Crypto news

Here’s how the CFTC could prevent the next FTX

FTX declared bankruptcy this month with $900 million in assets against $9 billion in liabilities. Its founder and former CEO, Sam Bankman-Fried, is being questioned by police in the Bahamas, and many customers are unable to withdraw their deposits. Its holdings of Serum’s SRM, a token Bankman-Fried developed, dropped from a value of more than $2 billion to less than $100 million. Things got worse over the weekend after FTX was apparently hacked, leading to the loss of an additional several hundred million. Some commentators are already calling it cryptocurrency’s “Lehman moment,” referring to the 2008 collapse of Lehman Brothers that signaled we were in a financial crisis. In the wake of this epic collapse, Congress should get its head out of the sand and pass the Digital Commodities...

US Sen. Warren and Durbin demand answers from Bankman-Fried and his successor at FTX

United States Senators Elizabeth Warren and Richard Durbin wrote to the former and current CEOs of FTX — Sam Bankman-Fried and John Jay Ray III, respectively — on Nov. 16 to ask for more information on the collapse of the cryptocurrency exchange. They made 13 requests for documents, lists and answers. “The public is owed a complete and transparent accounting of the business practices and financial activities leading up to and following FTX’s collapse,” the lawmakers wrote. They provided a summary of the major press coverage of the unfolding events and reconstructed a timeline from the media sources. Noting “the apparent lack of due diligence by venture capital and other big investment funds eager to get rich off crypto” among the issues they identified, they wrote: “These developments just...

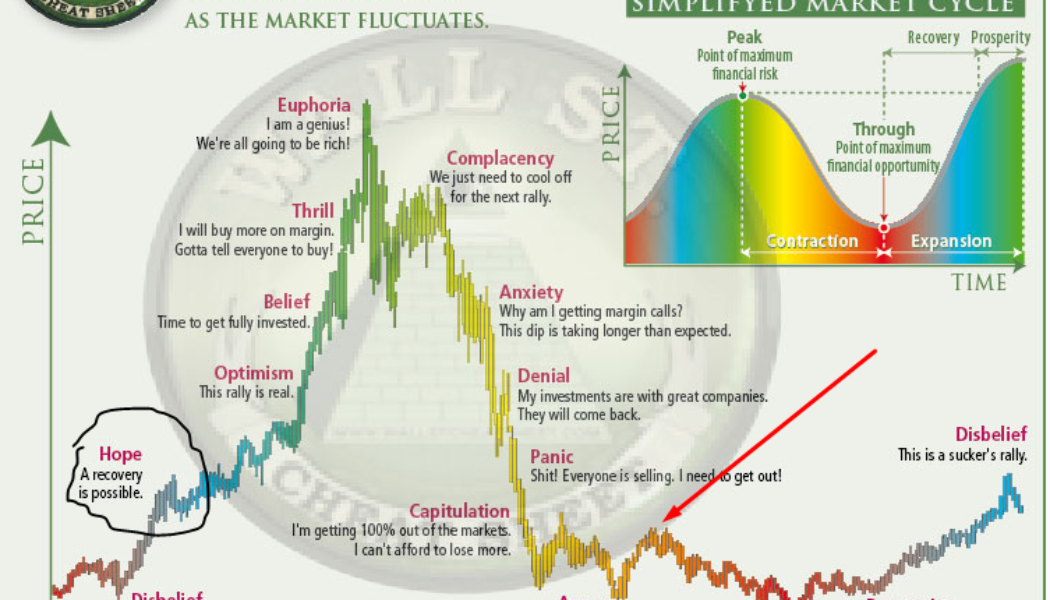

FTX will be the last giant to fall this cycle: Hedge fund co-founder

While the FTX crisis is continuing to unfold, the former head of risk at Credit Suisse believes the exchange’s fall from grace should be the last catastrophic event — at least in this market cycle. CK Zheng, the former head of valuation risk at Credit Suisse and now co-founder of crypto hedge fund ZX Squared Capital said that FTX’s fall was part of a “deleveraging process” that began after the COVID-19 pandemic and further accelerated after the fall of Terra Luna Classic (LUNC), formerly Terra (LUNA). “When LUNA blew up a few months ago, I expected a huge amount of deleveraging process to kick in,” said Zheng, who then speculated that FTX should be last of the “bigger” players to get “cleaned up” during this cycle. Before its collapse, FTX was the third largest crypto exch...

Crypto industry was ‘judge, jury and executioner’ for FTX: Pompliano

Prolific podcaster and cryptocurrency investor Anthony Pompliano has not lost faith in people or the crypto industry despite the disappointing conduct of former FTX CEO Sam Bankman-Fried. Bankman-Fried, once widely regarded as crypto’s “white knight” is now a pariah in the crypto industry due to — by his own admission — the “careless” mishandling of FTX customer funds and his ongoing strange behavior on Twitter. Appearing on Nov. 17 at the Texas Blockchain Summit, Pompliano was asked about how to ensure high-quality representation “in the halls of power,” responding that market forces eliminate bad people as quickly as bad businesses: “It might be a little counterintuitive, but the free market is a hell of a fucking referee. If you watch what just happened, this industry is who held the in...

Sensorium Teams Up With Polygon Studios To Accelerate The Development And Adoption Of Web3 Projects

Zug, Switzerland, 17th November, 2022, Chainwire Sensorium, the company behind the industry-leading Sensorium Galaxy metaverse, is pleased to announce that it is entering into a collaboration agreement with Polygon Studios. As part of this wide-ranging alliance, Polygon’s blockchain infrastructure will be crucial in underpinning and furthering Sensorium’s Web3 developments, supporting token and NFT-related features within the Sensorium Galaxy metaverse, SENSO dApp, and the recently announced UNDER project. The first Sensorium product to rely on Polygon’s infrastructure will be SENSO dApp — a Play-to-Earn tycoon game where players are tasked with scouting NFT artists, organizing metaverse music events and selling tickets in return for SENSO token rewards. “Polygon is a go-to hub for some of...

Heroic Story secures $6 million to build Web3 tabletop RPG world

Web3 gaming protocol Heroic Story raised $6 million in a seed round led by Upfront Ventures with participation from Multicoin Capital and Polygon Technology, the company announced on Nov. 17. The funds will be used to hire talent, market the live beta and develop on-chain technology for a massively multiplayer role-playing game (RPG) world, the company told Cointelegraph. The round brings Heroic Story’s total financing to $7.4 million. Other investors included strategic angels, such as a16z Games Fund One founding investor Jonathan Lai, Team Liquid CEO Steve Arhancet and Quantstamp CEO Richard Ma, alongside Miramax head of film Wolfgang Hammer and screenwriting duo Ryan and Kaz Firpo, who are cousins and co-writers of Marvel’s Eternals. “We fell in love with the vision for Heroic Sto...

Could Hong Kong really become China’s proxy in crypto?

With its partial autonomy, the island city of Hong Kong has traditionally served as “a gate to China” — the local trade center, backed by transparent English-style common law and an openly pro-business government strategy. Could the harbor, home to seven million inhabitants, inherit this role in relation to the crypto industry, becoming a proxy for mainland China’s experiments with crypto? An impulse to such questioning was given by Arthur Hayes, the former CEO of crypto derivatives giant BitMEX in his Oct. 26 blog post. Hayes believes the Hong Kong government’s announcement about introducing a bill to regulate crypto to be a sign that China is trying to ease its way back into the market. The opinion was immediately replicated in a range of industrial and mainstream media. What happe...

3 reasons why the FTX fiasco is bullish for Bitcoin

The “Bitcoin-is-dead” gang is back and at it again. The fall of the FTX cryptocurrency exchange has resurrected these infamous critics that are once again blaming a robbery on the money that was stolen, and not the robber. “We need regulation! Why did the government allow this to happen?” they scream. For instance, Chetan Bhagat, a renowned author from India, wrote a detailed “crypto” obituary, comparing the cryptocurrency sector to communism that promised decentralization but ended up with authoritarianism. Perhaps unsurprisingly, his column conveniently used a melting Bitcoin (BTC) logo as its featured image. Hi all,“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,” my colum...

Bitcoin price target now $13.5K as BTC trader says ‘exit all the markets’

Bitcoin (BTC) ranged around $16,500 on Nov. 17 as markets digested the latest events surrounding exchange FTX. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView FTX CEO tells of “complete failure of corporate controls” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD seeing only mild volatility at the Wall Street open. The pair showed acclimatization to events around the FTX insolvency, the latest including revelations that Alameda Research had been immune from liquidation while trading on the platform. After the departure of Sam Bankman-Fried, new CEO John Ray III wasted no time in acknowledging the extent of the problems left in his wake. In a filing with the U.S. Bankruptcy Court for the District of Delaware, Ray describes the corporate control of FTX as a “c...

Candy Club Integrates with OKC (OKX Chain) Ecosystem

Hong Kong, Hong Kong, 17th November, 2022, Chainwire Candy Club has successfully integrated into the OKC ecosystem and added a use case for the OKC token and community. OKC is an EVM-compatible L1 built on Cosmos with a focus on true interoperability (IBC) and maximized performance. At high scalability, developers can build and scale with low gas fees. The OKC ecosystem and infrastructure, including the all-in-one multi-chain Web3 interface, enables a seamless experience for both developers and users. Since Candy Club’s launch at Token2049 Singapore, the social cypto gaming club has been working with Ethereum layer 1s, Polygon, Binance Smart Chain & Tron projects to increase their token utility and demand despite the bearish sentiments. “Candy Club’s chain agnostic token utility driver...

Nayib Bukele announces Bitcoin prescription for El Salvador: 1 BTC a day

As the world’s first nation to adopt Bitcoin (BTC) as a legal tender in September 2021, El Salvador is going back to its BTC buying days after a pause for months amid bearish market conditions. El Salvador President Nayib Bukele announced on Nov.16 that the Central American nation will start purchasing BTC on a daily basis starting from Nov.17. The announcement comes nearly three months after the nation made its last BTC purchase in July 2022. We are buying one #Bitcoin every day starting tomorrow. — Nayib Bukele (@nayibbukele) November 17, 2022 El Salvador started buying BTC in September 2021, right after making it a legal tender. At the time, BTC was in the mid of a bull market and every purchase made by the nation looked lucrative as the price was hitting a new all-time high every other...

NFT rides shotgun as Red Bull Racing closes out F1 season

Cryptocurrency and blockchain technology firms continue to feature in the world of Formula 1, with a nonfungible token (NFT) making its mark on Red Bull Racing’s vehicles to close out the 2022 calendar. Red Bull Racing dominated the F1 season, topping the constructors’ standings, while Max Verstappen closed out the drivers’ standings for a second consecutive season. With the curtain closing on 2022’s race schedule in Abu Dhabi on Nov. 20, the team’s cars will feature an NFT on their livery in what is being called a first in F1. Red Bull Racing struck a deal with cryptocurrency exchange ByBit as a Principal Team Partner in February 2022, one of a handful of cryptocurrency firms sponsoring teams in Formula 1. The exchange’s logo will feature alongside Lei the Lightning Azuki, an NFT artwork ...