Ethereum 2.0

Will the Ethereum 2.0 update reduce high gas fees?

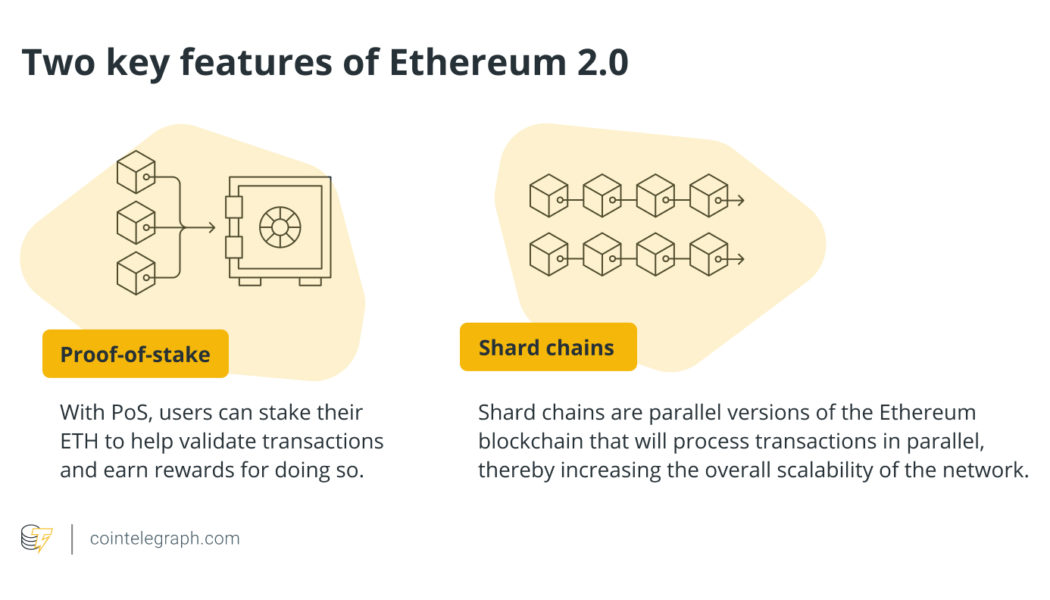

Purpose of Ethereum 2.0 The primary goal of the Ethereum 2.0 update is to improve scalability so that the network can handle more transactions without delays or high fees. While the full effects of the update will not be felt until it is fully rolled out, some of the possible use cases for Ethereum 2.0 include: Supporting the large-scale enterprise adoption of blockchain technology in private corporations and businesses; Creating more decentralized autonomous organizations (DAOs) and governance models based on smart contracts and trustless interactions; Ethereum token launches that will allow new projects to fundraise and launch their own tokens on the Ethereum network; The further expansion of nonfungible tokens (NFTs) and other digital assets that can be stored on the...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

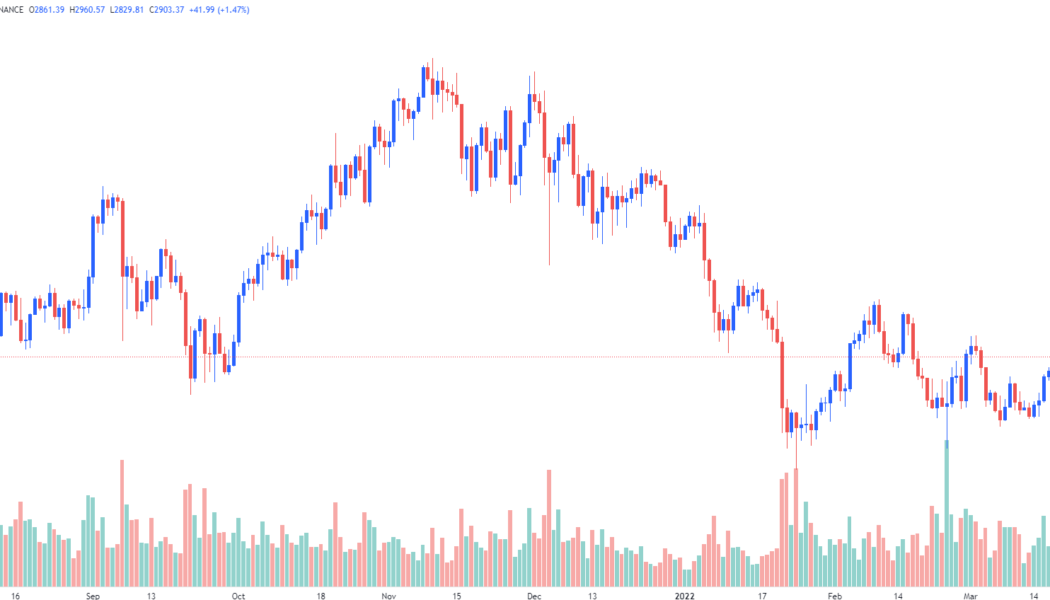

Ethereum price ‘bear flag’ could sink ETH to $2K after 20% decline in three weeks

Ethereum’s native token Ether (ETH) has dropped by nearly 20% in the last three weeks, hitting monthly lows near $2,900 on April 19. But despite rebounding above $3,000 since, technicals suggest more downside is possible in the near term, according to a classic bearish pattern. Ethereum price ‘bear flag’ setup activated Dubbed “bear flag,” the bearish continuation signal appears as the price consolidates higher inside an ascending parallel channel after a strong downward move (called the flagpole). It resolves after the price breaks out of the channel to drop further. ETH’s price turned lower after testing its bear flag’s upper trendline on April 4 and now eyes an extended decline towards its lower trendline near $2,700. If the pattern pans out as ...

Altcoin Roundup: Analysts give their take on the impact of the Ethereum Merge delay

The rollout of Ethereum 2.0, or Eth2, includes a transition from proof-of-work to proof-of-stake that will supposedly transform Ether (ETH) into a deflationary asset and revolutionize the entire network. The event has been a trending topic for years and while anticipation for “The Merge” has been building over the past couple of months, this week Ethereum core developer Tim Beiko informed the world that “It won’t be June, but likely in the few months after. No firm date yet.” Delays in Ethereum network upgrades are nothing new and so far, the immediate effect on Ether’s price following the revelation has been minimal. Here’s what several analysts have said about what the merger means for Ethereum and how this most recent delay could affect ETH price moving forward. Staking Rewards ex...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

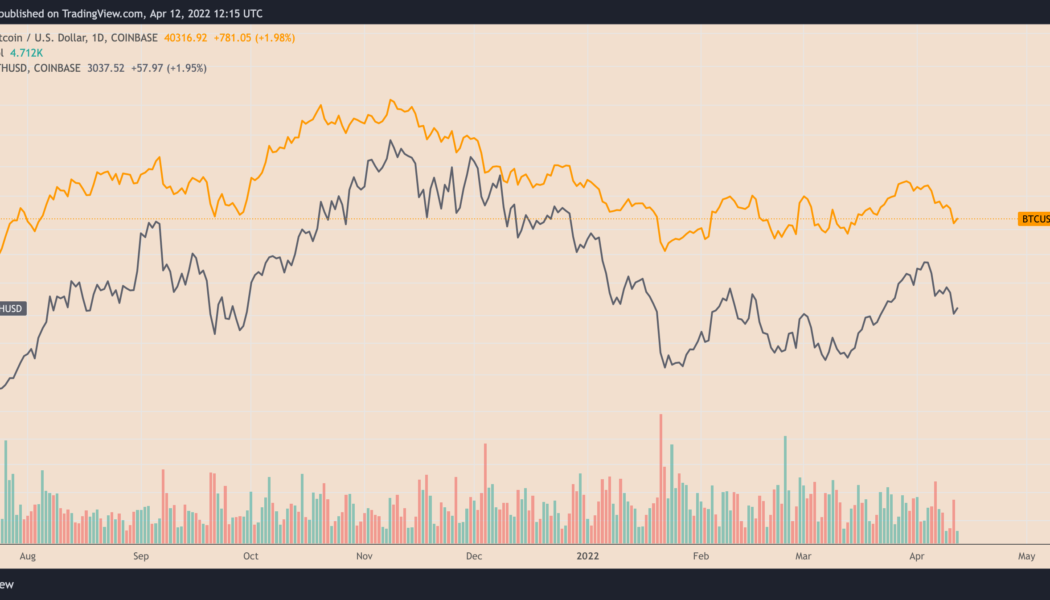

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

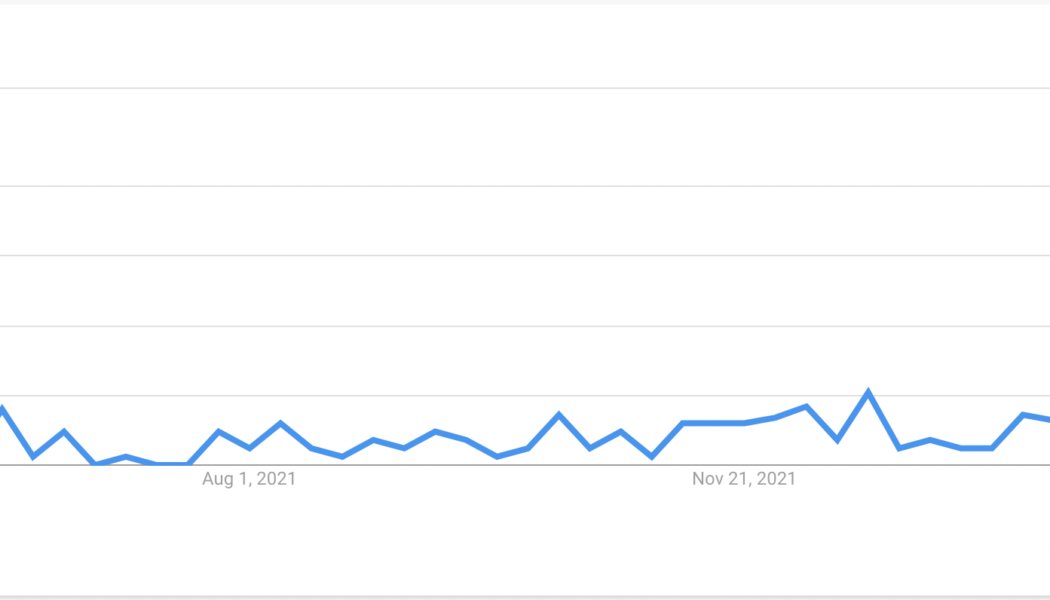

3 reasons why Ethereum price can hit $4K in April

Three market catalysts suggest that Ethereum’s native token Ether (ETH) is well-positioned to reach $4,000 this month. Google searches for “Ethereum merge” spike Internet users’ interest in Ethereum’s upcoming network upgrade, dubbed “the Merge,” surged substantially in the week ending April 2, Google Trends’ data shows. Searches for the keyword “Ethereum Merge” reached a perfect Google Trends score of 100 on a 12-month timeframe with most traffic coming from the U.S., Singapore, Canada, and Australia. Internet trend score for the keyword ‘Ethereum Merge.’ Source: Google Trends Merge, also called ETH 2.0, refers to the Ethereum network’s full transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW),...

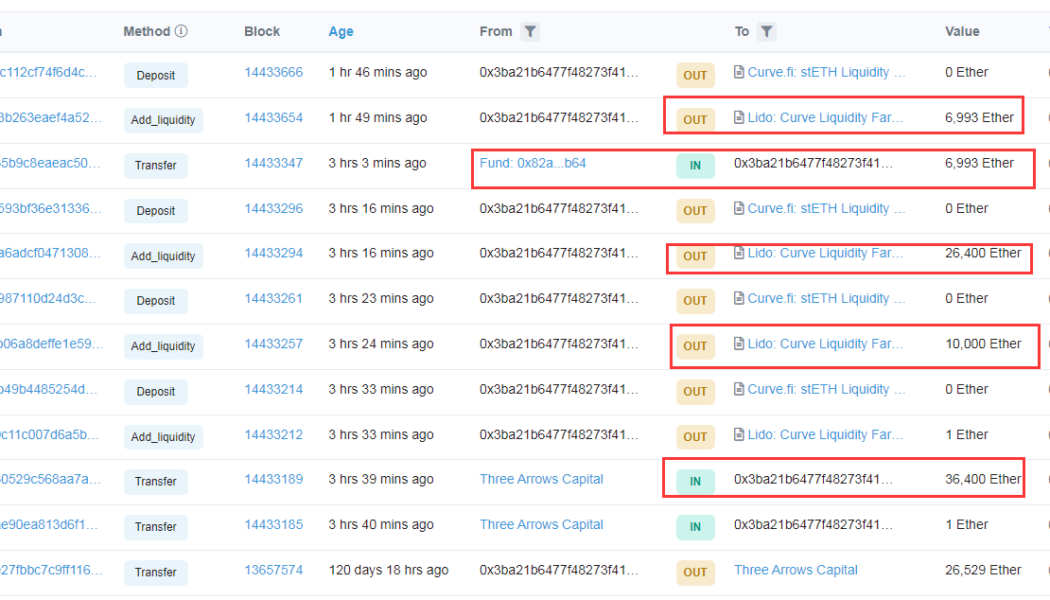

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Ether bulls eye resistance at $3K as the network prepares to undergo ‘The Merge’

A new week in the cryptocurrency market has brought more of the same sideways price action that the wider ecosystem has experienced in recent months, as Bitcoin (BTC) continues to hold support near $41,000 while some analysts warn that high inflation and rising interest rates could see the top cryptocurrency fall to $30,000. On the altcoin front, Ether (ETH) appears to be showing some signs of life as noted by cryptocurrency analyst Willy Woo, who recently tweeted that “Ether [is] setting up to break upwards out of a very long term, 3.5-month bearish trend line.” Data from Cointelegraph Markets Pro and TradingView shows that the ETH price is now trading above support at $2,900, with bulls looking to make another run at breaking the $3,000 resistance after being firmly rejected a...

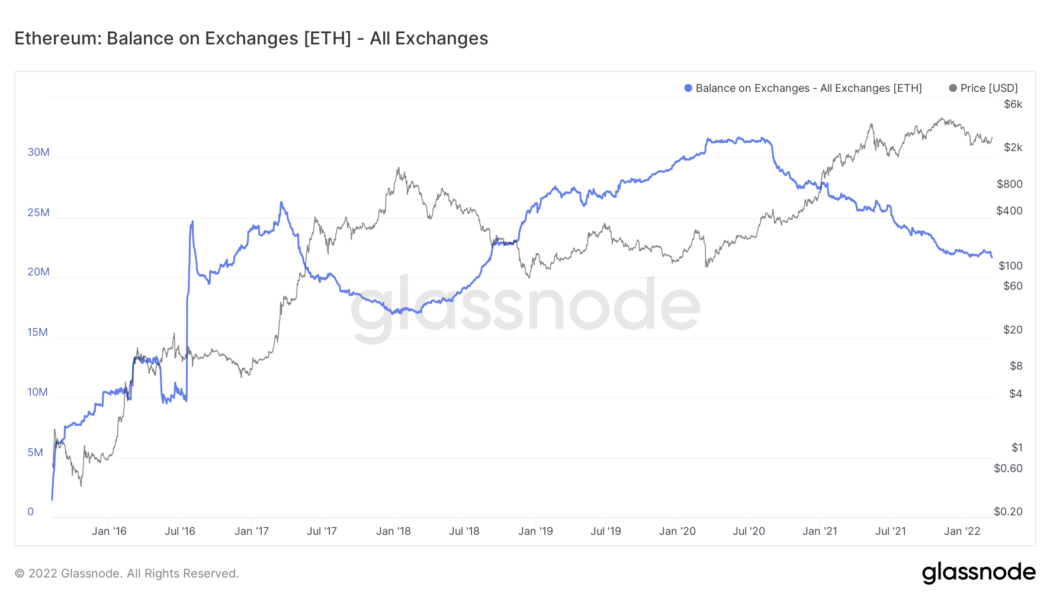

Ethereum balance on crypto exchanges falls to lowest levels since 2018

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...

Vitalik Buterin talks crypto’s perils in Time Magazine interview

Ethereum co-founder Vitalik Buterin graced the front page of Time Magazine this month after he was interviewed by the publication about the potential perils of the industry he helped tocreate. During the 80-minute interview, Buterin explained the “dystopian potential” of digital assets if implemented incorrectly. Among his biggest worries are overzealous investors, high transaction fees and public displays of wealth by those claiming to have made a fortune trading crypto and nonfungible tokens (NFTs). Although Buterin has high hopes for Ethereum — the network powering the second-largest cryptocurrency by market capitalization and countless other projects — he fears that his vision of creating a more egalitarian digital economy risks being overtaken by nefarious actors who are only af...

Ethereum Merge testing on Kiln mostly successful, save for one minor bug

On Tuesday, Ethereum (ETH) developer Tim Beiko tweeted that Kiln successfully passed the Ethereum Merge, with validators producing post-merge blocks containing transactions. Kiln will be the last Merge testnet (formerly Ethereum 2.0) before existing public testnets are upgraded. “Merge” involves taking Ethereum’s Execution Layer from the existing Proof of Work layer and merging it with the Consensus Layer from the Beacon chain, turning the blockchain into a proof-of-stake network. The Foundation writes: “This merge signals the culmination of six years of research and development in Ethereum and will result in a more secure network, predictable block times, and a 99.98%+ reduction in power use when it is released on mainnet later in 2022.” However, it app...