Crypto news

Stablecoins will remain relevant even with the dawn of the CBDCs era, says Tether CTO

CBDCs will leverage private blockchains for tech infrastructure They, however, won’t be issued on private chains like stablecoins are at present Chief Technology Officer at Tether, Paolo Ardoino, has dismissed concerns that central bank digital currencies (CBDCs) will affect the currently offered private stablecoins. Ardoino was speaking in regards to the debate that has been happening in recent months, as more countries are declaring ambitions in CBDCs. CBDCs will power bank activities Explaining his view, Ardoino engaged his Twitter followers with the perspective that CBDCs are not built to digitise fiat currencies since most transactions in the modern day are already digital. Rather, he argued that these government-controlled digital currencies would essentially replace legacy pay...

FTX joins other crypto goliaths to promote autonomy over sensitive information

Centre, an open-source technology project developed by Coinbase and Circle, has onboarded crypto exchange FTX and Alkemi Network as its latest partners to collaborate on Verite. Verite is a set of shared decentralized identity protocols — developed by Centre — to empower crypto-centric individuals and businesses by granting total control of personal information. Supporting Verite’s commitment to collaborate on shared decentralized identity standards, FTX and Alkemi have added to the list of 14 crypto companies, which include Coinbase, Circle, Hedera Hashgraph, Ledger, the Solana Foundation and more. Verite launch partners include @circlepay , @blocks, @Algorand, @coinbase, @compoundfinance, @ConsenSys, Espresso Systems, @hedera, @Ledger, @MMInstitutional, @phantom, @SolanaFndn, @Spru...

Okcoin launches $165M collective investment to push Bitcoin adoption

Cryptocurrency exchange Okcoin, along with the Stacks Accelerator and Stacks Foundation, announced on Thursday the start of the “Bitcoin Odyssey,” a one-year commitment among investment firms to invest $165 million in inventive solutions to help drive Bitcoin (BTC) adoption. The Bitcoin Odyssey is funded by Digital Currency Group, GBV Capital, White Star Capital and GSR, among other organizations, to respond to the rise in interest in decentralized finance (DeFi) and new technological capabilities made possible with Stacks. Alex Chizhik, head of listings at Okcoin, and Kyle Ellicott, partner at Stacks Accelerator, will co-lead the initiative. The money and assets will be used to finance initiatives that are being built on Stacks, an open-source network for Bitcoin-based smart contracts, an...

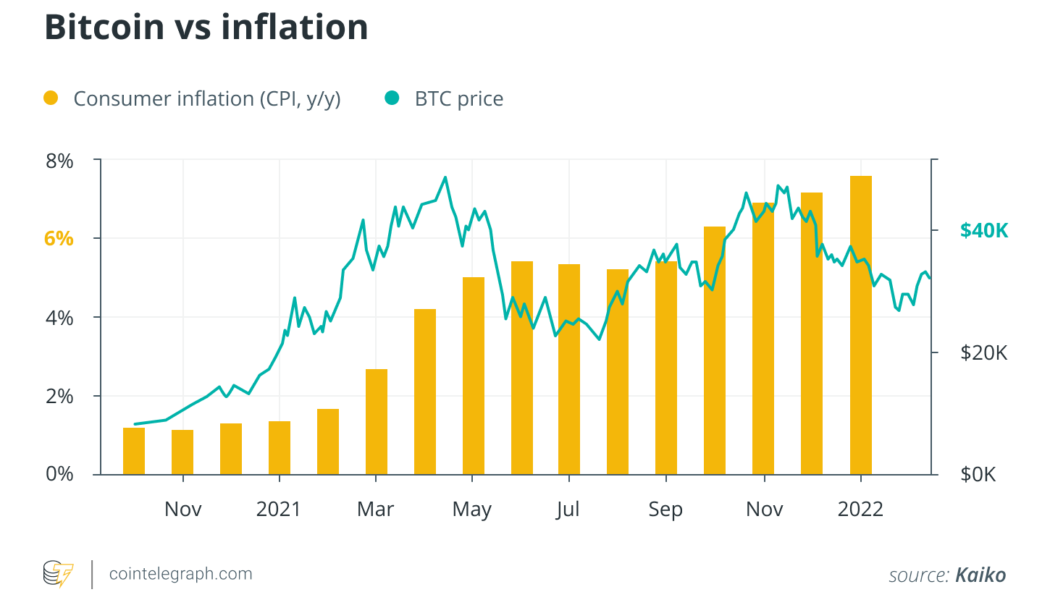

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

Bridgewater’s Rebecca Patterson believes the Ukraine situation will speed up growth in the crypto sector

Patterson said that crypto is currently liquid sensitive and has a long way to evolve She held that the Russia-Ukraine standoff should speed up growth in the crypto space In her opinion, the momentum in crypto could become self-fulfilling as more investors join in Bridgewater Associates’ Chief Investment Strategist Rebecca Patterson has predicted that the current situation in Russia-Ukraine will only speed up the overall growth of ecosystems around digital assets. Speaking to CNBC’s Closing Bell, the investment manager noted that this is a significant moment for crypto as it is the first time the digital asset has been used as a geopolitical tool, unlike capital markets that have, in the past, been caught up in the midst of a geopolitical crisis. Patterson added that crypt...

Crypto market recedes after Wednesday’s rally, FTM and XMR down over 10%

The upwards momentum inspired by yesterday’s release of the Biden crypto executive order has waned The majority of the top cryptocurrencies are seeing losses in the range of 4% to 8% The price of most crypto coins soared late Tuesday and remained high for the larger part of Wednesday. The midweek upswing was as a result of the White House crypto directive that was released yesterday, albeit the Treasury department, through Janet Yellen, had inadvertently shown a glimpse of what the order would entail. Bitcoin and company surged as the markets welcomed the vague order, interpreting it as progressive for the sector. Crypto assets have nosedived The market outlook has, however, changed 24 hours later, with many crypto assets resuming a downtrend after failing to sustain the momentum. Co...

Crypto-friendly Yoon Suk-yeol emerges victorious in South Korean presidential election

Policy changes in the digital assets industry formed a key campaign issue Suk-yeol promised reduced taxes and incentives to realise the potential of digital assets in the economy Yoon Suk-yeol, a conservative candidate in South Korea, has clinched the presidency with a narrow margin over his closest competitor, Lee Jae-myung. Suk-yeol, a former prosecutor who has in the past imprisoned South Korean leaders on corruption charges, campaigned on the platform of deregulating crypto. Crypto took centre-stage as a campaign issue, with the leading candidates defining crypto-friendly stances to win over the young voters. The debate came on the back of harsh regulations on the crypto markets. Korea’s financial watchdog, the Financial Services Commission (FSC), has imposed tight regulatory req...

Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar. Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView. Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%. Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Hold...

THORChain spikes by 34% after activating synthetic assets

The price of the native asset for cross-chain decentralized exchange THORChain (RUNE) has spiked by 34% in a day following the activating of synthetic assets on the network. At the time of writing the price had settled back to a 21% gain over the past 24 hours to sit at $5.27.. Crypto synthetics or synths are derivative tokens of other digital assets that are pegged to the value of the underlying collateralized asset such as Bitcoin (BTC) or Ether (ETH). In THORChain’s variation, the project has opted to back its synths with 50% of the underlying asset and 50% in RUNE. The activation went live earlier today and synthetics such as sBTC and sETH are now able to be traded on the network. THORSwap Finance highlighted the advantages of the synthetic assets via a March 10 blog post, noting that ...

Crypto-friendly Yoon Suk-yeol wins Sth Korean presidency, ICX surges 60%

Conservative South Korean presidential candidate Yoon Suk-yeol has officially been elected as South Korea’s next president. The election was one of the closest in South Korean history, according to BBC coverage, which saw Yoon, representing the conservative People Power Party, claim victory over his more politically progressive opponent, Lee Jae-myung, by a margin of less than 1%. Cryptocurrency played a leading role in South Korea’s election debate, with both candidates releasing campaign-related NFTs. Their crypto-sympathetic stances are in opposition to former-President Moon Jae-In’s crackdown on crypto exchanges last year, and helped curry favor with the younger, more crypto enthusiastic demographic. Speaking at a virtual asset forum in January, Yoon promised to deregulate South Korea’...

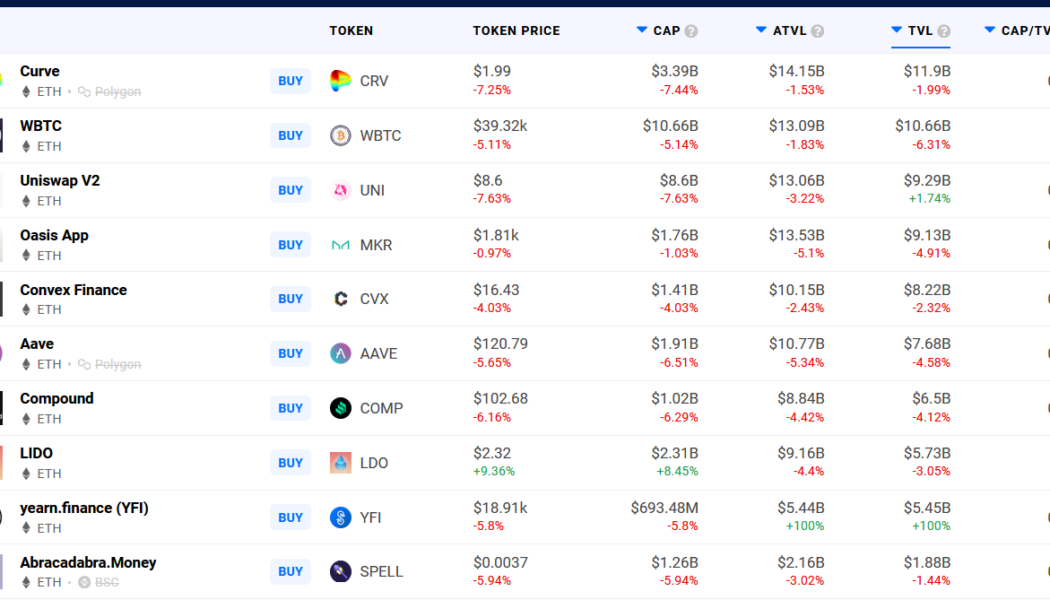

Ethereum gas fees drop to lowest levels since August 2021

Gas fees for transactions on the Ethereum (ETH) blockchain have dropped to the lowest levels since August. But they’re still not cheap. According to data sourced from Coinmetrics and shared by CryptoRank Platform, the seven-day moving average cost of an Ethereum transaction as of March 9 totaled $11.14, placing it back amongst the levels recorded mid-last year before it surged dramatically to as high as $55 at the tail end of 2021. The cost of transactions on the @Ethereum network has not been this low since Aug 2021. Notably, gas prices surged after staying in this range for about 3 months with experts attributing the spike to a rise in interest in the #NFT and #DeFi ecosystems. https://t.co/oLDJyfSea2 pic.twitter.com/ieigvLT4Gz — CryptoRank Platform (@CryptoRank_io) March 9, 2022 At the ...