Crypto news

Why Metacade (MCADE) Seems to Be One of The Best Investments in 2023 After Its Presale Launch

The last crypto bull market turned countless beggars into millionaires. All you had to do was invest in top cryptocurrency like Solana, The Sandbox, Axie Infinity, or even Ethereum at the right time. If you missed out on your big break during the last bull market, don’t make the same mistake in 2023. Metacade is one of the hottest emerging metaverse tokens that could repeat the performance of some of the top cryptocurrency candidates in the last market cycle. Don’t believe us? Keep reading. This article will tell you everything that you need to know about Metacade and its MCADE token in the sections below. What is Metacade? Metacade is setting up to become Web3’s first community arcade. It’s a virtual arcade destination that users can visit to try out the latest GameFI projects, compete in...

Rumors of a new native ‘Twitter Coin’ emerge while Dogecoiners remain hopeful

Social media users are swirling around rumors that Twitter is looking at introducing its own native asset called “Twitter Coin” to be used for payments and tipping on the platform. Some are citing the initial reports from sources such as Nima Owji, who runs an app-focused information leak account on Twitter. On Dec. 4, he posted a screenshot of what appears to be a prototype Twitter interface showing a “Coins” option for tipping, along with a vector image showing a coin bearing Twitter’s logo. #Twitter is working on Coins! pic.twitter.com/67upjUn37D — Nima Owji (@nima_owji) December 3, 2022 Others have pointed to tweets from tech researcher Jane Manchun Wong, who claimed to have extracted code from a specific version of Twitter’s web app to find the same information as Owji, though the pos...

Crypto Twitter uses new AI chatbot to make trading bots, blogs and even songs

The crypto community appears to be having a ball with ChatGPT, a recently launched Artificial Intelligence (AI) chatbot created by research company OpenAI — using it for a multitude of applications including a trading bot, a crypto blog, and even an original song. The bot is a language interface tool that OpenAI says can interact “in a conversational way” and can be used to answer questions or assist in making almost anything it’s prompted to create, with some limitations. A user on Twitter posted their interaction with ChatGPT showing that from a simple prompt the tool created a basic trading bot using Pine Script, a programming language used for the financial software TradingView. Should I try running this chatGPT generated crypto trading algorithm? pic.twitter.com/0xlFoTNYdL — Guy (@who...

Silvergate CEO calls out ‘short sellers’ spreading misinformation

Silvergate Capital CEO Alan Lane has slammed “short sellers” and “other opportunists” for spreading misinformation over the last few weeks — just to score themselves a quick buck. In a Dec. 5 public letter, Lane said there was “plenty of speculation – and misinformation” being spread by these parties to “capitalize on market uncertainty” caused in part to FTX’s catastrophic collapse in November. His crypto-focused bank was recently forced to deny one of these so-called FUD (fear, uncertainty and doubt) campaigns last week when there was speculation that the firm was exposed to the bankrupt crypto lender BlockFi. Lane also used the latest letter to the public as an “opportunity to set the record straight” about its investment relationship with FTX, as well as the company’s “robust ris...

Metallica issues crypto scam alert before the 72 Seasons album launch

It’s quite evident that bad actors have left no stone unturned as legendary metal band Metallica warned fans against crypto giveaway scams right before their highly anticipated launch of its new album, 72 Seasons. Cashing in on the buzz around Metallica’s new album launch and upcoming tour, scammers have started targeting metalheads through social media impersonation. Metallica, however, was quick to point out “the ugly side of social media,” asking fans to steer away from Metallica Crypto giveaways, stating: “Let’s be as clear as possible. [Metallica crypto giveaways] are scams.” Sad but true, Cointelegraph recently highlighted a rise in front-running scams on YouTube, which according to blockchain security firm CertiK, has risen by 500% in one year. The ongoing Metallica scams contribute...

Nexo leaving US, says country lacks clear regulations

The crypto borrowing and lending platform Nexo plans to gradually cease operations in the United States “over the coming months,” according to a blog post on Dec. 5. Nexo has stated that the decision to leave the U.S. is “regrettable but necessary.” Today we are announcing the regrettable but necessary decision that Nexo will be phasing out its products and services in the United States due to a lack of regulatory clarity. — Nexo (@Nexo) December 5, 2022 In the post, Nexo said that it has been talking to U.S. regulators for 18 months in an attempt to determine how to comply with U.S. financial laws. But these talks have not resulted in an agreement between the company and U.S. officials. “Our decision comes after more than 18 months of good-faith dialogue with US state and federal reg...

Bitcoin bears beware! BTC holds $17K as support while the S&P 500 drops 1.5%

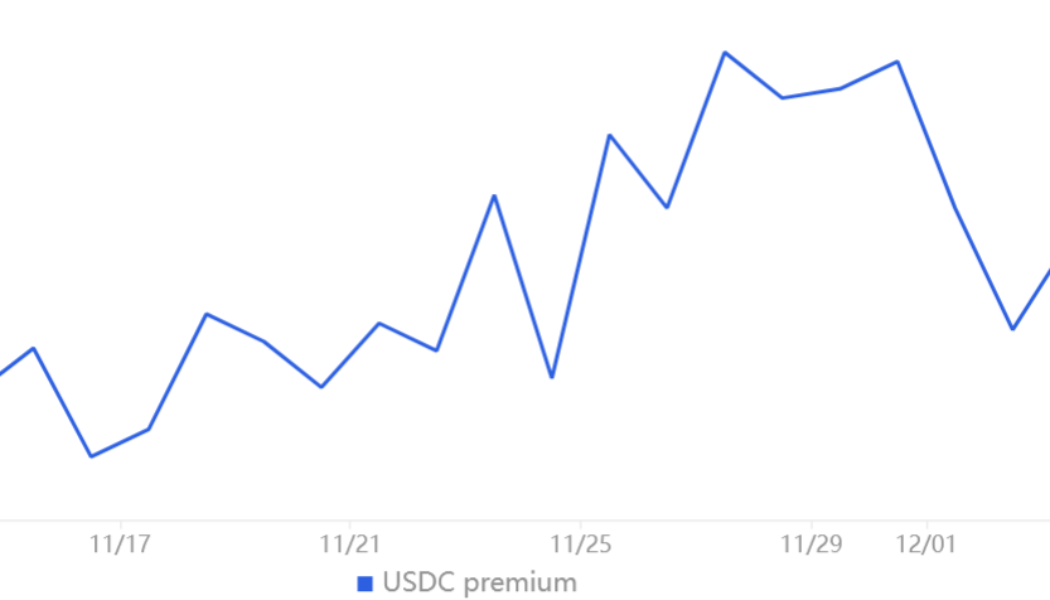

Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises. One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.” Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain ...

US House committee chair pushes back against SBF’s excuse to potentially delay testimony

Maxine Waters, chair of the United States House Financial Services Committee, has called out former FTX CEO Sam Bankman-Fried for announcing on social media he intended to testify after “learning and reviewing what happened” at the exchange. In a Dec. 5 Twitter thread, Waters cited Bankman-Fried’s numerous media interviews in the wake of FTX’s bankruptcy as evidence that his information was “sufficient for testimony” before the committee. Waters will preside over a hearing investigating the collapse of FTX on Dec. 13, in which committee leadership said they expected Bankman-Fried and other individuals associated with the events around the exchange’s downfall to appear. “The collapse of FTX has harmed over one million people,” said Waters, in a statement directed to Bankman-Fried. “Your tes...

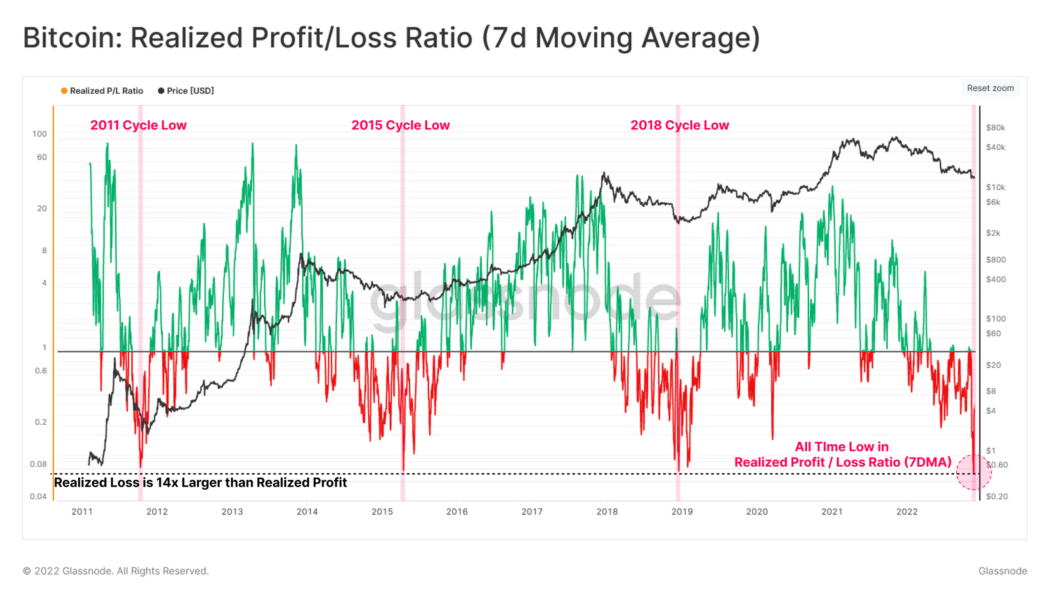

Bitcoin price recovery possible after record realized losses and leverage flush out create a healthier market

Bitcoin (BTC) price is showing notable resilience at the $17,000 level, and according to data from Glassnode, a number of metrics that track the pace of selling and the on-chain behavior of investors are beginning to show a reduction in the factors that trigger sharp sell-offs. The FTX bankruptcy fueled a historic sell-off resulting in $4.4 billion in realized Bitcoin losses. By analyzing realized losses with the daily weighted average metric, Glassnode analysts found that the on-chain losses are subsiding. According to Glassnode, Bitcoin hit an all-time low in the realized profits versus losses ratio. Toward the end of the most recent bull market, realized losses were 14 times larger than profits, which historically coincided with a positive market shift. Bitcoin realized profit and loss....

Brazilian crypto industry gets regulatory clarity amid global uncertainty

As the global crypto community is still licking its wounds from the FTX collapse, a liquidity crisis continues to spread around centralized exchanges and decentralized finance (DeFi) alike. It is soon to be decided whether the coming regulation triggered by FTX’s bankruptcy will bring a silver lining to crypto. The Chamber of Deputies of Brazil, the lower house of the country’s federal legislative body, has passed a regulatory framework that legalizes the use of cryptocurrencies as a payment method within the country. It is estimated that 10 million Brazilians, or about 5% of the population, trade crypto assets. The largest centralized exchange in Brazil is a local business called Mercado Bitcoin, with roughly three million users. International players like Coinbase or Gemini do not ...

USDC issuer Circle terminates SPAC merger with Concord

Circle, the issuer of USD Coin (USDC), announced the mutual termination of its proposed merger with the special purpose acquisition company (SPAC) Concord Acquisition on Dec. 5. The deal was announced in July 2021 with a preliminary valuation of $4.5 billion and was then amended in February 2022 when Circle’s valuation ballooned to $9 billion. USDC is currently the second-largest stablecoin in circulation, with a market capitalization of $43 billion. Under the terms of the agreements, Concord had until Dec. 10 to consummate the transaction or seek a shareholder vote for an extension. However, it appears that Concord chose to have the time limit lapse instead. As told by Circle CEO Jeremy Allaire: “Concord has been a strong partner and has added value throughout this process, and we w...

How can UK-based businesses accept Bitcoin?

Accepting Bitcoin payments is advantageous due to lower fees than credit and debit cards, expansion of customer base and real-time bank balances. However, risks like volatility and cybercrime may undermine these benefits. Cryptocurrency payments help save excessive credit and debit card processing fees as they are decentralized and do not need intermediaries to verify the transaction. Moreover, merchants do not incur overseas currency exchange changes if payments are made in BTC or other cryptocurrencies. High transaction speed is another benefit of accepting Bitcoin payments, allowing businesses to receive payments in real-time. Moreover, with the increasing customer demand to pay in crypto, offering Bitcoin as a payment method will help acquire more shoppers. However, accepting cryptocur...