Crypto news

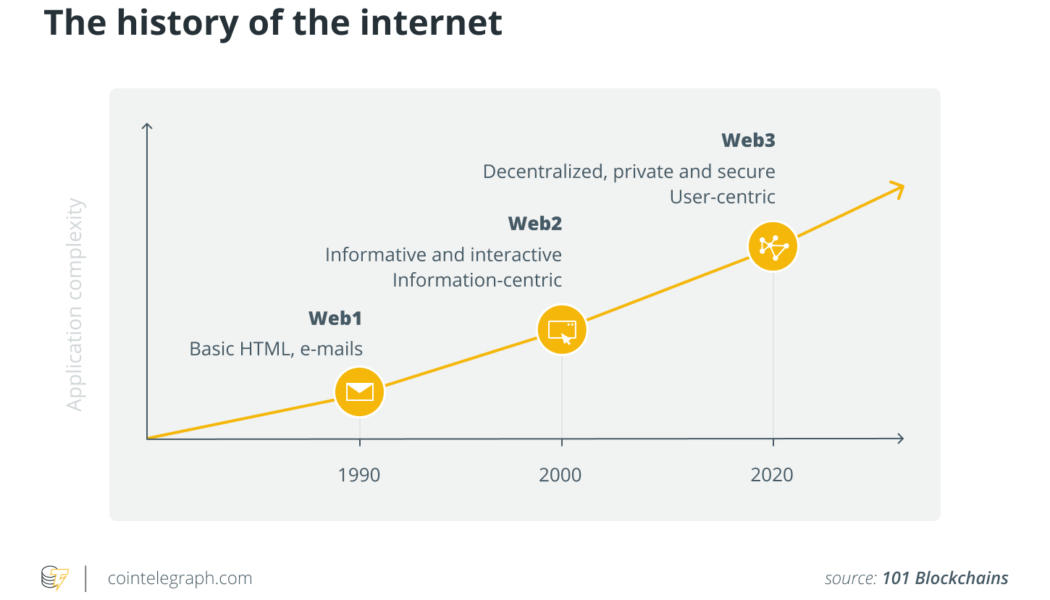

Decentralized technology will end the Web3 privacy conundrum

Although the modern internet connects us like never before, one thing that younger generations have never truly experienced is the feeling of genuine privacy. Even older generations have forgotten what life was like before our every thought and action were tracked. Web3 envisions an open, trustless, permissionless internet where users can interact with each other peer-to-peer without giving up ownership control, privacy or relying on intermediaries. Underlying that vision, blockchains are one of the most important tools. They eliminate the need for trusted third parties and help to create a direct relationship between users and service providers, recording the rules of engagement on immutable ledgers and even storing direct interactions between them. Blockchains also fundamentally reconfig...

Cyber vigilante hunts down DeFi scammers running away with $25M rug pull

In the world of digital finance, where the weapon of choice for a heist is a computer rather than a semi-automatic firearm, tracking down scams and frauds from across the world becomes a near-impossible feat for centralized police forces. However, in an interview with Cointelegraph, an anonymous cyber vigilante shares insights into how he went about tracking down a group of decentralized finance (DeFi) scammers responsible for the $25 million StableMagnet rug pull, coordinating with police authorities and eventually having the stolen money returned back to the investors. [embedded content] The StableMagnet platform lured unwary investors under the pretext of high returns against stablecoin deposits. In a typical rug pull event, StableMagnet managed to run away with the $25 million th...

Bitcoin stays near $38K as RSI breakout challenges ‘boring’ weekend

Bitcoin (BTC) circled the $38,000 mark into Jan. 30 as a “trappy” weekend still offered the chance of a solid weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Choppy waters” for Bitcoin Data from Cointelegraph Markets Pro and TradingView showed BTC/USD regaining the $38,000 mark after seeing local highs of $38,740 on Bitstamp the previous day. Despite its strong “out of hours” performance, few analysts believed in BTC as a firm bullish play without traditional market guidance. “Still choppy waters for Bitcoin,” Cointelegraph contributor Michaël van de Poppe summarized in his latest Twitter update. “Looking at $37K to see whether that sustains. If not -> I’m assuming we’ll test lows for daily...

Eth2 rebrands to consensus layer, Elon Musk fails to boost DOGE, YouTube gaming head switches to Polygon Studios: Hodler’s Digest, Jan. 23-28

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’ Bitcoin had a turbulent week, its price dropping as low as $33,300 and surging as high as $38,000 before retracting back to the $36,000 region at the time of writing. Many analysts have attributed the uninspiring performance of BTC, along with other assets such as stocks, to macro factors such as expectations that the United States Federal Reserve will embark on several interest rate hikes throughout 2022 to tame inf...

From cash to crypto: The Cantillon effect vs. the Nakamoto effect

Bitcoin introduces the world to the Cantillon effect 2.0, often known as the Nakamoto effect. Those who live closer to the truth can receive value creation benefits in a Bitcoin world, rather than being rewarded for privilege, status or geography. The issue of why we need Bitcoin (BTC) is a prevalent one these days, but most people’s responses leave them shaking their heads and declaring it to be either a Ponzi scheme or money for criminals. This conclusion falls short of describing how Bitcoin has the potential to address the systemic inequity and corruption that plague our present monetary system. Miners contributing to the Bitcoin network’s security are rewarded with new Bitcoin and fees based on how much protection they give, referred to as the Nakamoto effect. In...

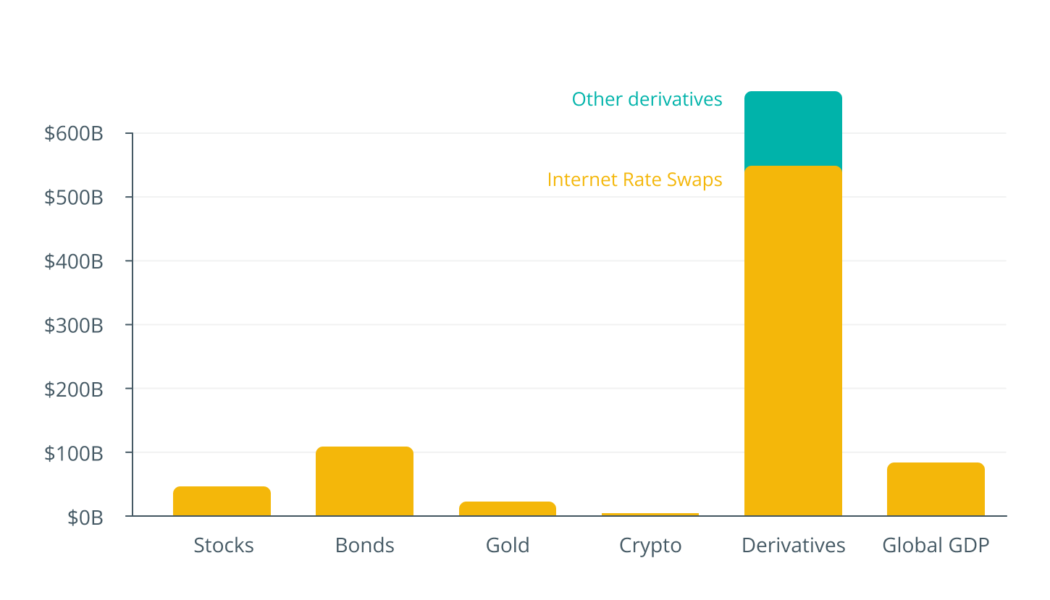

Is the rise of derivatives trading a risk to retail crypto investors?

BTCWith an increase in the number of retail investors dabbling in derivatives trading and investors hopping into decentralized exchanges (DEXs) due to regulations in the United States and China, there has been a rise in users utilizing derivatives DEXs, with Bitcoin (BTC) whales moving into derivatives and an increase in buying interest in derivative contracts. This has created a surge in the daily trading volume for derivatives protocols, allowing them to briefly take over centralized finance platforms such as Coinbase, which sparked interest in retail investors with regard to moving towards derivatives trading in decentralized finance (DeFi). However, without a proper introduction to derivatives in DeFi, new investors are likely to hop off derivatives trading as quickly as they hopped on...

PayPal stablecoin: What it could mean for payments

PayPal confirmed on Jan. 8 it is “exploring a stablecoin” that could be called PayPal Coin after a developer found evidence of such a stablecoin within the source code of the company’s iPhone app. PayPal senior vice president of crypto and digital currencies Jose Fernandez da Ponte said at the time that if the company plans to move forward with the stablecoin, it will do so while working closely with relevant regulators — an approach that could help the fintech firm avoid the wrath of United States senators that doomed Meta’s Diem cryptocurrency project. The company has clarified that the source code found on its iPhone app was developed in an internal hackathon. When Cointelegraph contacted PayPal to learn more, a spokesperson confirmed the previous reporting but did not offer any additio...

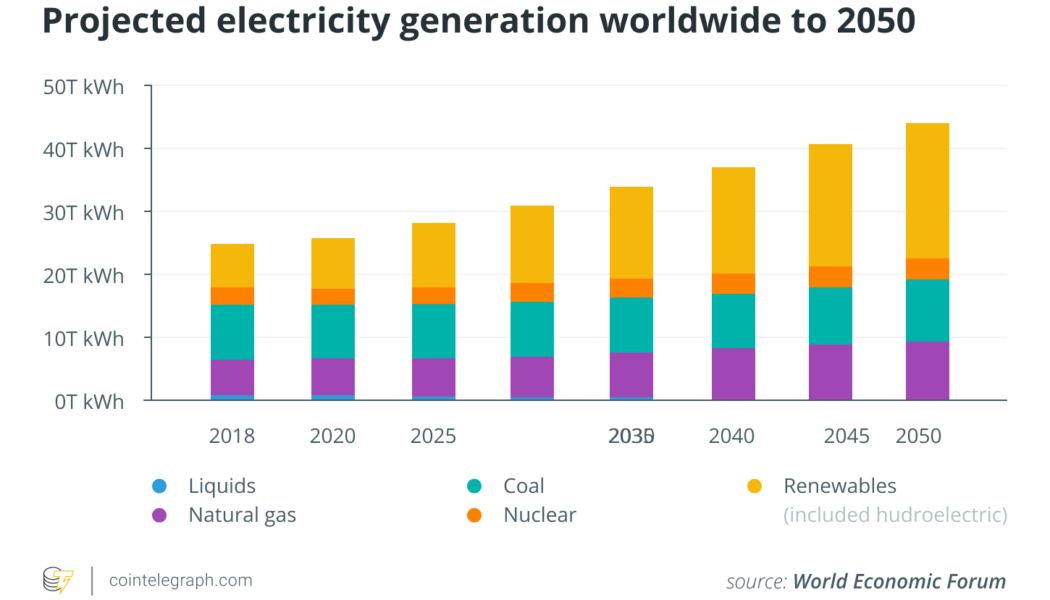

Crypto mining won’t survive another round of environmental legislation

It was only a matter of time before China slapped a ban on Bitcoin (BTC) mining, trading and crypto services. To do anything with Bitcoin anywhere in the People’s Republic, one needs a special exemption. The Chinese government’s given reason for the Bitcoin crackdown is to reduce its well-documented climate impact. Regardless of the amount of truth in this explanation, one thing is clear: China’s righteous anger toward electricity-guzzling and carbon-spewing mined cryptocurrencies in the service of Earth’s climate is only the first shot in an impending global showdown over Bitcoin and other crypto projects that rely on proof-of-work (PoW), the complicated crypto security mechanism we subsume under “mining.” This does not seem like a battle crypto can or will win. For many cryptocurrency en...

Why is my Bitcoin transaction unconfirmed?

Transaction costs are calculated based on the transaction’s data volume and network congestion. As a block can only hold 4 MB of data, the number of transactions that can be executed in one block is limited. Therefore, more block data is required for a larger transaction. As a result, more significant transactions are usually charged on a per-byte basis. When you use a BTC wallet to send a transaction, the wallet will typically provide you with the option to choose your Bitcoin fee rate. This charge will be determined in satoshis per unit of data (there are 100,000,000 satoshis in one Bitcoin) consumed on the blockchain by your transaction, abbreviated as sats/vByte. This rate will then be multiplied by the size of your transaction to get the total fee you’ll pay. If you want y...

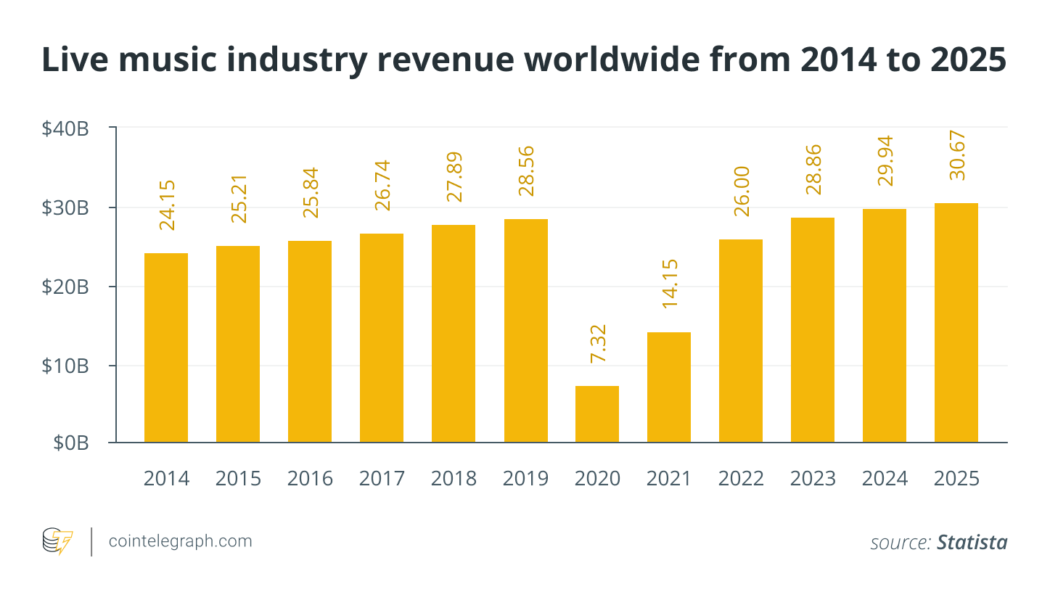

The Metaverse will change the live music experience, but will it be decentralized?

As the two-year anniversary of the global COVID-19 pandemic begins to hurtle toward us, we are no closer to knowing when our social lives will return to normal or what will the new normal be. The effect this has had on businesses like nightclubs, music venues and musicians have been immeasurable. With crowded in-person events either made impossible — or far more difficult and laborious — at many points over the last two years, changes to the industry that were already set in motion have been accelerated. Namely, the music industry’s adoption of digital instruments, among others and, increasingly, the Metaverse. First coined by science-fiction author Neal Stephenson in his 1992 cyberpunk novel Snow Crash, the Metaverse is described as a virtual world where individuals could interact with ea...

Terra (LUNA) at risk of 50% drop if bearish head-and-shoulders pattern plays out

Terra (LUNA) may fall to nearly $25 per token in the coming weeks as a head-and-shoulders (H&S) setup develops, indicating a 50% price drop, according to technical analysis shared by CRYPTOPIKK. H&S patterns appear when the price forms three peaks in a row, with the middle peak (called the “head”) higher than the other two (left and right shoulders). All three peaks come to a top at a common price floor called the “neckline.” Traders typically look to open a short position when the price breaks below the H&S neckline. However, some employ a “two-day” rule where they wait for the second breakout confirmation when the price retests the neckline from the downside as resistance, before entering a short position. Meanwhile, the ideal short ta...