Crypto news

New House Financial Services Committee chair wants to delay crypto tax changes

The incoming United States House Financial Services Committee chair, Patrick McHenry, wants the Treasury to delay implementing a section of the Infrastructure Investment and Jobs Act that deals with digital assets and tax collection. McHenry sent a letter on Dec. 14 to U.S. Treasury Secretary Janet Yellen with questions and concerns about the scope of Section 80603 of the act. In the letter, he requested clarification over the “poorly drafted” and potentially privacy-compromising section that deals with the taxation of digital assets, scheduled to go into effect next yea. He said the section requires the government to treat digital assets as the equivalent of cash for tax purposes, which could “jeopardize” the privacy of Americans and hamp innovation. The section, called “Information...

Japan set to ease 30% crypto tax on paper profits for token issuers

The Japanese government is set to ease tax requirements for local crypto firms, as it pushes to stimulate growth in the domestic finance and tech sectors. At present, Japanese firms that issue crypto are required to pay a set 30% corporate tax rate on their holdings, even if they haven’t realized a profit through a sale. As such, a number of domestically founded crypto/blockchain firms and talent have reportedly chosen to set up shop elsewhere over the past few years. Japan’s ruling party, the Liberal Democratic Party’s (LDP) tax committee held a meeting on Dec. 15 and approved a proposal — initially tabled in August — which removes the requirement for crypto companies to pay taxes on paper gains from tokens that they have issued and held. The softer crypto tax rules are expected to be sub...

Charges laid over alleged ‘crypto mining’ Ponzis that netted $8.4M

United States prosecutors have laid charges in two separate cases against nine people who founded or promoted a pair of cryptocurrency companies alleged to be Ponzi schemes that netted $8.4 million from investors. On Dec. 14 the U.S. Attorney’s Office for the Southern District of New York unsealed the indictment, alleging the purported crypto mining and trading companies IcomTech and Forcount promised investors “guaranteed daily returns” that could double their investment in six months. In reality, prosecutors say both firms were using the money from later investors to pay earlier investors, while other funds were spent on promoting the companies and buying luxury items and real estate. “Lavish expos” were held in the U.S. and abroad, along with presentations in small communities, that lur...

Silvergate faces class-action lawsuit over FTX and Alameda dealings

A class-action lawsuit against Silvergate Bank, Silvergate Capital Corporation and Silvergate CEO Alan Lane was filed at the California Southern District Court concerning accounts held by embattled crypto companies FTX and Alameda Research. The suit aims to hold Silvergate accountable for its alleged roles in placing FTX user deposits into the bank accounts of Alameda, which caused panic within the crypto market, eventually leading to both firms declaring bankruptcy. The lawsuit was filed by the plaintiff Joewy Gonzalez on behalf of himself and others in the same situation. According to the suit, the plaintiff invested his savings in crypto through the FTX exchange as the platform promised investors that they were able to “store assets securely as they gained in value, cash them out ...

Dutch central bank says KuCoin is not licensed and ‘illegally offering services’

The central bank of the Netherlands, De Nederlandsche Bank, has issued a warning to investors using KuCoin, saying the exchange was operating without legal registration. In a Dec. 15 announcement, the central bank said that MEK Global Limited, or MGL, which does business in the Netherlands as KuCoin, was not in compliance with the country’s Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT) regulations. De Nederlandsche Bank added the crypto firm was “illegally offering services” as well as “illegally offering custodian wallets” for users. “Customers of MGL are not in violation,” said the bank. “However, this may increase the risk of customers becoming involved in money laundering or terrorist financing.” DNB warns against MEK Global Limited, doing business as K...

The VC-dominated crypto funding model needs a reboot

Does the crypto industry’s funding space need an overhaul? This is one of many questions swirling in the wake of FTX’s downfall: When the prominent exchange collapsed, it left behind a long line of helpless creditors and lenders — including many promising projects dependent on funds promised by Sam Bankman-Fried and company. But there is a bigger problem at the heart of the current funding picture, wherein deep-pocketed venture capital firms throw their weight around in the low-liquidity Web3 market, heavily backing early-stage projects before cashing out at a profit once retail has FOMO’d into the market. For all the talk of how blockchain and cryptocurrencies represent a critical fiat off-ramp and a wholesome pathway towards greater decentralization, transparency, fairness and incl...

Researchers use zero-knowledge to address privacy, AML concerns in stablecoins

Researchers from German crypto blockchain-based payments fintech etonec and other organizations have proposed using zero-knowledge proofs to ensure regulatory compliance and privacy in stablecoins. They have created a design that allows fiat-based stablecoins to be used like cash, within limits. The researchers’ design allows a number of limits, including on transactions, balances and turnover, and enables Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance with the use of zero-knowledge proofs, particularly zk-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). Below the preset limits, transactions would be invisible to third parties. According to the researchers’ report: “In essence, our goal is to create a stablecoin that provides si...

Crypto.com continues its worldwide registration push with Brazilian EMI license

Crypto.com has received a Payment Institution License (EMI) from Banco Central do Brasil, the central bank of Brazil. The license will allow it to “continue offering regulated fiat wallet services for customers in Brazil,” according to an announcement on the company’s website. Crypto.com has offered a Visa card in Brazil for purchases in cryptocurrency or fiat since last year. The Singapore-based cryptocurrency exchange recently added a proof-of-reserves page to its website. It has received approvals in several countries in recent months, including France, the United Kingdom and South Korea, the announcement states. It has provisional approvals in several more jurisdictions, including Singapore, Dubai and Ontario. It also had an agreement with the city of Busan, South Korea, whic...

Metropoly Pre-Sale Raised 300k After Releasing Beta

British Virgin Islands, BVI, 15th December, 2022, Chainwire The Metropoly presale for the METRO token has started successfully, with seven stages sold out and only three remaining. The METRO token presale started at $0.033 and will launch at a fixed price of $0.1. Metropoly has already managed to raise over $300,000 in its presale. The blockchain-based project aims to transform the real estate industry’s operations, bringing it into the digital age. Interest in Metropoly’s presale can be attributed to the fact that more investors are looking for alternative investment opportunities. Real estate-based projects are seen as a strong hedge against inflation and fluctuating market prices. Implementing crypto in the real estate industry could disrupt one of the oldest industries in the world. It...

Project alleges unreturned listing deposit as Binance announces delistings

On Dec. 15, cryptocurrency exchange Binance announced that four tokens — Mithril (MITH), Tribe (TRIBE), Augur (REP) and Bitcoin Standard Hashrate Token (BTCST) — would be delisted from the exchange effective Dec. 22 due to not meeting the “high level of standard we expect.” Immediately after the announcement, decentralized social media protocol Mithril, whose token had a market capitalization of less than $10 million at the time of publication, posted the following statement on Twitter: “Today, Binance has announced that it will delist MITH. As part of the MITH listing, Binance required a 200,000 BNB deposit, which was never returned. On behalf of the Mithril community, we ask @cz_binance to return this deposit so that Mithril may continue to operate.” At the time of the initial ...

Ethics 101: Should crypto projects ever negotiate with hackers?

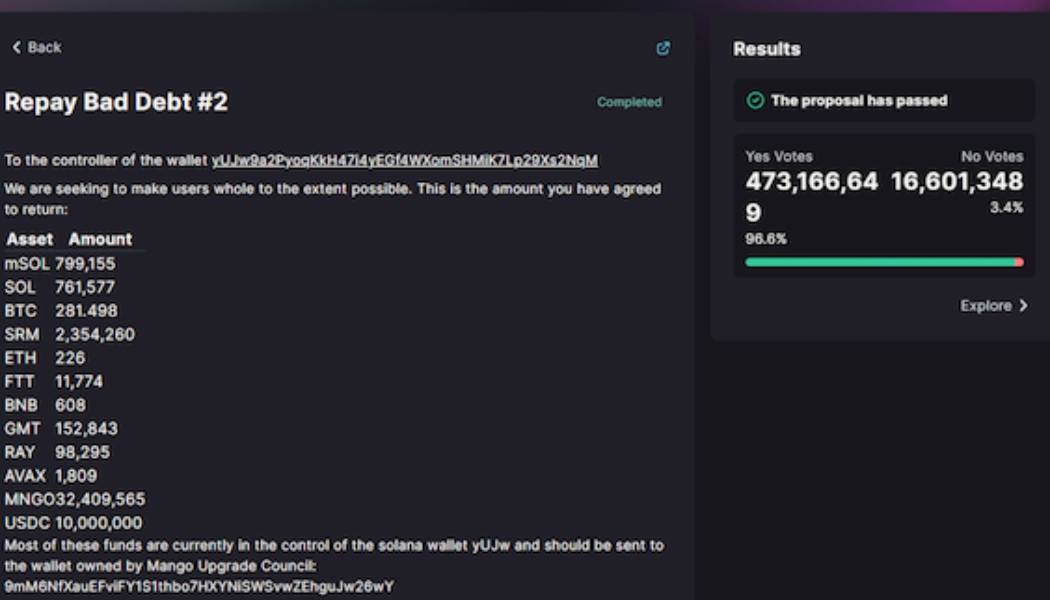

“A highly profitable trading strategy” was how hacker Avraham Eisenberg described his involvement in the Mango Markets exploit that occurred on Oct. 11. By manipulating the price of the decentralized finance protocol’s underlying collateral, MNGO, Eisenberg and his team took out infinite loans that drained $117 million from the Mango Markets Treasury. Desperate for the return of funds, developers and users alike voted for a proposal that would allow Eisenberg and co. to keep $47 million of the $117 million exploited in the attack. Astonishingly, Eisenberg was able to vote for his own proposal with all his exploited tokens. This is something of a legal gray area, as code is law, and if you can work within the smart contract’s rules, there’s an argument saying it’s perfectly legal. Alt...

Coinbase launches tool to recover ‘mistakenly sent’ ERC-20 tokens

Major cryptocurrency platform Coinbase has offered an asset recovery tool for users who “mistakenly send unsupported tokens” to exchange addresses. In a Dec. 15 announcement, Coinbase said users who sent any of roughly 4,000 ERC-20 tokens to a Coinbase address could recover their previously unrecoverable funds by providing “the Ethereum TXID for the transaction where the asset was lost and the contract address of the lost asset.” The exchange said certain ETC-20 tokens including Wrapped Ether (wETH), TrueUSD (TUSD), and staked Ether (STETH) would be eligible for recovery, with a 5% charge on transactions of more than $100. “Our recovery tool is able to move unsupported assets directly from your inbound address to your self-custodial wallet without exposing private keys at any point,” said ...