Fees

How not to Bitcoin: User pays 1,000x fee to send 4 BTC

Fat fingers? A Bitcoin (BTC) user spent over $200 to make a transaction, paying astronomically above the average fee. In a transaction that entered Bitcoin block 760,077, a user paid 1,136,000 satoshis, (0.0136 BTC or $220.52) to move 3.8 BTC ($63,000). This extraordinarily high fee is a whopping 1,000 times the usual Bitcoin transaction fee, as at block height 760,077, the average transaction fee was roughly $0.20. Twitter user Bitcoin QnA first spotted the out-of-the-ordinary transaction, asking, “Y tho?” The Bitcoin educator told Cointelegraph that “Ultimately, we’ll never know [why they paid high], but there are a few possible answers.” QnA listed the following: “1. Using a wallet with terrible fee estimations 2. A user making a typo when manually entering their fee rat...

3 major mistakes to avoid when trading cryptocurrency futures markets

Many traders frequently express some relatively large misconceptions about trading cryptocurrency futures, especially on derivatives exchanges outside the realm of traditional finance. The most common mistakes involve futures markets’ price decoupling, fees and the impact of liquidations on the derivatives instrument. Let’s explore three simple mistakes and misconceptions that traders should avoid when trading crypto futures. Derivatives contracts differ from spot trading in pricing and trading Currently, the aggregate futures open interest in the crypto market surpasses $25 billion and retail traders and experienced fund managers use these instruments to leverage their crypto positons. Futures contracts and other derivatives are often used to reduce risk or increase exposure and are not r...

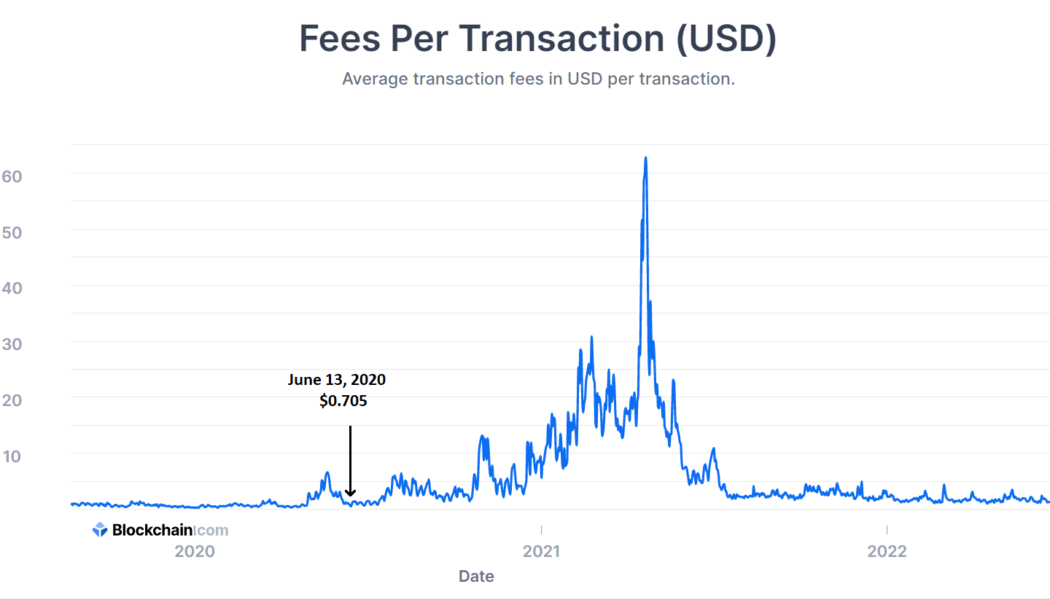

Average Bitcoin transaction fee drops under $1 as network difficulty recovers

The average transaction fees on the Bitcoin (BTC) blockchain fell below $1 for the first time in over two years, further strengthening its use case as a viable mainstream financial system. High transaction fees over blockchain networks work against the users, especially when making low-value transactions. For example, transaction fees over Ethereum (ETH) blockchain skyrocketed several times during the nonfungible token (NFT) hype, inducing stress on general users. While the Bitcoin ecosystem has also endured its fair share of high transaction fees in the past, timely upgrades — including the Lightning Network and Taproot — guarantee faster and cheaper transactions over time. As of Aug. 22, the average Bitcoin transaction fees fell down to $0.825, a number last seen on June 13, 2020. Averag...

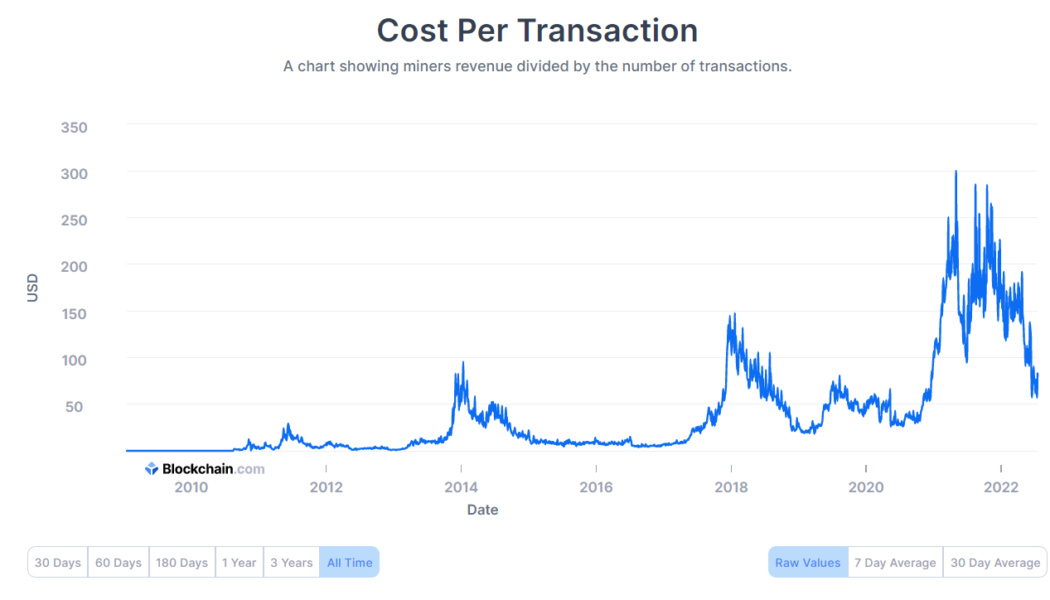

Bitcoin per transaction cost goes down every four years, coincidence?

Diving deep into the thirteen-year-old Bitcoin (BTC) ecosystem makes one come across interesting patterns powered organically by investor sentiment and market conditions. With BTC’s per transaction cost coming down to $56.846 on July 14, the ecosystem unveiled a cycle wherein the per transaction costs invariably fall every four years. The cost per Bitcoin transaction is calculated by dividing miners’ revenue by the number of transactions, thus implying an unpredictive trend — however, data from Blockchain.com reveals a pattern many would find satisfying. Bitcoin cost per transaction YTD. Source: blockchain.com The cost per transaction dropped over 81% in July 2022 from its all-time high of $300.331 in May 2021, factored by a combination of a prolonged bear market and fewer on-chain t...

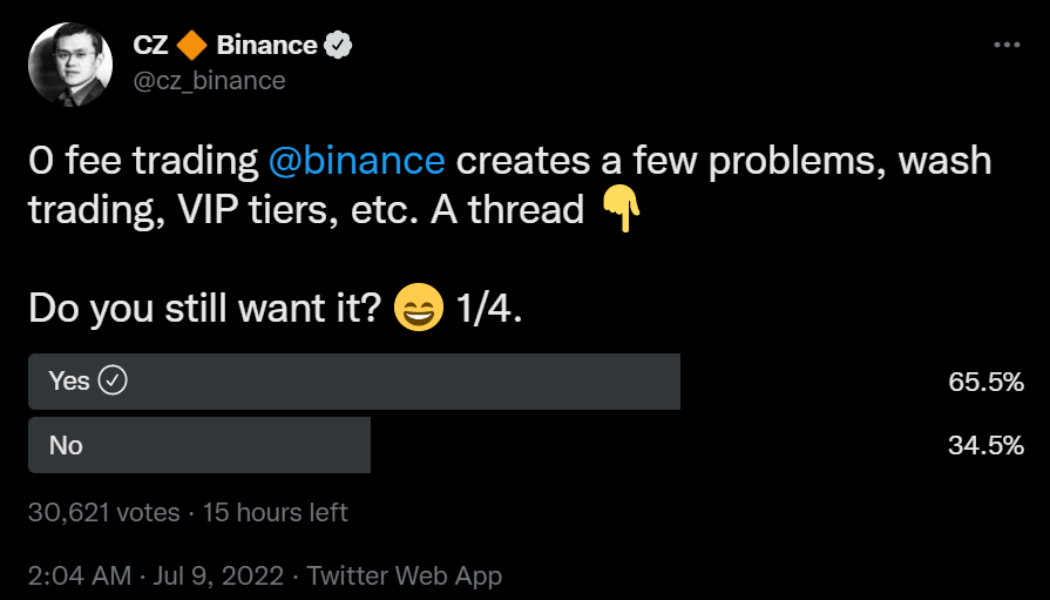

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

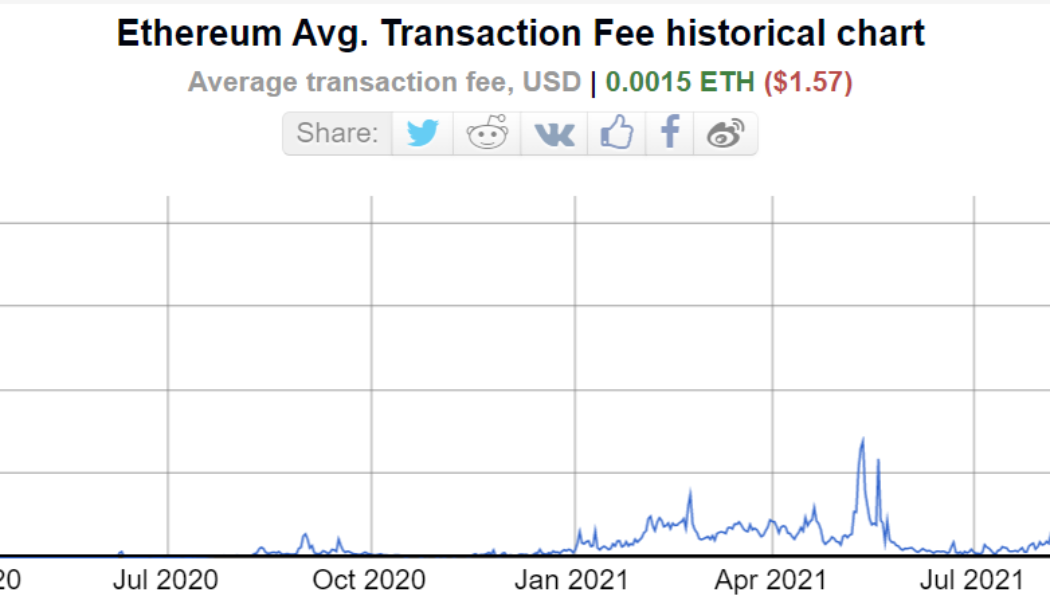

Ethereum average gas fee falls down to $1.57, the lowest since 2020

The Ethereum (ETH) ecosystem’s biggest roadblock to mainstream dominance is often attributed to the extremely high transaction fees or gas fees it requires to complete a transaction. However, with Ethereum’s average gas fees coming down to 0.0015 ETH, the narrative is set to change. The average transaction fee on the Ethereum blockchain fell down to 0.0015 ETH or $1.57 — a number previously seen in December 2020. However, starting in January 2021, Ethereum’s gas fees surged owing to the hype around nonfungible tokens (NFT), decentralized finance (DeFi) and a promising bull market. Ethereum average transaction fee YTD. Source: BitInfoCharts For nearly two years, between Jan. 2021 and May 2022, the average gas fee required by the Ethereum network was roughly $40, with May 1, 2022 recor...

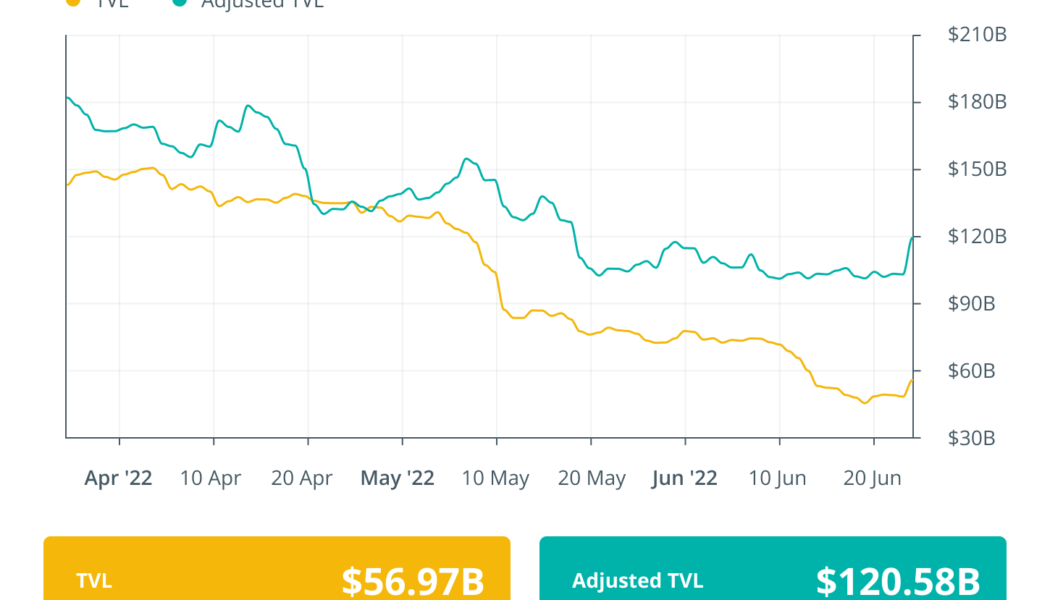

Finance Redefined: Uniswap goes against the bearish trends, overtakes Ethereum

This past week, the decentralized finance (DeFi) ecosystem tried gaining some momentum amid the bear market crash. Uniswap saw a trend reversal and overtook Ethereum regarding network fees paid. However, not all DeFi protocols were as lucky, as Bancor had to pause its “impermanent loss protection” in the wake of a hostile market. DappRadar’s report shows that the GameFi ecosystem continues to thrive despite the current downturn in the market. Solend invalidates Solana whale wallet takeover plan with second governance vote. The top 100 DeFi tokens showed signs of recovery after last week’s mayhem, and several of the tokens registered double-digit gains. DeFi Summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms Decentralized exchange (DEX) Uniswap has overtaken its host blockchai...

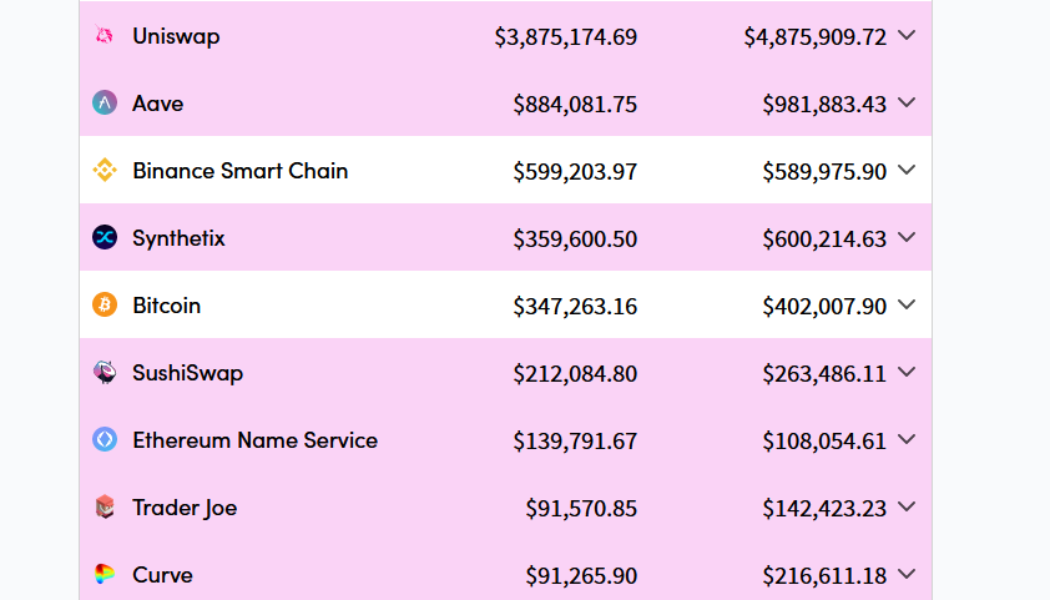

DeFi summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms

Decentralized exchange (DEX) Uniswap has overtaken its host blockchain Ethereum in terms of fees paid over a seven-day rolling average. The surge appears part of a recent spate of high demand for DeFi amid the current bear market. Decentralized finance (DeFi) platforms such as AAVE and Synthetix have seen surges in fees paid over the past seven days, while their native tokens, and others such as Compound (COMP) have also boomed in price too. According to data from Crypto Fees, traders on Uniswap accounted for an average daily total of $4.87 million worth of fees between June 15 and June 21, overtaking the average fees from Ethereum users which accounted for $4.58 million. Uniswap’s most advanced V3 protocol (based on the Ethereum mainnet) accounted for the lion’s share of the total f...

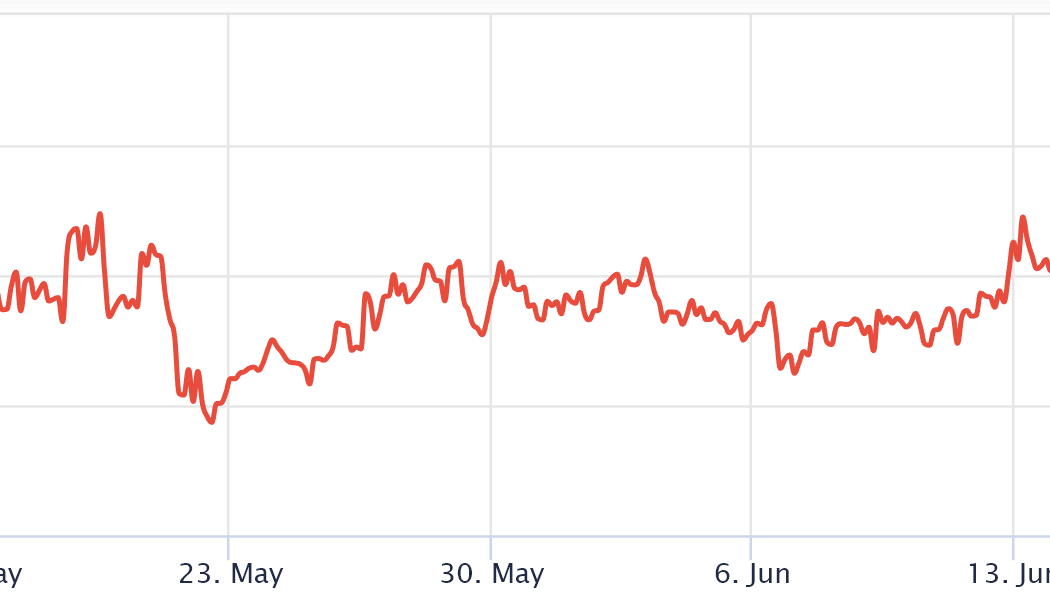

Synthetix racks up over $1M in daily fees as SNX token value surges 100%

Layer-2 scaling solution Synthetix recently collaborated with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC, & sUSD/3CRV, allowing investors to cheaply convert synths such as sETH to Ether (ETH). Given the investors’ willingness to hold tokens instead of synths, the protocol racked up over $1.02 million in trading fees — overshadowing Bitcoin’s (BTC) daily performance by five times. Synthetix, Ethereum-based decentralized finance (DeFi) protocol, created a buzz across the crypto ecosystem after witnessing a sudden increase in trading activities and an unprecedented comeback of its in-house token, SNX, during an unforgiving bear market. Crypto fees of popular projects. Source: cryptofees.info As a direct result of the massive trading volumes, the SNX...

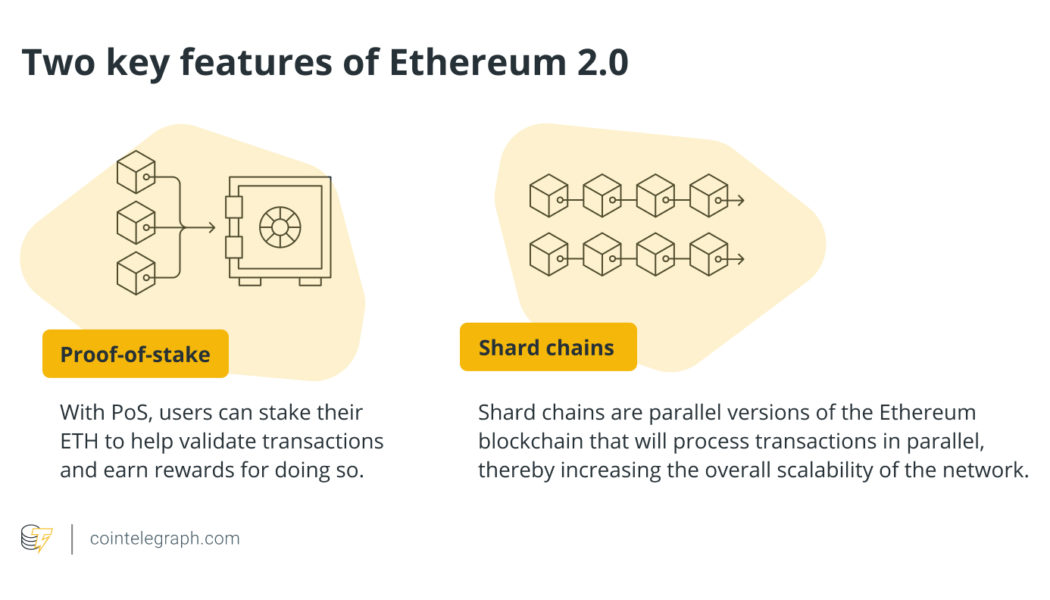

Will the Ethereum 2.0 update reduce high gas fees?

Purpose of Ethereum 2.0 The primary goal of the Ethereum 2.0 update is to improve scalability so that the network can handle more transactions without delays or high fees. While the full effects of the update will not be felt until it is fully rolled out, some of the possible use cases for Ethereum 2.0 include: Supporting the large-scale enterprise adoption of blockchain technology in private corporations and businesses; Creating more decentralized autonomous organizations (DAOs) and governance models based on smart contracts and trustless interactions; Ethereum token launches that will allow new projects to fundraise and launch their own tokens on the Ethereum network; The further expansion of nonfungible tokens (NFTs) and other digital assets that can be stored on the...