Crypto news

Crypto market rallies on reports of a ‘positive’ Biden crypto executive order

News of the release of a now-deleted Treasury response to Biden’s crypto executive order has sent bullish waves in the market Bitcoin has gained more than 8.25%, racing past $42,000, while Ethereum has retested $2,750 Reports of the highly-anticipated crypto executive order from the White House being bullish or neutral in the worst case have spurred a market rally on Wednesday morning. Treasury’s response hints Biden’s crypto executive is likely not bearish Late yesterday, US Secretary of Treasury Janet Yellen published a response to the Biden crypto order even before the latter was released. The incident struck as unintentional since the response shared was dated March 09 (today) yet went up live a day earlier. In the statement, Yellen ‘accidentally gave an inkling...

More than $195M liquidated in the last 24 hours as Bitcoin and altcoins rebound

The combined crypto market capital has swelled by over $115 billion in the last 12 hours Market data shows $195 million worth of leveraged positions have been closed on account of the unexpected rally Top crypto assets are soaring in the market led by Bitcoin and the premier altcoin – both have seen 24-hr price gains of more than 6.50%. The market upsurge started late yesterday following the accidental release of a statement from Treasury’s Janet Yellen acknowledging the White House’s ‘positive’ crypto directive. Through Yellen’s comments, the market construed the crypto executive order as pragmatic and even positive to some extent. This triggered a market-wide rally, with the total crypto market capital growing from $1.726 trillion to a peak of $1.847 trillion a few hours ago. Massive liq...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

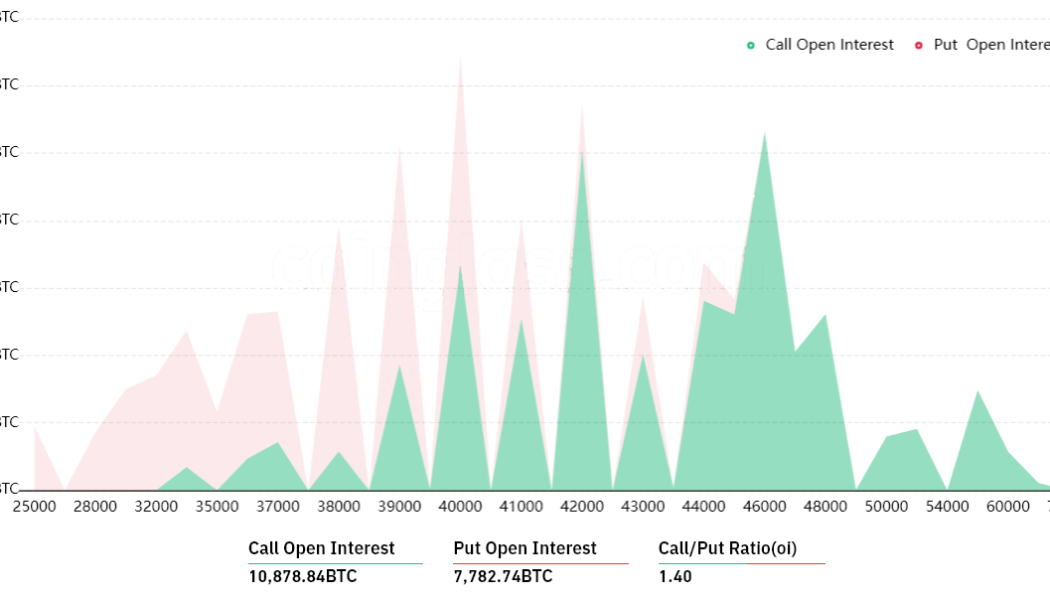

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...

Elizabeth Warren is drafting legislation to check Russian activity in crypto

There are bipartisan concerns on the role of crypto in enabling Russia to skirt economic sanctions Warren’s proposed bill would require crypto exchanges to track and submit records on transactions to private crypto wallets As the sanctions against Russia become stringent and more companies including Visa and MasterCard join the list of those suspending operations in the country, the United States political class wants to go a step further to ensure that “crypto isn’t used by Putin and his cronies to undermine our economic sanctions,” as Democratic senator Elizabeth Warren put it. According to a report first published by NBC News on Tuesday, the senior senator from Massachusetts is crafting a piece of legislation to crack down on crypto and prevent its use by Ru...

P2P file-sharing platform LimeWire stages a comeback as an NFT marketplace

The discontinued file sharing platform will launch as an NFT marketplace in May The NFT marketplace project is yet to conduct external funding but will soon launch a LimeWire token Defunct software peer-to-peer file sharing (P2P) client LimeWire has today announced that it’s coming back but not in the same way it used to be. LimeWire intends to relaunch as an NFT marketplace. At the height of its prominence, LimeWire was popular for its service that allowed users to share and download music at no cost. However, its run came to an end and had to shut down in 2010 after a federal court found that LimeWire had caused large-scale copyright infringement via the service it offered users. Here is what to expect Austrian brothers Julian and Paul Zehetmayr, who acquired LimeWire’s intel...

Cake DeFi launches groundbreaking tech firm growth accelerator CDV

Cake DeFi, a fully transparent, highly innovative and regulated global fintech platform, has launched Cake DeFi Ventures. The venture arm, worth $100 million, will be vested in accelerating growth of tech firms with a focus on gaming, web3, and fintech, CoinText learned from a press release. $1B+ managed in customer assets With over $1 billion managed in customer assets, Cake DeFi helps its user base of more than half a million registered members to profit from their digital asset investments. Focus on investments in tech startups Cake DeFi Ventures (CDV) will turn attention to tech startups across the metaverse, the NFT space, Web3, gaming, fintech, and esports. The venture arm will look for investment opportunities in startups across the globe. CDV portfolio companies will get str...

Crypto mining’s cost: How has hardware availability changed the industry?

Cryptocurrency mining has been and remains an attractive endeavor not only for fans of alternative financial instruments but also for those serious about investing. When deciding whether to start mining, potential miners keep several well-known factors in mind: equipment and electricity costs, suitable climate and favorable legislation in the country of operation. At least, that was the case until recently. In 2022, the situation changed and became more complicated. A few years ago, it was possible to mine cryptocurrencies by purchasing a graphics processing unit (GPU), reading a guide on how to construct a rig and simply mining coins. Such income was attractive for many online entrepreneurs, and soon new miners flooded the global market. Yet over time, the complexity of mining has i...

Biden to sign executive order on crypto, authorize all-government effort to consolidate regulation

Later today, U.S. President Joe Biden will sign a long-anticipated executive order on digital assets. Despite fears that the order may resound a regulatory clampdown on the industry, the language of the document is fairly favorable, the key focus being the coordination and consolidation of various agencies’ efforts within a unified national policy. The order designates six key areas of the federal government’s involvement with the digital asset ecosystem — consumer and investor protection, financial stability, financial inclusion, responsible innovation, the United States’ global financial leadership and combating illicit financial activity — and directs specific agencies to lead in designated policy and enforcement domains. The Department of the Treasury will take the lead in developing p...

Web3 platform integrates social commerce app into Circle’s payment infrastructure

Web3 infrastructure platform Our Happy Company has announced their inaugural product, OurSong — a social commerce mobile application designed to enable digital creators to monetize their content and cultivate their communities via nonfungible tokens (NFTs) — will utilize Circle’s established payment infrastructure to drive demand in the creator economy. Our Happy Company was incorporated in July 2018 by globally renowned musical artist John Legend — the company’s chief impact officer — alongside several pioneering tech entrepreneurs, including co-founder and CEO of KKCompany, Chris Lin, co-founder of Twitch and Kevin Lin, among others. The platform launched OurSong, its first product offering, in February to moderate fanfare. In the official press release, Chris Lin, CEO ...