Crypto news

Weekly Report: Stripe introduces crypto and NFTs support, Goldman Sachs to offer OTC bilateral crypto options

Here are the top headlines from the cryptocurrency space that you might have missed this week: Multinational bank Goldman Sachs wants to offer new OTC crypto options Goldman Sachs is now among several Wall Street banks looking to offer crypto options. The financial services and investment bank revealed this week it has intentions to soon start availing over-the-counter bilateral crypto options for enterprise clients. A recent report by Bloomberg, citing a person familiar with the matter, detailed that the American banking giant is looking to sink its claws deeper into cryptocurrencies. The news outlet said that the individual, who preferred to remain anonymous, observed that Goldman Sachs isn’t the only Wall Street bank exploring bilateral options. The said options enable crypt...

Cryptocurrencies against the ‘silent thief.’ Can Bitcoin protect capital from inflation?

The world is becoming increasingly volatile and uncertain. The assertion that “inflation is the silent thief” is becoming less relevant. In 2021, inflation has turned into a rather loud and brazen robber. Now, inflation is at its highest in the last forty years, already exceeding 5% in Europe and reaching 7.5% in the United States. The conflict between Russia and Ukraine affects futures for gold, wheat, oil, palladium and other commodities. High inflation in the U.S. and Europe has already become a real threat to the capital of tens of thousands of private investors around the world. Last week at the Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell said that he would recommend a cautious hike in interest rates. At the same time, Powell mentioned that he ...

Bitcoin drifts into weekly close while Fed rate hike looms as next major BTC price trigger

Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-awaited Fed action set to come this week Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday. The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and outside crypto continued without surprises. Now, attention was already focusing beyond Sunday’s close, specifically on the upcoming decision on interest rates from the United States Federal Reserve. Due March 16, the extent of the presumed rate hike could provide temporary volatility and even...

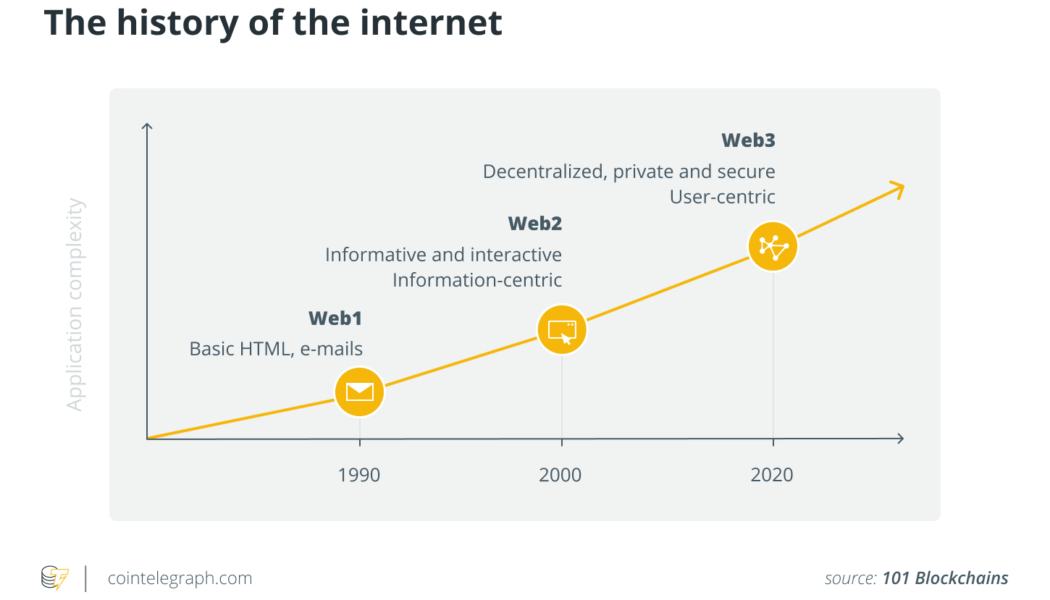

Web3 relies on participatory economics, and that is what is missing — Participation

Web3 is hailed as a technology paradigm that is fueled by the creator economy and is in the future, or rather, the next evolution of the internet. As we draw evolutionary comparisons of the technology that underpinned everything from information consumption to content creation, Web2 contributed an unparalleled economic growth and represented a significant era in human evolution with new ways to work, consumer information and progress in human civilization. So with this enormous success of Web2, why is there a need for Web3? As we rethink the internet, which relies primarily on a few centralized entities that have devices, channels of information that feeds the social media, mobile apps and provides connectivity points between service providers and seekers of these services, the control ove...

3 reasons why XRP price could drop 25%-30% in March

XRP price risks dropping by more than 25% in the coming weeks due to a multi-month bearish setup and fears surrounding excessive XRP supply. XRP descending triangle XRP has been consolidating inside a descending triangle pattern since topping out at its second-highest level to date — near $1.98 — in April 2021. In doing so, the XRP/USD pair has left behind a sequence of lower highs on its upper trendline while finding a solid support level around $0.55, as shown in the chart below. XRP/USD weekly candle price chart. Source: TradingView In the week ending March 13, XRP’s price again tested the triangle’s upper trendline as resistance, raising alarms that the coin could undergo another pullback move to the pattern’s support trendline near $0.55, amounting to ...

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...

Valkyrie Investments‘ Leah Wald on Bitcoin ETFs and the future of digital assets

Cointelegraph sat down with Leah Wald, CEO of digital asset investment firm Valkyrie Investments, to learn more about the importance of a Bitcoin (BTC) exchange-traded fund (ETF) and the future of digital assets. For context, Valkyrie Investments was launched in 2020 and is one of the only asset managers to have three Bitcoin-adjacent ETFs trading on the Nasdaq. Valkyrie launched a Bitcoin Strategy ETF in October 2021 that offered indirect exposure to BTC with cash-settled futures contracts following a United States Securities and Exchange (SEC) approval for a similar ETF from ProShares. Valkyrie also has a balance sheet opportunities ETF that invests in public companies with exposure to Bitcoin. In addition, the investment firm’s Bitcoin Miners ETF began trading on the Nasdaq o...

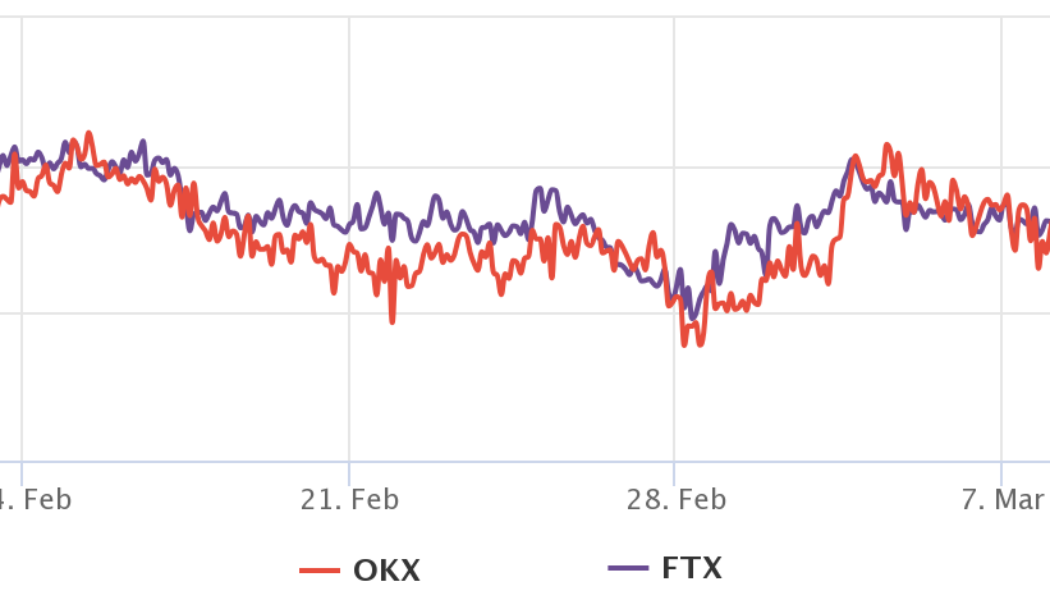

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

23-year-old Australian buys $314k property via planned crypto investments

A young resident from Queensland, Australia played the long game of accumulating Bitcoin (BTC) and Ethereum (ETH) over several years to eventually overcome the soaring real estate prices during the 2020 bull run and own his dream home. The 23-year-old Loi Nguyen started his journey as an investor back in 2017 by purchasing a few hundred dollars worth of BTC, ETH and traditional stocks. However, his interest in crypto reached new heights while pursuing an Economics degree: “Crypto came back into my life when I did a course at the uni on inflation. I learned that Bitcoin can be disinflationary.” Speaking to news.com.au, Nguyen revealed that the lower interest rates (less than 0.5%) offered by traditional banks could never help him break into the real estate market. By following a dollar-cost...

Yuga Labs faces user backlash for under wraps KYC-restricted project

Yuga Labs, the creator of the Bored Ape Yacht Club, or BAYC, teased a new collaboration with blockchain game publisher Animoca Brands on Twitter on Thursday. The catch is that no details about the project have been revealed yet, and users who signed up for it via a Know Your Customer, or KYC, verification process have expressed their concerns on social media. BAYC simply tweeted out a link to a website where interested fans can apply in the hope of being approved to participate in whatever “is brewing.” To apply, users must connect to an Ethereum wallet, provide a photo of their license, passport or other ID as well as proof of their home address, and take a headshot on the camera of the device on which they sign up. fuck it, again.https://t.co/1KlPpVjWkb — Bored Ape Yacht Club...

US and EU double down on measures against Russia potentially using crypto to evade sanctions

The United States and the European Union have announced new actions targeting Russia’s economy and wealthy individuals as a report suggests Vladimir Putin’s allies have attempted to circumvent sanctions using cryptocurrency in foreign countries. In a Friday announcement, the White House said leadership from the United States, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union will take additional actions aimed at economically isolating Russia in response to President Vladimir Putin’s military invasion of Ukraine. The announcement includes banning imports of many Russian goods, banning the export of luxury goods to Russia and guidance for the U.S. Treasury Department to monitor the country’s attempts to evade existing sanctions. “Treasury’s expansive actions ag...