Ethereum Price

Ethereum ICO-era whale address transfer 145,000 ETH weeks before the Merge

An Ethereum (ETH) whale wallet that participated in the Genesis Initial Coin Offering (ICO) and obtained about 150,000 ETH in 2014 was activated again on Aug. 14 after three years of dormancy. The whale address transferred 145,000 ETH to multiple wallets as Ether price surged to a new 3-month high of over $2,000. The transfers were made in a batch of 5,000 ETH per transaction and a few transfers of over 10,000 ETH. The total value of the transferred ETH is over $280 million, and the wallet address currently has a balance of 0.107 ETH. Ethereum ICO era wallet transactions Source: Etherscan The 145,000 ETH transfer was only the second instance after the ICO when the whale wallet was activated, the first coming in July 2019 when the wallet sent out 5,000 ETH to Bitfinex3 exchange ...

Bitcoin hits $25K as bearish voices call BTC price ‘double top’

Bitcoin (BTC) spiked through $25,000 for the first time in months on Aug. 14, but traders refused to take any chances on a bull run. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Weekend produces brief $25,000 tap for BTC Data from Cointelegraph Markets Pro and TradingView tracked a sudden run-up on BTC/USD, which hit $25,050 on Bitstamp in a $350 hourly candle. The move took the pair to a new personal best since June 13, erasing more of the losses seen that day in what remains a significant BTC price correction. Analyzing the market setup, however, familiar bearish tones remained. For popular Twitter account Il Capo of Crypto, the latest highs appeared to provide the last piece of the puzzle before a new downtrend set in. Il Capo had previously called for a peak o...

Bitcoin traders still favor new $20K lows as Ethereum hits $2K

Bitcoin (BTC) is still due to return to near $20,000, fresh analysis warns as BTC/USD attempts to retest multi-month highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Buy-the-dip set for invalidation at $20,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD staging a second run-up to near $25,000 on Aug. 13, so far seeing rejection. The pair had gained over $1,300 overnight, but as bulls again ran out of momentum near crucial resistance, few were optimistic over Bitcoin avoiding a deeper comedown. “One last high to rekt early shorts,” popular trading account Il Capo of Crypto told Twitter followers. Similarly cautious was fellow trader Jibon, who said that he would even prefer to wait and “buy higher” than spot price t...

Fallout from crypto contagion subsides but no market reversal just yet

The blockchain industry showed some surprising resilience in July, which may point to a period of greater fundamental support for the crypto space overall in the short term. In looking at a wide variety of indicators, including Bitcoin’s (BTC) price action, open interest on Ether (ETH) and activity in GameFi, there are some strong signals to suggest that a bullish sentiment is returning to this space. Smooth sailing from now on is not a given, though. Cointelegraph Research’s latest Investor Insights analyzes key indicators from different sectors of the blockchain industry to navigate those potentially treacherous crypto waters. In the latest edition, Cointelegraph Research’s bearish-to-bullish index was a level C indicating a short-term cautionary time. While there are still mixed signals...

Ethereum whale transactions peak at 2-month high amid Goerli testnet merger

The Goerli testnet was successfully merged to the proof-of-stake (PoS) network, marking the final step before Ethereum’s mainnet transition. The triumphant final testnet merger means the mainnet transition slated for Sept. 19 could go as scheduled. Goerli is the third and final testnet after Ropsten and Sepolia that makes Ethereum’s final rehearsal before its official transition to the PoS network. BREAKING: The Goerli Testnet has activated Proof of Stake Mainnet™ — bankless.eth (@BanklessHQ) August 11, 2022 The PoS Merge is considered to be one of the most significant updates for the Ethereum blockchain since its inception, and the bullish sentiment behind the event has started to reflect on the altcoin’s price. The native token Ether (ETH) has more than doubled its price sin...

Bitcoin price reaches $23.4K on 4.6% gains amid ‘very mixed’ outlook

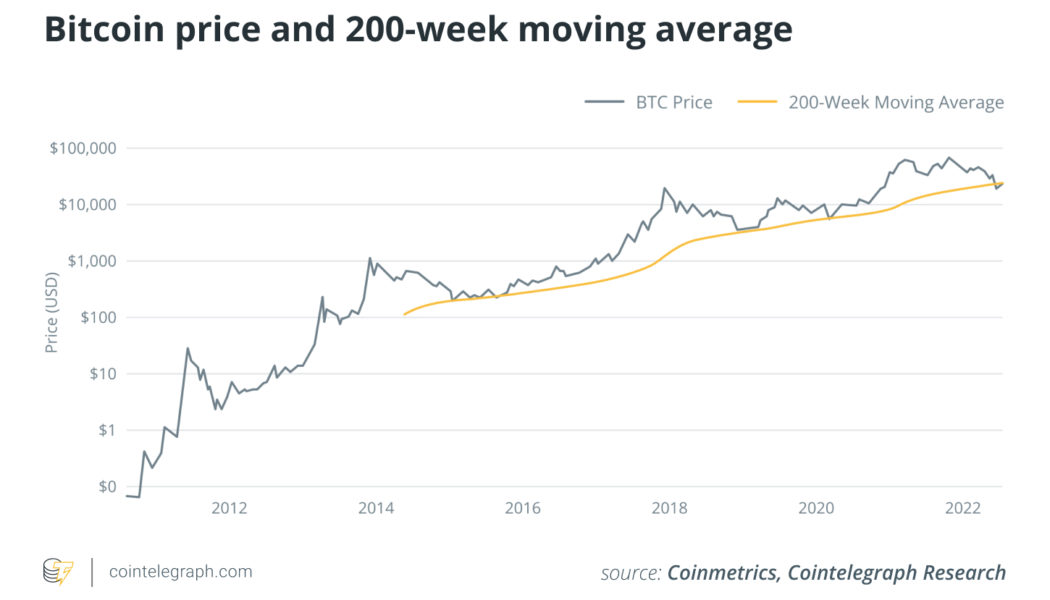

Bitcoin (BTC) rebounded overnight into Aug. 5 as a fresh trendline reclaim opened the door to further gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Daily BTC pricechart sets up “tentative” long signal Data from Cointelegraph Markets Pro and TradingView showed BTC/USD bouncing off a local bottom at $22,400 to add around 4.6%. The pair had reversed direction right at key bid support on major exchange Binance, this helping avoid a more substantial loss of the 200-week moving average (MA) at around $22,800. While that key zone remained uncertain for bulls, a reclaim of the 21-period MA on the daily chart gave on-chain analytics resource Material Indicators cause for optimism. BTC/USD might not spark a long signal at the daily candle close, it told Twitter follo...

Nansen admits neglecting DeFi plans during the NFT craze

Despite the general downturn in the cryptocurrency markets throughout the year, Ethereum blockchain analytics platform Nansen has continued to report impressive growth numbers. CEO and co-founder Alex Svanevik recently spoke about Nansen’s growth, highlighting that the company has registered over 130 million addresses and has grown 30% despite the crypto downturn. Svanevik credited much of his success to the value of blockchain platforms, notably those based on Ethereum. Cointelegraph reached out to Nansen’s Andrew Thurman for more insight into the company’s success. Thurman, a Simian psychometric enhancement technician, explained that after the nonfungible tokens (NFT) craze, Nansen realized it would be a big area for the company and became its most popular section. He added: “A...

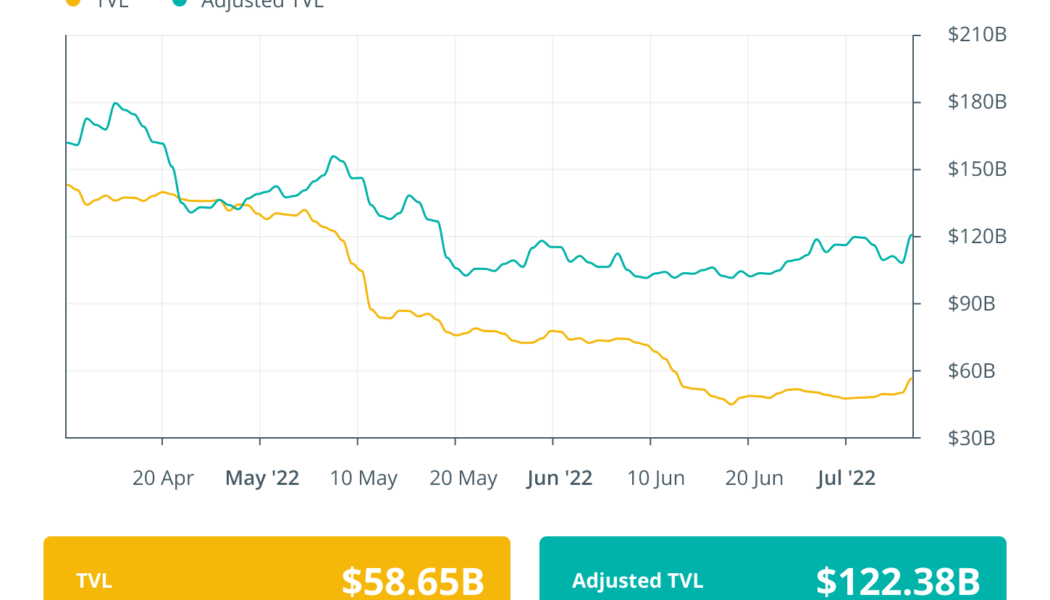

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

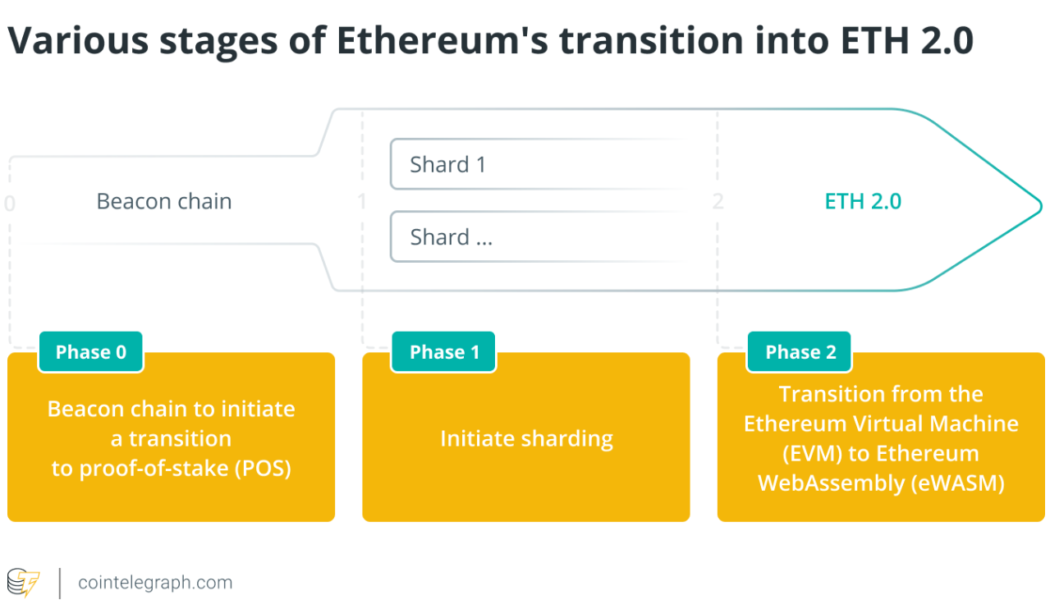

Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2. Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later. The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the...

Bitcoin wobbles on Wall Street open as Ethereum hits $1.6K in 6-week high

Bitcoin (BTC) took a step back as Wall Street trading began on July 22 after recovering most of its previous losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls fail to sustain assault on multi-week high Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD encountering fresh resistance near $24,000. The pair had spent the past 24 hours slowly clawing back lost ground after news that Tesla had sold most of its BTC holdings. With the pre-announcement high of $24,280 still in force, bulls saw something of a setback as Wall Street opened on the day, with BTC/USD losing around $400. Analyzing the current order book structure on major exchange Binance, on-chain monitoring resource Material Indicators warned that the overall bear market structure re...

Ethereum Classic soars 100% in nine days outperforming ETH as ‘the Merge’ approaches

Ethereum Classic (ETC) has been outperforming its arch-rival Ethereum’s native token Ether (ETH) during the current crypto market rebound with the ETC/ETH pairs at 10-month highs. Why is ETC beating ETH? ETC’s price has risen to $27 on July 22, amounting to a 100% gain in nine days after bottoming out at $13.35. Comparatively, ETH’s price has seen a 64% rally in U.S. dollar terms. ETC/USD versus ETH/USD daily price chart. Source: TradingView Ethereum’s rebound has been among the sharpest among the top cryptocurrencies, primarily due to the euphoria surrounding its potential network upgrade in September. Dubbed “the Merge,” the long-awaited technical update will switch Ethereum from proof-of-work (PoW) to proof-of-stake (PoS). Anyone who believes the #Eth...

Finance Redefined: DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to leverage Pocket’s distributed network of 44,000 nodes to access on-chain data from various blockchains, and gamers are plugging in DeFi through the Razer reward partnership. The majority of the top 100 DeFi tokens traded in green, with many registering double-...