Crypto news

Ethereum and Litecoin make a move while Bitcoin price searches for firmer footing

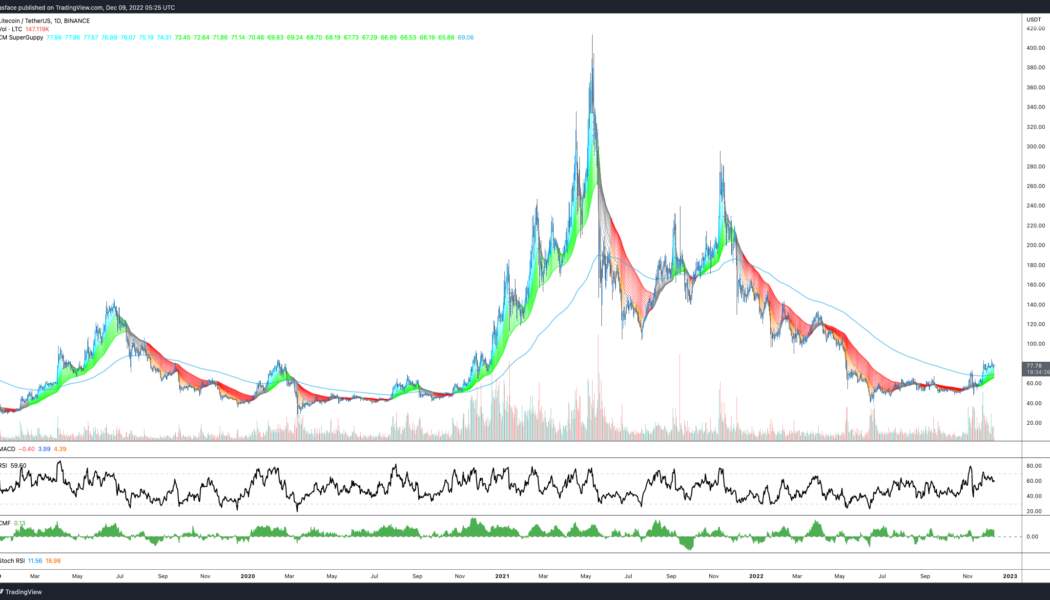

Crypto price action has been rough over the past few months, but a few green shoots are finally beginning to emerge. While Bitcoin (BTC) remains in a downtrend, its price has recently found support at the $17,000 level, and ping-pong price action in the $16,700–$17,300 range appears to be allowing traders to pursue some interesting setups in a few altcoins. Let’s take a quick peek at some enticing patterns showing up on the weekly time frame. Time for Litecoin’s halving hopium? LTC/USDT 1-day chart. Source: TradingView As a fork of Bitcoin, Litecoin (LTC) tends to turn bullish several months before its reward halving takes place, as was the case in 2015 and 2019. Litecoin’s next reward halving is 237 days away, and it appears that the altcoin is undergoing a little pre-halving hype. Since ...

Data shows the Bitcoin mining bear market has a ways to go

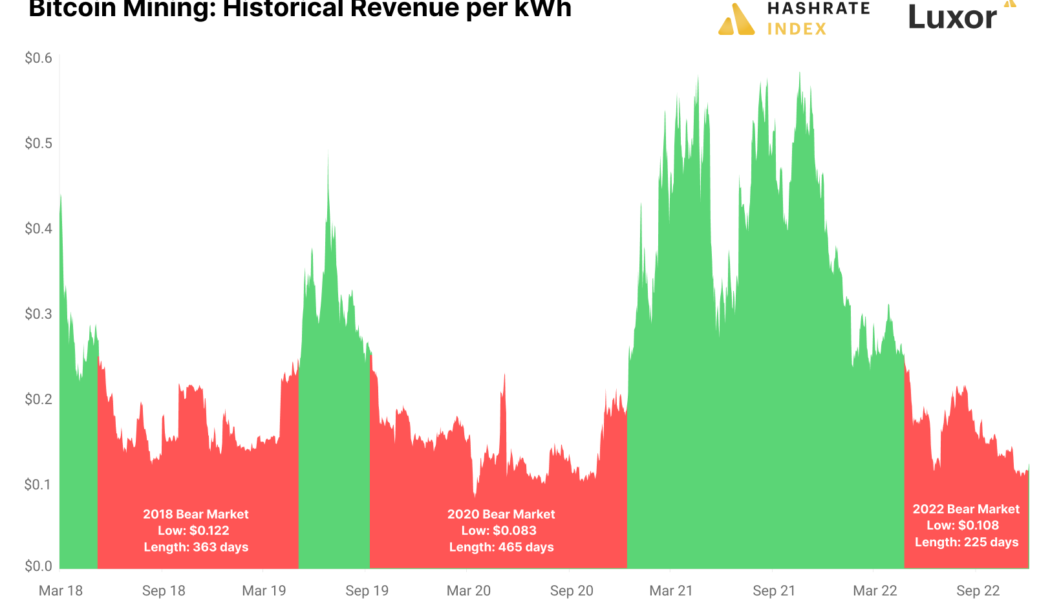

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

Lessons we learned from the Terraform-FTX implosions

In May 2022, Terraform Labs’ LUNA cryptocurrency and TerraUSD (UST) stablecoin collapsed, triggering a massive shock in the crypto industry. Six months later, the bruised industry took another hammering as one of the largest cryptocurrency exchanges, FTX, filed for bankruptcy protection and billions of dollars of user assets went missing. The FTX empire, once valued at more than $30 billion, fell to zero in fewer than 10 days. FTX reportedly has more than 1 million creditors, most of whom are retail investors who were convinced that FTX would not collapse and had been keeping their assets on the exchange. Taking a look at Mt. Gox in 2014 — whose creditors still failed to reclaim compensation — FTX may be a repeat of that mistake. It can be said that FTX succeeded because of Alameda Researc...

Amber Group ditches expansion plans after denying insolvency: Report

Cryptocurrency trading firm Amber Group is putting its expansion plans on hold despite the FTX contagion having “no disruption” to its daily operations, according to a senior executive. Amber has scrapped plans to expand in Europe and the United States as a consequence of exposure to the now-defunct exchange FTX and will focus on institutional clients in Asia, according to managing partner Annabelle Huang. Huang also said that Amber has been forced to deprioritize its new metaverse project due the FTX contagion, the Financial Times reported on Dec. 9. Apart from ditching its expansion plans, the firm has reportedly been cutting its headcount recently. After reportedly laying off up to 40% of staff in September, the firm continued to lay off employees again in December. According to Huang, ...

CZ and SBF duke it out on Twitter over failed FTX/Binance deal

Binance CEO Changpeng Zhao, or CZ, and former FTX CEO Sam Bankman-Fried, or SBF, have revealed new details about the failed agreement between the exchanges during FTX’s liquidity crisis in November. In a Dec. 9 Twitter thread, CZ referred to Bankman-Fried as a “fraudster,” saying Binance exited its position in FTX in July 2021 after becoming “increasingly uncomfortable with Alameda/SBF.” According to the Binance CEO, SBF was “unhinged” at the exchange pulling out — a claim that prompted an online response from the former FTX CEO. Bankman-Fried criticized CZ for his public admonition of FTX, adding details about the negotiations between the exchanges amid FTX’s reported “liquidity crunch” in November prior to the firm filing for bankruptcy. SBF said at the time that FTX had reached a ...

BTC price tests $17K on PPI as Bitcoin analysts eye CPI, FOMC catalysts

Bitcoin (BTC) fell on the Dec. 9 Wall Street open as United States economic data appeared to disappoint markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Attention turns to Bitcoin vs. CPI “big trigger” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to come closer to $17,000 after passing the level overnight. The pair reacted badly to U.S. Producer Price Index (PPI) data, which despite being above expectations still beat the readout from the month prior. “Bit of an over reaction towards PPI, which has been dropping significantly from last month, but less than expected,” Michaël van de Poppe, founder and CEO of trading firm Eight, responded. Van de Poppe, like others, noted that the crux of macro cues would come next week in the for...

Investors chase Web3 as blockchain industry builds despite bear market

The third quarter of 2022 saw a reduction in venture capital activity across the entire blockchain industry. Investors appear to be moving away from decentralized finance (DeFi) and into Web3. The crypto industry tends to have a problem with overusing buzzwords, like the way “DeFi” was everywhere just a couple of years ago. In 2022, it seems like every new startup and established blockchain company alike is taking up the “Web3” mantle. But what exactly is Web3? Cointelegraph Research delved into the matter in its recently released Q3 2022 Venture Capital Report. To further understand the subject, it held a panel discussion with venture capitalist investors to find out how they see Web3. [embedded content] Web3: The newest buzzword The panel was asked whether the term Web3 is ov...

Turkey has an obsession with crypto — Specifically Dogecoin: Study

The crypto market slump doesn’t mean interest in crypto is also down. A new study from the cryptocurrency education platform CryptoManiaks revealed that many countries are still scouring the internet, hungry for crypto-related information. According to the study, the Netherlands and Turkey take the top two spots, with 8.2% and 5.5% of the population, respectively, searching for crypto-related terms. Turkey particularly accounted for 4.7 million searches, leading the searches with sheer numbers. The study analyzed the combined number of searches for a select set of popular cryptocurrencies into a percentage of the population for each country in order to calculate the percentage of locals searching each month. While it was in second for overall searches, Turkey came in first place ...

FTX reportedly gets 3 more months to stop all operations in Japan

The Japanese subsidiary of the now-defunct cryptocurrency exchange FTX has received approval from local regulators to continue sorting out issues with withdrawals until next year. The Kanto Local Finance Bureau, a local financial regulator running under the Ministry of Finance of Japan, has issued a statement regarding FTX Japan operations, Reuters reported. The Japanese authority has postponed FTX’s business suspension deadline until March 9, 2023, extending the original time limit by three months. In mid-November, Japan’s Financial Services Agency (FSA) initially requested FTX Japan to suspend business orders by Dec. 9. According to the announcement, the Kanto Local Finance Bureau has ordered the extension of the deadline because FTX Japan has so far failed to return assets from custody ...

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

Remote work triggers move to DAOs in the post-pandemic world: Survey

A survey sample of working Americans suggests that millennial and Generation Z workers are far more in favor of joining decentralized autonomous organizations (DAOs) and working remotely in the post-Covid-19 world. Over 1,100 Americans took part in a survey conducted by MetisDAO Foundation which explores trends in remote working preferences and the emergence of DAOs in recent years. A key consideration is the effect that Covid-19 has had on worker sentiment and the growth of DAOs in corporate governance. Citing a research report on DAOs published by the Harvard Law School Forum on Corporate Governance, the results of the survey highlight how DAOs saw their treasuries swell from $400 million to $16 billion in 2021. This coincided with growing participant figures, up from 13,000 to 1.6 milli...

What Paul Krugman gets wrong about crypto

In mid-November, as crypto markets reeled in the aftermath of FTX’s meltdown, Nobel Prize-winning economist Paul Krugman made use of his New York Times column to disparage crypto assets — again. Despite his unquestionable academic credentials, Krugman reiterated a common misunderstanding in his attempt to understand crypto assets — by conflating Bitcoin (BTC) with other cryptocurrencies. Despite being the oldest, most valuable and most well-known member of this emerging class of digital assets, Bitcoin has a unique use case that differs widely from all others. Therefore, in order to understand this asset class as a whole, it would make more sense to choose as your starting point an asset with more tangible utility. Filecoin, for instance, provides storage for digital files in a similar vei...