Ethereum 2.0

Ethereum’s bearish U-turn? ETH price momentum fades after $1.6K rejection

Ethereum’s native token Ether (ETH) tumbled on July 26, reducing hopes of an extended price recovery. The ETH/USD pair dropped by roughly 5%, followed by a modest rebound to over $1,550. Ethereum gets rejected at $1,650 These overnight moves liquidated over $80 million worth of Ether positions in the last 24 hours, data from CoinGlass reveals. ETH/USD hourly price chart. Source: TradingView The seesaw action also revealed an underlying bias conflict among traders who have been stuck between two extremely opposite market fundamentals. The first is the euphoria surrounding Ethereum’s potential transition to proof-of-stake in September, which has helped Ether’s price to recover 45% month-to-date. However, this bullish hype is at odds with macroeconomic headwinds, namel...

Ethereum Classic soars 100% in nine days outperforming ETH as ‘the Merge’ approaches

Ethereum Classic (ETC) has been outperforming its arch-rival Ethereum’s native token Ether (ETH) during the current crypto market rebound with the ETC/ETH pairs at 10-month highs. Why is ETC beating ETH? ETC’s price has risen to $27 on July 22, amounting to a 100% gain in nine days after bottoming out at $13.35. Comparatively, ETH’s price has seen a 64% rally in U.S. dollar terms. ETC/USD versus ETH/USD daily price chart. Source: TradingView Ethereum’s rebound has been among the sharpest among the top cryptocurrencies, primarily due to the euphoria surrounding its potential network upgrade in September. Dubbed “the Merge,” the long-awaited technical update will switch Ethereum from proof-of-work (PoW) to proof-of-stake (PoS). Anyone who believes the #Eth...

Ether price stalls at $1,630 after gaining 50% in under a week

Price action across the cryptocurrency market was largely subdued on July 21, as traders took a day to digest gains over the past week and book profits following the biggest relief rally since early June. Amid speculation about what drove the recent rally, the Ethereum Merge has consistently ranked at the top of the list. The market rally shifted into high gear after a tentative date of Sept. 19 was set for the mainnet Merge. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a high of $1,620 on July 20, Ether’s (ETH) price retraced to a low of $1,463 in the early trading hours on July 21 and has since climbed back above support at $1,500. ETH/USDT 1-day chart. Source: TradingView Now that the initial price surge brought on by the Merge announcemen...

Ethereum traders gauge fakeout risks after 40% ETH price rally

Ethereum’s native token Ether (ETH) saw a modest pullback on July 17 after ramming into a critical technical resistance confluence. Merge-led Ethereum price breakout ETH’s price dropped by 1.8% to $1,328 after struggling to move above two strong resistance levels: the 50-day exponential moving average (5-day EMA; the red wave) and a descending trendline (black) serving as a price ceiling since May. ETH/USD daily price chart. Source: TradingView Previously, Ether rallied by over 40% from $1,000 on July 13 to over $1,400 on July 16. The jump appeared partly due to euphoria surrounding “the Merge” slated for September. Meanwhile, a golden cross’s appearance on Ethereum’s four-hour chart also boosted Ether’s upside sentiment among technical a...

2018 Ethereum price fractal suggests a $400 bottom, but analysts say the merge is a ‘wildcard’

There’s no rest for the weary during a bear market, and the Crypto Fear and Greed index shows that investor sentiment has been stuck in a state of “extreme fear” for a record 70 consecutive days. As the market looks for a catalyst to reverse the trend, there is little on the horizon besides the Ethereum (ETH) Merge that seems capable of sparking a rally. If that is indeed the case, the market could continue to trend down or sideways until the tentative Merge date of September 19. Data from Cointelegraph Markets Pro and TradingView shows that Ether price remains sandwiched in the trading zone it has been trading in since June 13 and it is currently running into the upper resistance near $1,240. ETH/USDT 1-day chart. Source: TradingView With the Merge still a couple of months awa...

Lido DAO most ‘overbought’ since April as LDO price rallies 150% in two weeks — what’s next?

The price of Lido DAO (LDO) dropped heavily a day after its key momentum oscillator crossed into “overbought” territory. LDO undergoes overbought correction LDO’s price plunged to as low as $1.04 on July 16 from $1.32 on July 15, amounting to a 20%-plus decline. The token’s sharp downside move took its cues from multiple bearish technical indicators, including its daily relative strength index (RSI) and its 100-day exponential moving average (EMA). LDO’s latest plunge came after it rallied over 150% in just two weeks, a move that simultaneously pushed its daily RSI above 70 on July 15, thus turning it overbought. An overbought RSI signals that the rally may be nearing an end while readying for a short-term pullback. Meanwhile, more downside cues for the ...

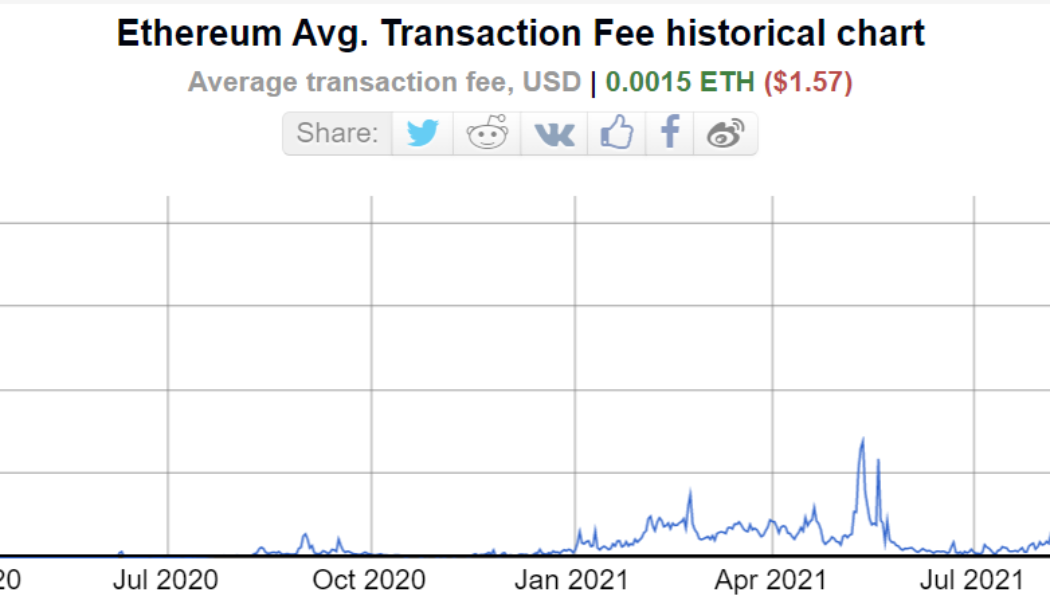

Ethereum average gas fee falls down to $1.57, the lowest since 2020

The Ethereum (ETH) ecosystem’s biggest roadblock to mainstream dominance is often attributed to the extremely high transaction fees or gas fees it requires to complete a transaction. However, with Ethereum’s average gas fees coming down to 0.0015 ETH, the narrative is set to change. The average transaction fee on the Ethereum blockchain fell down to 0.0015 ETH or $1.57 — a number previously seen in December 2020. However, starting in January 2021, Ethereum’s gas fees surged owing to the hype around nonfungible tokens (NFT), decentralized finance (DeFi) and a promising bull market. Ethereum average transaction fee YTD. Source: BitInfoCharts For nearly two years, between Jan. 2021 and May 2022, the average gas fee required by the Ethereum network was roughly $40, with May 1, 2022 recor...

Finance Redefined: Three Arrow Capital and Celsius fall brings a tsunami of sell-off in DeFi

This past week, the decentralized finance (DeFi) ecosystem faced the brunt of the bears fueled by liquidation rumors of Three Arrow Capital (3AC) and Celsius liquidations. MakerDAO decided to cut off Aave (AAVE) from its direct deposit module as a safeguard in light of the possibility that Celsius folds and crashes the price of staked Ether (stETH). Trading firm 8 Blocks Capital called out to platforms holding funds owned by 3AC to freeze the assets as rumors of 3AC’s insolvency stay afloat. Micheal Saylor believes Bitcoin (BTC) and the Lightning Network can solve many of the DeFi ecosystem problems. The top 100 DeFi tokens were hit hard by bears, with the majority of tokens registering multi-month low along with double-digit losses over the past week. Crypto crash wreaking havoc on DeFi p...

Ethereum eyes fresh yearly lows vs. Bitcoin as bulls snub successful ‘Merge’ rehearsal

Ethereum’s native token Ether (ETH) resumed its decline against Bitcoin (BTC) two days after a successful rehearsal of its proof-of-stake (PoS) algorithm on its longest-running testnet “Ropsten.” The ETH/BTC fell by 2.5% to 0.0586 on June 10. The pair’s downside move came as a part of a correction that had started a day before when it reached a local peak of 0.0598, hinting at weaker bullish sentiment despite the optimistic “Merge” update. ETH/BTC four-hour price chart. Source: TradingView Interestingly, the selloff occurred near ETH/BTC’s 50-4H exponential moving average (50-4H EMA; the red wave) around 0.06. This technical resistance has been capping the pair’s bullish attempts since May 12, as shown in the chart above. Staked Ether behind ...

Bitcoin’s real energy use questioned as Ethereum founder criticizes BTC

The ever-raging debate around Bitcoin’s energy consumption has been re-ignited, with founding member of Ethereum Anthony Donofrio claiming that Bitcoin is using “way too much” energy. According to figures from Digiconomist, Bitcoin (BTC) currently uses 0.82% of the world’s power while Ethereum (ETH) uses 0.34%. Ethereum researcher Justin Drake posted the figures to his 56,000 followers that Donofrio retweeted, stating: If bitcoin is really using nearly 1% of the energy on earth that is way too much for a pet rock. https://t.co/CDL32jk5FF — Texture, PhD (@iamtexture) June 9, 2022 Ethereum proponents are attempting to take shots at Bitcoin while simultaneously promoting Ethereum’s upcoming transition to proof-of-stake, Drake added another tweet moments later that read: “Ethereum post-m...

Ethereum preparing a ‘bear trap’ ahead of the Merge — ETH price to $4K next?

Ethereum’s native token, Ether (ETH), continues to face downside risks in a higher interest rate environment. But one analyst believes that the token’s next selloff move could turn into a bear trap as the market factors in the possible release of the Merge this coming August. ETH to $4K? Ether’s price could reach $4,000 by 2022’s end, according to a technical setup shared on May 20 by Wolf, an independent market analyst. The analyst envisioned ETH moving inside a multi-month ascending triangle pattern, which comprises a horizontal trendline resistance and rising trendline support. Notably, ETH’s latest retest of the structure’s lower trendline could initiate a big rebound toward its upper trendline, which sits around the $4,000-level, as s...

Ethereum devs tip The Merge will occur in August ‘if everything goes to plan’

Ethereum’s long-awaited migration to a proof-of-stake (PoS) consensus mechanism, which has been pushed back time and time again, looks set to occur sometime in August. Hopefully. Preston Van Loon, a core developer of the Ethereum (ETH) network, told attendees at the Permissionless conference that the transition, known as the Merge, would occur sometime in August if everything plays out according to plan. Ethereum core Dev @preston_vanloon just said the eth merge is ready,they are now only testing, and expects the merge to happen in August. Packed room @Permissionless are excited about it. Great question @TrustlessState. Also on panel @drakefjustin pic.twitter.com/vX4beNatJ5 — Benjamin Cohen (benjicohen.eth) (@benjicohen421) May 19, 2022 Van Loon told the 5000 attendees that the team ...