Funding

How to incorporate a DAO and issue tokens to be ready to raise money from VCs

What is a DAO? A DAO, or decentralized autonomous organization, is an online-based organization that exists and operates with no single leader or governing body. DAOs are run by code written on a blockchain like Ethereum (ETH) and are owned and operated by the people who use them. There are many different types of DAOs, but they all have one thing in common: they are decentralized, meaning that decisions about the organization’s future are decided by the collective group and not a single individual. This decentralization is what makes DAOs promising, as it theoretically removes the possibility of corruption or manipulation by a single entity. Smart contracts (and not people) execute the terms and conditions of the organization, making them incredibly efficient and resilient to change...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

VC Roundup: Gaming, crypto fintech and blockchain infrastructure dominate venture capital rounds

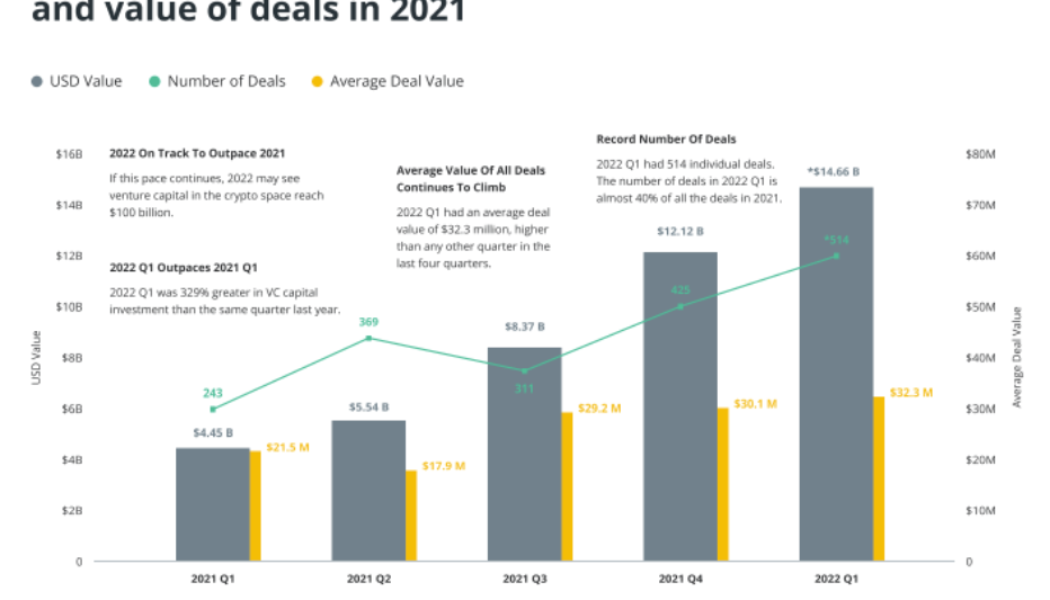

Cryptocurrency markets remain caught in a macro-based downtrend, with Bitcoin (BTC) and Ether (ETH) showing further signs of weakness at the end of April. But, venture capital activity in the crypto and blockchain sectors is the strongest it has ever been, offering further evidence that major investors are looking beyond immediate price action and ignoring divisive bull/bear narratives. The latest edition of VC Roundup highlights the growing excitement surrounding Web3 gaming, decentralized finance (DeFi) and blockchain infrastructure. The first quarter of 2022 was brutal for crypto prices, but venture capital activity was the strongest ever. bloXroute secures $70M from major investors Blockchain distribution network provider bloXroute has raised $70 million in funding to continue de...

Crypto Biz: The Web3 arms race is upon us, April 14–20, 2022

“Web3” used to be an empty industry buzzword that described the next iteration of the internet. In 2022, Web3 is still an annoying buzzword, but at least the blockchain community is trying to assign it real-world utility. This week’s Crypto Biz newsletter features several major funding rounds dedicated to building the Web3 economy. After reading through the stories, you can decide whether we’re actually getting closer to defining Web3. Oh, and remember all the buzz surrounding Special Purpose Acquisition Companies, or SPACs? A crypto-focused SPAC just closed an initial public offering on the Nasdaq, raising $115 million in the process. Framework Ventures allocates half of $400M fund to Web3 gaming Remember DeFi Summer 2020? Well, venture capitalists are gearing up for Web3 Summer 202...

Framework Ventures allocates half of $400M fund to Web3 gaming

Crypto-focused venture firm Framework Ventures has raised $400 million in new funding to invest in early-stage companies across the Web3, blockchain gaming and decentralized finance (DeFi) industries. The completed raise will go towards “FVIII,” an oversubscribed fund worth $400 million, the company announced Tuesday. Approximately $200 million of that total will be allocated to the emerging blockchain gaming industry. The venture firm, which had early exposure to DeFi, now has over $1.4 billion in assets under management. Framework Ventures was an early investor in projects such as Chainlink, Aave and The Graph. Like DeFi in 2020, gaming and Web3 have been identified as the next major growth plays for the blockchain industry. Axie Infinity — a popular play-to-earn game constructed a...

Crypto exchange CoinDCX raises $135M funding to support Indian Web3

Crypto exchange CoinDCX became India’s first crypto business to complete a Series D funding round, raising $135 million in support of various Web3 and crypto initiatives in the country. The latest funding round resulted in CoinDCX doubling its valuation to $2.15 billion, which was led by Pantera and Steadview and saw participation from prominent investors including Kingsway, DraperDragon and Republic. Existing investors such as B Capital Group — a venture capitalist firm from Facebook co-founder Eduardo Saverin — Coinbase, Polychain and Cadenza also joined in on the oversubscribed funding round to increase their investments in the crypto exchange. Excited to share that CoinDCX has raised over USD 135 million, in our latest Series D funding round. Another step closer to our dream of m...

KuCoin-backed companies launch $100M Web3 developer fund

Crypto exchange KuCoin’s venture capital arm and nonfungible token (NFT) marketplace have launched a $100 million “Creators Fund” to help bootstrap early-stage NFT projects at the intersection of art, sports and GameFi. KuCoin Ventures and the Windvane NFT marketplace have created the fund to help artists and creators showcase their work and scale their business to wider audiences, the companies announced Tuesday. The fund’s mandate is to support promising NFT projects that are contributing to the development of Web3, which refers to the next iteration of the internet powered by blockchain technology. Windvane is a new NFT marketplace from KuCoin that aims to tap into the crypto exchange’s large user base. At the time of writing, KuCoin was the fifth largest crypto exchange by volume, acco...

Crypto Biz: An eye-opening chat with Mr. Wonderful, April 7–13, 2022

The past seven days have reminded me of how lucky I am to have forged a career in the Bitcoin (BTC) and cryptocurrency industry. Cointelegraph sent a contingency of reporters to the Bitcoin conference in Miami, where we got to chop it up with billionaires, business leaders and hedge fund managers. I had the privilege of sitting down with Canadian businessman and Shark Tank star Kevin O’Leary, who actually revealed most of his crypto portfolio. I also got to interview Bloomberg’s senior commodity strategist Mike McGlone, who shed light on crypto market volatility, as well as Mark Yusko of Morgan Creek Capital. Yusko and I laughed at traditional 60/40 portfolio strategies, and I got to ask him a curious question: Who in their right mind is buying bonds today? This week’s Crypto Biz giv...

Ecosystem expansion and $45M funding round boost Boba Network (BOBA) price by 30%

The institutional adoption of cryptocurrencies has been gaining momentum over the past couple of years due to venture capitalists and money managers looking to the crypto market as the next investment class that will offer the greatest return. The Boba Network (BOBA) is the most recent protocol to benefit from institutional interest and the long search for an Ethereum (ETH) layer-two scaling solution capable of low-cost transactions and fast processing times. Data from Cointelegraph Markets Pro and TradingView shows that BOBA has gained 50.71% over the past week and a half after climbing from a low of $1.24 on March 27 to a daily high at $1.873 on April 5. BOBA/USDT 4-hour chart. Source: TradingView Three reasons for the climbing price of BOBA include the completion of a $45 million ...

Blockchain.com’s value rockets to $14B after new funding round: Reports

Cryptocurrency exchange and financial services firm, Blockchain.com, has reportedly raised new funding at a valuation of $14 billion. According to Bloomberg, the financing round was led by global venture capital firm Lightspeed Ventures and Baillie Gifford & Co., an investment management firm renowned for its early involvement in growth stocks such as Tesla. The funding round — which is yet to be publicly confirmed by Blockchain.com or the investors — reportedly saw the firms’ valuation increase from $5.2 billions to $14 billion. The total amount of funding raised is yet to be announced. Founded in 2011, Blockchain.com is now one of the world’s largest cryptocurrency companies, and offers a wide range of blockchain-based financial services from its exchange platform and crypto wallets ...

Blockchain.com’s value rockets to $14B after new funding round: Reports

Cryptocurrency exchange and financial services firm, Blockchain.com, has reportedly raised new funding at a valuation of $14 billion. According to Bloomberg, the financing round was led by global venture capital firm Lightspeed Ventures and Baillie Gifford & Co., an investment management firm renowned for its early involvement in growth stocks such as Tesla. The funding round — which is yet to be publicly confirmed by Blockchain.com or the investors — reportedly saw the firms’ valuation increase from $5.2 billions to $14 billion. The total amount of funding raised is yet to be announced. Founded in 2011, Blockchain.com is now one of the world’s largest cryptocurrency companies, and offers a wide range of blockchain-based financial services from its exchange platform and crypto wallets ...

Crypto Biz: Do you believe in Ethereum killers? Put your money where your mouth is, March 18–24

While crypto markets are still in a state of “fear,” as evidenced by Bitcoin’s Fear & Greed Index, the industry as a whole is giving us reasons to be bullish. Large venture funding rounds, growing adoption of decentralized governance models and new institutional-grade product offerings suggest that crypto is more than just daily chart patterns. This week’s Crypto Biz newsletter looks at a new Grayscale product that’s giving accredited investors more ways to bet on the so-called “Ethereum killers.” We also document two funding stories and draw your attention to the latest developments surrounding El Salvador’s Bitcoin (BTC) bond. Grayscale launches smart contract fund for Ethereum competitors Grayscale Investments, the world’s largest digital asset manager, has officially launched...