Europe

Lithuania aims to tighten crypto regulation and ban anonymous accounts

In its efforts to fight money laundering risks and the possible schemes of Russian elites circumventing financial sanctions, the 2.8-million nation of Lithuania is planning to tighten its scrutiny over crypto. As the local Ministry of Finance announced on Wednesday, June 8, various ministries of the Lithuanian government approved legal amendments to anti-money laundering (AML) and countering the financing of terrorism in the crypto sector. The amendments to the current law — should they later be approved by the Seimas, Lithuania’s legislature — would stiffen the guidelines for user identification and prohibit anonymous accounts. The new regulations would also tighten up demands for exchange operators — from January 1, 2023, they will be obliged to register as a corporate body w...

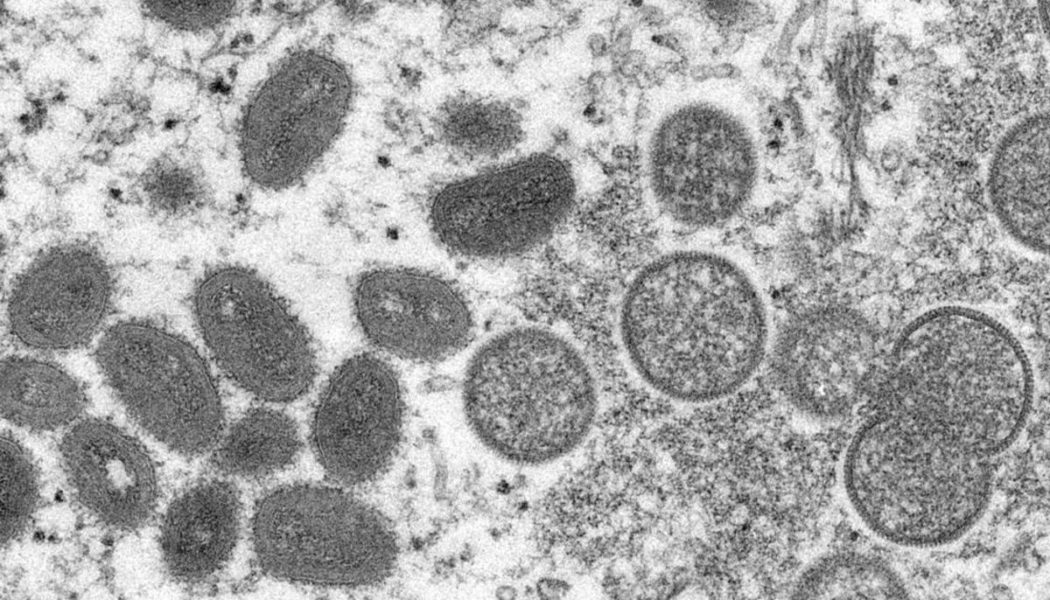

WHO Advisor Suggests Monkeypox Spread by European Raves

Dr. David Heymann, former head of the World Health Organization’s (WHO) emergencies department and now a leading advisor, suggested that sexual transmission at two raves in Spain and Belgium may have spurred the recent outbreak of Monkeypox. However, names and details of the events were not shared. “We know monkeypox can spread when there is close contact with the lesions of someone who is infected, and it looks like sexual contact has now amplified that transmission,” Heymann told The Associated Press. Symptoms of Monkeypox—similar to past cases of smallpox though clinically less severe—include fevers, chills, muscle pains, headaches, and lesions on the face or genitals. The recovery period is usually a few weeks and does not require hospitalization. In the past, Monkeypox has typically s...

Asset manager Grayscale announces maiden ETF in Europe

The Grayscale Future of Finance UCITS ETF tracks the Bloomberg Grayscale Future of Finance Index The ETF will list on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra Digital asset management firm Grayscale on Monday issued a press release revealing that it is stretching its offering to European investors by listing its first European EFT. The Grayscale Future of Finance UCITS ETF will be a stark indicator of the evolution of Grayscale to the next level. The first in Europe The ETF offering is planned to get listed on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra under the ticker GFOF. It is structured to allow investors to interact with firms at the intersection of virtual assets, technology, and finance. The new offering will tra...

Digital euro could come as soon as 2026 — ECB official

Fabio Panetta, an executive board member of the European Central Bank, or ECB, has said that a digital euro could come within four years, potentially designed with a person-to-person payment solution. In a Monday speech at the National College of Ireland, Panetta said the ECB could start the development and testing of solutions toward providing a digital euro for members of the European Union in 2023, a phase that could take up to three years. He added that making the digital currency legal tender and for use in P2P payments could help promote adoption. Panetta also commented on the recent market volatility for cryptocurrencies, with TerraUSD (UST) depegging from the U.S. dollar and the price of many major coins including Bitcoin (BTC) dropping. According to the ECB official, stablecoins, ...

Chairman of the Digital Euro Association: ‘The primary aim of the digital euro is still not clear’

The European Central Bank (ECB) is planning to launch a prototype of the digital euro in 2023. In the next five years, Europe could have its own central bank digital currency (CBDC) up and running. However, there are still many questions surrounding the prospective digital currency. In what form could it be issued? Is the ECB too late to the CBDC party, especially compared to other central banks such as that of the People’s Republic of China? To address these and other questions, Cointelegraph auf Deutsch spoke with Jonas Gross, chairman of the Digital Euro Association (DEA) and member of the expert panel of the European Blockchain Observatory and Forum. New digital cash Gross said that compared to digital cash issued by a commercial bank, central bank money carries fewer risks. A commerci...

Head of Bitstamp’s European arm becomes latest CEO of global crypto exchange

Bitstamp, one of the oldest crypto exchanges in the world, has announced the appointment of Jean-Baptiste (JB) Graftieaux as its new global CEO following the departure of Julian Sawyer. In a Monday announcement, Bitstamp said Sawyer, who first became CEO of the crypto exchange in October 2020, “has decided to pursue other opportunities.” Graftieaux took over the position on May 7, having been the Bitstamp Europe CEO since May 2021. According to the exchange, Graftieaux has 20 years of experience in “crypto, payments, and financial sectors,” having first joined Bitstamp in November 2014 as the firm’s chief compliance officer following five years at PayPal. “JB was with Bitstamp in its early days, and has admirably led our European business over the past year,” said Bitstamp’s board of direc...

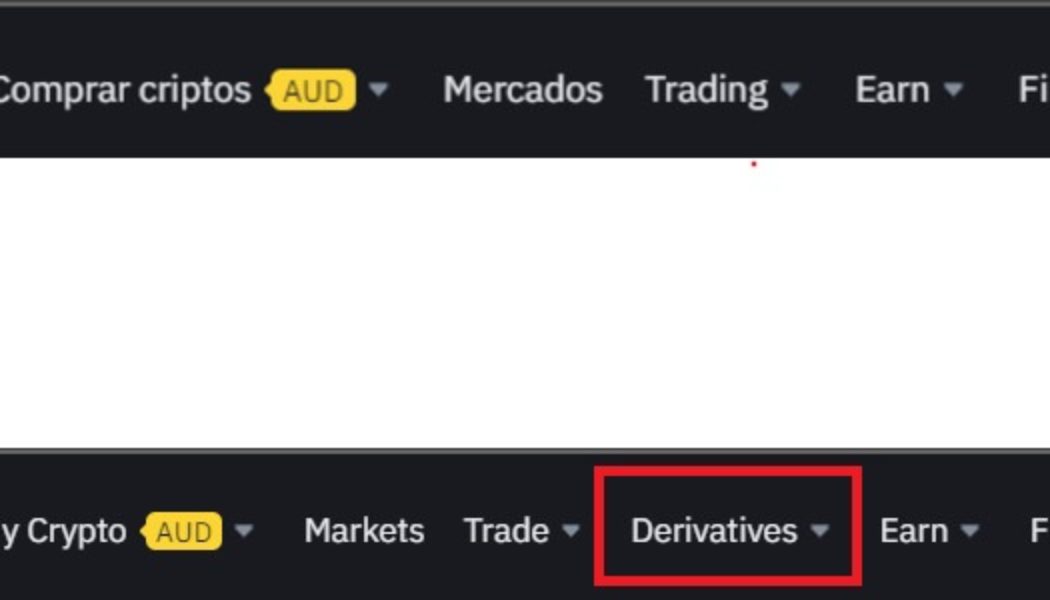

Binance reportedly halts crypto derivatives service in Spain

Binance stands as one of the most persistent crypto exchanges when it comes to gaining regulatory approval and operational licenses from regulators across the world. In this effort to operate as a fully licensed financial institution, the exchange has stopped offering it’s crypto derivatives services in Spain as it reportedly awaits approval from the Spanish regulator, Comisión Nacional del Mercado de Valores (CNMV). As evidenced by Binance’s official Spanish website, the crypto exchange removed the derivatives drop-down menu, which is still available on the global version. According to local news publication La Información, the move to hide derivatives offering in Spain comes as a way to comply with the requirements set by CNMV, a.k.a. the National Securities Market Commission....

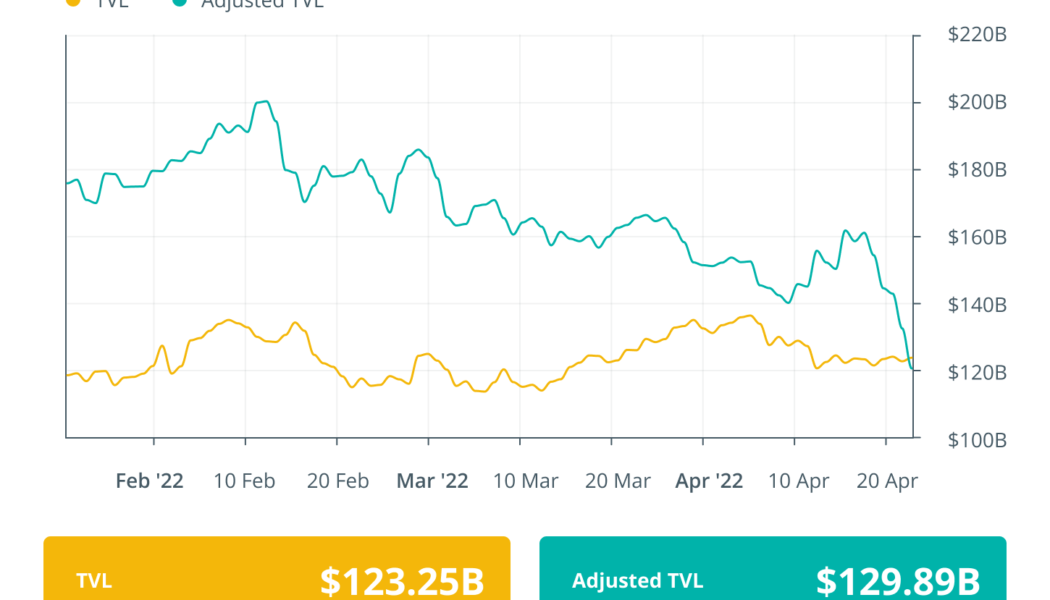

Finance Redefined: DeFi protocols lost $1.6B, EU to rethink DeFi approach, and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments from an adoption perspective and protocol developments. The European Commission added a new chapter on DeFi, showing the growing impact of the nascent ecosystem, while a county in the United States State of Virginia wants to put its pension fund in a DeFi yield. DeFi exploits became the center of attention again as recent research shows that in the first two quarters of 2022, DeFi protocols have lost $1.6 billion to various exploits. Rari Fuze hacker, who got away with $80 million worth of funds, was offered a $10 million bounty. The DeFi tokens also made a bullish comeback toward the end of the past week. However, the overall weekly performance remained in the red. European Commission report suggests ret...

EU commissioner calls for global coordination on crypto regulation

Mairead McGuinness, the commissioner for financial services, financial stability and capital markets union at the European Commission, is calling for global regulators to work together to address potential risks in the crypto market. In a Sunday opinion piece in political media outlet The Hill, McGuinness said the European Union and the United States could help lead the world in a regulatory approach for cryptocurrencies that considers the benefits of the innovative technology while addressing “significant risks.” The EU commissioner pointed to the volatility of certain assets, the risk of insider trading, the possibility of crypto being used by Russia to evade sanctions and environmental concerns. “To make rules on crypto fully effective, crypto requires global coordination and joint inte...

Belgian financial regulator FSMA to regulate crypto exchange services

A new rule imposed by Belgium’s financial regulatory agency, the Financial Services and Markets Authority (FSMA), will now require crypto exchanges and custodial wallet services in the region to register within a sharp deadline. Starting tomorrow, May 1, legal individuals and entities that wish to provide crypto exchange services or custodial wallets in Belgium will have to register in advance, according to the information released by the FSMA. As from 1 May 2022, providers of exchange services between #virtual #currencies and legal currencies, or custody #wallet services will have to register with the #FSMA. Please consult the FAQs. https://t.co/P44mkovn5L pic.twitter.com/aAdtQ9Dqwx — FSMA (@FSMA_info) April 29, 2022 Crypto businesses in Belgium that have been already operating before thi...

Grayscale to expand crypto fund offering into Europe

Digital asset manager Grayscale Investments is planning to expand its product offerings into Europe to tap into growing institutional demand for cryptocurrencies in the region, CEO Michael Sonnenshein confirmed Tuesday. In an interview with Bloomberg, Sonnenshein said the company was holding meetings with local partners to discuss how Grayscale’s suite of products would be rolled out in the region. The company hasn’t made any definitive plans regarding which exchanges and countries would be supported initially, though Grayscale plans to launch pilot tests in several markets across the European Union. Sonnenshein explained that Grayscale would be looking at investor behaviors and local regulations in determining its product rollout. “Although the EU is unified, we don’t view the entir...

21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold. The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aiming to provide inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold. Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold. The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP. “Gold has hi...