Crypto news

Bitcoin spikes to $41.7K highs as Ethereum nears $3K reclaim

Bitcoin (BTC) saw brisk upwards action during the Wall Street trading session on March 18, conforming to predictions that higher levels would see a retest. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets placed on $46,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it advanced $1,650 from daily lows to nearly matching the $41,700 high from March 16. The move buoyed traders, who began to reinforce their short-term view of levels near the top of Bitcoin’s 2022 trading range being challenged. For popular trader Pentoshi, however, such a result would not mean that BTC/USD had broken its downtrend definitively. “Macro headwinds still too strong but midterm, I think we rally bc seller exhaustion before any shot at new lows or prev low...

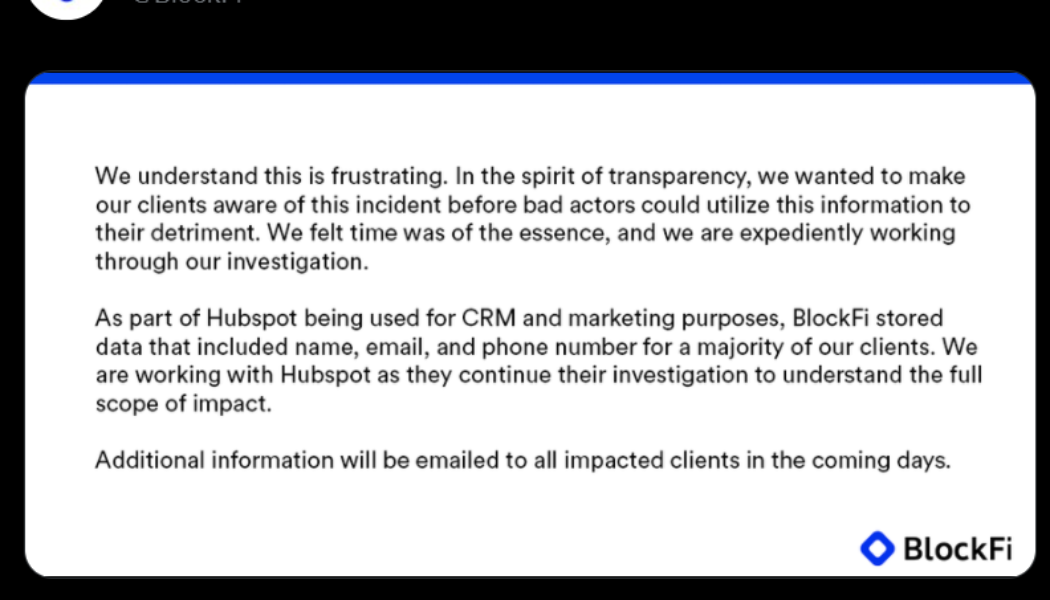

BlockFi confirms unauthorized access to client data hosted on Hubspot

New Jersey-based crypto financial institution BlockFi confirmed a data breach incident via one of its third-party vendors, Hubspot. BlockFi’s proactive warning about the breach aims to deter the intentions of bad actors in repurposing the user data for fraudulent activities. According to the announcement, the hackers gained access to BlockFi’s client data on Friday, March 18, that were stored on Hubspot, a client relationship management platform: “Hubspot has confirmed that an unauthorized third-party gained access to certain BlockFi client data housed on their platform.” As a third-party vendor for BlockFi, Hubspot stored user data such as names, email addresses and phone numbers. Historically, bad actors have used such information for conducting phishing attacks and gaining access to acc...

A detailed guide on how to lose all your Bitcoin investments

Let’s say you want to lose your Bitcoin (BTC) totally, irretrievably and forever. Hey, it’s not our place to wonder why. Maybe it’s part of some elaborate performance art piece, like the guy who destroyed all his possessions or perhaps you’ve always been big fans of electronic music outfit The KLF, who famously burned 1 million pounds on a remote Scottish island. Or, your reason might be more mundane and you simply don’t want your soon-to-be-divorced spouse to get their share of the investment you both know you own. Whatever your reason, we’re not here to judge. And, while we’re usually in the business of helping people protect their coins, it’s easy enough to reverse engineer security to help you lose them in the fastest and easiest way possible. Brag about your Bitcoin If you’ve got it a...

PoW avoids EU ban, two DeFi protocols suffer a combined $11M hack and BAYC does an ApeCoin airdrop: Hodler’s Digest, March 13-19

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Ukraine’s president signs law establishing regulatory framework for crypto Crypto regulation has received approval from Ukrainian president Volodymyr Zelenskyy. The bill, titled “On Virtual Assets,” was signed by the president, opening the door to government oversight of the domestic cryptocurrency industry. Ukraine’s Ministry of Digital Transformation said: “The signing of this law by the president is another important step towards bringing the crypto sector out of the shadows and launching a legal market for...

Bitcoin beats owning COIN stock by 20% since Coinbase IPO

Buying a Coinbase stock (COIN) to gain indirect exposure in the Bitcoin (BTC) market has been a bad strategy so far compared to simply holding BTC. Notably, COIN is down by nearly 50% to almost $186, if measured from the opening rate on its IPO on April 14, 2021. In comparison, Bitcoin outperformed the Coinbase stock by logging fewer losses in the same period — a little over 30% as it dropped from nearly $65,000 to around $41,700 BTC/USD (orange) vs. COIN price (blue). Source: TradingView What’s bothering Coinbase? The correlation between Coinbase and Bitcoin has been largely positive to date, however, suggesting that many investors consider them as assets with similar value propositions. That is primarily due to the buzz around how COIN could become a simpler onboarding experi...

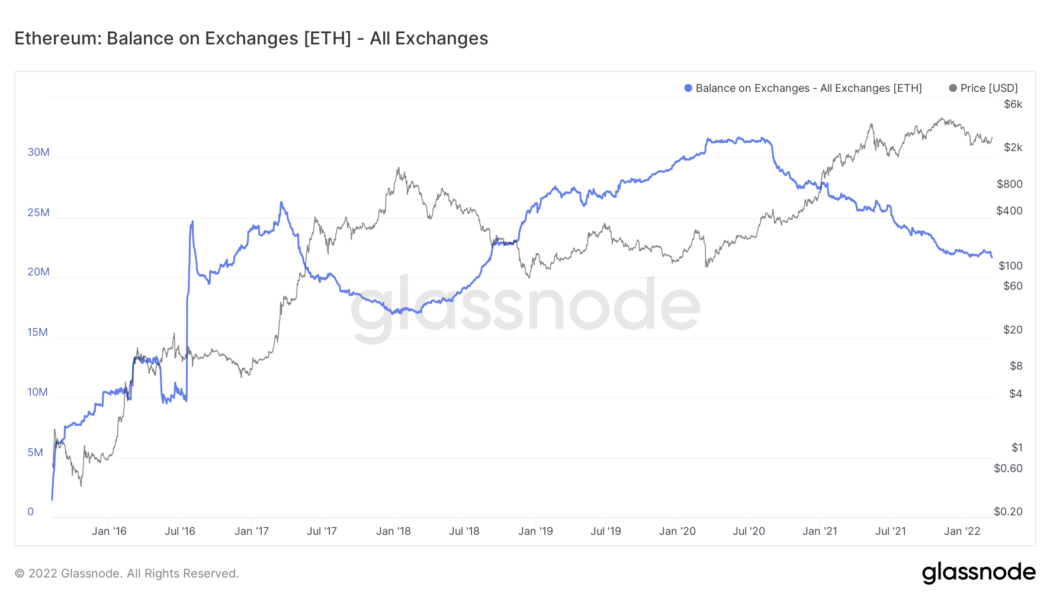

Ethereum balance on crypto exchanges falls to lowest levels since 2018

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...

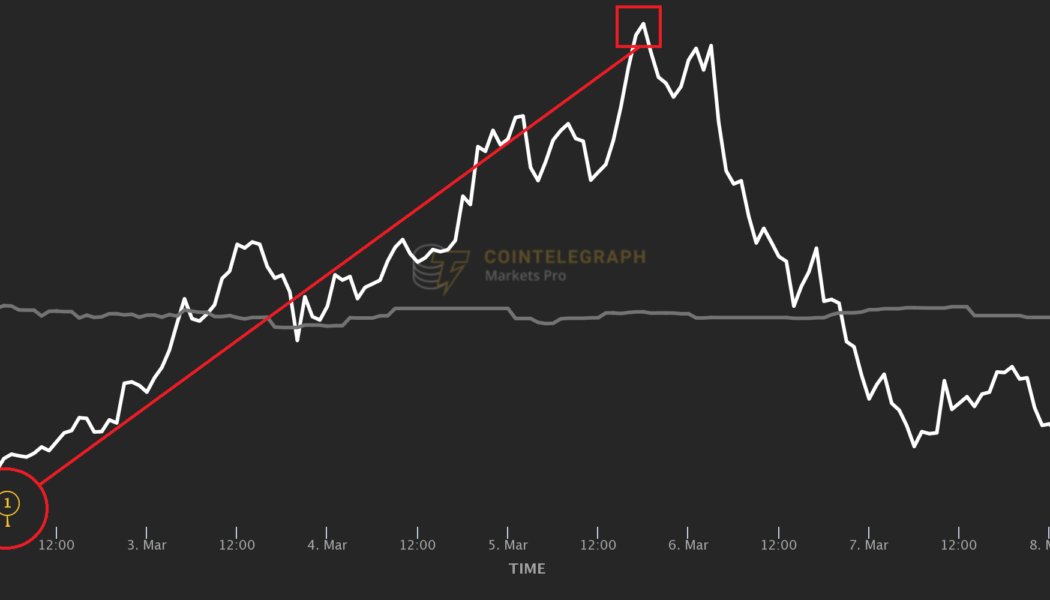

3 times in March that savvy crypto traders bought breaking news for the price of a rumor

As an old saying goes: Buy the rumor, sell the news. As a digital-native asset class, the prices of cryptocurrencies are clearly susceptible to market-moving news developments that instantly spread on the internet. Staying on top of bullish announcements can help crypto traders reap huge gains, but navigating the crypto news landscape can be daunting. Two major roadblocks get in the way: the abundance of potentially relevant information and the difficulty of making sure one is always among the first to learn the news that really matters. Extensive research shows that three types of crypto-related developments move digital asset prices most consistently: listings, staking announcements and big partnerships. This insight somewhat narrows down the scope of the developments that will most inte...

Old but gold: Can digital assets become part of Americans’ retirement plans?

On March 11, the United States Department of Labor warned employers that sponsor 401(k) retirement plans to “exercise extreme care” when dealing with cryptocurrencies and other digital assets, even threatening to pay extra legal attention to retirement plans with significant crypto investments. Its rationale is familiar to any crypto investor: The risk of fraud aside, digital assets are prone to volatility and, thus, may pose risks to the retirement savings of America’s workers. On the other hand, we are seeing established players in the retirement market taking steps toward crypto. For one, retirement investment platform ForUsAll decided last year to implement crypto as an investment option for 401(k) fixed retirement accounts in partnership with Coinbase. Is this the beginning of a large...

Fact or fiction? Did ApeCoin (APE) really drop by 80% since launch?

ApeCoin (APE), the governance token of the well-known Bored Ape Yacht Club (BAYC) NFT project was airdropped to BAYC and Mutant Ape Yacht Club (MAYC) owners at 8.30 am EST on March 17 and only eight hours after APE became tradable in the open market, it has already jumped to the 110th most traded token ranked by CoinGecko, totaling $900 million in trading volume across all tracked platforms. As one would expect, there were some volatile price movements minutes after the airdrop and headlines show the price of APE dropping 80% since its launch. This raises the question of whether the ordinary BAYC and MAYC owner could have sold APE at $40 instead of $14, which it is trading for at the time of publishing. Let’s take a look at APE’s price minutes after the airdrop was claimed and the token li...

Vitalik Buterin talks crypto’s perils in Time Magazine interview

Ethereum co-founder Vitalik Buterin graced the front page of Time Magazine this month after he was interviewed by the publication about the potential perils of the industry he helped tocreate. During the 80-minute interview, Buterin explained the “dystopian potential” of digital assets if implemented incorrectly. Among his biggest worries are overzealous investors, high transaction fees and public displays of wealth by those claiming to have made a fortune trading crypto and nonfungible tokens (NFTs). Although Buterin has high hopes for Ethereum — the network powering the second-largest cryptocurrency by market capitalization and countless other projects — he fears that his vision of creating a more egalitarian digital economy risks being overtaken by nefarious actors who are only af...

European ‘MiCA’ regulation on digital assets: Where do we stand?

The proposed European Union Regulation on Markets in Crypto Assets, or MiCA, (hereinafter the “regulation”) was put to a vote in the European Union Parliament’s Committee on Economic and Monetary Affairs on March 14, 2022, and in the end, the proposed amendment to ban or restrict proof-of-work-based crypto assets, which would have effectively resulted in a ban on Bitcoin (BTC), was rejected. The question of how crypto assets will be assessed from an environmental regulation perspective remains, however, with the Member of the European Parliament in charge of the text indicating that crypto assets will be included, like all other financial products, in the area of the union’s taxonomy (the process of classifying economic activities that have a favorable impact on the environment), without s...