Crypto news

KPMG Canada updates its corporate treasury with more Bitcoin and Ether

KPMG Canada has allocated an undisclosed amount of Bitcoin and Ether to its corporate balance sheet. The company plans to make more inroads into crypto assets in the future. KPMG in Canada disclosed yesterday that it has added crypto assets Bitcoin and Ether onto its balance sheet. The firm revealed that it employed the services of Gemini Trust Company’s crypto custody and execution in updating its corporate treasury. It, however, did not divulge how much of either asset it had purchased. In addition to the ETH and BTC acquired, the audit, tax, and advisory service provider also said it bought carbon offsets to retain a net-zero carbon transaction. Such is important as this conforms to the company’s environmental, social, and governance (ESG) mandate. Managing partner for advis...

FTX is running a Bitcoin giveaway alongside the Super Bowl ad

FTX plans to reward users with Bitcoin, whose amount depends on what time its Super Bowl ad will run CEO Sam Bankman-Fried has previously said that the advertisement stage doesn’t get any bigger than the Super Bowl. Bahamian-based cryptocurrency exchange FTX has told users that it will be giving away free Bitcoin alongside the airing of an advertisement during the upcoming Super Bowl LVI on February 13. Time is money, literally, since even though FTX has not said the exact amount that is out for grabs. The exchange has told the community that the winners would take home the same number of Bitcoin as the time the ad runs. Say the ad airs at 9:02 pm EST; FTX rewards 9.02 Bitcoin. “We’re giving some Bitcoin away! How much? $1 million worth? $1.5 million worth? We don’t...

Bitcoin begins correction after $45K rejection — Where can BTC price bounce next?

Bitcoin (BTC) gave back $2,500 of its newly-won gains during Feb. 8 as a long-awaited correction took center stage. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopes $42,000 will be preserved Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it neared $43,000 after previously hitting new multi-week highs of $45,500. At the Wall Street open, ranging continued as bulls eyed levels for potential support in the event of further losses. Previously, these had included both $40,000 and $41,000, along with several zones in the upper $30,000–$40,000 corridor. For popular Twitter trader Muro, however, $42,000 needed to gain significance as an intermediate floor to flip sentiment bullish. “Either we get not significant pullback and go to 51 next,...

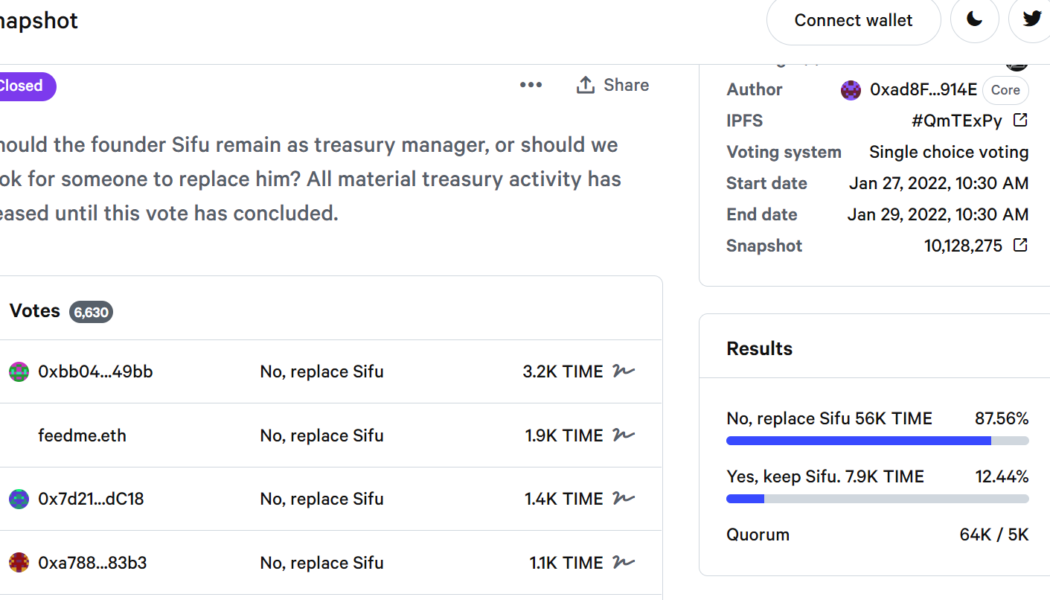

Wonderland’s treasury saga exposes the fragility of DAO projects today

The Wonderland protocol became the talk of the decentralized finance (DeFi) world after the platform was found at the center of a brewing controversy. On Jan. 27, DeFi analyst zachxbt revealed that one of the anonymous co-founders of Wonderland happened to be QuadrigaCX co-founder Michael Patryn, who has been operating under the name of Sifu. QuadrigaCX is a defunct crypto exchange from Canada which closed when Gerald Cotten, the exchange founder and sole person with knowledge of the exchange’s wallet keys, passed away. Following his death, $169 million worth of user funds were irreversibly lost. Cotten’s passing led to a wave of litigation as former exchange users sought to recover their funds. Others in the crypto community claimed that Cotten faked his death to get awa...

Bybit partners with Cabital to offer EUR and GBP fiat onramps

On Tuesday, Singapore-based crypto exchange, Bybit, announced a new partnership with digital assets institution Cabital for the euro (EUR )and British pound sterling (GBP) on-ramp integration. Bybit crypto exchange platform users can now use EUR and GBP to buy cryptocurrency directly on the system through Cabital’s fiat on-ramp solution, with no transfer fees between their Bybit and Cabital wallets. According to the release, Cabital’s fiat-to-crypto on- and off-ramp service allows Bybit customers to purchase cryptocurrencies at reduced gas costs without having to leave the platform. Bybit is Cabital’s first partner to use its fiat on- and off-ramp infrastructure for cryptocurrency exchanges. Ben Zhou, co-founder and CEO of Bybit, explained that Cabital’s goals...

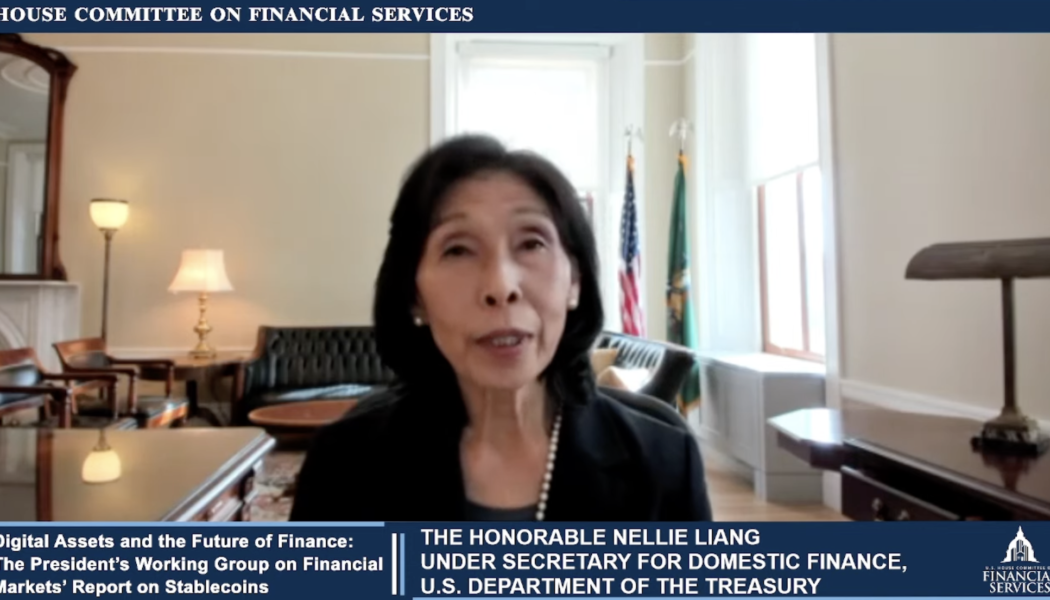

US lawmaker pushes for state-level regulations on stablecoins at hearing on digital assets

Whether regulations on stablecoins and digital assets should be addressed at the state or federal level was the topic of discussion among at least two U.S. lawmakers in a hearing for the House Committee on Financial Services. Speaking virtually at a Tuesday hearing titled “Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins,” North Carolina Representative and ranking committee member Patrick McHenry asked the committee to consider state-level regulatory frameworks in lieu of a comprehensive federal law on stablecoins. In response to McHenry, Jean Nellie Liang, the Under Secretary for Domestic Finance at the U.S. Treasury Department, said there was no explicit law governing stablecoins and digital assets at the federal level bu...

Polygon raises $450 million from token sale to fund Web 3 development

The Ethereum secondary scaling solution gave out MATIC tokens to the participating investors at a discount The blockchain founders intend to dole out the funds across its scaling products and in building Web3 applications The blockchain scalability platform Polygon has announced the completion of a private token sale through which it was able to net $450 million. The raise doesn’t come as a surprise as TechCrunch disclosed at the end of last year that a number of venture capital firms were looking to provide financial muscle to Polygon. Venture funds are shifting focus to scaling projects and Web3 The token sale led Sequoia Capital India, featured over 40 investors in and out of the blockchain space. Some notable names include SoftBank Vision Fund 2, Tiger Global, Accel, Dragonfly Capital,...

Most appealing DeFi tokens to buy on February 8, 2022: CAKE, LUNA, LINK, UNI and GRT

CAKE, LUNA, LINK, UNI, and GRT are all DeFi tokens. Each of them has seen a high level of growth. They can all reach new heights by the end of March 2022. PancakeSwap (CAKE), Terra (LUNA), Chainlink (LINK), Uniswap (UNI) and The Graph (GRT) are the best DeFi tokens you can buy on February 8, 2022, and we are about to go over exactly why this is the case. Should you buy PancakeSwap (CAKE)? On February 8, 2022, PancakeSwap (CAKE) had a value of $8.18. The all-time high value of the PancakeSwap (CAKE) token was on April 30, 2021, when it had a value of $43.96. This marks a $35.78 difference or 437%. When we go over last month’s performance of PancakeSwap (CAKE), its highest point was at $12.5 on January 2, while its lowest point was on January 24, with a value of $6.91. This marked a decrease...

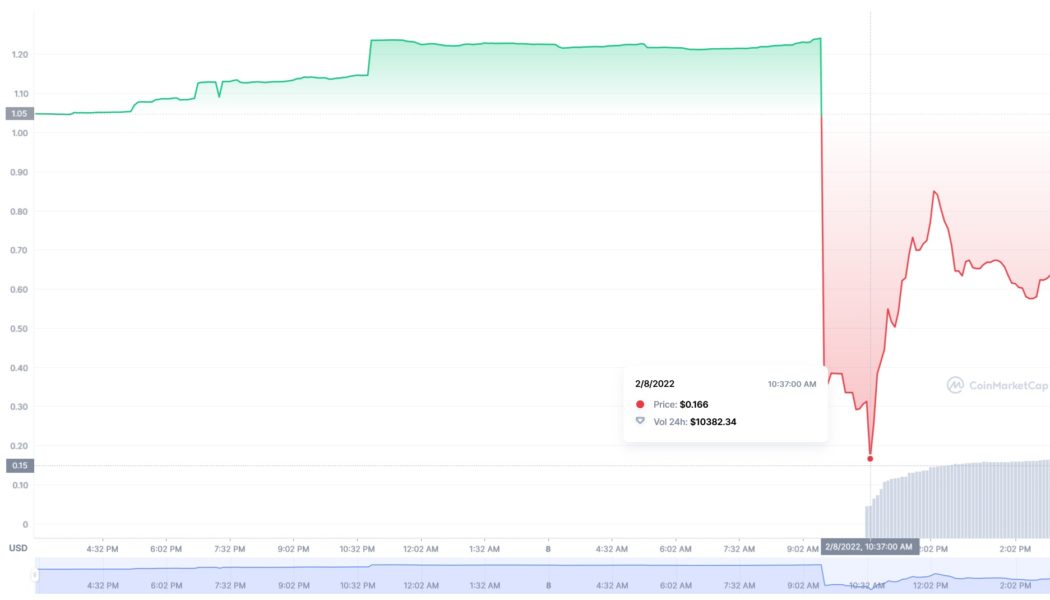

Superfluid’s vesting contract for QI hacked, funds on QiDao contracts unaffected

The hack on Polygon stablecoin QiDao comes barely a day after Polygon Network completed a $450 million private token sale QiDao protocol shared an update, confirming that user funds on QiDao contracts are safe Mai Finance creator QiDao has been exploited to a tune of $13 million. The Polygon’s native stablecoin protocol shared a Twitter post a few hours ago revealing that its Superfluid vesting contract had been compromised. “Superfluid’s vesting contract for QI has been exploited. User funds on QiDao contracts remain safe. The exploit is solely on Superfluid. We will release an update when we know more,” QiDao wrote. The team sent a quick update via a follow-up post detailing that the situation was still under assessment. The update also specified that no user fund...

Bitcoin rebound hits $45.5K as focus switches to future support retests

Bitcoin (BTC) hit new multi-week highs above $45,000 on Feb. 8 as the largest cryptocurrency’s comeback continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $40,000 becomes popular retest target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $45,500 on Bitstamp in its latest surge before consolidating. Volatility was once again in evidence as the pair fluctuated by $1,000 on intra-hour timeframes, circling $44,800 at the time of writing. Fears of a major correction were nonetheless left unfounded on the day, despite theories that $40,000 could see a retest next. lol okay a couple hundred dollars lower than previous tweet but I’m back to thinking we run it back to retest 40K idk honestly listening to this space has my brain all...

Singapore saw 13x jump in crypto investments in 2021: KPMG

Singapore has seen a tenfold increase in crypto-related investments last year worth $1.48 billion, up from $110 million in 2020, according to KPMG’s Pulse of Fintech report. As per the study, the city-state has long been recognized as a center of cryptocurrency activity, with over $1.48 billion in investment completed last year alone. KPMG suggests that the increase is in part due to government efforts to stimulate the capital market, such as establishing a special-purpose acquisition company (SPAC) listing framework to position the country as a choice location where fast-growing firms and unicorns can go public. This year, regulators are ramping up their efforts to regulate speculative digital assets. Even as authorities impose even more regulation, KPMG forecasts that Singapor...

Simple math says Russia could collect up to $13B in crypto tax each year

The Russian government is expected to collect up to 1 trillion rubles ($13 billion) in crypto tax each year, as per an estimation by the authorities. The Bell, a local Russian publication, reportedly got its hands on the government analytic note that estimated the yearly tax revenue. According to the letter’s authors, Russians hold 12% or nearly $214 billion in crypto. The number of users on foreign exchanges is estimated to be about 10 million, added with the significant number of over-the-counter (OTC) crypto trades. The government agency believes even the most straightforward tax imposition can generate anywhere from 146 billion rubles to 1 trillion in crypto tax revenue. The note suggests two possible taxation methods: One for the crypto platforms such as exchanges, int...