cryptocurrency exchange

Europol reports $19.5M in crypto seized in enforcement action against Bitzlato

The operation conducted by authorities across Europe and the U.S. resulted in the arrest of 5 individuals linked to the exchange, including Bitzlato founder Anatoly Legkodymov. News Own this piece of history Collect this article as an NFT The European Union Agency for Law Enforcement Cooperation, or Europol, has reported authorities took control of crypto wallets containing more than $19 million in cryptocurrency as part of enforcement actions against crypto firm Bitzlato. In a Jan. 23 announcement, Europol reported that roughly 46% of assets — 1 billion euro, or $1.09 billion at the time of publication — moved through Bitzlato were linked to illicit activities. The government agency’s analysis suggested that Bitzlato received more than 2.1 billion euro in cryptocurrencies including Bitcoi...

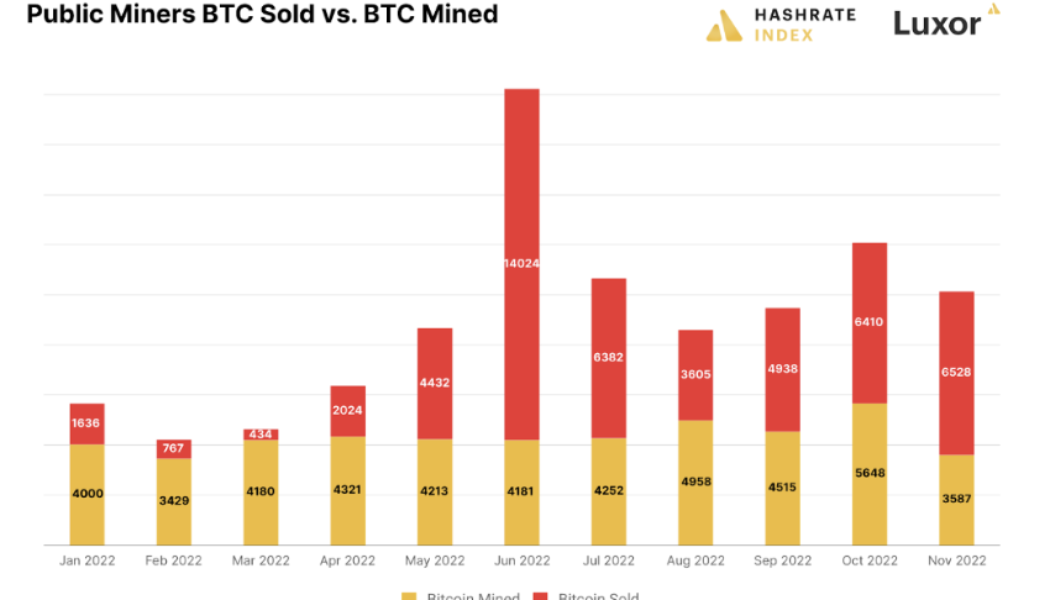

Bitcoin price rally provides much needed relief for BTC miners

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

FTX-linked Moonstone bank to exit the crypto space

Moonstone Bank, a rural Washington state bank that received an estimated $11.5 million investment from FTX’s sister company, Alameda Research, says that it will be exiting the crypto space and returning to its “original mission” as a community bank. In a Jan. 18 statement, the bank said that the change in strategy comes as a result of “recent events in the crypto assets industry and the changing regulatory environment surrounding crypto asset businesses.” As part of the bank’s initiative to “return to its roots,” it said that it will no longer use the name Moonstone Bank and will be rebranding and re-adopting the Farmington State Bank name, known in the local community for 135 years. According to the bank, the change is estimated to take effect in the coming weeks and loca...

FTX CEO says he is exploring rebooting the exchange: Report

John Ray, who took over as CEO of cryptocurrency exchange FTX prior to bankruptcy proceedings, has reportedly set up a task force to consider restarting FTX.com. According to a Jan. 19 report from the Wall Street Journal, Ray said everything was “on the table” when it came to the future of FTX.com, including a potential path forward with rebooting the exchange. FTX Trading, doing business as FTX.com, was one of roughly 130 companies under FTX Group that filed for Chapter 11 bankruptcy in November 2022. Ray reportedly was considering reviving the crypto exchange as part of efforts to make users whole. FTX reported on Jan. 17 that it had identified roughly $5.5 billion of liquid assets in its investigations, with more than $3 billion owed to its top 50 creditors. According to the FTX CEO, he...

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

FTX fallout: SBF trial could set precedent for the crypto industry

After the collapse of major cryptocurrency exchange FTX in November 2022, former CEO Sam “SBF” Bankman-Fried was arrested by Bahaman authorities on Dec. 12. Just a day later, the United States Securities and Exchange Commission and Commodity Futures Trading Commission filed charges against him for allegedly defrauding investors and violating securities laws. On Dec. 22, Bankman-Fried was granted bail on a $250 million bond paid by his parents against the equity in their house. The bail order added that he would require “strict pretrial supervision,” including mental health treatment and evaluation. The former CEO faces eight criminal counts in the United States, which could result in 115 years in prison if convicted. Bankman-Fried had been under house arrest at his parent’s home in Califor...

FTX: It took ‘Herculean investigative effort’ to identify $5.5B in liquid assets

The debtors behind FTX have identified $5.5 billion in liquid assets but reported a “substantial shortfall of digital assets” at the bankrupt crypto exchange and its U.S. arm. In a Jan. 17 announcement, FTX said it had identified $1.7 billion in cash, $3.5 billion in crypto assets and $0.3 billion in securities following the firm filing for Chapter 11 bankruptcy in November. The debtors added that they had identified roughly $1.6 billion in digital assets associated with FTX.com — including roughly $426 million being held by the Securities Commission of the Bahamas — and $181 million connected to FTX US. “We are making important progress in our efforts to maximize recoveries, and it has taken a Herculean investigative effort from our team to uncover this preliminary information,” said FTX ...

3AC, Coinflex founders collaborating to raise $25M for new claims trading exchange

Founders of collapsed crypto hedge fund Three Arrows Capital (3AC) Su Zhu and Kyle Davies are reportedly trying to raise money for a new cryptocurrency exchange in partnership with Coinflex cofounders Mark Lamb and Sudhu Arumugam. According to a pitch deck, they are looking to raise $25 million. The proposed new exchange is to be called GTX, according to the presentation. They propose to specifically target claims against bankrupt firms. “FTX users are selling claims at ~10% face value for immediate liquidity or waiting 10+ years for the bankruptcy to process disbursements,” the presentation said. It promised to crack the claims market: “Our legal team will streamline and automate claims onboarding to GTX and make it the dominant marketplace for FTX and other bankrupt companies...

Gemini and Genesis’ legal troubles stand to shake up industry further

With investor confidence seemingly at an all-time low thanks to the recent slew of insolvencies, a new saga seems to be now unfolding in real time. This one involves crypto exchange Gemini’s Winklevoss twins and Barry Silbert, CEO of Digital Currency Group (DCG) — the parent firm behind crypto market maker and lender Genesis. On Jan. 2, Cameron Winklevoss posted an open letter to Barry Silbert reminding him of the fact that it had been “47 days since Genesis halted withdrawals” while also providing a blunt, seemingly confrontational assessment of DCG’s existing business practices: “For the past six weeks, we have done everything we can to engage with you in a good faith and collaborative manner in order to reach a consensual resolution for you to pay back the $900 million that you owe.” Th...

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

Alameda Research liquidators lost $72K during fund consolidation attempt

The liquidators of Alameda Research continue to encounter obstacles in their efforts to recover funds for creditors. Crypto analytics firm Arkham disclosed on Twitter that the liquidators lost $72,000 worth of digital assets on the decentralized finance (DeFi) lending platform Aave while trying to consolidate funds into a single multisignature wallet. The liquidators were attempting to close a borrow position on Aave but instead removed extra collateral used for the position, putting the assets at risk of liquidation. Arkham reported that over nine days, the loan was liquidated twice for a total of 4.05 Wrapped Bitcoin (WBTC), which creditors will now not be able to recoup. This resulted in the liquidation of around 4 WBTC, $72K at current prices. When positions are forcibly closed on...

Trust is key to crypto exchange sustainability — CoinDCX CEO

Investor sentiment has always been a critical driver in the crypto space. Both positive and negative sentiment influence ongoing trends — be they price movements, product launches or regulations. In 2022, sentiment worldwide suffered as major crypto firms and ecosystems collapsed, further straining investors amid an unforgiving bear market. While many showed resilience as Terraform Labs, Celsius and Voyager, among others, closed down, Sam Bankman-Fried’s alleged misappropriation of FTX customers’ funds drove even the most die-hard crypto investors to question the integrity of those running the show. A series of scams, crashes, bankruptcy filings and court cases have forced investors to rethink how they store crypto and seek accountability from crypto exchanges. Proof of reserves (PoR) beca...