Crypto news

DeFiance Capital founder loses $1.6M in hot wallet hack

Founder of major crypto investment firm DeFiance Capital, “Arthur_0x”, has suffered a hack on one of his hot wallets resulting in the loss of more than $1.6 million in nonfungible tokens (NFTs) and crypto. In a tremendous show of support, the crypto community has come to his aid to help retrieve the stolen items as he asked people to blacklist the hacker’s wallet. Several individuals on Twitter have attempted to determine exactly how the hack occurred and where the hacker gained access to his wallets. NFT community member “Cirrus” went as far as buying two of the stolen Azuki NFTs and deciding to return them to Arthur at cost. Cirrus told Cointelegraph today that he: “found out they were hacked, and instead of selling them for profit like the other folks who got some of his, decided I’d se...

Bitcoin hits 3-week high as fresh impulse move sends BTC price to $43.3K

Bitcoin (BTC) saw a fresh impulse move overnight into March 22 as bulls briefly reclaimed $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI hints at underlying strength Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $43,337 on Bitstamp Tuesday, the pair’s highest since March 3. The action contrasted with the lack of volatility since the weekend, and neatly fitted with the more bullish predictions surrounding near-term trajectory. For popular trader Crypto Ed, who had previously given $43,000 as a low-timeframe target, all was going to plan. #BTC Been showing red box at $43k for a couple of days now…. Imagine not watching my YT videos….. No need at all to listen to dudes, who like to hear talking themselves for >2...

FTX exchange expands operation by launching Australian unit

The exchange completed an acquisition to gain the required regulatory license to launch in Australia FTX Australia will offer locals derivatives and other market-leading products Sam Bankman-Fried led crypto exchange FTX has revealed that it’s launching a new service for its customers in Australia. The leading global exchange announced the creation of FTX Australia in a statement published yesterday. The exchange said that Australian consumers will get exposure to market-leading products and services, including derivatives and a collection of exchange and over-the-counter products. CEO Sam Bankman-Fried was keen to point out that the launch of the subsidiary would allow users to conduct their activity on a locally regulated and licensed platform. Though Australians have previously be...

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

OCEAN gains 86.4% in March ahead of Q2 launch of Ocean v4

Data security and accessibility have become important issues of the modern age as the world slowly progresses towards a Web3 future that establishes blockchain technology as the underlying infrastructure for the new internet. One project that is looking to capitalize on this growing trend by establishing tools for the new Web3 data economy is Ocean Protocol (OCEAN), a blockchain ecosystem that helps individuals and businesses unlock the value of their data and monetize it through the use of datatokens. Data from Cointelegraph Markets Pro and TradingView shows that, over the past two weeks, the price of OCEAN has rallied 86.4% from a low of $0.40 on March 7 to a daily high of $0.748 on March 21 amid a 562% surge in its 24-hour trading volume to $321 million. OCEAN/USDT 4-hour chart. Source:...

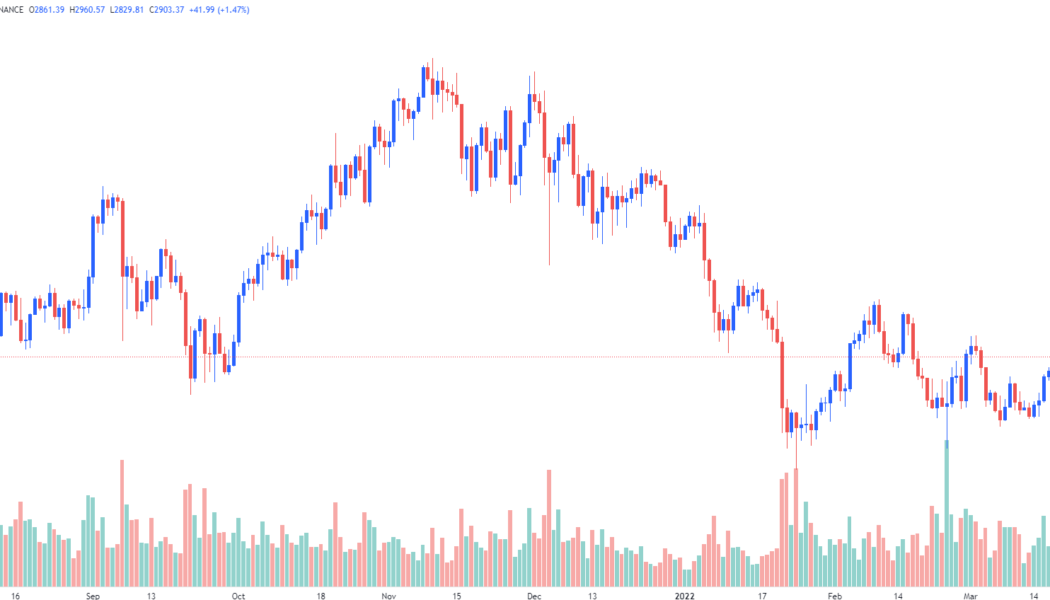

Ether bulls eye resistance at $3K as the network prepares to undergo ‘The Merge’

A new week in the cryptocurrency market has brought more of the same sideways price action that the wider ecosystem has experienced in recent months, as Bitcoin (BTC) continues to hold support near $41,000 while some analysts warn that high inflation and rising interest rates could see the top cryptocurrency fall to $30,000. On the altcoin front, Ether (ETH) appears to be showing some signs of life as noted by cryptocurrency analyst Willy Woo, who recently tweeted that “Ether [is] setting up to break upwards out of a very long term, 3.5-month bearish trend line.” Data from Cointelegraph Markets Pro and TradingView shows that the ETH price is now trading above support at $2,900, with bulls looking to make another run at breaking the $3,000 resistance after being firmly rejected a...

Euroclear invests in Fnality to advance digital ledger technology strategy

On Monday, Euroclear, a securities clearing firm that claims it has over 37.6 trillion euros in assets under custody, announced an investment into Fnality, a consortium of financial institutions focused on the regulated adoption of tokenized assets and marketplaces, for an undisclosed amount. Meanwhile, Euroclear is also focusing on developing its distributed ledger technology, or DLT, to settle digital securities against digital cash through the partnership. The solution aims to increase the speed and efficiency of post-trade operations in areas such as market issuance, collateral trades and servicing interest payments. Founded in 2019, Fnality International said that it seeks to improve the efficiency of central banks for payment settlements. Its notable shareholders include Barcla...

Australian Liberal Senator proposes digital assets regulation

Senator Andrew Bragg has submitted a proposal pushing for policies to protect the consumer The legislative proposal, if approved, would define regulation for DAOs, crypto markets, custodial services, and taxation Australia is set to join the list of countries worldwide that have adopted initiatives towards regulating the use and adoption of digital assets. According to recent reports, the Australian government plans to redefine the state of payments systems, a move that would also affect digital currencies. The goal is to create investor protection measures, laws for crypto taxation and regulate digital asset custodial firms and exchanges. “The government can’t guarantee your crypto any more than it can guarantee a painting or a share in a company, and nor should it,” Aus...

Struct Finance raises $3.9M to compose, customize, and invest in DeFi products

Struct Finance, a decentralized (DeFi) blockchain-based platform for structured financial products, announced in a Monday press release the completion of a $3.9 million seed round. The company said it will use the proceeds to compose, customize, and invest in DeFi products. Avalanche one of many investors Struct Finance is a protocol on Avalanche although it expects to scale into other EVM compatible chains in the near-term. Struct Finance tapped 24 investors to partake in the financing round. The group includes several notable standsouts, including Avalanche’s 200 Million Blizzard Fund. The roster of other investors includes: Antler, Assymetries Technologies, Arcanum Capital, Avalaunch, AVentures Dao, Bison Fund, Bixin Ventures, Double Peak, FBG Capital, Finality Capital Partners, Infinit...

Deputy Minister of Malaysia’s Communication Ministry roots for legalising crypto

Deputy minister Zainul Abidin has proposed the legalisation of cryptocurrencies in Malaysia to ease financial dealings among the younger population Earlier this, the deputy minister of finance in the country spoke strongly against crypto assets In a move to indicate that the Malaysian Ministry of Communications and Multimedia (KKMM) is supporting the adoption of crypto assets, deputy minister Zainul Abidin has called for the legalisation of crypto. Speaking during a parliamentary session today, Abidin explained that it is important for Malaysia to legalise some facets of crypto and NFTs as they could potentially be useful, especially for the younger generation. He noted that the crypto space has increasingly become popular with this demographic. “We hope the government can try to leg...

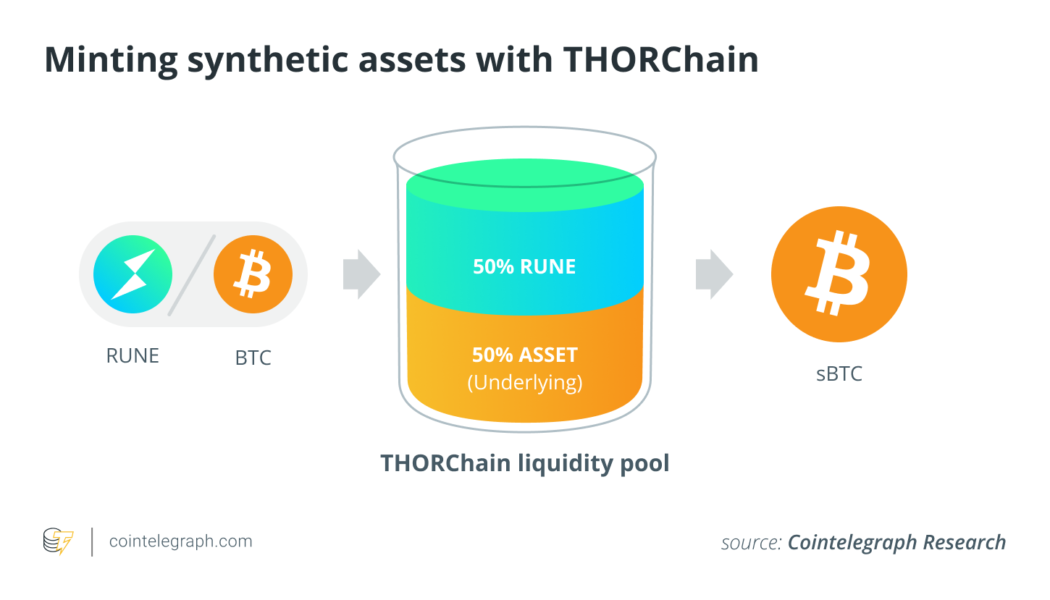

RUNE rally: A closer look at THORChain’s new synthetic assets

THORChain (RUNE) has appreciated nearly 41% in the past seven days, according to the data from Cointelegraph Markets Pro, and its recent price action is even leading the entire crypto market in the first quarter of 2021. Its mainnet launch, which was originally slated last year, is one of the main factors that led to its recent price surge. But, the other factor that provided added momentum is the integration of synthetic assets to its network. Why was this such a huge deal, and what are its implications for THORChain going forward? THORChain is often compared to Uniswap since it provides users a way for traders to swap different tokens. The only difference is THORChain lets users trade layer-1 coins in a decentralized manner, whereas Uniswap is limited to only the tokens that are of the E...

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...