Crypto news

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

ImmuneFi report $10B in DeFi hacks and losses across 2021

Decentralized finance, or DeFi, security platform and bug bounty service ImmuneFi published an official report on Thursday, which calculated the total volume of losses in the cryptocurrency markets in 2021. According to its report, the company found that losses resulting from hacks, scams and other malicious activities exceeded $10.2 billion dollars over the past year. Responsible for protecting over $100 billion worth of assets for a number of well-established DeFi protocols, including Synthetix, Chainlink, SushiSwap and PancakeSwap, among others, ImmuneFi has regularly facilitated seven-figure pay-outs to whitehat hackers and other good-willed entities for preventing protocol compromises. According to the report, across 2021, there were 120 instances of crypto exploits or fraudulent rug-...

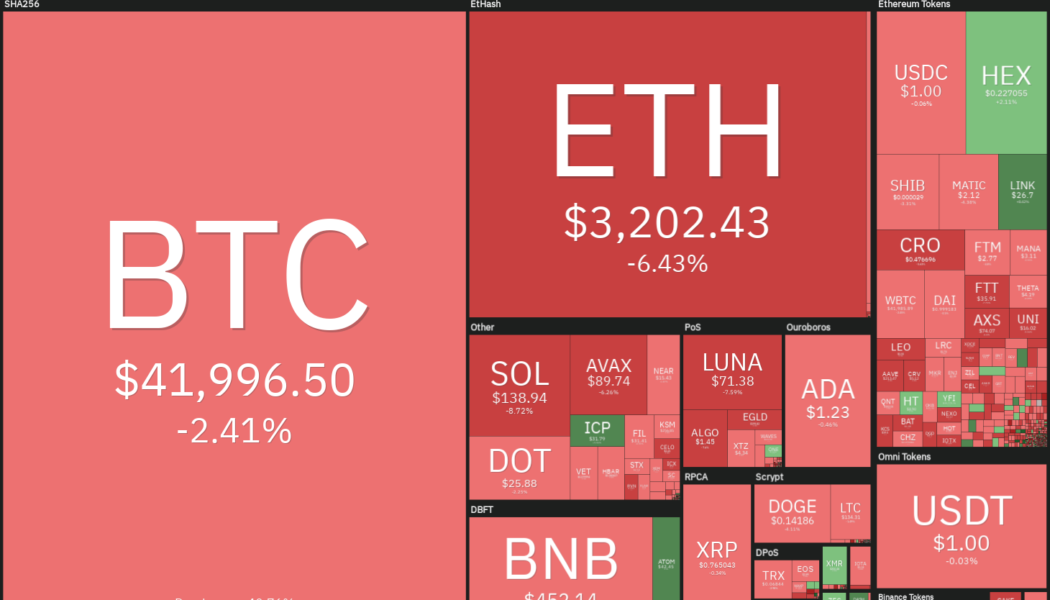

Price analysis 1/7: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and the U.S. equity markets fell sharply on Jan. 5, reacting negatively to the minutes from the Federal Reserve’s December FOMC meeting, which showed that the members expect the balance sheet reduction to start after the Fed begins hiking interest rates in early 2022. Adding to the negative sentiment was the shutdown of the world’s second-biggest Bitcoin mining hub in Kazakhstan, where the internet has been shut down following massive protests by citizens. This caused a dip of about 13.4% in the Bitcoin network’s overall hash rate from 205,000 petahash per second (PH/s) to 177,330 PH/s. Daily cryptocurrency market performance. Source: Coin360 According to Galaxy Digital Holdings CEO Mike Novogratz, the current decline was with low volumes and he believes that the market...

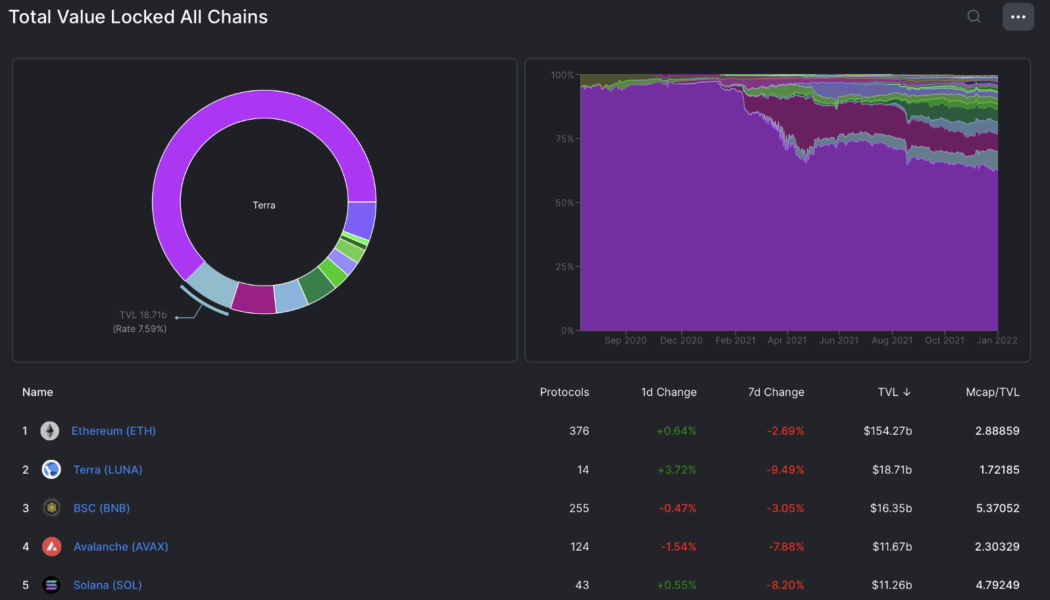

Here’s how Terra traders use arbitrage to profit from LUNA and bLUNA

The end of the year is normally a time to wind down and prepare for the holiday season, but the last few weeks of 2021 saw a crypto market that showed no signs of resting. One of the headline-grabbing stories related to Terra reaching an all-time high in terms of the total value locked (TVL), and the project surpassed Binance Smart Chain (BSC) as the second-largest decentralized finance blockchain after Ethereum. After reaching the $20-billion TVL mark on Dec. 24, Terra’s TVL has come down to around $19.3 billion at the time of writing according to data from Defi Llama, but this is in no way, shape or form a bearish signal. Top 5 total value locked on the top 5 blockchains. Source: Defi Llama Currently, Terra has only 14 protocols built on the chain, compared to the 257 protocols on ...

PayPal reportedly confirms plans to explore the launch of a stablecoin

American fintech giant PayPal Holdings has reportedly confirmed its intent to launch its own stablecoin named PayPal Coin. The development of an in-house stablecoin was first discovered in the source code of Paypal’s iPhone app by developer Steve Moser. Confirming the evidence found on the PayPal app, Jose Fernandez da Ponte, PayPal’s SVP of crypto and digital currencies, told Bloomberg News: “We are exploring a stablecoin; if and when we seek to move forward, we will of course, work closely with relevant regulators.” PayPal Coin logo found inside of PayPal app. Source: PayPal iPhone app Moser’s finding uncovered that PayPal is in the works of building PayPal Coin, which will be backed by the United States dollar. However, a PayPal spokesperson clarified that the source codes of the iPhone...

UK lawmakers form crypto advocacy group for parliament: Report

Lisa Cameron, a member of parliament for the United Kingdom’s House of Commons, is reportedly chairing a lobbying group aimed at promoting crypto-related legislation in government. According to a Friday report from the Financial Times, members of parliament, as well as members of the House of Lords in the United Kingdom, launched the Crypto and Digital Assets Group to ensure rules for the crypto industry in the U.K. “support innovation” as of last week. The cross-party group aims to protect investors from financial crimes, including token scams or offerings from regulated companies. “We are at a crucial time for the sector as global policymakers are also now reviewing their approach to crypto and how it should be regulated,” said Cameron. Palace of Westminster at night. Source: Pexels...

Finance Redefined: Terra expanding UST and LUNA, and Aave Arc seeks institutional adoption, Dec. 31–Jan. 7

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. The new year is upon us, and the expectations for DeFi innovation, utility and mainstream adoption are greater than ever. Read on to hear about the inaugural stories of 2022. Reading this article, you’re only receiving a portion of the content from our DeFi newsletter. Drop your email below for the full copy. Terra Research proposes new utility for TerraUSD and LUNA Decentralized algorithmic stablecoin issuer Terra published an ambitious proposal via its research team this week to expand the interchain deployment of its TerraUSD (UST) stablecoin across five projects on Ethereum, Polygon and Solana. Titled “UST Goes Interchain: Degen Strats Part Three,” the lengthy governance post extensively detailed t...

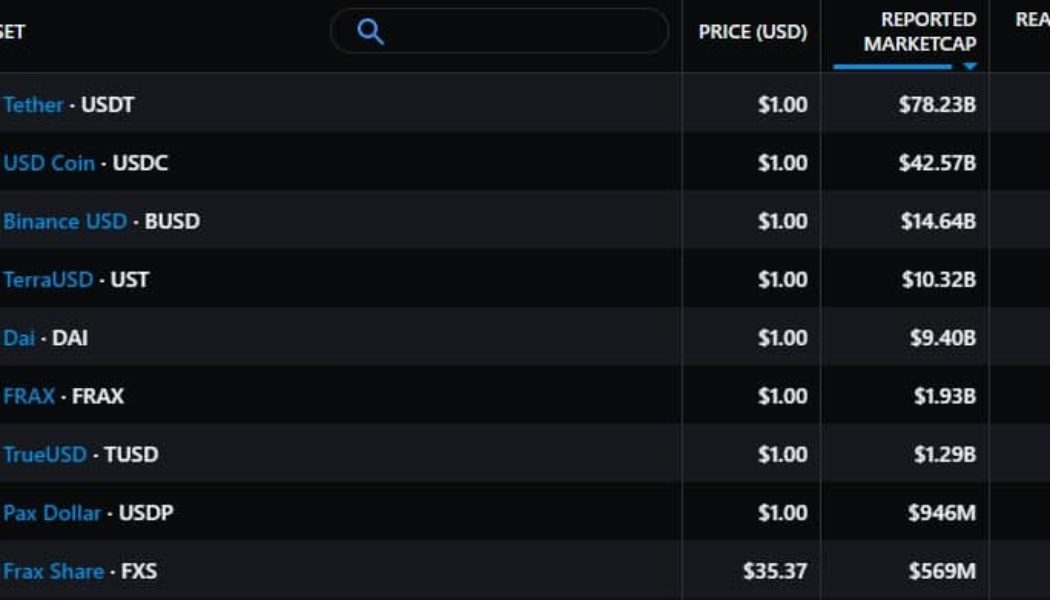

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

Ava Labs and EV maker Togg to build smart contract-based mobility services

Turkey’s electronic vehicle (EV) manufacturer Togg has announced a strategic partnership with Ava Labs to design and build smart contract-based services aimed at improving autonomous mobility. Togg’s collaboration with Ava Labs, a team dedicated to supporting and developing the Avalanche public blockchain, was revealed at the CES 2022 event in Las Vegas. As Cointelegraph Turkey reported, the partnership aims to fast-track Togg’s Use-Case Mobility initiative, which combines different technologies and transportation solutions to produce cars with more functionalities as compared to traditional EVs. According to the official announcement, Togg has been exploring use cases around blockchain and related technologies in EVs for more than a year. With Ava Labs’ partnership, Togg intends to ...

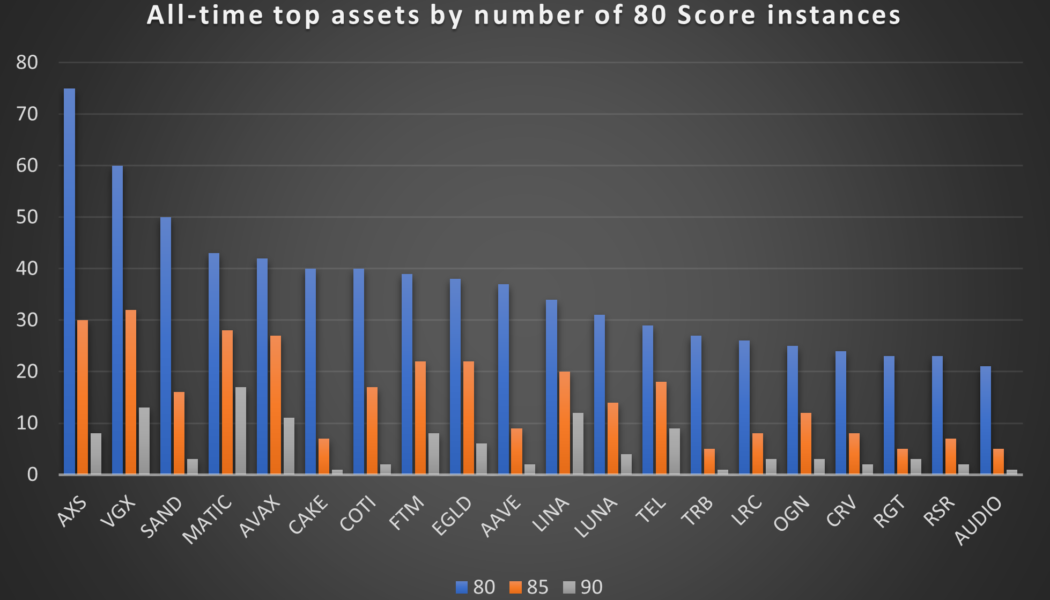

Here are the most predictable tokens of 2021 – for those who knew where to look

Digital assets’ past performance is never a guarantee of future price movement. There are never two identical situations in the crypto marketplace, so even historically similar patterns of a token’s behavior can be followed by starkly different price action charts. Still, crypto assets’ individual history of price action often rhymes, giving those who can ready this history right a massive edge over other traders. And, importantly, some tokens are much more likely than others to exhibit recurring behavior, which makes their bullish setups more recognizable ahead of time. Cointelegraph Markets Pro, a subscription-based data intelligence platform whose job is to search for regularities in crypto assets’ past trading behavior and alert traders to historically bullish conditions around individ...

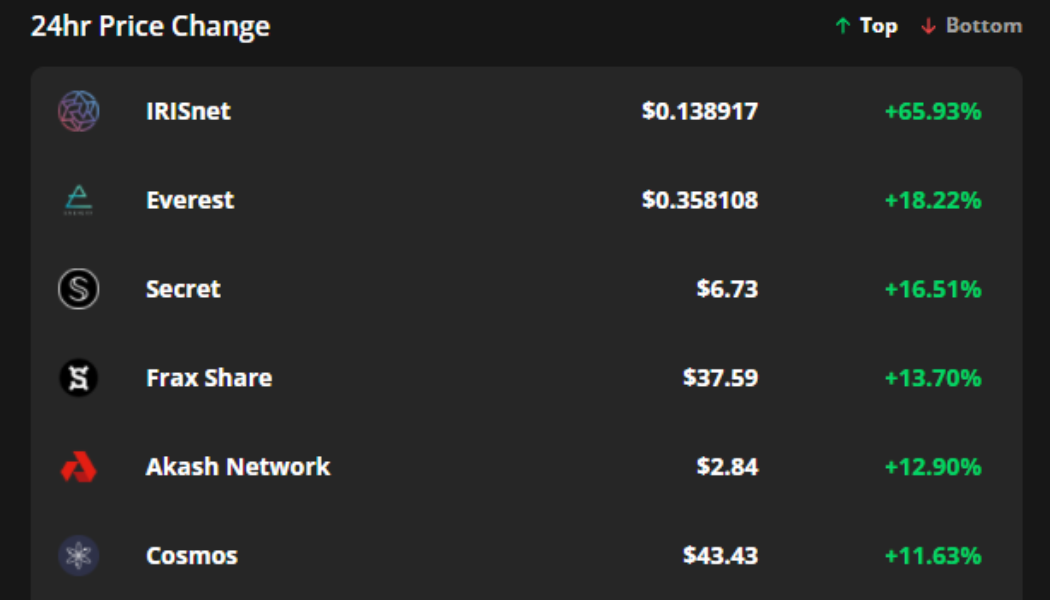

Cosmos ecosystem tokens rally after Evmos promises Ethereum interoperability

The wider cryptocurrency market is facing another day of volatility and selling on Jan. 7 as Bitcoin (BTC) bears managed to break bull support at $42,000. The price of Bitcoin was pushed to a daily low of $40,620 before resources were exhausted. Data from Cointelegraph Markets Pro shows that four of the top seven gainers of the day are part of the growing Cosmos Hub. This ecosystem currently uses the Interblockchain Communication protocol (IBC) to facilitate interoperability and communication between connected networks. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Here’s a look at what’s behind the strength seen in IRISnet (IRIS), Secret (SCRT), Akash Network (AKT) and Cosmos (ATOM). IRISnet expands its NFT capabilities The top gainer over the ...

Vitalik Buterin gives thumbs down to cross-chain applications

In a Reddit post on Friday, Vitalik Buterin, the co-founder of Ethereum (ETH), outlined critical security concerns surrounding cross-chain bridges in the blockchain ecosystem. As told by Buterin, storing native assets directly-chain (Ethereum on Ethereum, Solana on Solana, etc.) provides a certain degree of immunity against 51% attacks. Even if hackers manage to censor or reverse transactions, they cannot propose blocks to take away one’s crypto. The rule also applies to the Ethereum application. For example, if hackers launch a 51% attack (by controlling 51% of all circulating ETH supply) while an investor swaps 100 ETH for 320,000 DAI stablecoin, the end state remains invariant, i.e., the investor would always get either 100 ETH or 320,000 DAI. However, Buterin continued, that the ...