Crypto news

World’s biggest douchebag releases NFT collection

Around the world, douchebags are getting into NFTs in a big way. Now it’s true that there are thousands and thousands of legitimate artists in the growing non-fungible token space, and that precisely none of them are Paris Hilton. And sure, NFTs are a potentially world-changing phenomenon that were just declared ArtReview’s most powerful entity in the art world, though probably not as a result of the “catastrophic failure” that resulted in John Cena selling just 37 sad copies of a one thousand-NFT drop. There may indeed be all kinds of use-cases for NFTs — such as the censorship-proof preservation of historical records — that will cause future generations to wonder why it took us so long. But don’t let any of these important developments detract from the absolute douchebaggery that’s curre...

Shanghai Man: AscendEX reopened after $80m hack, Huobi suffers key personnel departures, and government officials punished for mining activities

This weekly roundup of news from Mainland China, Taiwan, and Hong Kong attempts to curate the industry’s most important news, including influential projects, changes in the regulatory landscape, and enterprise blockchain integrations. Limping out of 2021 Last week we thought we had hit rock bottom for Chinese exchanges, as Bitmart was on the unfortunate end of a $150m hack. This week, it was more of the same, as AscendEX lost $80m to a similar style of theft affecting its Ethereum, BSC and Polygon hot wallet. On December 16, AscendEX released a security post-mortem detailing the attack: An in-depth security audit identified the breach as the result of an exploit of hardware-level vulnerability from third-party infrastructure utilized by AscendEX. The infiltration was carri...

Happy ‘bearday,’ Bitcoin: It’s been 3 years since BTC bottomed at $3.1K

Bitcoin (BTC) may be flagging below $50,000, but its bull market is actually three years old this month. Data from Cointelegraph Markets Pro and TradingView confirms that Bitcoin bulls have at least something to celebrate as 2021 draws to a close. Three years, 2,125% upside Despite disappointing when it comes to end-of-year price expectations, BTC/USD remains an order of magnitude higher than where it was even 18 months ago. March 2020 marked a brief return to near cycle lows in what had otherwise been a solid bull market ever since December 2018. At that time, Bitcoin capitulated to lows of $3,100 — a level that was never seen, and likely never will be seen again. SAME DAY THREE YEARS AGO #Bitcoin BOTTOMED OUT THE BEAR MARKET OF 2018 — CRYPTO₿IRB (@crypto_birb) December 15, 202...

Crypto Biz: All I want for Christmas is Bitcoin, Dec. 9–16

On Wednesday, the United States Federal Reserve wrapped up its final policy meeting of 2021 by voting to keep interest rates at record lows. In doing so, the Fed set the stage for a series of interest rate hikes beginning in the spring, which will be accompanied by a more accelerated taper of its bond-buying program. While the Fed’s decision to reduce market liquidity could impact crypto investors in the short term, Bitcoin (BTC), Ether (ETH) and DeFi are carving out their own narratives heading into 2022. Those narratives could supersede the latest episode of central-bank tightening. Below is the concise version of the latest “Crypto Biz” newsletter. For a comprehensive breakdown of business developments over the last week, register for the full newsletter below. Block’s Cash App will all...

Circle and Endaoment to create USDC-based disaster relief fund for communities impacted by deadly tornado

Circle, the company that created the USDC stablecoin, announced a partnership with public charity Endaoment to create a disaster relief fund. The fund will help mid-western American communities impacted by last week’s deadly tornadoes. The two entities hope to raise $1 million in grants to support the American Red Cross and local non-profits. Via Endaoment, blockchain enthusiasts will be able to directly contribute USDC or other cryptos using connected wallets with a minimum donation of $20. The funds will be distributed in $20,000 intervals to seven participating charities, the Team Western Kentucky Tornado Relief Fund, Center for Disaster Philanthropy, Team Rubicon, All Hands and Hearts, Midwest Food Bank NFP, American Red Cross, and Mutual Aid Relief. At the time of publication, t...

HSBC and IBM create successful multi-ledger CBDC demo

On Thursday, HSBC and IBM announced the successful test of an advanced token and digital wallet settlement between two central bank digital currencies, or CBDCs, in a cloud environment. The experiment consisted of transactions between CBDCs, eBonds, and forex. IBM’s Hyperledger Fabric and enterprise technology provider R3’s Corda served as the basis of the distributed ledger facilitating the transactions. The project was overseen by central bank Banque de France as part of a series of tranche projects to implement a digital Euro. Previously the French and Swiss central banks reported positive results on a pilot run of the digital Swiss Franc and Euro. Nevertheless, the two financial institutions issued caution on the subject, citing regulatory concerns. Mark Williamson, managin...

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...

US Fed Chair says cryptocurrencies aren’t a danger to country’s financial stability

While speaking at a press conference after the recent Fed interest rate decision, the Fed Chair Jerome Powell said that cryptocurrencies are currently not a danger to the country’s financial stability. He however noted that there should focus should shift to monitoring and controlling cryptocurrencies. Jerome Powell has served as the Federal Reserve Chair since 2018 and is likely to serve for a second term following a positive backing by President Joe Biden. Powell and his vice chair Lael Brainard have shown enthusiasm on ensuring that cryptocurrencies do not cause financial instability. Powell actually did express his reservations about cryptocurrency industry despite saying that it does not pose any risk at the moment. He stated that cryptocurrencies are speculative assets “ris...

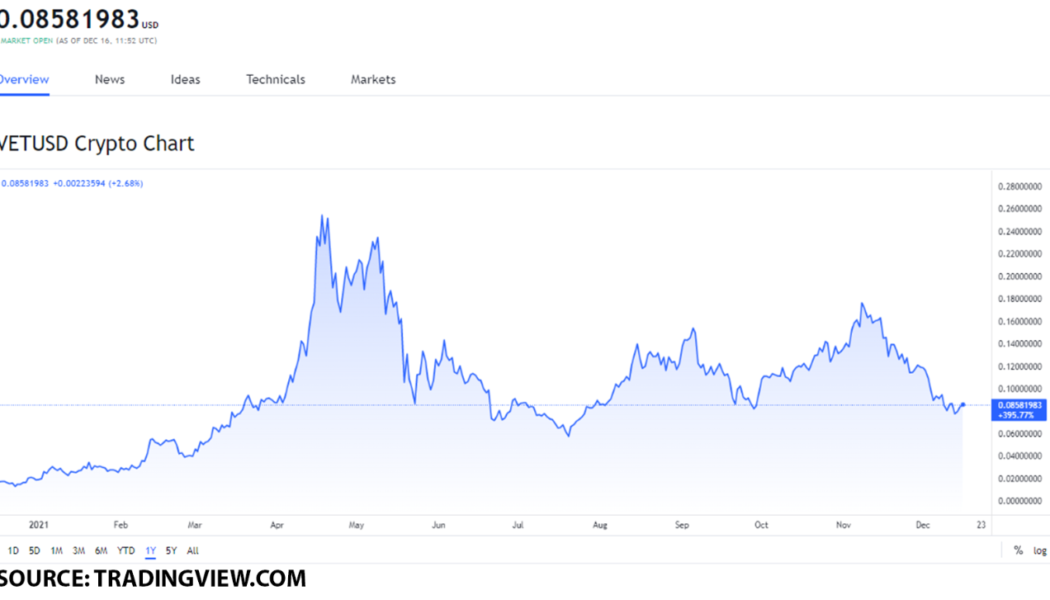

Enter the world of Internet-of-Things with these 3 top tokens worth buying on December 16: VET, HNT and IOTX

VET saw an increase in its trading volume by 43% in the last 24 hours. HNT’s value increased by 20% in the last 24 hours. IOTX is at a solid price point with huge potential for growth. VeChain is an enterprise-blockchain platform that enables transactions between the Internet of Things (IoT) enabled devices. Helium is a blockchain-based network that was developed to enable communication between IoT devices. IoTeX is a decentralized network for users, developers, and businesses, and the IOTX token is the utility token that powers the platform. It connects IoT devices with decentralized applications (dApps). Should you buy VeChain (VET)? On December 16, VeChain (VET) had a value of $0.085819. To see what this value point means for the token, we will go over its all-time high value as well as...

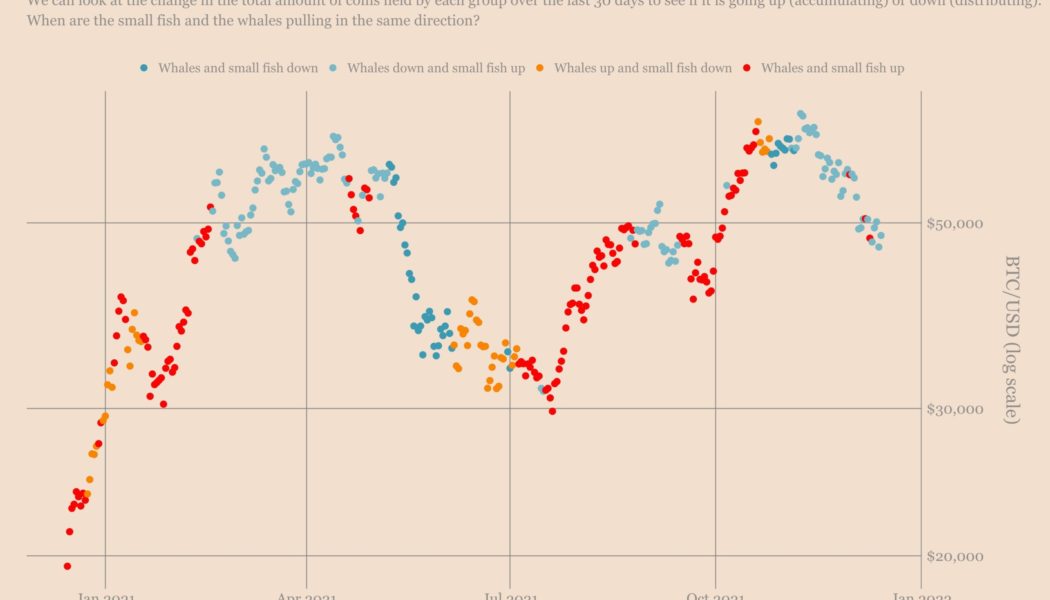

Fish food? Data shows retail investors are buying Bitcoin, whales are selling

Bitcoin (BTC) staged an impressive recovery after dropping to its three-month low of $42,333 on Dec. 4, rising to as high as $51,000 since. The BTC price retracement primarily surfaced due to increased buying activity among addresses that hold less than 1 BTC. In contrast, the Bitcoin wallets with balances between 1,000 BTC and 10,000 BTC did little in supporting the upside move, data collected by Ecoinometrics showed. “Bitcoin is still stuck in a situation where small addresses are willing to stack sats [the smallest unit account of Bitcoin], while the whale addresses aren’t really accumulating,” the crypto-focused newsletter noted after assessing the change in Bitcoin amounts across small and rich wallet groups, as shown in the graph below. Bitcoin on-chain ...

Nexo partners with Three Arrows Capital to launch NFT lending & art financing service

Nexo, the crypto borrowing and exchange platform, has launched an NFT Lending Desk in partnership with NFT hedge fund Three Arrows Capital. The new lending desk caters to over-the-counter, or OTC, clients to offer crypto credit backed by NFTs. Nexo is one of the first crypto lenders to allow customers to borrow stablecoins, ETH, and other cryptocurrencies using certain NFTs as collateral. The company stated that in its initial iteration, the service will accept Bored Ape Yacht Club and CryptoPunks NFTs, with more collections on the way. Clients can also use issued lines of credit as a means of art financing by executing further NFT purchases with t borrowed funds. In a statement shared with Cointelegraph, Nexo Cofounder and Managing Partner Antoni Trenchev said: “Our partnership with...

Kazakhstan’s central bank reports results on CBDC pilot project

Kazakhstan, the country behind one of the largest sources of Bitcoin mining hash power, has released the results of a pilot program for its digital tenge. According to a Wednesday report, the National Bank of Kazakhstan, or NBK, said it had confirmed the possibility of implementing a retail central bank digital currency, or CBDC, based on distributed ledger technology. In addition, the central bank tested how Kazakhstan’s citizens might use a digital tenge for offline payments as well as its programmability. In a series of hypothetical scenarios, the central bank tested how a CBDC could be used between second-tier banks and other external participants. The tests also explored how a digital tenge would work for cross-border transactions under Kazakhstan’s regulatory framework. Source:...