Crypto news

SBF tried to destabilize crypto market to save FTX: Report

Tether executives and Binance CEO Changpeng “CZ” Zhao worried that Sam Bankman-Fried (SBF), former FTX CEO, was attempting to destabilize the crypto market aiming to save the now-bankrupt exchange, according to reports on Dec. 9. Messages seen by The Wall Street Journal of a Signal group chat named “Exchange coordination” reveals an argument between CZ and SBF on Nov. 10 about Tether’s stablecoin USDT. According to the report, CZ and others in the group worried that trades made by Alameda Research were focusing on depeg the stablecoin, which would have a ripple effect in crypto prices. Binance CEO reportedly confronted SBF: “Stop trying to depeg stablecoins. And stop doing anything. Stop now, don’t cause more damage.” SBF denied the claims in a statement to the WSJ....

Goldman Sachs buying crypto firms, FTX news, 3AC and Celsius updates: Hodler’s Digest Dec. 4-10

Top Stories This Week 7 class action lawsuits have been filed against SBF so far, records show Former FTX CEO Sam Bankman-Fried has been named in seven class action lawsuits filed since the fall of his crypto empire. These lawsuits, however, are separate from the numerous probes and investigations examining the crypto exchange and its founder, including a reported market manipulation probe by federal prosecutors. Another headline shows the United States House of Representatives has called on SBF to speak at a hearing on Dec. 13. Amid investigations by lawmakers and a flurry of civil litigation, SBF hired former federal prosecutor Mark Cohen to act as his defense attorney. A team of financial forensic investigators was also hired by FTX’s new management to track down the billions of dollars...

A Supreme Court case could kill Facebook and other socials — allowing blockchain to replace them

The internet — arguably the greatest invention in human history — has gone awry. We can all feel it. It is harder than ever to tell if we are engaging with friends or foes (or bots), we know we are being constantly surveilled in the name of better ad conversion, and we live in constant fear of clicking something and being defrauded. The failures of the internet largely stem from the inability of large tech monopolies — particularly Google and Facebook — to verify and protect our identities. Why don’t they? The answer is that they have no incentive to do so. In fact, the status quo suits them, thanks to Section 230 of the Communications Decency Act, passed by the United States Congress in 1996. Related: Nodes are going to dethrone tech giants — from Apple to Google But things may be about t...

Bitcoin bulls protect $17K as trader eyes key China BTC price catalyst

Bitcoin (BTC) maintained $17,000 support into Dec. 10 ahead of a critical week of macro data. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print will make Fed “slow down” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it traded sideways after the close of trading on Wall Street. The pair looked set for a quiet weekend, with all eyes focused on United States inflation readings and policy updates due from Dec. 13 onward. With the Producer Price Index (PPI) November print behind it, the month’s Consumer Price Index (CPI) results took center stage. As Cointelegraph reported, expectations remain that CPI will show U.S. inflation continuing to abate, sparking renewed strength in risk assets, including crypto. “My personal expectations are t...

Gensler’s approach toward crypto appears skewed as criticisms mount

Since taking over at the United States Securities and Exchange Commission (SEC), chairman Gary Gensler has repeatedly been referred to as the “bad cop” of the digital asset industry. To this point, over the past 18 months, Gensler has taken an extremely hard-nosed approach toward the crypto market, handing out numerous fines and enforcing stringent policies to make industry players comply with regulations. However, despite his aggressive crypto regulatory stance, Gensler, for the most part, has remained mum about several key issues that digital asset proponents have been talking about for a long time. For example, the SEC has still failed to clarify which cryptocurrencies can be considered securities, stating time and again that most cryptocurrencies in the market today could be classified...

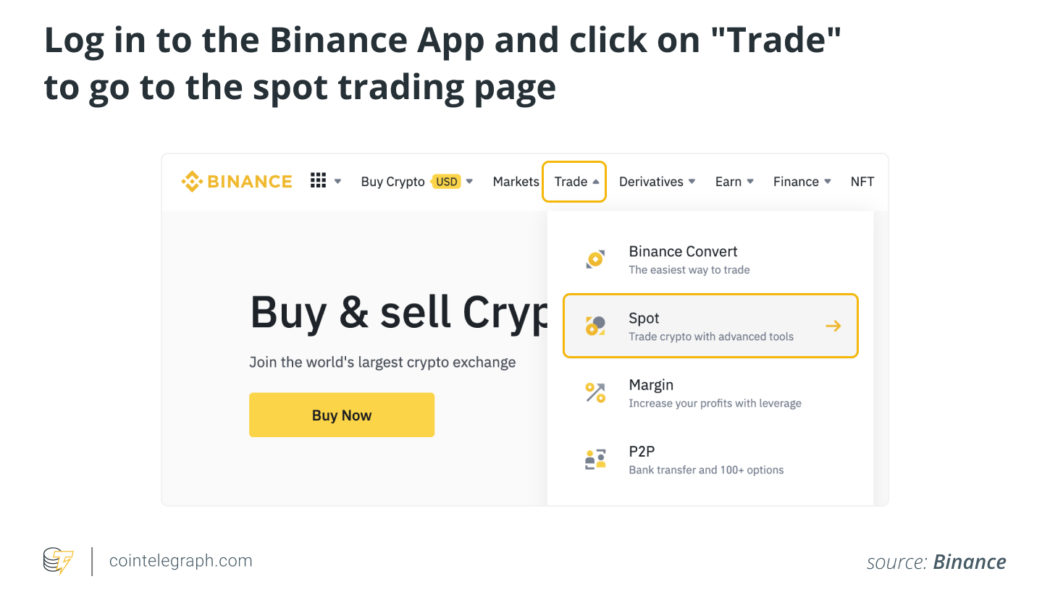

What is spot trading in crypto and how does it work?

Since their inception, cryptocurrencies have seen rapid growth and widespread market adoption, as evidenced by the assets tied to crypto assets that have started to appear in the portfolios and trading methods of numerous asset managers. The process of purchasing and selling cryptocurrencies to profit is known as cryptocurrency trading. Trading in cryptocurrencies can be defined in terms of its objective, mode of operation and trading approach. For example, the asset being exchanged, or cryptocurrency, is the goal of cryptocurrency trading. The manner in which cryptocurrencies are traded depends on the type of transaction, such as futures, options or perpetual contracts that take place on the market. An investor’s trading strategy for cryptocurrencies specifies a set of predetermined...

Yuga Labs, Moonpay faces lawsuit over celebrities NFT promotion

Yuga Labs, creators of Bored Ape Yacht Club (BAYC) and crypto fintech Moonpay are facing a class-action lawsuit for allegedly using celebrities to misleadingly promote and sell nonfungible tokens (NFTs). Over 40 people and companies are named as defendants in the lawsuit, including Paris Hilton, Snoop Dog, Jimmy Fallon, Justin Bieber, Madonna, Serena Williams, Post Malone, and Diplo. The class-action was filed on Dec. 8 by John T. Jasnoch of Scott+Scott Attorneys at Law LLP in the Central District of California and claims the crypto companies used its Hollywood network to promote the digital assets without complying with disclosure requirements. The document states: “This case epitomizes these concerns as it involves a vast scheme between a blockchain start-up company, Yuga Lab...

US regulator seeks feedback on DeFi’s impact on financial crime: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The United States regulators want to take a closer look at money laundering and terror financing laws by the Financial Crimes Enforcement Network (FinCEN), as it asked banking sector players for feedback on DeFi’s crime risks. Ethereum developers are targeting the last week of March for Ethereum’s Shanghai hard fork and some additional improvement upgrades by June of next year. Ankr protocol has deployed $15 million to buy back the bad debt resulting from its recent exploit and the resultant circulation of HAY (HAY). Chainlink deploys staking to increase the security of oracle services. Stakers will earn Chainlink...

A year after Taproot, Bitcoin community works to unlock its DeFi potential

Taproot support across the industry is still crawling one year after the Bitcoin soft fork, indicating a strong potential for innovation and broader adoption of Web3 solutions to be unlocked through the world’s largest cryptocurrency, sources told Cointelegraph. “Since early on, Satoshi predicted that layers being built on top of the Bitcoin blockchain would enable Bitcoin to move beyond being only sound money by adding programmability, which makes Bitcoin the optimal framework to build out Web3 capabilities,” noted Alex Miller, CEO of the Web3 developer platform Hiro. The Taproot upgrade took place in November 2021 and laid the foundation for accelerating decentralized financial services through the Bitcoin (BTC) network. It enables more efficient validation o...

Bahamian attorneys pursue access to FTX data of international customers

Authorities across the globe are fighting against time to bring justice to the millions of people impacted by the financial frauds committed by FTX CEO Sam Bankman-Fried. As part of the ongoing investigations, attorneys representing the Securities Commission of the Bahamas seek access to FTX’s database with international customer information. The Bahamian attorneys filed an emergency motion with a Delaware bankruptcy judge requesting access to FTX’s customer database to aid their ongoing investigations. The motion highlighted previous failed attempts to access the defunct crypto exchange’s database. As a result, the lawyers claimed that FTX employees and counsel prevented authorities from getting critical financial information. The database in question is reportedly stored on Amazon Web Se...

US DOJ reportedly investigating FTX CEO for siphoning funds out of the US

While many crypto fraudsters were able to slip through the cracks in the past, the same does not hold for FTX CEO Sam Bankman-Fried (SBF). Running parallel to the ongoing scrutiny related to FTX frauds, the United States Department of Justice (DOJ) is reportedly investigating a potential fraud that involves SBF siphoning funds offshore just days before FTX filed for bankruptcy. According to a Bloomberg report, the federal investigation aims to examine SBF’s involvement in improperly transferring FTX funds to the Bahamas as the defunct crypto exchange filed for bankruptcy on Nov. 11. The anonymous informant further revealed that DOJ officials met with FTX’s court-appointed overseers to discuss the scope of the information they need for further investigation. DOJ also plans to investigate wh...

Who’s expected to testify before Congressional hearings on FTX?

United States lawmakers have been pushing for certain witnesses — including Sam Bankman-Fried — to appear before committee hearings scheduled in December. Who should the crypto space expect to see testifying on the events leading to the downfall of FTX? On Dec. 9, Bankman-Fried, or SBF, said — under threat of a potential subpoena — that he was willing to speak at a U.S. House hearing aimed at exploring FTX’s collapse. Leadership with both the House Financial Services Committee and Senate Banking Committee had suggested that they might subpoena the former FTX CEO, prompting SBF to say on Twitter he was “willing to testify” on Dec. 13. At the time of publication, SBF’s name did not appear as a witness in the House committee’s ‘Investigating the Collapse of FTX, Part I’ hearing — suggesting m...