Crypto news

Finance Redefined: Vitalik bearish on cross-chain, dYdX decentralizing, Jan. 7–14

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. Despite the market printing bearish numbers for a second consecutive week, the industry is not short of bullish fundamental news. Read on to hear about the most impactful DeFi stories of the last seven days. What you’re about to read is a shorter, more succinct version of the newsletter. For a comprehensive summary of DeFi’s developments over the last week, subscribe below. Vitalik is optimistic for multichain, not cross-chain, Web3 world Vitalik Buterin, a co-founder of Ethereum, shared a candid assessment of the security limitations in implementing fully functional cross-chain bridges within the blockchain industry. Buterin argued that storing assets on their native chain provides a higher level of securit...

Binance CEO’s net worth hits $96B, Jack Dorsey launches BTC defense fund, Bill Miller apes into Bitcoin: Hodler’s Digest, Jan. 9-15

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Binance CEO CZ is the richest crypto billionaire at $96B: Bloomberg Bloomberg has estimated Binance CEO Changpeng Zhao — also known as “CZ”— to be the 11th-richest person in the world at a net worth of around $96 billion, making him the wealthiest billionaire in crypto. However, Bloomberg’s tabulation excluded CZ’s personal holdings of crypto assets such as Bitcoin and Binance Coin, suggesting that the $96 billion could become much larger in the future. To make the list of the top 10 richest people...

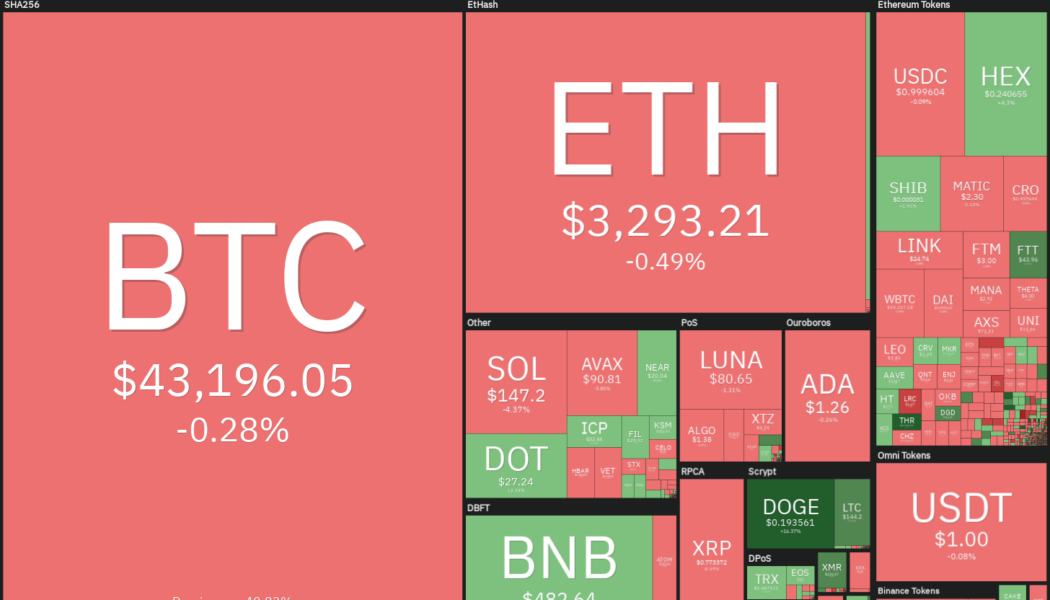

Price analysis 1/14: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are facing selling at higher levels and buying on dips, indicating the possibility of a range formation. On-chain analysis firm Whalemap said that a “reclaim of $46,500 will look like a trend reversal,” for Bitcoin as the previous accumulation phase of 90,000 BTC was at this level. Fidelity Digital Assets said in its annual report that the “massive “ Bitcoin accumulation by Bitcoin miners suggests that the “Bitcoin cycle is far from over.” The report went on to add that more sovereign nations may “acquire Bitcoin in 2022 and perhaps even see a central bank make an acquisition.” Daily cryptocurrency market performance. Source: Coin360 Switzerland-based financial institution SEBA Bank CEO Guido Buehler said in a recent interview that if the right co...

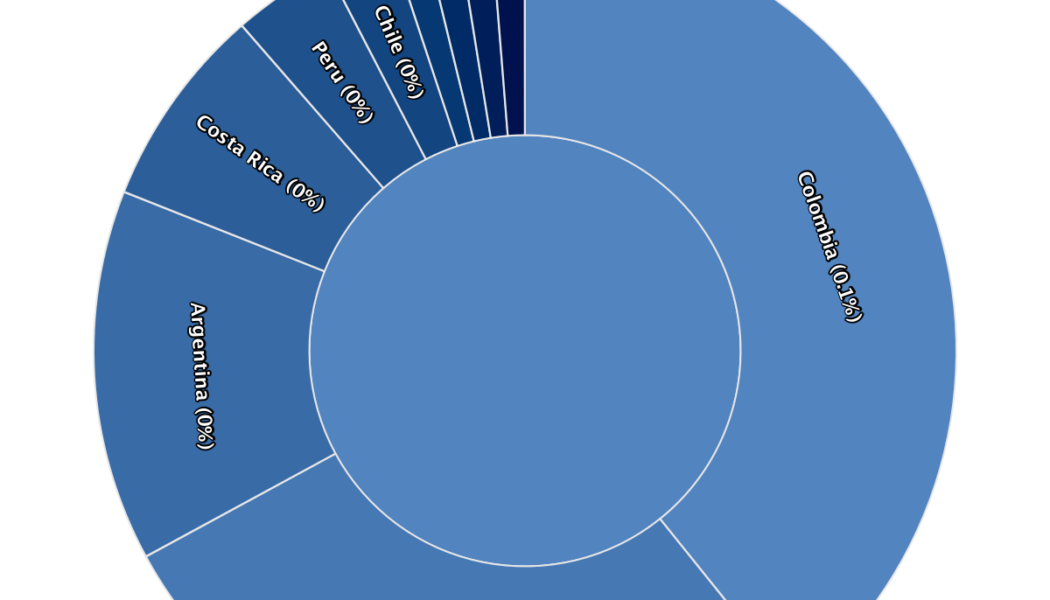

Uruguay reportedly installs its first Bitcoin ATM

Uruguay has reportedly installed its first Bitcoin (BTC) ATM, making it the 11th South American country to publicly encourage crypto adoption. Prior to Uruguay’s involvement, South America hosted 79 ATMs, which represented 0.2% of global BTC ATM installations. According to Ámbito, Uruguay’s first crypto ATM was installed in the coastal city of Punta del Este, a major tourist attraction in the region. Uruguay’s first Bitcoin ATM was developed and installed in partnership with two local crypto companies — URUBit and inBierto. The crypto ATM in Uruguay currently supports withdrawal and deposits of five cryptocurrencies, namely — BTC, Binance Coin (BNB), Binance USD (BUSD), Ferret Token (FRT) and Urubit (URUB). FRT and URUB are in-house cryptocurrencies managed and distributed by URUBit and in...

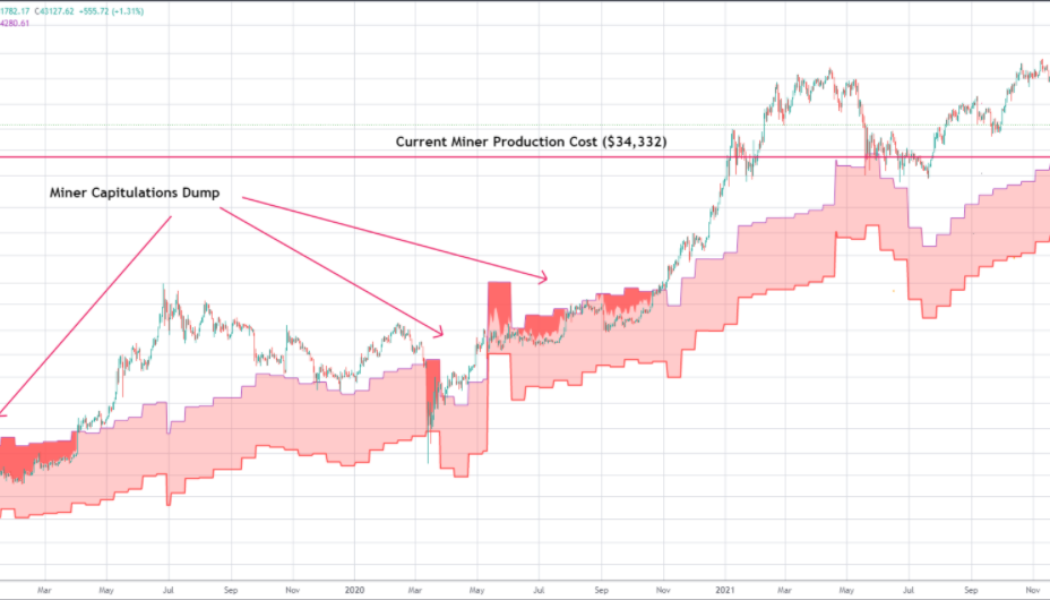

Bitcoin miners can take fresh 20% BTC price hit before capitulating, data shows

The Bitcoin (BTC) mining business is bigger than ever at current price levels, and new data shows just how unlikely a mass miner sell-off really is. As noted by popular Twitter account @venturefounder on Jan. 14, even at $42,000, the BTC/USD trading pair is around 20% above miners’ cost price. Miner capitulation behind “worst” BTC price dips Despite falling a full $27,000 below all-time highs, BTC is more enticing than ever for miners. Hash rate, an estimate of the total processing power dedicated to mining, reached new all-time highs this week. Those concerned that a fresh BTC price dip could pressure miners into selling, meanwhile, received fresh assurances via data covering how much BTC/USD should trade at for them to break even. Referencing the BTC productio...

Cathie Wood’s ARK ETF reportedly buys 6.93M shares of SPAC merging with Circle

Cathie Wood’s Ark Invest has reportedly purchased 6.93 million shares of the special purchase acquisition company, or SPAC, that is merging with Circle, for $70.6 million through the company’s ARK Fintech Innovation exchange-traded fund (ETF). This purchase would represent a new position for the ETF, according to MarketWatch. Ark Invest’s ETFs have a history of bold purchases within the tech industry as indicated by their move to buy $80 million in Robinhood shares after the prices dipped back in October 2021. Wood is also bullish on crypto despite passing on buying the first Bitcoin futures ETF that same month. Circle is the principal operator of USD Coin (USDC), which is currently the second-largest stablecoin in terms of market capitalization. Circle announced its inte...

CoinMarketCap allegedly lists 3 fake SHIB contract addresses, Twitter firestorm ensues

A bit Twitter drama ensued on Thursday, continuing well into Friday afternoon, when developers behind popular meme token Shiba Inu (SHIB) issued a statement alleging that CoinMarketCap had listed three fake SHIB contract addresses belonging to the Binance Smart Chain (BNB), Solana (SOL), and Terra Luna (LUNA) blockchains. The staff at Shiba Inu claimed that the addresses were unsafe and that CoinMarketCap had refused to correct the alleged mistake. At the time of publication, the contract addresses are still viewable on CoinMarketCap. Official Statement regarding the recent actions by @CoinMarketCap . pic.twitter.com/DXP2wZRhYC — Shib (@Shibtoken) January 13, 2022 Earlier in the day, CoinMarketCap issued a response claiming that the contract addresses listed on the page are wormhole addres...

Stacks ecosystem becomes #1 Web3 project on Bitcoin

On the first anniversary of the launch of Stacks blockchain (STX), which seeks to make Bitcoin (BTC) programmable, the network achieved over 350 million monthly API requests, 40,000 Hiro (development tool for Stacks to build applications on Bitcoin) wallet downloads, and 2,500 Clarity smart contracts. According to a report by Electric Capital, a venture capital firm focused on cryptocurrencies and fintech, these statistics make Stacks the largest project on Bitcoin. More than 11,000 users earned more than 100 BTC rewards per month on Stacks due to its unique proof-of-transfer, or PoX, consensus mechanism. Miners bid BTC to verify transactions, execute smart contracts and mine new blocks on the STX blockchain and earn STX as rewards. Meanwhile, the BTC bids are sent to STX holders as reward...

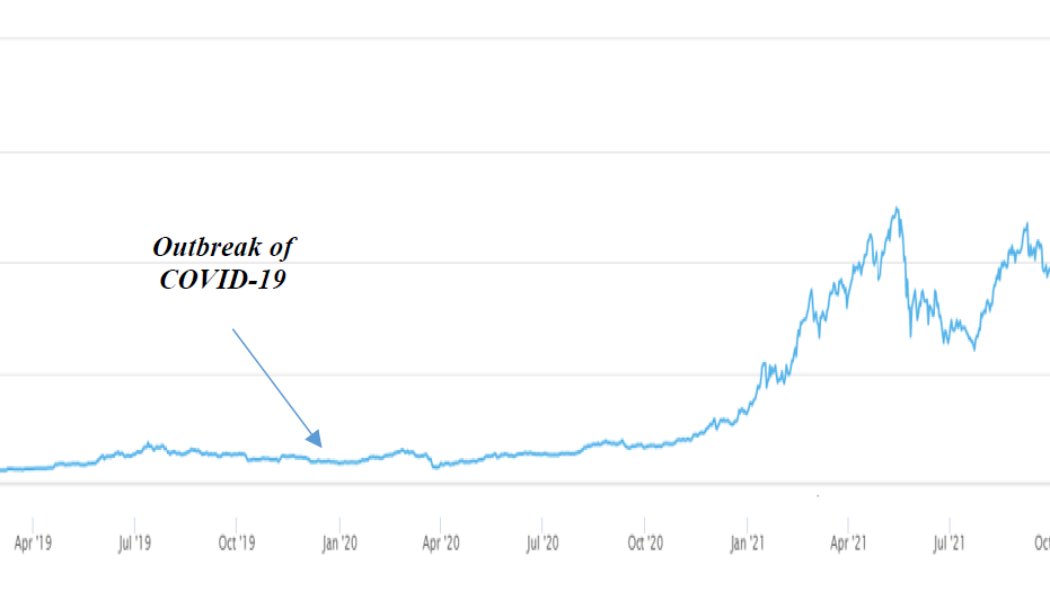

Hong Kong begins discussions to introduce stablecoin regulatory framework

Hong Kong’s central banking institution, the Hong Kong Monetary Authority (HKMA), released a questionnaire to gauge public opinion on regulations for crypto-assets and stablecoins. The state-backed regulator intends to establish a regulatory framework by 2023-24. HKMA’s “Discussion Paper on Crypto-assets and Stablecoins” highlights the explosive growth of the stablecoin market in terms of market capitalization since 2020 and the concurrent regulatory recommendations put forth by international regulators including the United States’ Financial Action Task Force (FATF), the Financial Stability Board (FSB) and The Basel Committee on Banking Supervision (BCBS). Market Capitalization of Crypto-assets. Source: HKMA According to the HKMA, the current size and trading activity of crypto-asset...

Dogecoin leaps 25% after Musk announces DOGE payments for Tesla merch

Dogecoin (DOGE) prices rose substantially on Jan. 14 as Elon Musk announced that Tesla would start accepting it as payment for merchandise. Tesla merch buyable with Dogecoin — Elon Musk (@elonmusk) January 14, 2022 After the announcement, DOGE price jumped nearly 13%, hitting a 30-day high of $0.2150. Its upside move came as a part of a larger intraday rally that already was taking place before Musk’s Dogecoin tweet went viral. The DOGE price went up by over 25% on Jan. 14 before correcting lower to $0.1986 on profit-taking. DOGE/USD hourly price chart. Source: TradingView Better than Bitcoin Tesla’s integration of a DOGE payment option on its online shopping portal came almost a month after Musk shared his willingness to accept the cryptocurrency as payment on ...