Crypto news

Family-friendly NFTs bring the next generation of youth into Web3

Nonfungible tokens (NFTs) continue to be a dominant force within the Web3 space for increasing innovation and adoption. As the space continues to push its way into mainstream adoption will reach new demographics, including minors. Recently big name entertainment companies such as Disney, which is highly catered to children, have expanded to include crypto-savvy team members and created partnerships with the Polygon blockchain network. Such developments hint at an impending entrance into the world of Web3, however if Web3 content is to be created for minors big questions arise such as how does an NFT become kid-friendly? Or, how does true ownership work when minors are involved? Cointelegraph spoke with Jeremy Fisher, artist and founder of Lucky Ducky, a family friendly NFT collection ...

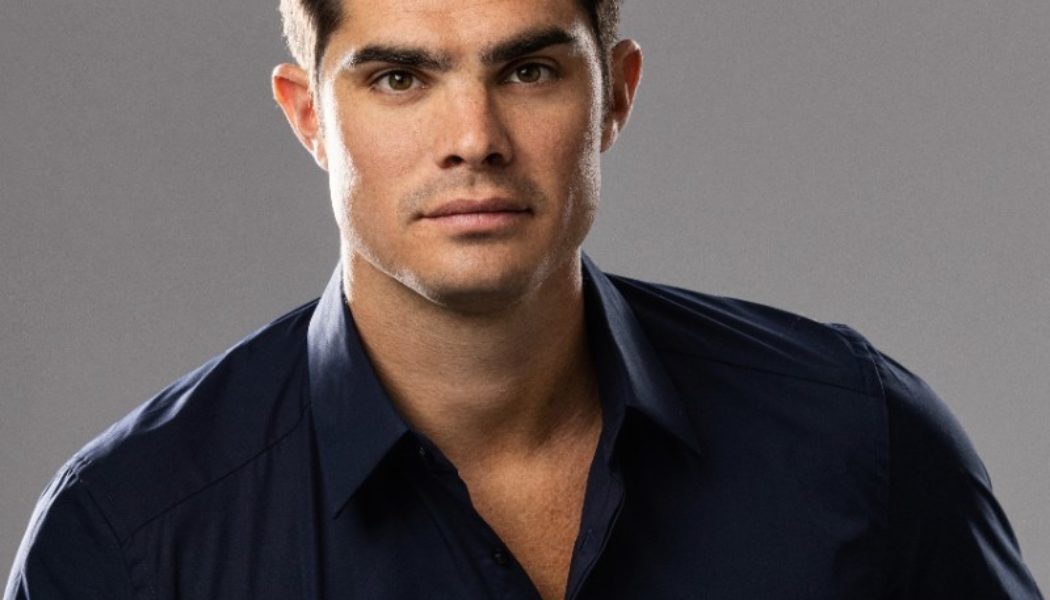

FTX Bahamas co-CEO Ryan Salame blew the whistle on FTX and Sam Bankman-Fried

A high-ranking executive at FTX’s Bahamian entity tipped off local regulators of potential fraud perpetrated at the cryptocurrency exchange just two days before the exchange was forced to close. According to Bahamian court records filed on Dec. 14, Ryan Salame, the former co-CEO of FTX Digital Markets (FDM), told the Securities Commission of the Bahamas (SCB) on Nov. 9 that FTX was sending customer funds to its sister trading firm Alameda Research. Salame said the funds were to “cover financial losses of Alameda” and the transfer was “not allowed or consented to by their clients.” He also told the SCB only three people had the access required to transfer client assets to Alameda: Former FTX CEO Sam Bankman-Fried, FTX co-founder Zixiao “Gary” Wang and FTX engineer Nishad Singh. Ryan Salame ...

Alameda tried to redeem 3,000 wBTC days before bankruptcy: BitGo CEO

Mike Belshe, the CEO of digital asset custodian BitGo has confirmed that Alameda Research attempted to redeem 3,000 Wrapped Bitcoin (wBTC) in the days before FTX’s bankruptcy filing on Nov. 11. During a Dec. 14 Twitter Spaces hosted by decentralized finance (DeFi) researcher Chris Blec, Belshe confirmed the firm knocked back the redemption request because the unknown Alameda representative involved didn’t pass Bitgo’s security verification process and seemed unfamiliar with how the wrapped Bitcoin burning process worked. Full convo here. This part starts at 1:09:30. https://t.co/0KQg6bzd8k — Chris Blec (@ChrisBlec) December 14, 2022 “[The security details] didn’t match the process. So we held it up and we said no, no, no, no. This is not what the burn looks like. And we need to...

Creditor offers Bitcoin miner Core Scientific $72M to avoid bankruptcy

B. Riley suggested the embattled miner’s issues were “self-imposed” and outlined a path for it to avoid bankruptcy. Financial services platform B. Riley has offered Bitcoin (BTC) miner Core Scientific $72 million in financing to avoid bankruptcy and preserve value for Core Scientific stakeholders. B. Riley, a top lender to Core Scientific with $42 million in loans currently outstanding, outlined the terms of the financing agreement in a Dec. 14 letter noting it’s prepared to fund the first $40 million “immediately, with zero contingencies.” The finance platform suggested the remaining $32 million would be conditional on the BTC miner suspending all payments to equipment lenders while Bitcoin prices are below $18,500. The last time the price of Bitcoin was above $18,500 was on Nov. 9,...

SEC approves 9 more WisdomTree ‘blockchain-enabled’ funds

The U.S. Securities and Exchange Commission (SEC) has given the green light to nine more blockchain-enabled funds from $82 billion asset manager WisdomTree. None of these funds track crypto assets themselves, but the firm does utilize the Ethereum and Stellar blockchains to keep a secondary record of share ownership, thus making them blockchain-enabled or “digital funds” as WidsomTree describes them. The firm announced the SEC’s approval on Dec. 14, and outlined that the nine digital funds offer exposure to a host of different asset classes such as equities, commodities and floating rate treasuries. The funds are expected to launch via the WisdomTree Prime mobile app in the first quarter of 2023. “We believe that blockchain-enabled finance has the potential to improve the investor experien...

New OECD report takes lessons from crypto winter, faults ‘financial engineering’

The Organisation for Economic Cooperation and Development (OECD) analyzed the crypto winter in a new policy paper titled “Lessons from the crypto winter: DeFi versus CeFi,” released Dec. 14. The authors examined the impact of the crypto winter on retail investors and the role of “financial engineering” in the industry’s current problems and found a lot not to like. The paper from the OECD, an intergovernmental body with 38 member states dedicated to economic progress and world trade, concentrated on events in the first three quarters of 2022. It placed the blame for them squarely on a lack of safeguards due to “non-compliant provision of regulated financial activity” and the fact that “some of these activities may fall outside of the existing regulatory frameworks in some jurisdictions.” T...

SBF’s Bahamian prison reported for ‘harsh’ conditions and ‘degrading treatment’ — US State Dept

After being denied bail in a Bahamas Magistrate Court, former FTX CEO Sam Bankman-Fried could spend up to two months in the country’s Fox Hill Prison, a facility with reported cases of physical abuse against prisoners and “harsh” conditions. Authorities in the Bahamas reportedly remanded Bankman-Fried to the medical wing of Fox Hill following a Dec. 13 hearing. SBF’s counsel said he had been taking medication prior to his arrest on Dec. 12, including Adderall and anti-depressants, but it’s unclear if the former CEO will serve his time at the correctional facility, its medical unit, or an alternative location. According to a 2021 human rights report from the U.S. State Department, conditions at Fox Hill were “harsh.” Investigations determined that the facility was overcrowded, prisoners had...

Maple Finance 2.0 overhaul aimed at speeding up the defaulting process

Maple Finance is a decentralized credit market powered by blockchain technology. Instead of requiring overcollaterlization of loans, it instead allows managers, called “Pool Delegates” to issue loans from its lending pools based on a set of risk-management criteria, according to the protocol’s documents. Introducing Maple 2.0. Maple 2.0 is a fundamental overhaul of the smart contract architecture. The new contracts are modular and robust and will facilitate Maple bringing capital markets on-chain. pic.twitter.com/5GGsMXaXhv — Maple (@maplefinance) December 14, 2022 However, in the wake of FTX’s collap, the platform experienced two major defaults from borrowers on the platform. On Dec. 1, algo trading and market maker Auros Global missed its payment of 2,400 Wrapped Ether (wETH) follo...

Fonbnk’s Michael Kimani sorts out facts on crypto adoption in Africa

The African continent has been tipped as an important market for crypto adoption due to its young population, lousy economic management by governments and lack of efficient financial infrastructure to connect the continent internally and globally. Adoption is becoming so widespread that celebrities do not want to get left out, with several big names in the entertainment and media space working with crypto brands. In the first episode of Cointelegraph’s new podcast Hashing It Out, hosted by Cointelegraph social media specialist Elisha Owusu Akyaw, Fonbnk co-founder Michael Kimani answers questions about what crypto adoption really looks like in the face of rising hype about the continent in the media and reports. One of the continent’s “OGs,” Kimani began working with one of the first...

Will FTX’s ill wind reach the Global South? Maybe not

With the crypto world still reeling from the FTX collapse, Brazil recently passed legislation that legalized cryptocurrency use for payments in the country. How to reconcile this with all those declarations in the West that crypto is having its “Lehman moment”? Brazil may have inadvertently revealed a cleft between the developed world and emerging markets with regard to the uses and misuses of cryptocurrencies. (The legislation still requires a presidential signature before it becomes law.) Unquestionably, FTX’s Nov. 11 bankruptcy filing hurt crypto exchanges and other crypto-focused enterprises in Brazil, as well as many crypto-based companies all through Latin America (LATAM). But this latest gale in the crypto winter is generally not seen as an existential threat — as it is someti...

Gemini allegedly suffered data breach; 5.7 million emails leaked

Cryptocurrency exchange Gemini appears to have suffered a data breach on or before Dec. 13. According to documents obtained by Cointelegraph, hackers gained access to 5,701,649 lines of information pertaining to customers’ account numbers, email addresses and partial phone numbers. In the case of the latter, hackers apparently did not gain access to the full phone numbers, as certain numeric digits were obfuscated. The leaked database did not include sensitive personal information such as names, addresses and other Know Your Customer information. In addition, some emails were repeated in the document; thus, the number of customers affected is likely lower than the total rows of information. Gemini currently has 13 million active users. Security breaches in the Web3 industry, even if mild i...