Crypto news

Ether drops below $3,800, but traders are unwilling to short at current levels

Even though Ether (ETH) reached a $4,870 all-time high on Nov. 10, bulls have little reason to celebrate. The 290% gains year-to-date have been overshadowed by Dec.’s 18% price drop. Still, Ethereum’s network value locked in smart contracts (TVL) increased nine-fold to $155 billion. Looking at the past couple of months’ price performance chart doesn’t really tell the whole story, and Ether’s current $450 billion market capitalization makes it one of the world’s top 20 tradable assets, right behind the two-century-old Johnson & Johnson conglomerate. Ether/USD price at FTX. Source: TradingView 2021 should be remembered by the decentralized exchanges’ sheer growth, whose daily volume reached $3 billion, a 340% growth versus the last quarter of 202...

Bitcoin holds $48K as final Wall Street session caps 60% YTD gains for BTC

Bitcoin (BTC) chipped away at its latest gains on Dec. 31 as the final trading session of 2021 opened on Wall St. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin posts 60% year-to-date gains Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it meandered around the $48,000 mark, having reached multi-day highs of $48,550 hours earlier. The uptick had coincided with the December expiry on Bitcoin options, by far the biggest date on the options calendar at nearly $6 billion. Conspicuous buying was recorded on U.S. professional exchange Coinbase Pro in the run-up to the event. With stocks heading higher in Asia, all eyes were on the potential for a final flourish against a background of concern over inflation in 2022. The S&P 500 broke its ...

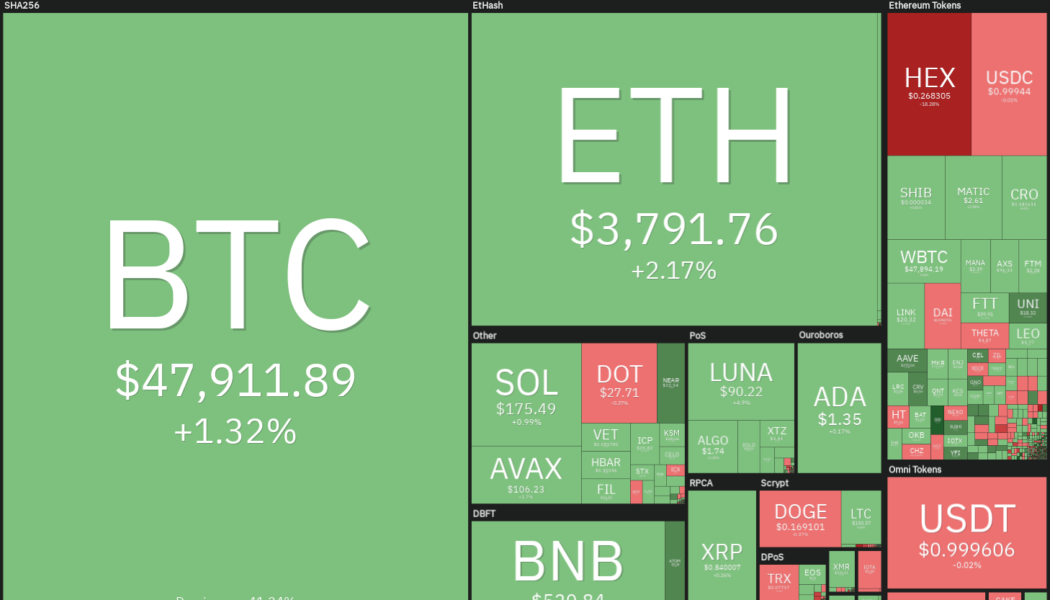

Price analysis 12/31: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting a rebound off their respective support levels, indicating that buyers continue to accumulate on dips. Data from Coinglass shows that 9,925 Bitcoin left Coinbase Pro, the professional trading arm of Coinbase, on Dec. 30, a possible sign of institutional buying. This is in sharp contrast to the strong inflows seen in Binance and OKEx. Several analysts believe that institutional buying could pick up in January. Economist and trader Alex Krüger expects a Bitcoin rally in early January based on fund flows. He also highlighted that January has produced positive results for Bitcoin between 2018 and 2021, with gains ranging from 7% to 36%. Daily cryptocurrency market performance. Source: Coin360 While investors debate about the next possible dir...

Bitcoin price reverses gains on New Year’s Eve; hodlers continue stacking sats

Bitcoin (BTC) and the broader cryptocurrency market turned lower later in the day on Dec. 31, erasing intraday gains to cap off a highly successful year on a weaker note. Market Update BTC price fell below $46,000 on Dec. 31 and was last seen hovering below that level, according to data from Cointelegraph Markets Pro and TradingView. The flagship cryptocurrency is down over 5% from its intraday peak and 2.9% on the day to trade at $45,933. Bitcoin’s price is back on the defensive as the year draws to a close. Source: Cointelegraph Markets Pro Altcoins faced a similar downward trajectory as Bitcoin, with the likes of Ether (ETH), Binance Coin (BNB) and Solana’s SOL each falling more than 2%. Cardano’s ADA declined over 4% on the day. The combined market capitaliz...

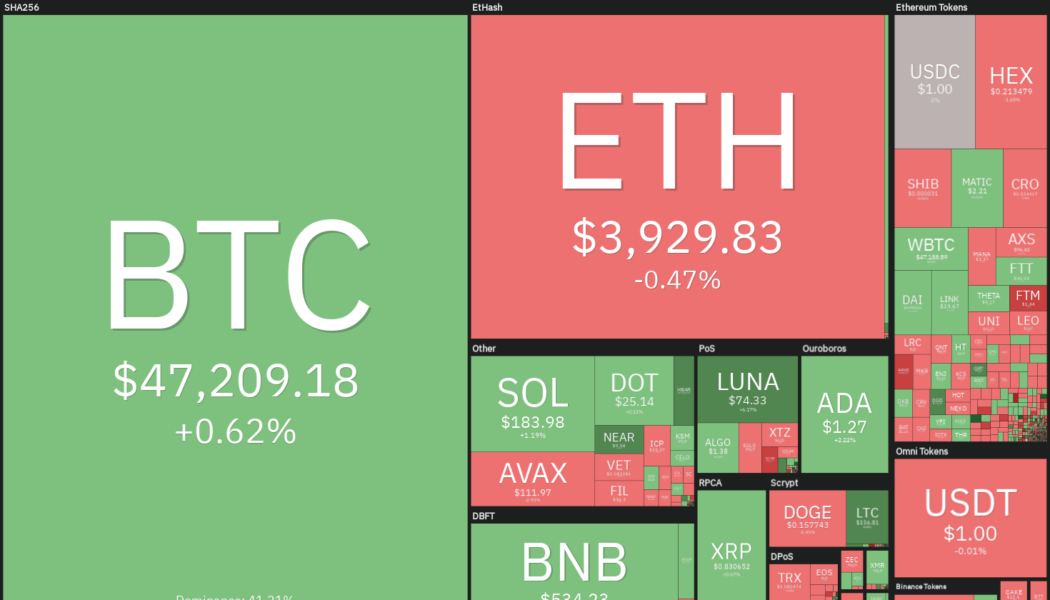

Bitcoin price fell short of analysts’ $100K target, but what about 2022?

Bitcoin (BTC) is likely to end 2021 well below analysts’ target projections of $100,000. Kraken CEO Jesse Powell, who had also projected a $100,000 price target for Bitcoin, still remains bullish in the long term, but he does not rule out a sharp drop in the short term. One of the negatives that may add pressure to Bitcoin in the short term is the shift in the United States Federal Reserve’s monetary policy. On Dec. 15, the Fed announced that it would wind down its bond-buying program at a faster pace, and it also projected three interest rate hikes in 2022. Crypto market data daily view. Source: Coin360 Sam Stovall, chief investment strategist of CFRA Research, told CNBC that historically, the S&P 500 tends to post negative returns in the 12-month period when the Fed undert...

Airdrop culture could pose integral threat to DeFi industry

EtherWrapped, a project designed to provide a yearly summary of users nonfungible token (NFT) activity, launched a little over eight hours ago to palpable fanfare within the crypto community. The website detailed a plan to airdrop YEAR tokens based upon quantitative engagement statistics in users’ MetaMask wallet, or in simpler terms, their number of transactions, volume traded and gas fees, among other data. Upon verification on EtherScan, a number of well-regarded developers and engineering experts in the space assessed the coding of the smart contract. Meows.eth noted that these parties saw a “presence of a function titled _burnMechanism,” but concluded that it was merely a harmless error by the seemingly amateur creator. What we noticed during a brief pass was the presence o...

Estonia’s new AML laws set to clamp down on crypto industry

Beginning in February, Estonia is set to introduce sweeping changes to its definition of Virtual Asset Service Providers, or VASPs, to include several cryptocurrency-related services — a move that could impact Bitcoin (BTC) ownership in the country — according to European compliance specialist Sumsub. On Sept. 21, the Estonian Ministry of Finance published a draft bill to update the Money Laundering and Terrorist Financing Prevention Act (the AML Act) as part of the government’s effort to prevent money laundering and terrorist financing. As Sumsub reported, the legislation is now in the interagency review process, with implementation set for February 2022. Regulated crypto companies have until March 18, 2022 to bring their operations and paperwork into compliance. According to ...

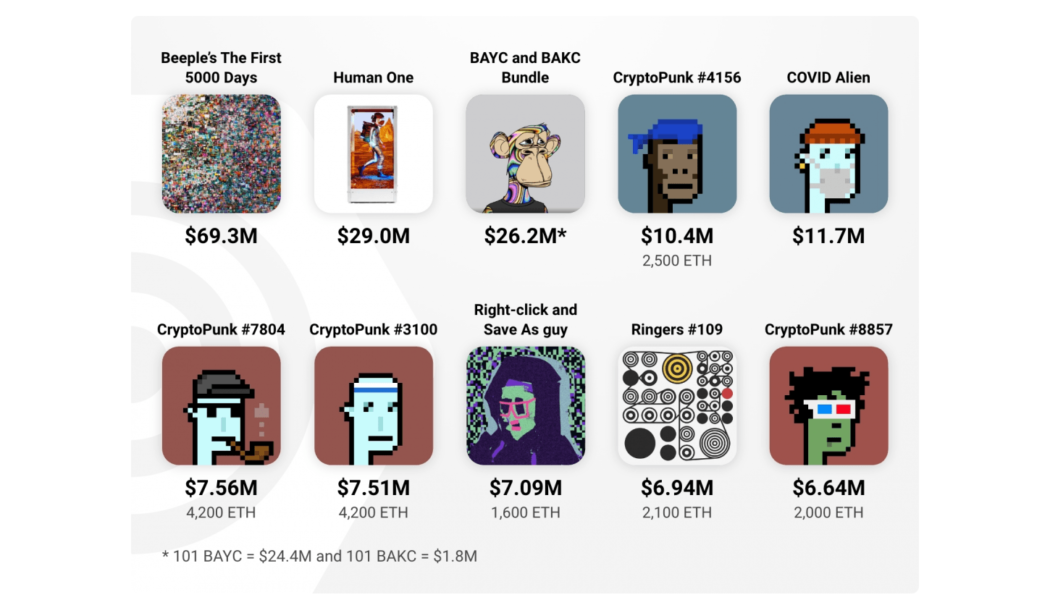

NFTs find true utility with the advent of the Metaverse in 2021

The growth of NFTs has shot to the next level in terms of popularity and finding acceptance from the crypto community and the mainstream alike. Nonfungible tokens (NFTs) that were initially thought to be a bubble are now expanding their coverage across the cryptoverse. According to a report by DappRadar, the NFT market has had its best year, generating over $23 billion with the floor market capitalization of the top 100 NFT collections standing at $16.7 billion, as of Dec. 17, even before the year closed out. The biggest move for NFTs and the metaverse space has been Facebook’s announcement of being rebranded to Meta on Oct. 28 in a bid to expand its reach beyond social media and into the Metaverse. In fact, in the last week of October, it was revealed that over $106 million worth of Metav...

Cointelegraph Consulting: Crypto events of 2021 in retrospect

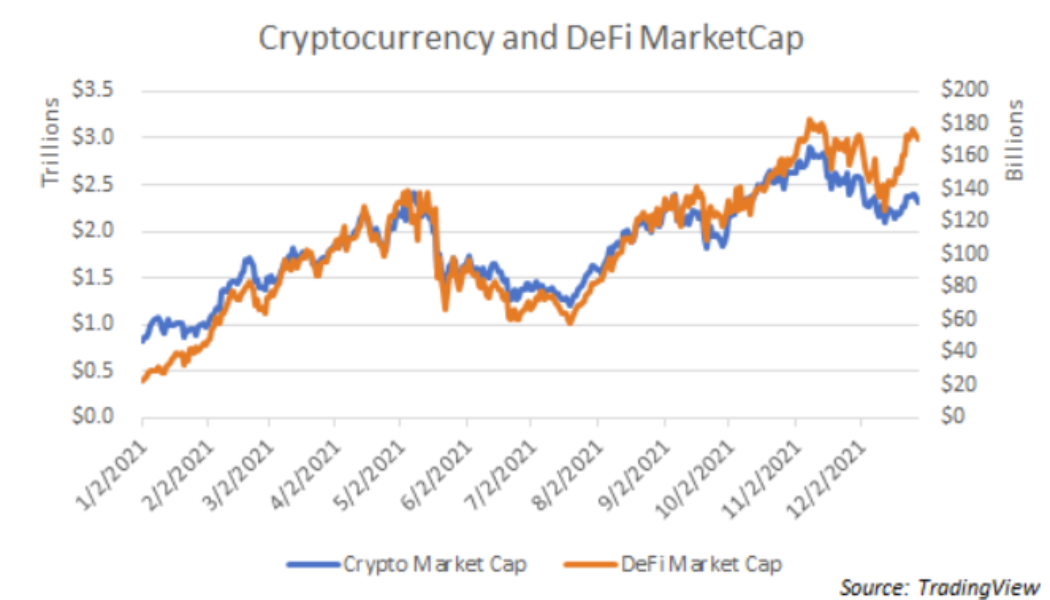

The year 2021 is coming to a close, and if there’s one way to describe how the cryptocurrency industry fared in the past 12 months, it would be momentous growth. Major cryptocurrencies shattered previous records, adoption grew, new sectors sprouted and novel blockchain use cases made significant breakthroughs. The Market Insight’s latest edition recalls the events covered in past issues as well as deep-dive topics in Cointelegraph Research’s industry reports. DeFi and Altcoins Two of the top gainers of 2021 were Solana (SOL) and Terra (LUNA). SOL gained 9,500%, while LUNA gained 13,000%. Significant investments and ecosystem growth catalyzed the immense gains for the two tokens. One could also argue that the two being billed as potential “Ethereum killers” had a part in contributing ...

Bank of Mexico to issue a digital currency by 2024

The sovereign digital currency will not replace rather will coexist with the Mexican currency On Wednesday evening, the government of Mexico shared on Twitter that the Bank of Mexico was looking to launch a digital currency within the next three years. The government considers digital currencies important in advancing the nation’s financial position, according to the shared post. “The Banxico reports that by 2024 it will have its own digital currency in circulation, considering these new technologies and the next-generation payment infrastructure are extremely important as options of great value to advance financial inclusion in the country,” the translated tweet read. The news comes not long after the Bank of Mexico Deputy Governor Jonathan Heath revealed that the ...

Bitcoin gains $1.5K in under an hour as BTC price erases days of downtrend

Bitcoin (BTC) put in an early end-of-year flourish on Dec. 31 as an upward boost saw BTC/USD retake $48,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Options expiry fades Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly gaining over $1,500 in a single hour on Friday. A refreshing counterpoint to several days of downtrend, the move gave a taste of what could happen in a crypto market where liquidity is thinner than normal over the holiday period. Futures + option expiry — IamNomad (@IamNomad) December 31, 2021 December’s Bitcoin options expiry event, worth almost $6 billion, could have provided the snap relief, traders argued, this traditionally pressuring BTC price action beforehand. A survey by the Bitcoin Twitter account earlier in Decem...