Crypto news

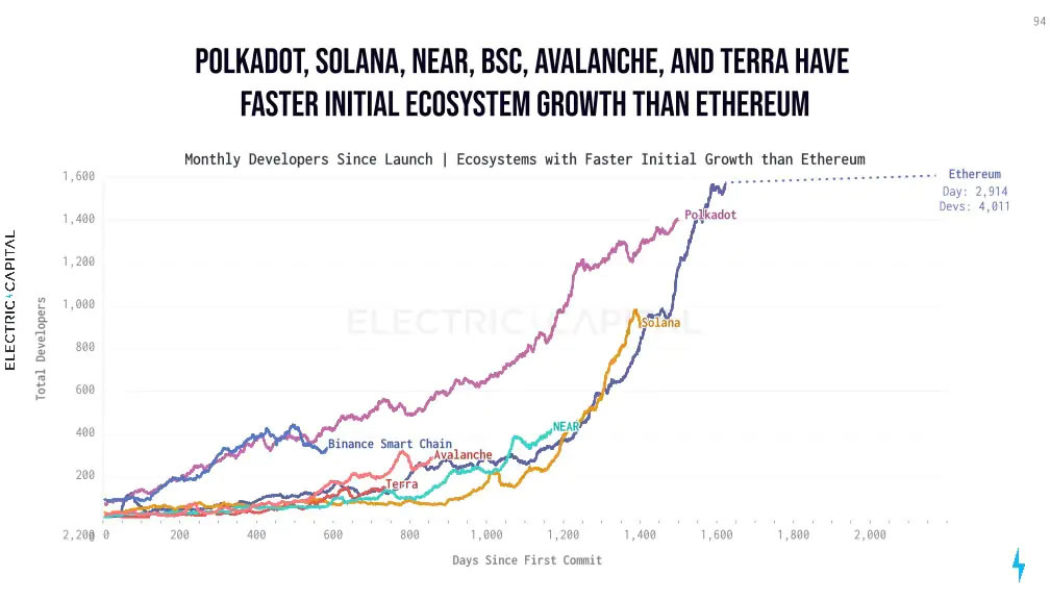

Ethereum dominates among developers but competitors growing faster

The Ethereum ecosystem still has far more developers than rival networks, but they are catching up with a faster rate of growth. Ethereum competitors such as Polkadot, Solana, and Binance Smart Chain are growing faster in terms of development activity according to crypto research firm Electric Capital which released its findings on the blockchain development ecosystem in a new report on Jan. 6. It revealed that more than 4,000 monthly active open-source developers work on Ethereum — considerably more than the 680 who work on the Bitcoin network. Across all chains, the total monthly active developers measured was more than 18,400 and the record was broken for the number of code commits by new developers in 2021 with more than 34,000. The measurements were gleaned by analyzing around 500,000...

Why Kevin O’Leary thinks NFTs could become bigger than Bitcoin

Millionaire investor and crypto proponent Kevin O’Leary thinks that the NFT sector could be worth more than Bitcoin in the future. Speaking with CNBC’s Capital Connection on Jan. 5, O’Leary — also known as Mr. Wonderful — argued that NFTs provide a greater potential to attract capital than Bitcoin due to their ability to tokenize and authenticate physical assets such as cars, watches and real estate: “You’re going to see a lot of movement in terms of doing authentication and insurance policies and real estate transfer taxes all online over the next few years, making NFTs a much bigger, more fluid market potentially than just Bitcoin alone.” Mr. Wonderful admitted however, that he is not tied to that bet and will still be investing on “both sides of that equation.” The former cr...

Raoul Pal says ‘reasonable chance’ crypto market cap could 100X by 2030

Former Goldman Sachs hedge fund manager and Real Vision CEO Raoul Pal thinks that the crypto market cap could increase 100X by the end of this decade. At the time of writing, the total market cap of the global crypto sector stands at $2.2 trillion, and Pal told podcast Bankless Brasil “there’s a reasonable chance” this figure could grow to around $250 trillion if the crypto network adoption models continue on their current trajectory. Pal drew comparisons between the current benchmarks of other markets and asset classes such as equities, bonds and real estate, noting that they all have a market cap between “$250-$350 trillion.” “If I look at the total derivatives market, it’s $1 quadrillion. I think there’s a reasonable chance of this being a $250 trillion asset class, which is 100X from h...

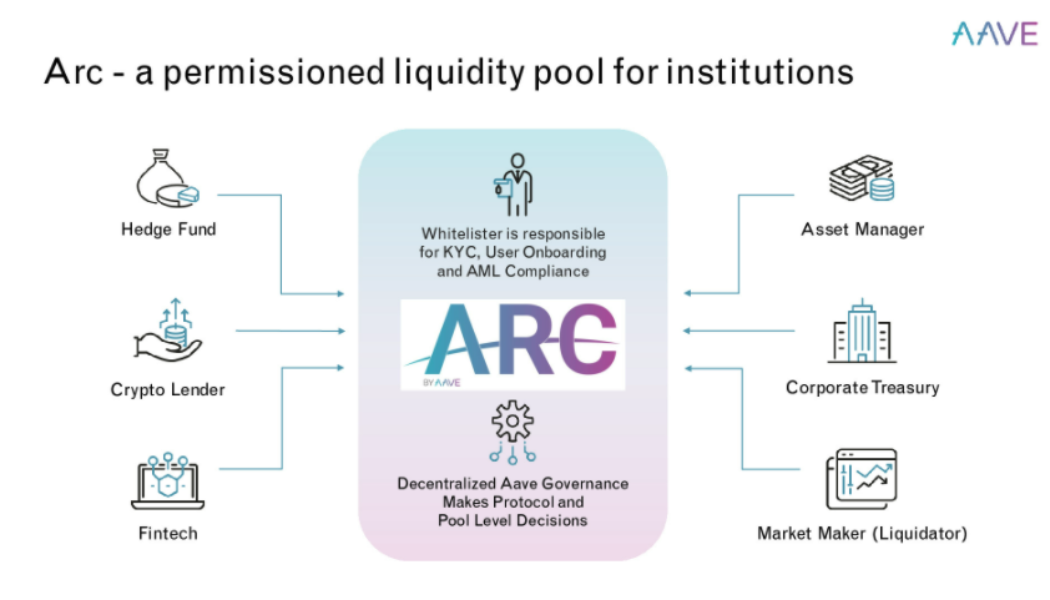

Aave launches its permissioned pool Aave Arc, with 30 institutions set to join

Decentralized lending platform Aave has launched its permissioned lending and liquidity service Aave Arc to help institutions participate in regulation-compliant decentralized finance. As opposed to its permissionless cross-chain counterparts on the platform, Aave Arc is a permissioned liquidity pool specifically designed for institutions to maintain regulatory compliance in the decentralized finance (DeFi) space. The first of 30 entities lined up for the whitelist for Aave Arc was Fireblocks, the institutional digital asset custodian. It explained in a Jan. 5 announcement the pool “enables whitelisted institutions to securely participate in DeFi as liquidity suppliers and borrowers.” Users of Aave Arc must perform due diligence procedures such as know your customer/ anti-money laundering ...

SEC delays decision on NYDIG Bitcoin ETF for another 60 days

The commission previously punted two other Bitcoin ETF products for an additional 45 days The US Securities and Exchange Commission on Tuesday revealed that it had pushed the deadline for reviewing the spot ETF proposal from technology and financial services firm NYDIG for another 60 days. The regulator explained that it saw it appropriate to delay the decision to either approve or reject the application until March 15th. The extended period, according to the commission, would provide enough time to review and make a determination on the ETF. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the iss...

Kazakh government resigns, shuts down internet amid protests, causing Bitcoin network hash rate to tumble 13.4%

On Wednesday, Kazakhstan, the second-largest country in the world when it comes to Bitcoin (BTC) mining hash rate, experienced unprecedented political unrest due to a sharp rise in fuel prices. As a result, the country’s presiding cabinet resigned, but not before the state-owned Kazakhtelecom shut down the nation’s internet, causing network activity to plunge to 2% of daily heights. The move dealt a severe blow to Bitcoin mining activity in the country. As per data compiled by YCharts.com, the Bitcoin network’s overall hash rate declined 13.4% in the hours after the shutdown from about 205,000 petahash per second (PH/s) to 177,330 PH/s. The country accounts for 18% of the Bitcoin network’s hash activity. Just days prior, the Kazakh government removed price cap...

Moneygram buys 4% stake in crypto ATM operator Coinme

Money transmission network MoneyGram now has a minority investment in crypto ATM operator Coinme following a Series A funding round. In a Wednesday announcement, MoneyGram said it had purchased a roughly 4% ownership stake in Coinme — likely more than $764,000, given its valuation of $19.1 million in June — as part of a strategic investment in the crypto company. The investment follows a May 2021 partnership between the two firms aimed at expanding access to crypto-fiat exchanges. “We continue to be bullish on the vast opportunities that exist in the ever-growing world of cryptocurrency and our ability to operate as a compliant bridge to connect digital assets to local fiat currency,” said MoneyGram CEO Alex Holmes. “Our investment in Coinme further strengthens our partnership and co...

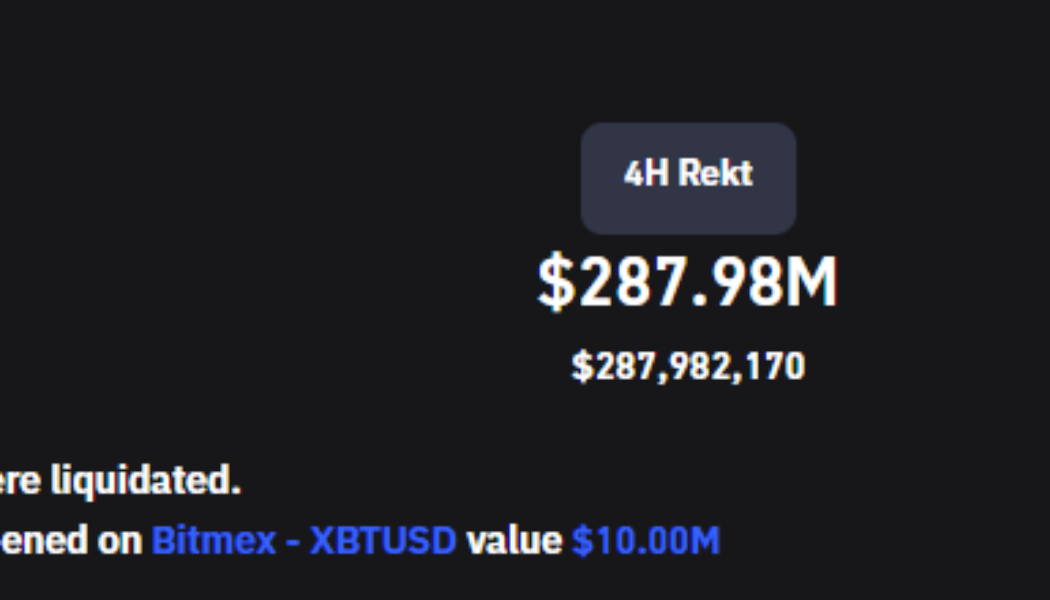

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

3 reasons why Cosmos (ATOM) price is near a new all-time high

Blockchain network interoperability is shaping up to be one of the main themes for the cryptocurrency ecosystem in 2022. New users are continuing to onboard into the growing world of crypto while both new and established projects search for the chain that will best serve the needs of their protocol and community. One project that has 2022 off to a bullish start thanks to its focus on facilitating the communication between separate networks is Cosmos (ATOM). This project bills itself as “the internet of blockchains” and seeks to facilitate the development of an interconnected decentralized economy. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $25.06 on Dec. 30, the price of ATOM has rallied 75% to hit a daily high at $43.98 on Jan. 4 as its 24-...

Bitcoin monthly RSI lowest since September 2020 in fresh ‘oversold’ signal

A key Bitcoin (BTC) metric has just reached its lowest levels since the months after the March 2020 market crash. As noted by popular analysts on Jan. 5, Bitcoin’s relative strength index (RSI) is printing a “hidden bullish divergence” on monthly timeframes — and if it plays out, they say, the result will be very pleasing for hodlers. RSI falls below summer 2021 floor Amid frustration at the lack of direction on BTC/USD, it is no secret that a host of on-chain indicators has long demanded higher price levels. The current $46,000 may slide further, but the classic RSI metric now shows just how comparatively “oversold” Bitcoin is at that price. “Bitcoin monthly RSI is currently lower than the May–July 2021 correction,” popular analyst Matthew Hyland ...

CertiK identifies Arbix Finance as a rug pull, warns users to steer clear

Binance Smart Chain-based yield farming protocol Arbix Finance was identified by blockchain security company CertiK as a rug pull. According to the firm’s incident analysis, there were several reasons why the project was flagged. The security firm states that “The ARBX contract has mint() with onlyOwner function, 10 million ARBX tokens were minted to 8 addresses,” and 4.5 million ARBX was minted to a single address. Following this, CertiK confirmed that “The 4.5M minted tokens were then dumped.” The firm also reported that the $10 million in funds deposited by users was directed to pools that are unverified, and eventually, a hacker drained all the assets from the pools. Using the platform’s Skytrace tool to analyze the risk of fraud, the firm determined...