Decentralization

The DAO is a major concept for 2022 and will disrupt many industries

The blockchain and cryptocurrency rave is not ending anytime soon. And as more people are being introduced to revolutionary technologies in the digital space, new improvements upon these technologies are also being introduced. In the last couple of years, the DeFi and NFT industries have experienced immense levels of growth and, currently, metaverses and Web3 are the technologies making the digital space light up. It is not yet clear where these disruptive technologies will lead us, but we are sure that there will be much value up for grabs. At the convergence of Web3 and NFTs lie many platforms looking to leverage technology and infrastructure to make the NFT ecosystem more decentralized, structured and community-driven. Using both social building and governance, the decentralized a...

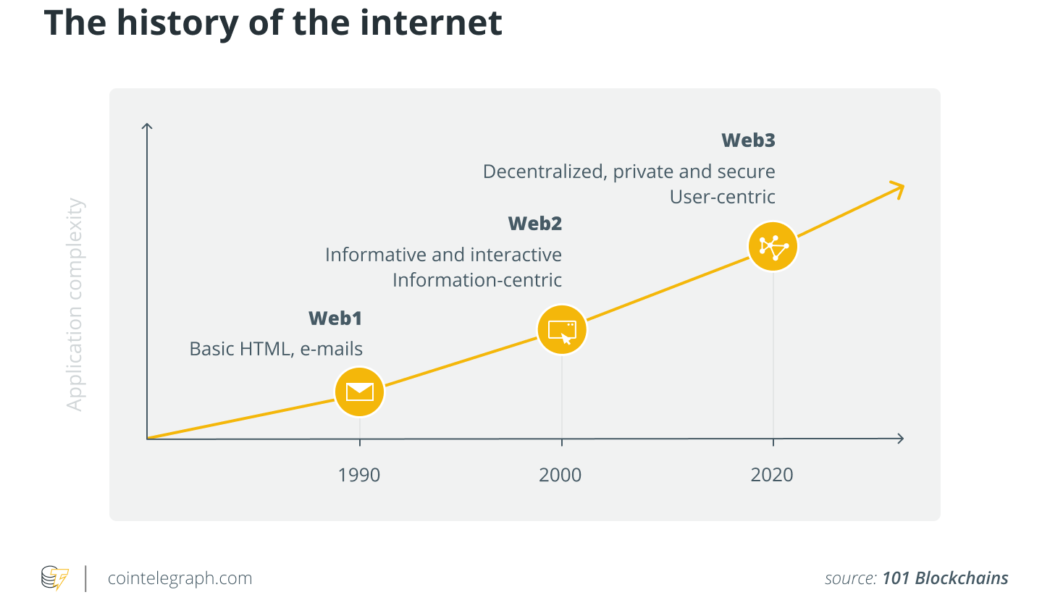

Why decentralization isn’t the ultimate goal of Web3

The transition from Web2 to Web3 is inevitable. Yet, as the demand for decentralization gains momentum, several important questions are being raised about the current state of blockchain technology and its promised “decentralization.” Vitalik Buterin responded with a confession that “a lot of it comes down to limited technical resources and funding. It’s easier to build things the lazy centralized way, and it takes serious effort to ‘do it right.’” Or, Jack Dorsey’s recent tweet where he claimed that it’s actually the venture capitalists who own the networks that exist today. You don’t own “web3.” The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into… — jack⚡️ (@jack) Decembe...

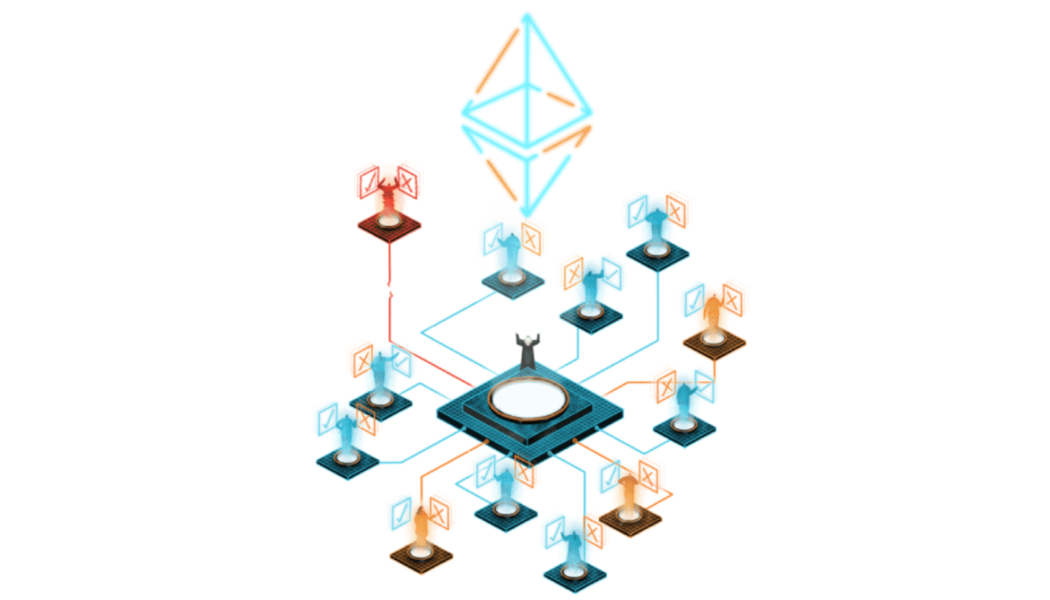

What is the role of a decentralized autonomous organization in Web3?

A DAO empowers its community members with voting rights and allows investors to send, receive and store value globally, automatically and anonymously. For years, automated systems have been viewed as a way to reduce annoying hurdles to humans, such as dealing with lengthy and burdensome traditional bureaucratic systems. A DAOs’ purpose is to primarily to help resolve such issues and encourage humans to focus on better productivity and other more rewarding aspects of an organization. A DAO’s automated system does not require a traditional central management, which is more vulnerable to failure, human error and manipulation. In terms of real-world applications, what can a DAO do? The lack of hierarchical management allows the organization to have different...

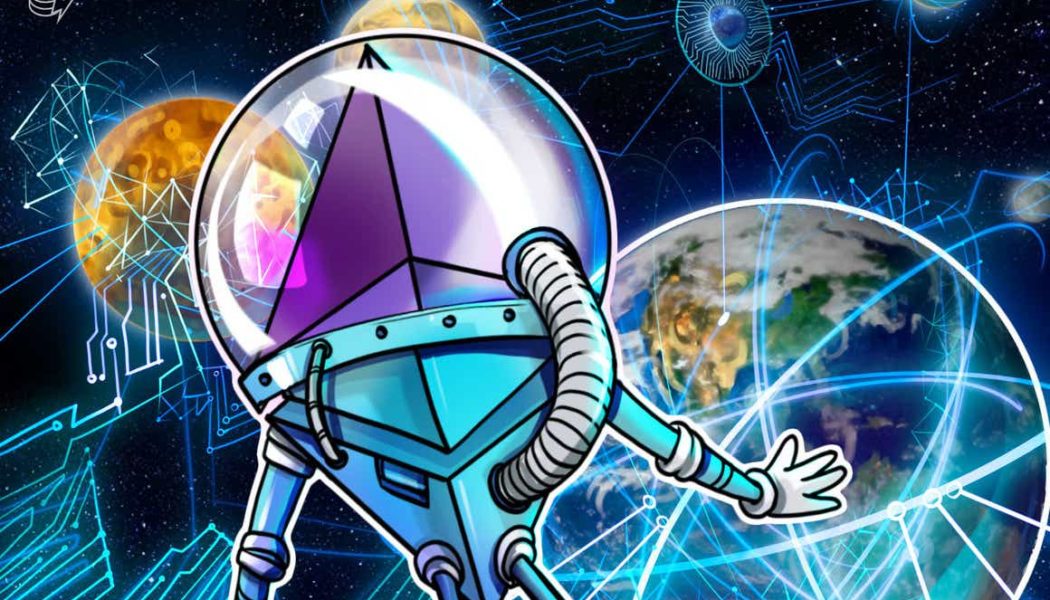

Crypto community welcomes Ethereum zkSync testnet

zkSync, a provider of zero-knowledge blockchain solutions, has announced the successful deployment of its Rollup protocol on the Ethereum (ETH) testnet. The deployment is seen as a positive development by proponents of Ethereum, as it removes the need for human operators to validate transactions. Last year, the creators of zkSync described their vision for a permissionless, Turing-complete rollout that allows decentralized applications (DApps) to be deployed in a low-cost and scalable layer-2 environment. Users will supposedly have “a better” experience on this network, according to the official announcement by Matter Labs. One of the major issues when utilizing the Ethereum blockchain is its prohibitively high gas fees. As a result, many users and developers have mig...

Puma registers ENS domain, changes name to Puma.eth on Twitter

Puma is the latest in a growing list of major brands to purchase a decentralized URL and reveal their nonfungible token, or NFT, by changing their Twitter handle to Puma.eth. The German sportswear brand registered the domain name with the Ethereum Name Service, or ENS. welcome PUMA.eth (@PUMA) https://t.co/BuPplzfJgR — ens.eth (@ensdomains) February 21, 2022 Other major companies with .ETH domains include Budweiser, the subsidiary of Anheuser-Busch InBev, which bought Beer.eth through ENS on OpenSea for 30 ETH last year. And when the fast-food chain White Castle registered whitecastleofficial.eth, ENS’ former director of operations even tweeted about his excitement. All .ETH names are NFTs that can be “easily plugged-in to the ever-expanding NFT ecosystem,” as an...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

NFTs, payments and conferences: Crypto in Latin America in 2021

In 2021, Latin America saw a soaring rise in crypto adoption among the 20 countries and 14 dependencies that make up the region. A slew of conferences, associations, new regulations and nonfungible token (NFT) projects as well as the global bull market made last year an intriguing one for the region. Let’s take a look at some of the most interesting developments in the blockchain and cryptocurrency ecosystem in Latin America in 2021. Colombian financial firms partner with crypto exchanges Early in 2021, the Financial Superintendence of Colombia authorized several partnerships between banking institutions licensed in the nation’s financial system and cryptocurrency exchanges. The nine partnerships included major names from the cryptocurrency industry such as Binance and Tyler and Cameron Wi...

The evolution of DAOs and why they are expected to take hold in 2022

In 2021, crypto has been one of the biggest trends shaping tech and finance, and according to mainstream news headlines, decentralized autonomous organizations (DAOs) are set to be a force to be reckoned with in crypto in 2022. Mark Cuban called them the “ultimate combination of capitalism and progressivism.” Yet, while DAOs are relatively easy to understand conceptually, they’re a segment of the crypto market in a state of rapid flux, with many innovative use cases emerging. However, setting up and running a DAO also comes with its own set of unique challenges, which are also changing and developing over time. What is a DAO? The purest definition of a DAO is inherent in the name. An organization is a group of people and entities with a common goal or idea. It’s decentralized, so the...

The evolution of DAOs and why they are expected to take hold in 2022

In 2021, crypto has been one of the biggest trends shaping tech and finance, and according to mainstream news headlines, decentralized autonomous organizations (DAOs) are set to be a force to be reckoned with in crypto in 2022. Mark Cuban called them the “ultimate combination of capitalism and progressivism.” Yet, while DAOs are relatively easy to understand conceptually, they’re a segment of the crypto market in a state of rapid flux, with many innovative use cases emerging. However, setting up and running a DAO also comes with its own set of unique challenges, which are also changing and developing over time. What is a DAO? The purest definition of a DAO is inherent in the name. An organization is a group of people and entities with a common goal or idea. It’s decentralized, so the...

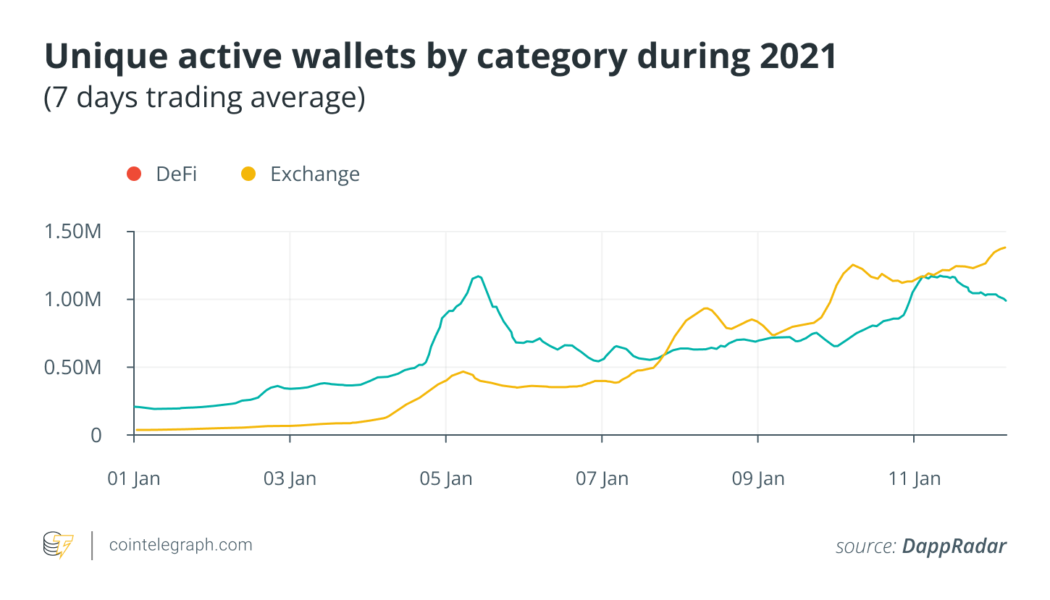

Staying cool: Is crypto snowballing to 1 billion users this year?

Crypto.com raised a few eyebrows this past week when it announced cryptocurrency users worldwide could reach 1 billion by the end of 2022. The timing was curious, given that Bitcoin (BTC) and many other cryptos are entwined in one of the largest drawdowns in their (albeit short) history and with the prospect of United States Federal Reserve interest-rate tightening edging ever nearer. But the cryptocurrency exchange, which in November gave its name to the arena where the Los Angeles Lakers basketball team plays in a 20-year deal, was obviously taking the long view. Also, its prediction was contingent on two things happening: one in the “developed” world, the other in less-mature national economies. It also involved some statistical extrapolation. To wit, the main arguments for ...