Crypto news

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

The biggest winners and losers of the crypto industry in 2021

The cryptocurrency and blockchain industry experienced explosive growth in 2021, particularly in its decentralized finance (DeFi) and nonfungible token (NFT) sectors. The year was also marked by continued price volatility, baffling behavior from China, a grand experiment in Central America, escalating institutional interest, and the rise of some faster smart-contract networks — all of which is reflected in this year’s list of industry “winners and losers.” Winners in 2021 Kazakhstan When China effectively banned Bitcoin (BTC) mining operations in May 2021, Kazakhstan rushed in to fill the vacuum, pitching displaced miners and others on its cheap and plentiful coal supply. Many set up operations in the Central Asian country, including a top-five crypto mining pool operated by BIT Mini...

The biggest winners and losers of the crypto industry in 2021

The cryptocurrency and blockchain industry experienced explosive growth in 2021, particularly in its decentralized finance (DeFi) and nonfungible token (NFT) sectors. The year was also marked by continued price volatility, baffling behavior from China, a grand experiment in Central America, escalating institutional interest, and the rise of some faster smart-contract networks — all of which is reflected in this year’s list of industry “winners and losers.” Winners in 2021 Kazakhstan When China effectively banned Bitcoin (BTC) mining operations in May 2021, Kazakhstan rushed in to fill the vacuum, pitching displaced miners and others on its cheap and plentiful coal supply. Many set up operations in the Central Asian country, including a top-five crypto mining pool operated by BIT Mini...

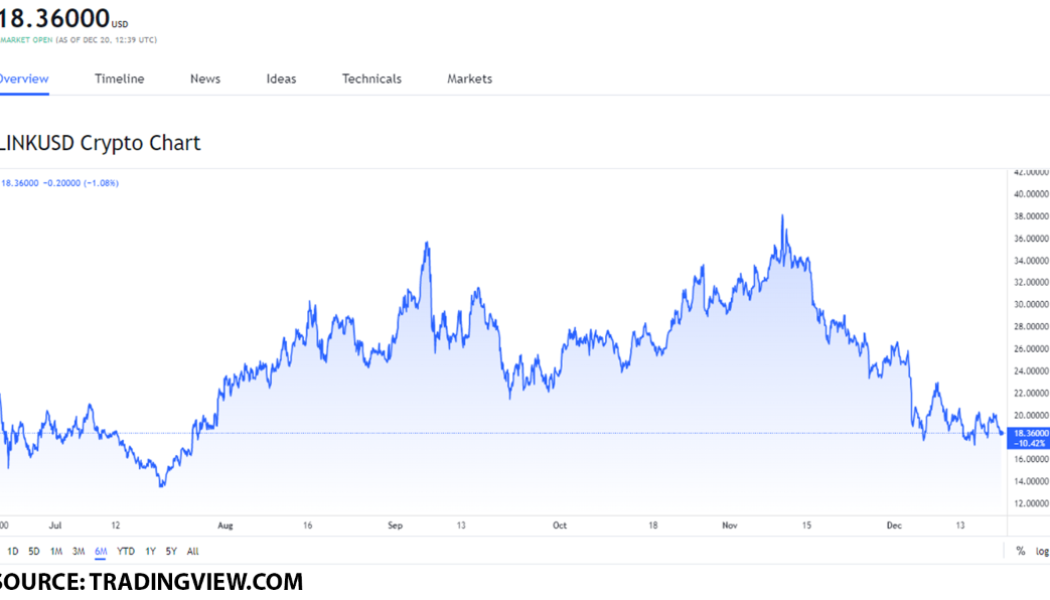

Top 3 Solana projects worth your attention on December 20: LINK, WAVES, and AUDIO

Chainlink, Waves, and Audius are the go-to projects to keep an eye on. LINK, WAVES, and AUDIOS are at a solid buy point. Each of them has the potential to reach a higher value point by the end of December. Chainlink is an Oracle protocol specifically used for trading binary options that are capable of price updates every 400ms through Solana’s architecture. Its price feeds went live on Solana due to its high performance as well as its low-cost blockchain network. Waves is an agnostic interchain DeFi ecosystem that was integrated with Solana, which enabled it to work in conjunction with other integrated chains, oracle systems, and data providers. Audius is a music streaming as well as sharing platform that aims to provide power back to the hands of the content creator and is a part of...

Ho-ho-hodl: Crypto-themed gifts that have you covered during the Holidays

Tis’ the season of giving and with Christmas right around the corner, it’s time to get the holiday shopping out of the way. With the digital asset market having matured as much as it has, there are now crypto enthusiasts in virtually every family and friend circle across the globe. In this festive piece, we’ve listed out some of the best crypto-themed gifts you can get for those who love everything about this fast-evolving space. From quality clothing and books to gift cards and everything else in between, when sourcing the perfect crypto-centric gift, it is best to probably think outside the box because that’s pretty much what might have gotten any cryptocurrency enthusiast into this market in the first place. So, without any further ado, let’s jump straight in. The annual Bit...

Biggest GBTC discount ever — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with analysts looking for a bottom — but one which may not mean a dip to $40,000 or lower. After an unremarkable weekend, Bitcoin bulls now face a fresh week of bearish sentiment across the global economy as risk appetite stays tepid. Amid the lack of a “Santa rally” for practically anyone, there seem to be few triggers to help BTC/USD return higher in time for the new year. At the same time, on-chain metrics remain strong, and miners are refusing to spend. With Christmas almost here, Cointelegraph takes a look at what to look out for this week when it comes to assessing where Bitcoin may be headed. $50,000 seems far away for Bitcoin bulls Bitcoin failed to produce any significant moves over the weekend, but now, attention is turning to a potenti...

Indian state government to accredit Web2 and Web3 blockchain startups

The state government of Telangana announced the launch of the India Blockchain Accelerator program to foster early-stage Web2 and Web3 startups and blockchain developers aimed at solving real-world challenges. The program will be launched in partnership with unicorn crypto exchange CoinSwitch Kuber and Lumos Labs, a technology innovation management firm. In a dialogue with Cointelegraph, Rama Devi Lanka, Director Emerging Technology and Officer on Special Duty (OSD), ITE&C Department, Government of Telangana, highlighted the state’s intent to adopt blockchain projects across multiple use cases: “Some of the interesting use cases that the state has already piloted in Blockchain include – T-Chits (Chit funds in Blockchain), Supply Chain (Seed Traceability), E-voting (Digital ...

DeFi protocol Grim Finance lost $30M in 5x reentrancy hack

The decentralized finance (DeFi) protocol Grim Finance reported $30 million in losses due to a reentrancy exploit of the platform’s deposits. Grim Finance officially announced on Dec. 18 that an “external attacker” had exploited the DeFi platform, stealing “over $30 million” worth of cryptocurrencies. According to Grim Finance, the hack was an “advanced attack,” with the attacker exploiting the protocol’s vault contract through five reentrancy loops, which allowed them to fake five additional deposits into a vault while the platform is processing the first deposit. Grim paused all vaults after the attack to minimize the risk for future funds: “We have paused all of the vaults to prevent any future funds from being placed at risk, please withdraw all of your funds immediately.” Grim no...

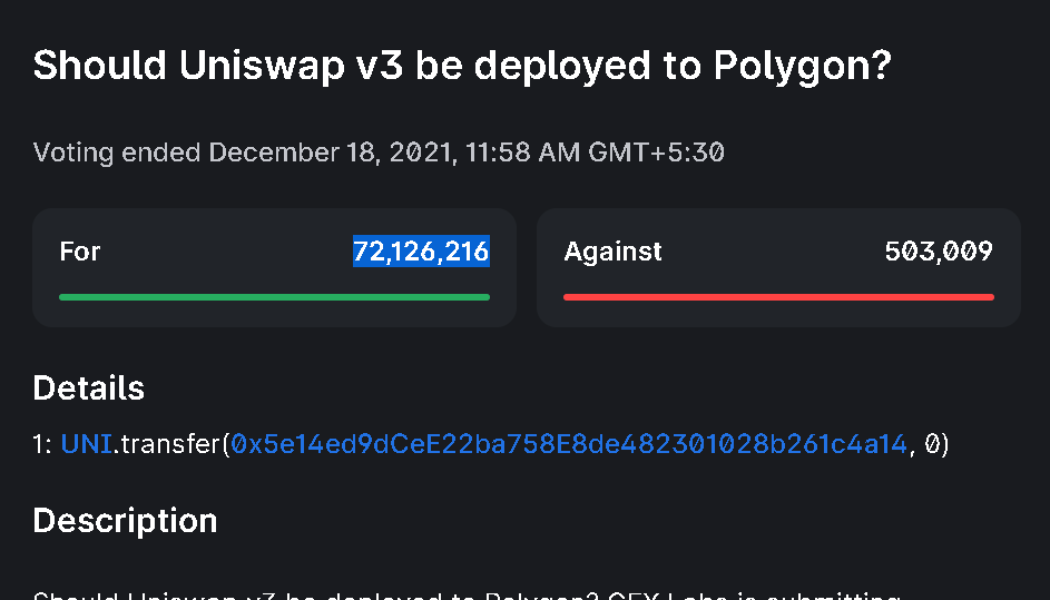

Uniswap v3 contracts deployment on Polygon approved with 99.3% consensus

The Uniswap community has approved the governance proposal that sought deployment of Uniswap v3 contracts over the Polygon PoS Chain. The approval comes in the form of an on-chain vote that saw the participation of over 72.6 million users from the community. Uniswap Labs announced to deploy Uniswap v3 contracts based on the votes that reflected over 99.3% approval consensus and will be supported by a $20 million fund — $15 million for long-term liquidity mining campaign and $5 million for the overall adoption of Uniswap on Polygon (MATIC). The Uniswap community has voted to deploy v3 on @0xPolygon through the governance process. ⚡️ Uniswap Labs will deploy Uniswap v3 contracts within a few days. Stay tuned. pic.twitter.com/LwVLwEngPl — Uniswap Labs (@Uniswap) December 18, 202...

Collateral damage: DeFi’s ticking time bomb

As 2021 draws to a close, the premier lineup in the DeFi landscape largely consists of synthetic asset platforms (SAPs). An SAP is any platform that enables users to mint synthetics, which are derivatives whose values are pegged to existing assets in real time. As long as oracles can supply a reliable price feed, synthetics can represent any asset in the world and take on its price — be it a stock, commodity or crypto asset. As such, SAPs finally bridge the gap between emergent DeFi platforms and legacy finance, allowing investors to place their bets on any asset anywhere, and all from the cozy confines of their favorite blockchain ecosystem. Decentralized and operating on Ethereum’s layer one, SAPs would appear to be crypto’s next major growth catalyst. However, unlike for sound mon...

Celebrities that rode the crypto wave in 2021

Overshadowing its glory in previous years, the crypto ecosystem managed to maintain a year-long spotlight throughout 2021. Key catalysts include mainstream adoption of Bitcoin (BTC), a meme coin frenzy driven by Shiba Inu (SHIB) and Dogecoin (DOGE), and proactive participation from popular celebrities and authority figures. The year 2021 witnessed a greater inflow of influencers and celebrities to the space than ever before. All the way from mainstream tech entrepreneurs and presidents to rappers and reality TV stars, celebrities have gotten involved in crypto in their own unique ways. While some chose to create their own versions of crypto ecosystems and tokens, others helped spread awareness of various projects. As a tribute to all those who showed involvement in our world of crypt...

Carbon-neutral Bitcoin? New approach aims to help investors offset BTC carbon emissions

Billion-dollar companies across the globe are betting big on Bitcoin (BTC). Recent analysis from European investment manager Nickel Digital Asset Management found that 20 publically listed companies with a market capitalization of over $1 trillion have about $9.6 billion invested in BTC. Individual investors are also taking an increasing interest in the asset. The “Third Annual Bitcoin Investor Study” from Grayscale Research found that demand for Bitcoin has risen tremendously. According to the study, 55% of current Bitcoin investors began buying the asset over just the last 12 months. Grayscale’s report also notes that the market for those interested in Bitcoin investment products expanded to 59% in 2021, up from 55% in 2020 and slightly more than one-third in 2019, reflecting steady grow...