Finance

Access Bank acquires Kenya’s Transnational Bank

Following its first announcement in October 2019, Access Bank Plc has announced the successful completion of the acquisition of Transnational Bank Plc, of Kenya (TNB). The Bank made this known through a statement signed by its Company Secretary, Sunday Ekwochi. “Access Bank Plc is pleased to inform the investing public and the Nigerian Stock Exchange of the Bank’s successful completion of the acquisition of Transnational Bank (Kenya) Plc. This follows the receipt of full regulatory approvals and fulfillment of all conditions precedent to completion,” the statement read. Commenting on the acquisition, Herbert Wigwe, the Group Managing Director, Access Bank PLC, said, “We are excited to make an entry into the vibrant Kenyan market. We pledge to put our customers at the forefront of everythin...

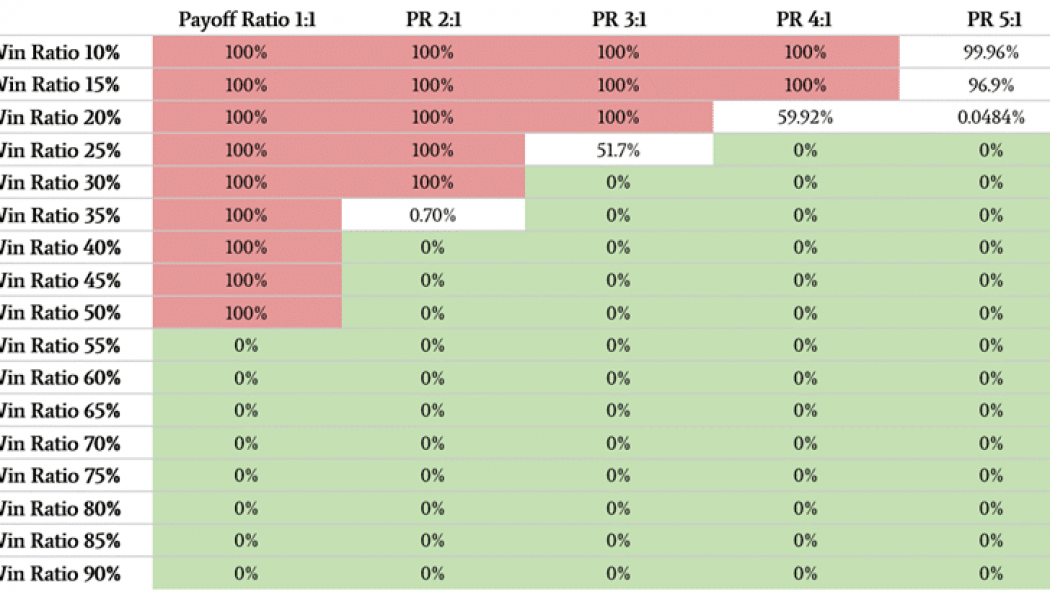

6 Terms You Have To Know To Trade Forex

Right now, a lot of people around the world are looking for new ways to invest. Market upheaval around the world has shaken confidence in traditional stocks, and as some alternative markets have shown resilience, there’s some understandable curiosity about how to invest more creatively. For some, this has translated to more interest in cryptocurrency. We mentioned when discussing ‘The Value of Digital Currency During the Age of COVID-19’ that some are now looking to fund their businesses with digital assets. And the same is true of portfolios. Bitcoin and its fellow cryptocurrencies have performed fairly well in this difficult time, prompting some investors to go ahead and give them a shot.That said, cryptocurrency is still a fairly bold option for a lot of people. They may ...

Live Nation Shares Bounce on Encouraging Vaccine Trial

Stocks of out-of-home entertainment companies got a boost from biotech company Moderna’s announcement on Tuesday. As markets reacted enthusiastically to a promising coronavirus vaccine trial, shares of concert promoter Live Nation leaped 12.2% to $52.09 on Wednesday (July 15) before closing at $51.84, up 11.7%. On Tuesday, biotech company Moderna published the results of an initial study for a coronavirus vaccine called mRNA-1273. The vaccine “elicits a robust immune response” in all trial participants, said chief medical officer Tal Zaks in a statement, and will enter the next phase — with approximately 30,000 participants — later this month. Jumps in other entertainment companies’ stocks reflect how desperate investors were for good news about markets brought to a...

ESET Research Dissects Evilnum Group as its Malware Targets

ESET researchers are releasing their in-depth analysis into the operations of Evilnum, the APT group behind the Evilnum malware. According to ESET’s telemetry, the targets are financial technology companies – for example, platforms and tools for online trading. Although most of the targets are located in EU countries and the UK, ESET has also seen attacks in countries such as Australia and Canada. The main goal of the Evilnum group is to spy on its targets and obtain financial information from both the targeted companies and their customers. “While this malware has been seen in the wild since at least 2018 and documented previously, little has been published about the group behind it and how it operates,” says Matias Porolli, the ESET researcher leading the investigation into Evilnum. “Its...

Nedbank Takes Home 5 Accolades at the 2020 Global Banking and Finance Awards

Image sourced from Nedbank Nedbank had revealed that it walked home with five accolades at this year’s International Banker Awards for the Middle East and Africa. These awards included recognition for the Best Banking Technology Implementation, Most Innovative Digital Branch Design, and Most Innovative Retail Banking App in South Africa in 2020. Nedbank also took top honours as the Best Retail Bank in South Africa for the second consecutive year, and Nedbank CIO, Fred Swanepoel was announced CIO of the Year in South Africa in the Technology Leadership Awards category. According to Ciko Thomas, Group Managing Executive for Nedbank Retail & Business Banking, the numerous awards validate Nedbank’s commitment to constant innovation – particularly in the digital space. “Nedbank’s continuous...

UBA Group appoints deputy managing directors

The United Bank for Africa Plc (UBA), a pan-African financial services group, on Tuesday announced the appointments of Mr Ayoku Liadi and Oliver Alawuba as Deputy Managing Directors. The bank in a statement in Lagos, said the Deputy Managing Directors would be in charge of UBA’s Nigeria and Africa businesses, respectively. The Group Chairman, Mr Tony Elumelu, said in the statement that the appointments were a representation of the groups’ strategic recognition now representing in excess of 40 per cent of the Group revenue. “In 2005, we set out our pan-African vision. Fifteen years later, we are present in 20 African countries, serving over 20 million clients, leveraging our service culture and technology platform, to provide an integrated and seamless customer offering across the continent...

The Value of Digital Currencies During the Age of COVID-19

Sourced from Hacker Noon. “Money is no longer the commodity it was a decade ago. How we acquire money is changing, and so is the form of money,” writes John Lombela, MD of African investment and tech company Cryptovecs Capital. He says that with the changing business landscape and the digital evolution, the only way one can define their digital future is by becoming familiar and looking at new digital assets especially if they are seeking funding for their business. “Gone are the days of depending on a bank loan or family and friends investing in your business. Entrepreneurs and those seeking funding can now consider cryptocurrency lending because it offers high yielding gains through margin trading on specific exchanges by lending cryptocurrencies,” Lombela continues. This move has result...