Crypto news

Love in the time of crypto: Does owning cryptocurrency make daters more desirable?

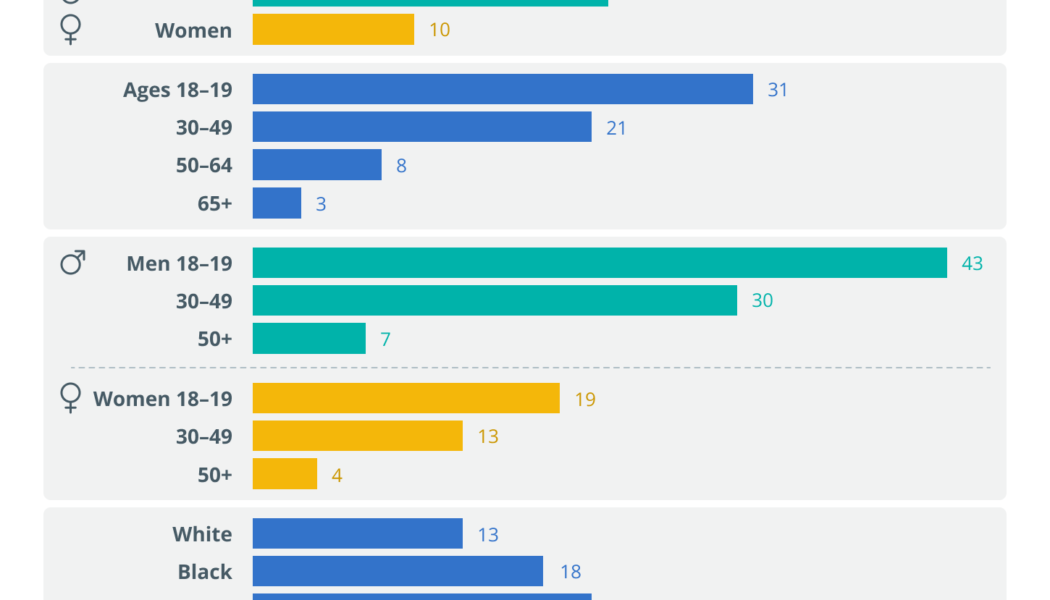

Cryptocurrency has become one of the most widely discussed topics of 2022. As such, it shouldn’t come as a surprise that mentioning “crypto” in an online dating profile may generate additional attention. A newstudy from brokerage firm eToro found that 33% of Americans who were surveyed would be more likely to go on a date with someone who mentioned crypto assets in their online dating profile. Out of the 2,000 adult residents in the United States between the ages of 18 and 99 surveyed, more than 40% of men and 25% of women indicated that their interest in a potential date is stronger when crypto is written on a dating profile. Crypto: What’s love got to do with it? Callie Cox, U.S. investment analyst at eToro, told Cointelegraph that the findings from eToro’s inaugural “Crypto & ...

Ethereum’s average and median transaction fee slip, lowest in six months

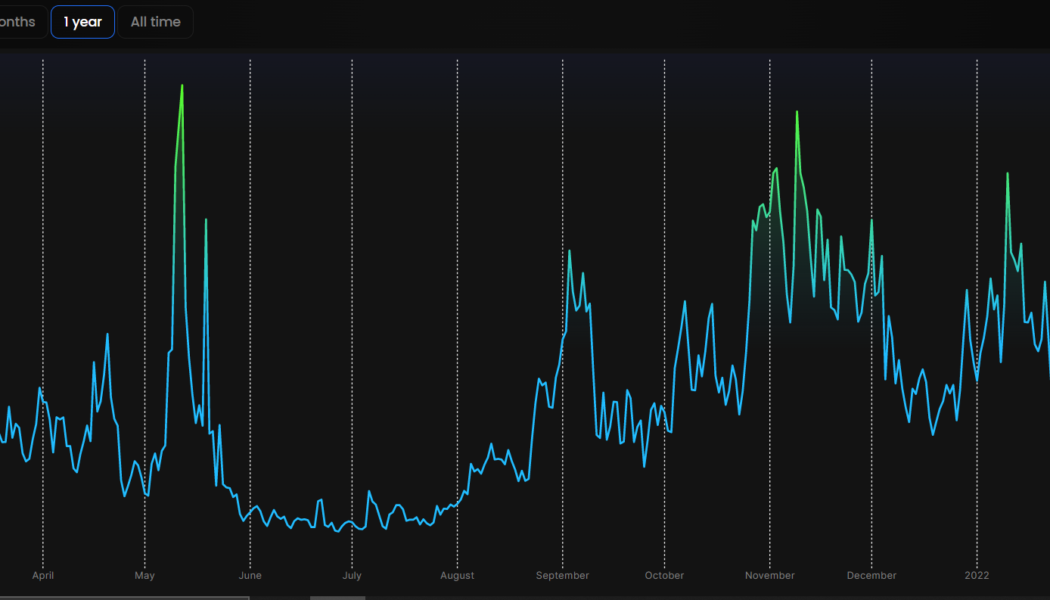

The infamous transaction fees of the Ethereum (ETH) ecosystem underwent a decremental phase from Jan. 10 to record the lowest average and median fees of $14.17 and $5.67 — lowest since September 2021. Data from Blockchair shows that the average transaction fee of ETH in January was $53.03, which at its peak was $70.83 back in May 2021. Just within a month, the average fees saw an almost 73.3% decline as evidenced by the following chart. Additionally, the resultant median transaction fee also witnessed an 81.02% drop from January’s $29.88. In the last six months, ETH’s median transaction fee was seen lowest in September at $6.26. Interestingly enough, the transaction count of the Ethereum network has also come down to numbers that were last seen back in early 2019. Blockchair data sho...

Bitcoin inches towards higher weekly close with CME futures gap in focus

Bitcoin (BTC) was on the cusp of making a new higher weekly close on Feb. 13 as bulls kept the market above $42,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin: Potential CME gap to come Data from Cointelegraph Markets Pro and TradingView tracked fairly stress-free conditions for BTC/USD over the weekend, with the weekly candle set to conclude in under 12 hours. The pair had briefly dipped below the $42,000 mark before recovering, this setting it up to challenge last week’s close of $42,400 on Bitstamp. Should it succeed, the close would be a three-week high, Bitcoin nonetheless keeping traders guessing as a matter of a few hundred dollars separated the upcoming close from the last. If #BTC loses this 4HR Range Low as support in the short-term, tha...

Inside the blockchain developers’ mind: Can EOS deliver a killer social DApp?

Cointelegraph is following the development of an entirely new blockchain from inception to mainnet and beyond through its series, Inside the Blockchain Developer’s Mind, written by Andrew Levine of Koinos Group. In my first article in this series, I explained why Ethereum and Steem haven’t been able to deliver a mainstream social decentralized application (DApp), despite taking two very different approaches and how this makes the solution seem. Therefore, why not combine the fee-less system developed for Steem with the flexibility of a blockchain with smart contracts like Ethereum? Then, we could give developers the best of both worlds, enabling them to create free-to-use applications with the freedom to add new features whenever they want. One could argue that this is exactly what Dan Lar...

Can XRP price reach $1 after 25% gains in one week? Watch this key support level

XRP price has continued to bounce back after falling by more than 70% in a correction between April 2021 and January 2022. Why the XRP/USD 50-week EMA is key On Feb. 13, XRP/USD reached as high as $0.916, above its 50-week exponential moving average (50-week EMA; the red wave) around $0.833. The upside move, albeit not decisive, opened possibilities for further bullish momentum, mainly owing to a historical buying sentiment around the said wave. XRP/USD weekly price chart featuring 50-week EMA. Source: TradingView For instance, traders had successfully reclaimed the 50-week EMA as support in the week ending July 27, 2020, more than a year after flipping the wave as resistance. Later, XRP’s price rallied by more than 820% to $1.98 in April 2021, its best level in more than three years...

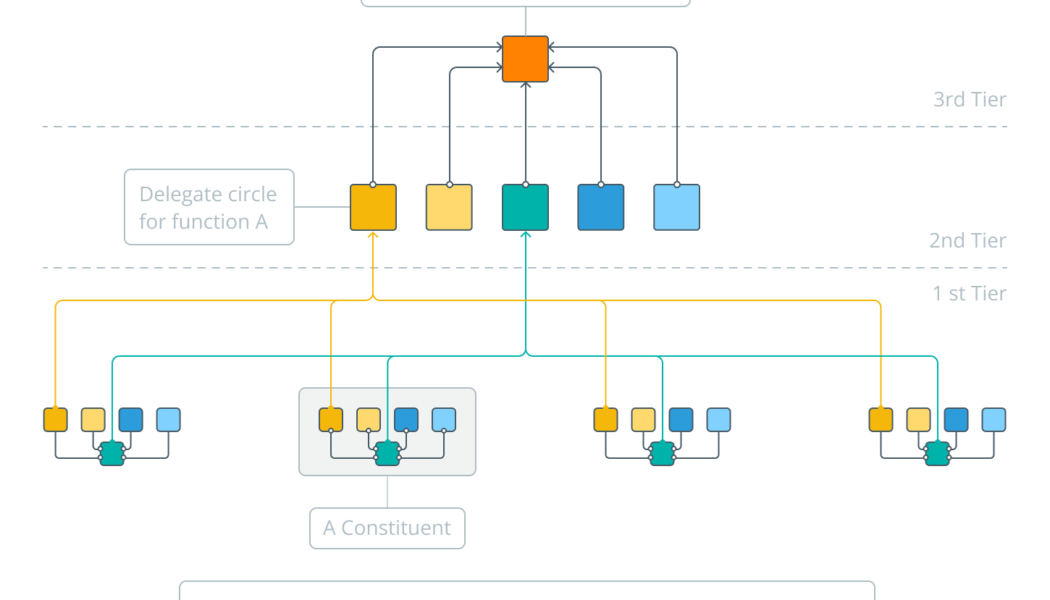

Bitcoin’s last security challenge: Simplicity

It’s been just 13 years since Bitcoin’s (BTC) “Mayflower moment,” when a tiny handful of intrepid travelers chose to turn their back on the Fiat Empire and strike out to a new land of financial self-sovereignty. But, whereas it took 150 years for the American colonists to grow sufficient in number to throw off the yoke of unrepresentative government, the Republic of Bitcoin has gone from Pilgrims to Revolutionary Army in little over a decade. What sort of people are these new Bitcoiners? How do their character, demographics and technical knowledge differ from earlier adopters? Is “Generation Bitcoin” sufficiently prepared to protect their investment against current and future security threats? And, most importantly, what are the challenges that the rapidly growing community must urgently a...

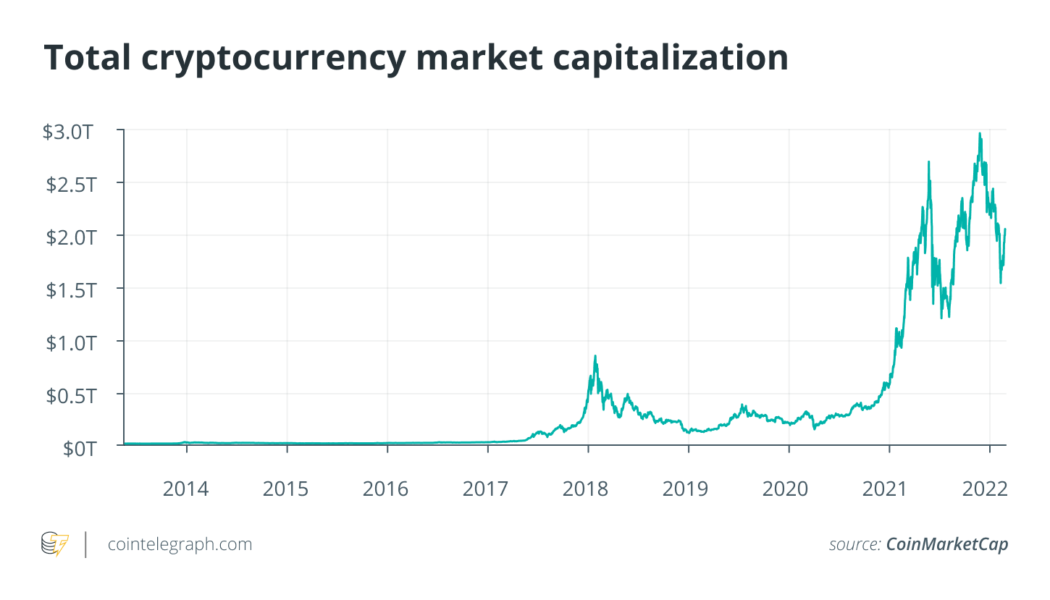

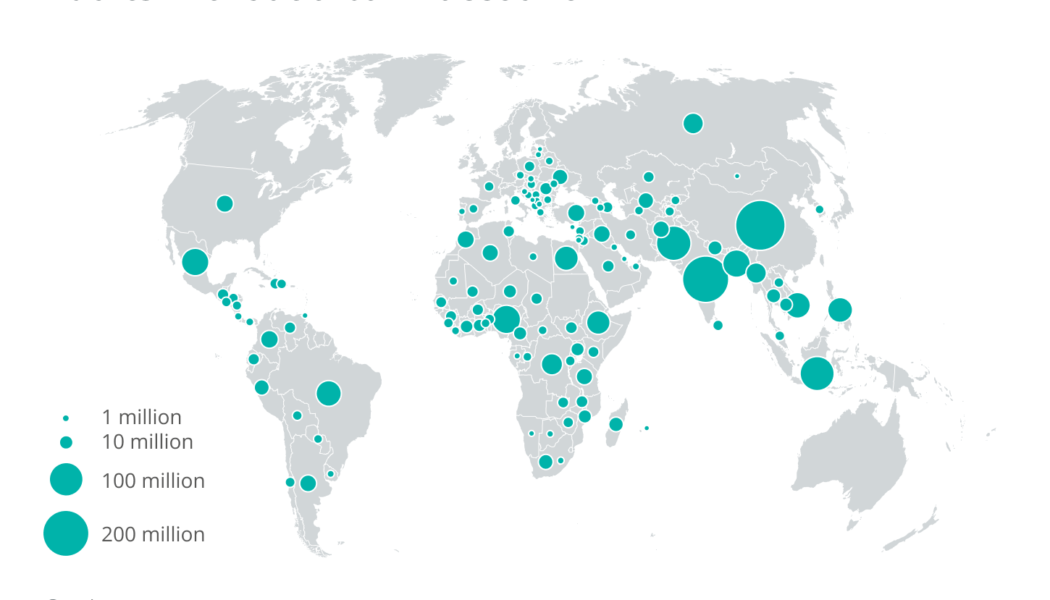

What’s shaping the future of the institutional crypto market?

2021 was a big year for cryptocurrency. El Salvador became the first country to adopt Bitcoin (BTC) as legal tender. In November 2021, the price of Bitcoin hit an all-time high approaching the psychologically significant mark of $70,000. And, all along the way, industry influencers like Elon Musk have been tweeting their enthusiasm about cryptocurrency more broadly. I anticipate 2022 will continue to be an even bigger year for digital currencies as the market grows to reach 1 billion people. Here are the five most prominent trends that I see on the horizon for the year to come. Institutional trading volume will grow 2022 will be a year in which institutional and retail cryptocurrency adoption, and trading in particular, will continue to grow. Fintech stalwarts PayPal and Square — along wit...

El Salvador’s Bitcoin Law: Understanding alternatives to government intervention

Last year, El Salvador dominated headlines as the first country to adopt Bitcoin as legal tender. The move is controversial both in and outside of the country, heralded for its potential to bring financial services to large portions of El Salvador’s unbanked population and criticized for its top-down implementation. This has created a sense of uncertainty and made some Salvadorans feel they lacked a choice, despite locations like El Zonte already accepting Bitcoin (BTC) as payment through organic developments that predate the law. These arguments, while for and against the law, don’t actually exist in contradiction to one another. While the decision may have been made by the government, it is bringing financial services to new portions of the population. Not all governments, however, are i...

Bitcoin network hash rate explodes to a new all-time high of 248.11 EH/s

The Bitcoin (BTC) network has recorded a new hash rate all-time high of 248.11M TH/s as of Feb. 12, 2022, further securing the decentralized ecosystem through a growing network of global BTC miners. The hash rate correlates to the computing power required by a miner’s computer equipment to confirm a transaction. The recent spike in BTC’s network hash rate ensures further security against attacks by deterring bad actors from confirming fraudulent transactions. Bitcoin hash rate over the past year. Source: YCharts As evidenced by the above screenshot, the network hash rate jumped 31.69% — from 188.40 EH/s to 248.11 EH/s — in just one day. Moreover, the Bitcoin network’s hash rate levels rose 54.33% over the past year. Bitcoin hash rate over the past one month. Source: YCharts Pre...

P2P payments spurred crypto adoption across Venezuela in 2021

For Venezuela, 2021 has been a year of considerable changes at the microeconomic level, where even more than in 2020, the results of powerful catalysts for change such as COVID-19 were clearly visible. In a more dynamic economy with a higher volume of operations with foreign currencies, cryptocurrencies played a key role during this year for the South American country. In this review, we’ll take a look at the highlights of the Venezuelan crypto ecosystem in 2021 including related areas such as trading, play-to-earn (P2E) games, fintech, mining, regulation and nonfungible tokens (NFTs). More people accepting cryptocurrencies According to blockchain analysis firm Chainalysis, Venezuela ranks seventh in the Global Cryptocurrency Adoption Index 2021 thanks in large part to pe...

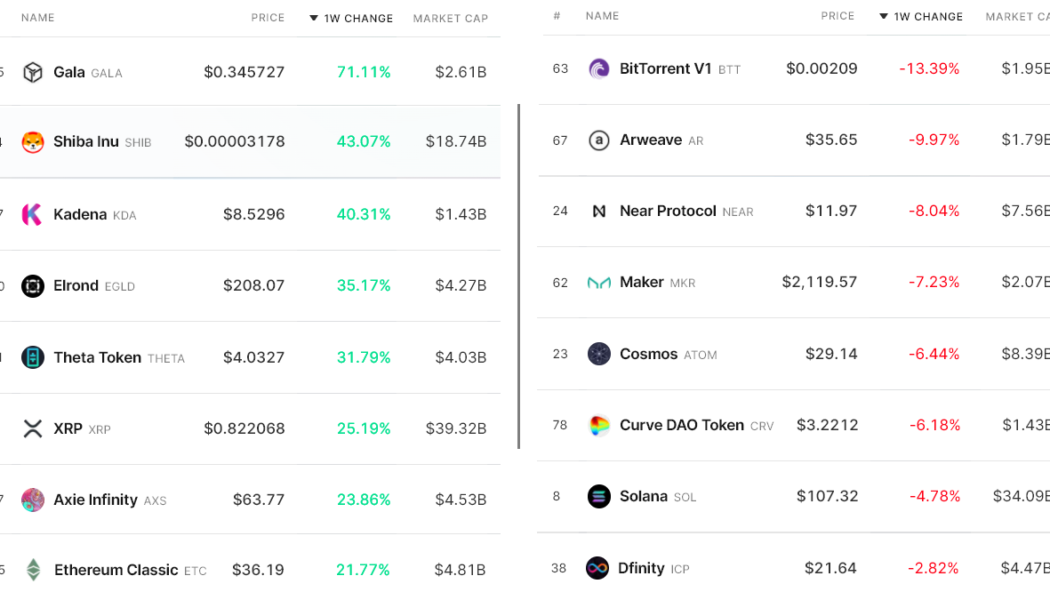

2 key indicators cast doubt on the strength of the current crypto market recovery

Analyzing the aggregate cryptocurrency market performance over the past 7 days could give investors the impression that the total market capitalization grew by a mere 4% to $2.03 trillion, but this data is heavily impacted by the top 5 coins, which happen to include two stablecoins. Excluding Bitcoin (BTC), Ether (ETH), Binance Coin (BNB) and stablecoins reflects a 9.3% market capitalization increase to $418 billion from $382 billion on Feb 4. This explains why so many of the top-80 altcoins hiked 25% or more while very few presented a negative performance. Winners and losers among the top-80 coins. Source: Nomics Gala Games (GALA) announced on Feb. 9 a partnership with world renowned hip-hop star Snoop Dogg to launch his new album and exclusive non-fungible token (NFT) campaign. Gala Game...

Russia to regulate digital assets as currency, McDonald’s eyes the metaverse, YouTube to adopt NFTs and XRP pumps 30%: Hodler’s Digest, Feb. 6-12

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Russian government and central bank agree to treat Bitcoin as currency The Russian government and central bank made an agreement to regulate crypto as an “analogue of currencies” instead of “digital financial assets.” The updated regulation is part of a draft law that is slated to launch on Feb. 18, and will see approved cryptocurrencies such as Bitcoin function in lawful exchanges through the banking system or licensed intermediaries. As part of the incoming framework, crypto transactions worth mo...