Energy

Climate tech VC argues Bitcoin’s ESG positives outweigh its negatives 31:1

A climate tech investor has painted a bright view of the Bitcoin network, suggesting its environmental positives outweigh its negatives by a whopping 31:1 ratio. On Jan. 12, self-proclaimed philanthropist and environmentalist Daniel Batten claimed in a Twitter thread that “Bitcoin is probably the most important ESG technology of our time.” According to Batten, the 31:1 positive impact ratio was calculated by researching and interviewing grid engineers, climate scientists, Bitcoin mining engineers, methane abatement experts and solar and wind installers. The findings discovered 21 ways Bitcoin (BTC) could be environmentally positive and just five ways it could be environmentally negative. 1/7 Environmentally, Bitcoin has a positive:negative ratio of 31:1 This mean Bitcoin is probably t...

1.5M houses could be powered by the energy Texas miners returned

During the winter storm in Texas in December 2022, Bitcoin (BTC) mining operators returned up to 1,500 megawatts of energy to the distressed local grid. It became possible due to the flexibility of mining operations and the ancillary services, provided by the state authorities. In his commentary to Satoshi Action Fund, Texas Blockchain Council president Lee Bratcher stated that miners returned up to 1,500 megawatts to the Texas grid. This amount of energy would be enough to heat “over 1.5 million small homes or keep 300 large hospitals fully operational,” according to the calculations from the Bitcoin advocacy group. While there’s no specification regarding the exact time period in which miners have accumulated such an amount of power, the global Bitcoin mining hashrate dropped by 30...

Why banking uses at least 56 times more energy than Bitcoin

The next time Bitcoin (BTC) comes under fire for energy consumption, remember this statistic: the banking industry uses at least 56 times more energy. That’s according to cryptographer and founder of Valuechain, Michel Khazzaka: “I’m not saying it uses less or the same, just know it uses 56 times more than Bitcoin.” The statistic, first shared by Michel Khazzaka in the summer, caused a stir in the Bitcoin and wider crypto community. He published his estimates in a Valuechain report, a company he founded to investigate the world of crypto payments. In an exclusive Cointelegraph Crypto Story interview, Khazzaka talks viewers through the extensive research that led to striking conclusions. In short, Bitcoin might not be as bad for the environment as the mainstream media lead peopl...

Record hash rates may see Big Oil become a major BTC mining player

Surging Bitcoin (BTC) network hash rates are causing problems for mining companies but might be rolling out the red carpet for energy giants. The Bitcoin hash rate, the amount of computing power given to the blockchain through mining, has reached another record peak. According to Blockchain.com, the metric hit an all-time high of 267 exahashes per second (EH/s) on Nov. 1 after increasing almost 60% since the beginning of the year. Commenting on the new peak, Capriole Fund founder Charles Edwards speculated that highly efficient government and oil company enterprises were entering the mining game at scale. New Bitcoin hash rate world record! 9% higher than the prior all time high set just a few days ago. I have no doubt that we have serious, highly efficient government & oil company ent...

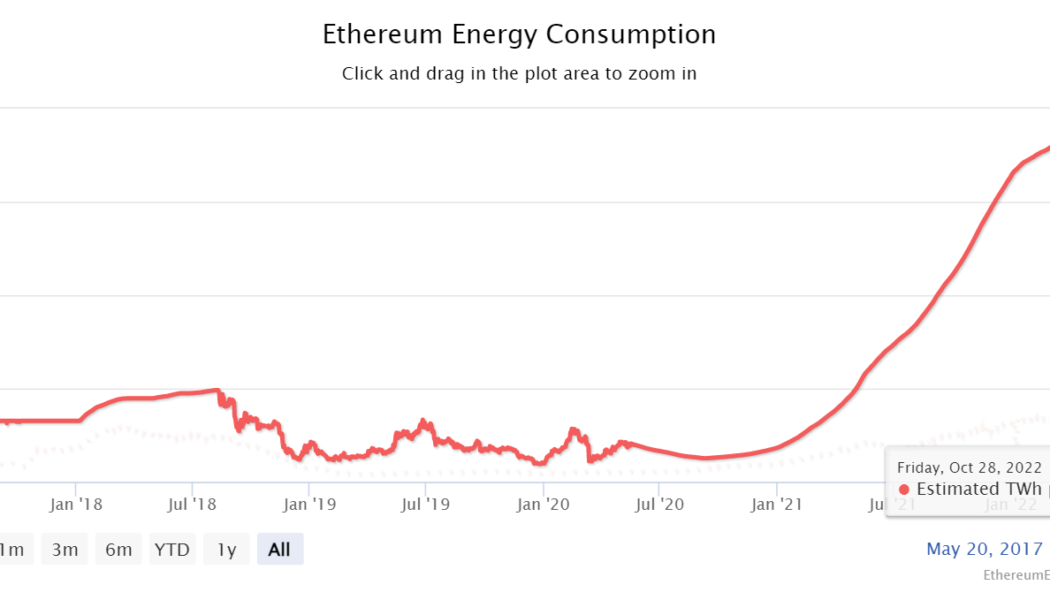

The Merge brings down Ethereum’s network power consumption by over 99.9%

The Merge, which is considered one of the most significant blockchain upgrades on Ethereum (ETH) to date, brought down the network’s energy consumption by 99.9% immediately. On Sept. 15, the Ethereum blockchain migrated from proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism in an effort to transition into a green blockchain. What followed was an immediate and steep drop in total energy consumption of the Ethereum network. The Ethereum Energy Consumption Index. Source: digiconomist.net Before the Merge upgrade, in 2022, the energy consumption of Ethereum ranged between 46.31 terawatt hour (TWh) per year to 93.98 TWh per year. The lowest energy consumption for Ethereum was recorded on Dec. 26, 2019, at 4.75 TWh per year. The estimated annual energy consumption in TWh/yr ...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

Is post-Merge Ethereum PoS a threat to Bitcoin’s dominance?

While Ethereum (ETH) fans are enthusiastic about the successful Merge, Swan Bitcoin CEO Cory Klippsten believes the upgrade will lead Ethereum into a “slow slide to irrelevance and eventual death.” [embedded content] According to Klippsten, the Ethereum community picked the wrong moment for detaching the protocol from its reliance on energy. As many parts of the world are experiencing severe energy shortages, he believed the environmental narrative is taking the back seat. In an exclusive interview with Cointelegraph, Klippsten said “I think the world is just waking up to reality and Ethereum just went way off into Fantasyland at the exact wrong time.” “It is just really bad timing to roll out that narrative. It just looks stupid.” According to some predictions, institutional capital...

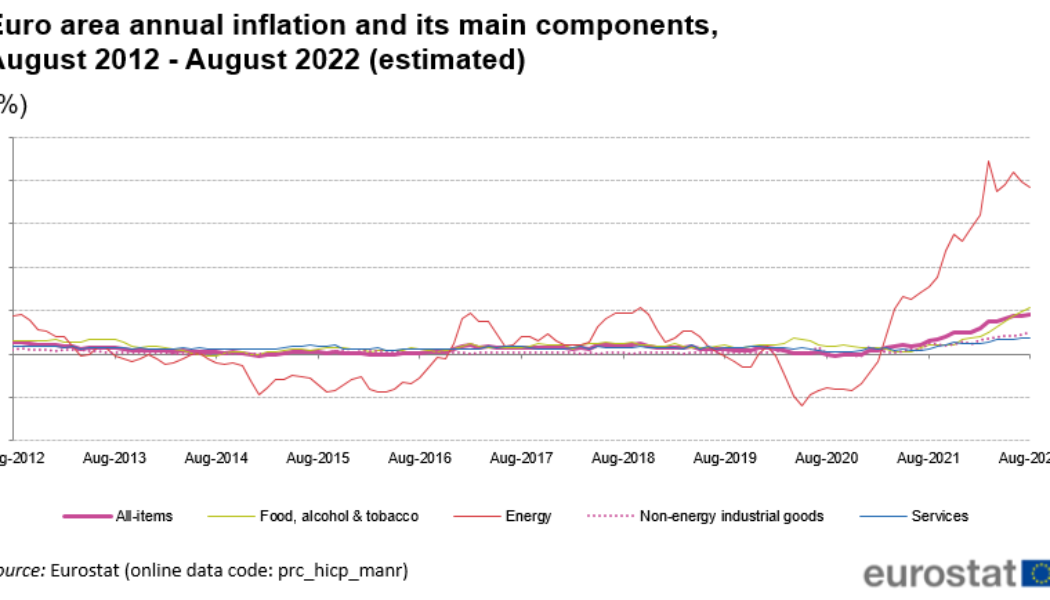

Eurozone hits record inflation of 9.1% amid gas and energy crisis

August marks the ninth consecutive month of rising inflation for the Eurozone at 9.1%. In July, the official inflation numbers landed at 8.9%. The Eurozone consists of 19 countries, including Germany, France and Belgium. This comes as the European Union (EU) faces a massive energy and gas crisis, largely as a result of the ongoing conflict in Ukraine. Current prices for daily necessities such as food, gas and electricity have soared across the continent. Over the last month, energy prices made up the largest price push, up by an annual rate of 38.3%, While food, alcohol and tobacco all rose by an annual rate of over 10%. Former EU member the United Kingdom also hit a 40-year-high inflation rate of 10.1% in July, as reported by the Organization of National Statistics (ONS). Eurozone countri...

President of Paraguay vetoes crypto regulation law

Paraguay’s president, Mario Abdo Benítez, vetoed a bill that sought to recognize cryptocurrency mining as an industrial activity on Monday. He reasoned that mining’s high electricity consumption could hinder the expansion of a sustainable national industry. The decree stated that crypto mining uses intensive capital with low manpower usage, and therefore would not generate added value on par with other industrial activities. Around the world, cryptocurrency is one of the largest job creators. The LinkedIn’s Economic Graph shows that crypto and blockchain jobs listing rose 615% in 2021 compared to 2020 in the United States. In accordance with the bill’s sponsor, Senator Fernando Silva Facetti, the law aimed to promote crypto mining through the use of surplus el...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...