of sellers based in Asia. Blockchain analytics firm Glassnode’s latest report on the weekly activity of the Bitcoin (BTC) network shows that the price of the largest crypto by market cap has stayed firmly within the same tight $5,000 range from $37,680 to $42,312. However, on March 22 the asset saw a sudden spike in price which elevated prices to a two-week high. Overall, the network is in a demonstrable lull according to Glassnode’s weekly review: “Bitcoin network utilization and on-chain activity remains firmly within bear market territory, albeit is recovering.” The research concluded that there is a distinct difference in the behavior of the average BTC inve...

Mobile banking app Dave scores $100M investment from FTX US

On March 21, mobile banking application Dave announced a partnership with FTX US to provide cryptocurrency payments on the platform. It also announced a $100 million investment from FTX Ventures. In the statement, Dave said the investment would aid its strategy for future crypto-related initiatives, with FTX US serving as its partner for cryptocurrencies. Both companies said they’re currently exploring ways to introduce crypto payments into Dave’s platform. FTX US President Brett Harrison commented that it looks to align with companies that can help drive widespread adoption of digital assets, believing Dave was a fit in that regard. Jason Wilk, Chief Executive Officer of Dave, expressed his views on the technology. “We believe blockchain technology has the potential to level the financial...