Decentralization

Russian protest group Pussy Riot seeks to tackle gender inequality in the NFT space

Russian punk rock collective Pussy Riot is planning to launch a DAO for LBTQ+ and women artists. As the group’s co-founder Nadya Tolokonnikova told Cointelegraph, the DAO will be working on reducing the gender inequality that still marks the nonfungible token (NFT) space and, more broadly, the crypto industry. Despite the large gender gap in crypto — around 60% of US crypto investors are white men, according to a survey from August 2021 — Nadya is convinced that it is still early enough for Pussy Riot to make an impact. “The NFT space is still so small, I feel that with a good enough effort you can actually change it,” she said. Nadya is already using her follower base to promote the work of women and LGBTQ+ artists and connect them with potential collectors. The DAO will continue doi...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 2

Michelle is the CEO of the Association for Digital Asset Markets, which works in partnership with financial firms and regulatory experts to devise a code of conduct for digital asset markets. “2021 was the year Washington woke up to the digital assets industry. The year started with the rushed FinCEN “Unhosted Wallets” proposal, which the industry was able to voice its concerns and delay. At the same time, pro-digital asset Senator Cynthia Lummis joined the Senate. As the Biden Administration got up to speed on digital assets, it seemed like all of Washington was studying the industry in some shape or form. Then came the Infrastructure Bill, which contained a rushed provision defining a broker for tax reporting purposes. This flawed language unleashed digital ...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 1

Hatu is the co-founder and chief strategy officer of DAO Maker, which creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors. “2021 has been a stop-start year for crypto and DeFi, as regulatory bodies have not clarified their stance on the industry. This has held back the retail population from getting involved, and this is a huge opportunity cost for the industry. However, with El Salvador adopting Bitcoin as legal tender and more countries embracing crypto, the future looks brighter. In 2021, yes, there have been multiple deliberations at various levels regarding crypto and its regulatory status. Governments and regulatory authorities across the globe have expressed reservations against the mainstreaming of crypto. Howe...

ImmuneFi report $10B in DeFi hacks and losses across 2021

Decentralized finance, or DeFi, security platform and bug bounty service ImmuneFi published an official report on Thursday, which calculated the total volume of losses in the cryptocurrency markets in 2021. According to its report, the company found that losses resulting from hacks, scams and other malicious activities exceeded $10.2 billion dollars over the past year. Responsible for protecting over $100 billion worth of assets for a number of well-established DeFi protocols, including Synthetix, Chainlink, SushiSwap and PancakeSwap, among others, ImmuneFi has regularly facilitated seven-figure pay-outs to whitehat hackers and other good-willed entities for preventing protocol compromises. According to the report, across 2021, there were 120 instances of crypto exploits or fraudulent rug-...

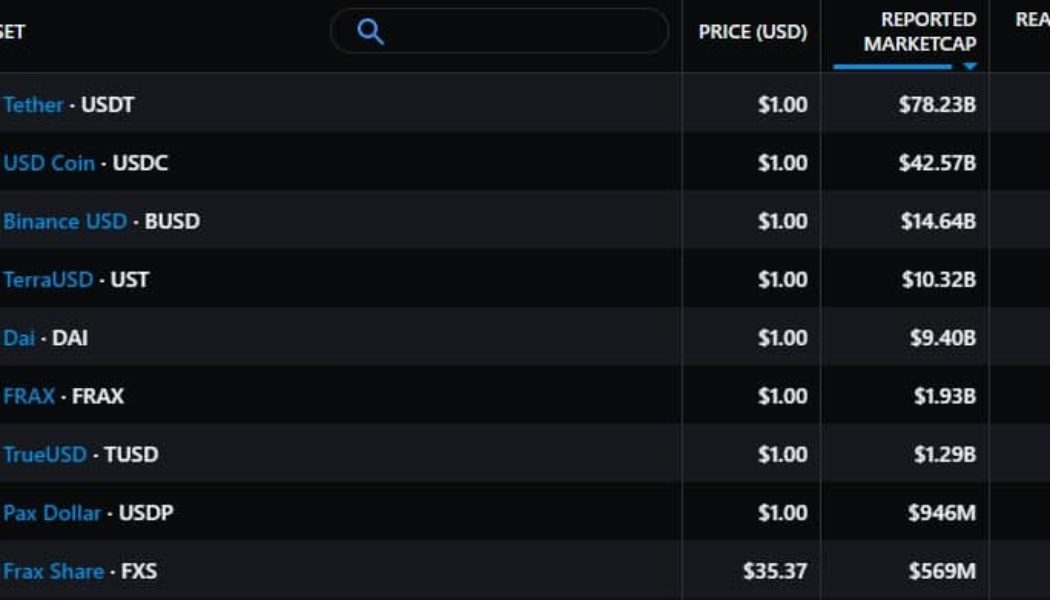

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

3 reasons why Cosmos (ATOM) price is near a new all-time high

Blockchain network interoperability is shaping up to be one of the main themes for the cryptocurrency ecosystem in 2022. New users are continuing to onboard into the growing world of crypto while both new and established projects search for the chain that will best serve the needs of their protocol and community. One project that has 2022 off to a bullish start thanks to its focus on facilitating the communication between separate networks is Cosmos (ATOM). This project bills itself as “the internet of blockchains” and seeks to facilitate the development of an interconnected decentralized economy. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $25.06 on Dec. 30, the price of ATOM has rallied 75% to hit a daily high at $43.98 on Jan. 4 as its 24-...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...

What were the biggest crypto outcomes of 2021? Experts Answer, Part 1

Hatu is the co-founder and chief strategy officer of DAO Maker, which creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors. “For a space as dynamic as blockchain, it is tough to pinpoint the reasons behind the industry evolving during the year. However, I feel the adoption of smart contracts has bolstered the growth of the industry and its relevance in the traditional setup. From optimizing supply chains to building a corporate structure around them, smart contracts are assisting everywhere. DAOs have emerged as a new wave of democratization of firms and associations. By transferring ownership to everyone involved and reducing centralized authority, DAOs and community governance are here to stay. In 2021, we could see m...

Crypto mainstream adoption: Is it here already? Experts Answer, Part 3

Sebastian is the chief strategy officer at Coinsource, a Bitcoin ATM provider in the United States. “In 2022, we expect more countries to follow El Salvador’s lead and adopt Bitcoin as legal tender, particularly countries across Latin America and Asia. As a result, we anticipate an increase in the number of Bitcoin ATMs across Latin America, and also in Europe. As new countries adopt, it is likely U.S. dominance in the crypto industry will be reduced. Regulation of crypto will continue into 2022, which is generally a good thing. However, it must be reasonable and fairly applicable to all. We have the potential to solve compliance in many of the protocols once and for all, so we need to double down on this. The industry is on a good path to increase the standards by whic...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 3

Tristan is the core contributor to Zeta Markets, an under-collateralized DeFi derivatives platform, providing liquid derivatives trading to individuals and institutions alike. “We’ve seen a Cambrian explosion in the DeFi ecosystem in 2021, with peak TVL approaching $300 billion vs the 2020 peak of $21 billion. This sounds like the growth surely has to slow. Yet, DeFi still represents just a fraction of CeFi trading volumes. At Zeta, we see a clear opportunity for more and more CeFi infrastructure to be built on-chain in a permissionless manner. This will unlock innovative products that have previously been impossible to implement. The following has already started to happen: Composability trumps the siloed products of CeFi, which has created really powerful network effe...