Ethereum 2.0

Everyone’s talking about the Ethereum Merge: New report reveals the most interested countries

A new report released from CoinGecko uncovered the places around the world most interested in the upcoming Ethereum Merge. The data found Singapore as the country most interested and by a large margin at that. Singapore scored 377, which is nearly 100 points higher than the second place nations, Switzerland and Canada, both tied at 286 points. Germany, the United States and the Netherlands filled out the remaining top five spots. Scores were determined through an analysis of the frequency of ten search terms and then combined for the overall ranking. These terms included “Ethereum Merge,” “ETH Merge” and “Ethereum PoW,” among others. Certain terms had particular potency in Singapore such as “Ethereum Merge,” “ETH Classic” an...

Vitalik reminds node operators to update client before the Bellatrix upgrade

Ethereum co-founder Vitalik Buterin is reminding node operators to upgrade their clients before the Bellatrix “hard fork,” slated for Sept. 6. Buterin said that the scheduled upgrade will be the final update that prepares the Beacon chain (proof-of-stake chain) for the Merge. The merge is still expected to happen around Sep 13-15. What’s happening today is the Bellatrix hard fork, which *prepares* the chain for the merge. Still important though – make sure to update your clients! — vitalik.eth (@VitalikButerin) September 6, 2022 An Ethereum client is the software that allows Ethereum nodes to read blocks on the blockchain and smart contracts. A “node” is the running piece of the client software. In order to run a node, one has to first download an Ethereum client applicati...

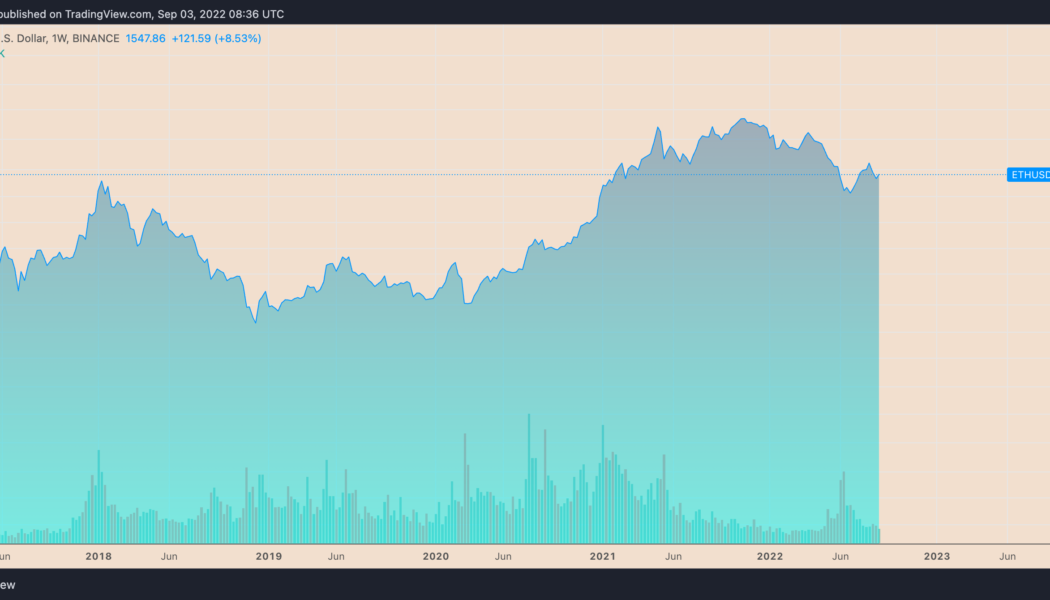

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

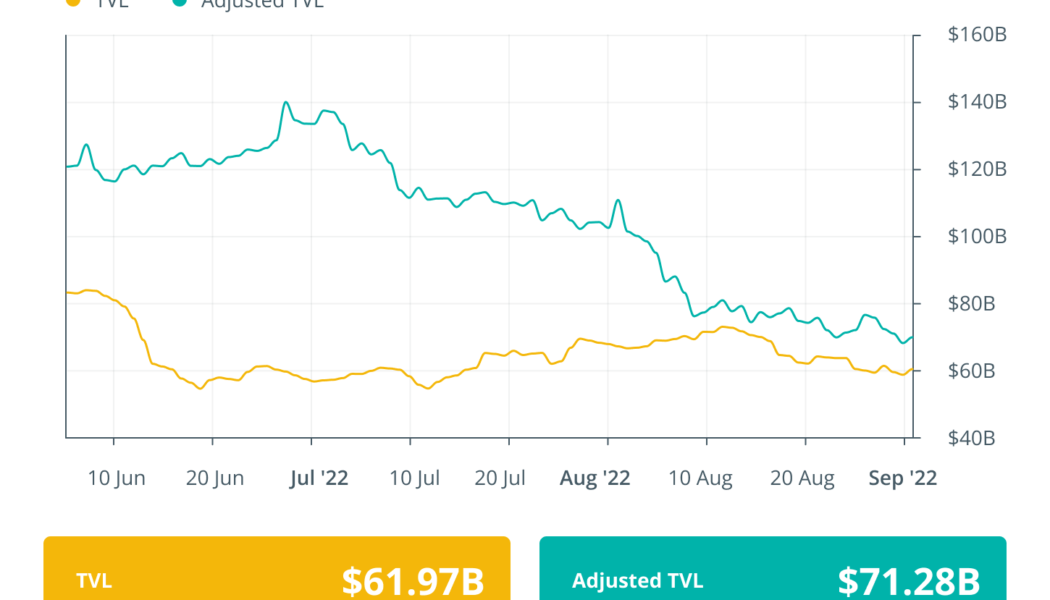

Experts weigh in on the Ethereum vulnerabilities after Merge: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The past week in the DeFi ecosystem saw major developments centered around the Ethereum Merge. Aave (AAVE) community proposed temporarily suspending Ether (ETH) lending before the Merge, citing the potential issue of high ETH utilization that may result in liquidations being hard or impossible and annual percentage yields (APYs) reaching negative figures. An industry expert shared his opinion on possible censorship vulnerabilities that the Ethereum network could eventually face in the wake of its transition to a proof-of-stake (PoS) blockchain. Moving ahead of the Ethereum Merge developments, some other major even...

Crypto Biz: Step aside, Warren Buffett; stablecoin issuers hold more US debt than Berkshire Hathaway

Warren Buffett raised eyebrows this week when his firm, Berkshire Hathaway, upped its exposure to United States Treasury bills. If you’re one of the few remaining bulls out there, Buffett’s flight to safety is concerning because it signals that the Oracle of Omaha would rather get a 3% yield instead of playing the stock market. If equities go belly-up in the fall, as I’ve been predicting for months, expect Bitcoin (BTC) to follow. Looking at the numbers, Berkshire’s T-bill exposure grew to $75 billion at the end of June, up from $58.5 billion at the beginning of 2022. But, even with the 28% spike, Berkshire doesn’t hold as many T-bill investments as the leading stablecoin issuers. Stablecoins presently command a market capitalization of $153 billion, and a large percentage of their b...

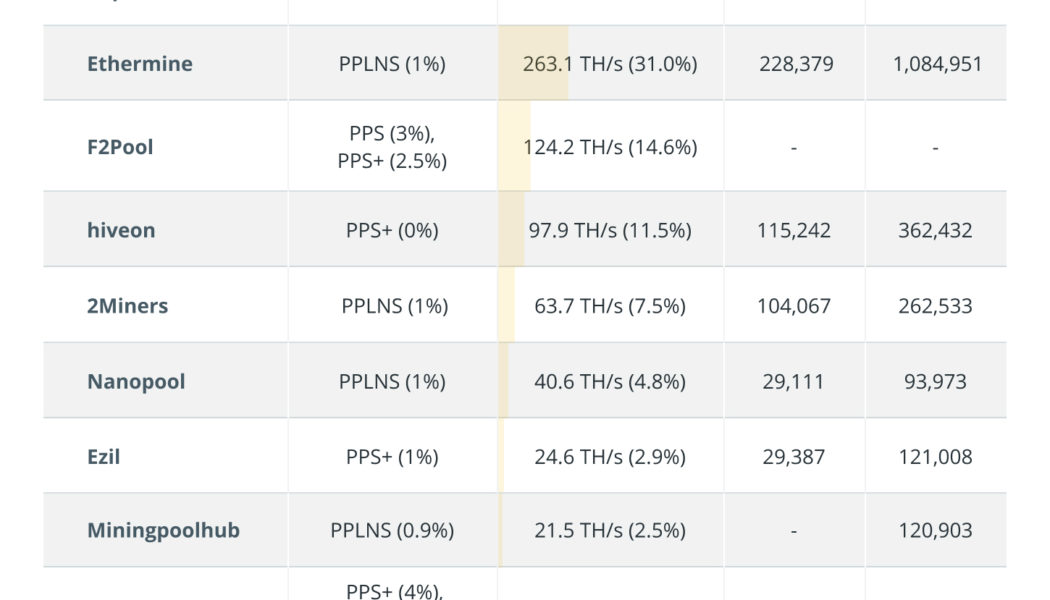

Ethereum Merge prompts miners and mining pools to make a choice

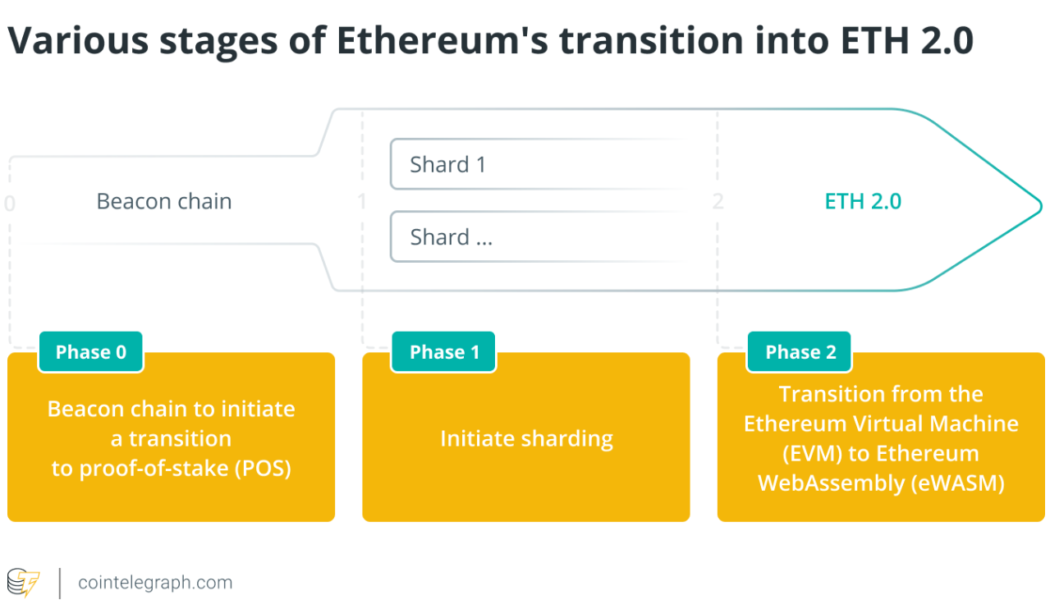

The Ethereum blockchain is all set to make its highly anticipated transition from its current proof-of-work (PoW) mining consensus to proof-of-stake (PoS). The Merge date is officially scheduled for Sept. 15–16 after the successful final Goerli testnet integration to the Beacon Chain on Aug. 11. At present, miners can create new Ether (ETH) by pledging a huge amount of computing power. After the Merge, however, network participants, known as validators, will be required to instead pledge large amounts of pre-existing ETH to validate blocks, creating more ETH and earning staking rewards. The three-phase transition process began on Dec. 1, 2020, with the launch of the Beacon Chain. Phase 0 of the process marked the beginning of the PoS transition, where validators started staking their ETH f...

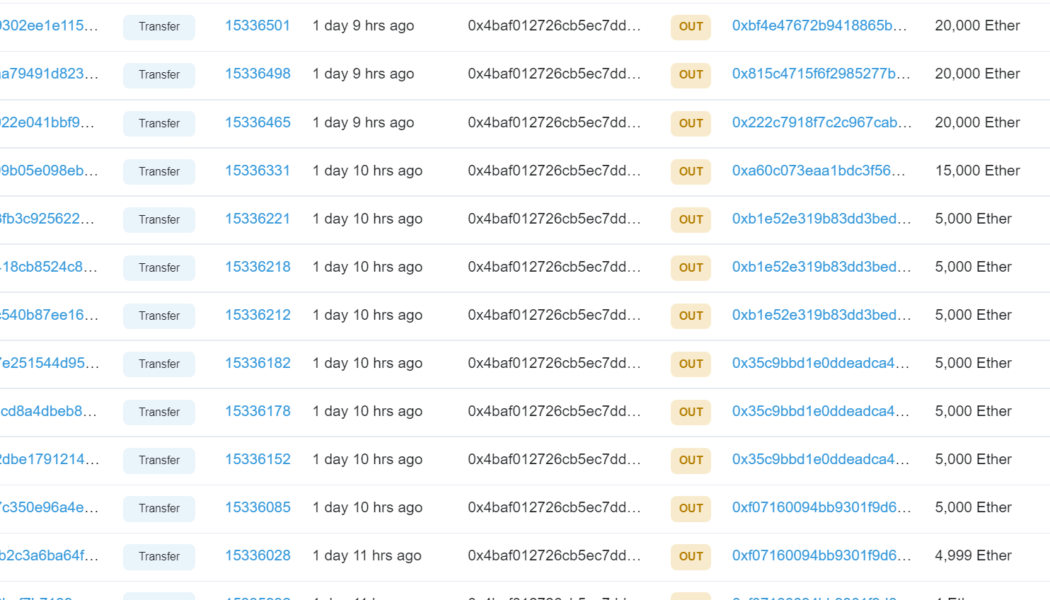

Ethereum ICO-era whale address transfer 145,000 ETH weeks before the Merge

An Ethereum (ETH) whale wallet that participated in the Genesis Initial Coin Offering (ICO) and obtained about 150,000 ETH in 2014 was activated again on Aug. 14 after three years of dormancy. The whale address transferred 145,000 ETH to multiple wallets as Ether price surged to a new 3-month high of over $2,000. The transfers were made in a batch of 5,000 ETH per transaction and a few transfers of over 10,000 ETH. The total value of the transferred ETH is over $280 million, and the wallet address currently has a balance of 0.107 ETH. Ethereum ICO era wallet transactions Source: Etherscan The 145,000 ETH transfer was only the second instance after the ICO when the whale wallet was activated, the first coming in July 2019 when the wallet sent out 5,000 ETH to Bitfinex3 exchange ...

The Merge: Top 5 misconceptions about the anticipated Ethereum upgrade

The excitement around Ethereum’s (ETH) upcoming upgrade, The Merge, which involves the merger of two blockchains — Mainnet Ethereum and Beacon Chain — has unknowingly spurred rumors across the community. Termed the most significant upgrade in the history of Ethereum, The Merge does indeed mark the end of proof-of-work (PoW) for the Ethereum blockchain. However, here are five misconceptions that stand out among the rest. Misconception 1: Ethereum gas fees will reduce after The Merge Ethereum’s impending upgrade will reduce Ethereum’s infamous gas fees (transaction fees) is one of the biggest misconceptions circulating among investors. While reduced gas fees tops every investor’s wishlist, The Merge is a change of consensus mechanism that will transition the Ethereum blockchain from PoW to p...

Ethereum whale transactions peak at 2-month high amid Goerli testnet merger

The Goerli testnet was successfully merged to the proof-of-stake (PoS) network, marking the final step before Ethereum’s mainnet transition. The triumphant final testnet merger means the mainnet transition slated for Sept. 19 could go as scheduled. Goerli is the third and final testnet after Ropsten and Sepolia that makes Ethereum’s final rehearsal before its official transition to the PoS network. BREAKING: The Goerli Testnet has activated Proof of Stake Mainnet™ — bankless.eth (@BanklessHQ) August 11, 2022 The PoS Merge is considered to be one of the most significant updates for the Ethereum blockchain since its inception, and the bullish sentiment behind the event has started to reflect on the altcoin’s price. The native token Ether (ETH) has more than doubled its price sin...

Chainlink ditches Ethereum PoW forks for PoS after The Merge

Chainlink is aligning itself with the decision of the Ethereum Foundation and its community. Therefore forked versions of the Ethereum (ETH) blockchain, which includes PoW forks, will no longer be supported by the Chainlink (LINK) protocol post-Merge. In an official announcement, the Chainlink protocol revealed its services will remain on the Ethereum blockchain post the long-awaited Merge. The Ethereum blockchain anticipates the Merge in September 2022, which will merge its mainnet with the Beacon Chain. This will transition all of Ethereum operations from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The Merge has been pushed back from mid-2021 to September 2022 before. If it goes according to the timeline of developers, Phase 1 will initiate the transition of the ecosystem’s transa...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...

Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2. Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later. The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the...