Funding

NFT creator Yuga Labs raises $450M, bringing company valuation to $4B

Yuga Labs, the creators of Bored Ape Yacht Club (BAYC) and new owners of the CryptoPunks and Meebits brands, announced it is now valued at $4 billion after its latest $450 million seed funding round. VC firm Andreessen Horowitz, or a16z, led the company’s first institutional investment, marking one of the largest seed rounds for any nonfungible token (NFT) collection to date. Other investors included Animoca Brands, FTX and MoonPay, as well as LionTree, Sound Ventures and Thrive Capital. The company plans to use the funds to scale its team, attract more creative, engineering and operations talent, as well as for future joint ventures and partnerships. To celebrate the occasion, Chris Lyons, a general partner at Andreessen Horowitz, loaned his Bored Ape to a16z, which upload...

VC Roundup: NFTs, crypto mortgages, 5G network and Web3 devs raise millions

The cryptocurrency market has failed to make significant headway in recent months, but that hasn’t stopped the industry’s builders from building. Nonfungible tokens (NFTs), crypto mortgages, blockchain-powered cellular networks and Web3 gaming have all piqued the interest of venture capitalists. These new and familiar investment themes headline the latest edition of VC Roundup, as venture funds continue to target blockchain’s most promising value plays. a16z execs back new NFT fund Andreessen Horowitz’s foray into the blockchain industry continued this month after a large segment of its investing team backed a new nonfungible token fund called Curated. The fund, which is worth $30 million, has the singular purpose of buying and holding NFT artwork. Among the a16z brass, Marc Andreess...

Exodus crypto wallet starts trading on SEC-registered platform

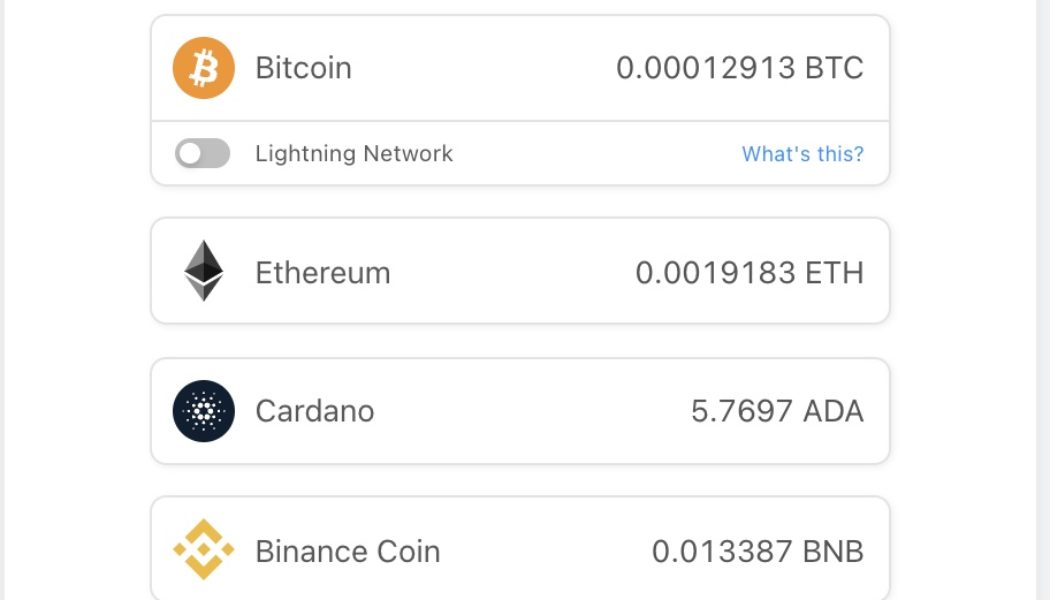

Major software cryptocurrency wallet Exodus has gone public on the digital asset securities firm Securitize Markets following a $75 million crowdfund capital raise. Exodus’ shares started trading on Securitize on Wednesday, allowing investors from all across the United States and international investors from more than 40 countries to trade the Exodus Class A common stock. Trading under the ticker symbol EXOD, the Exodus Class A common stock is digitally represented on the Algorand blockchain via common stock tokens. Tokenized shares in @Exodus_io are now trading on Securitize Markets. Retail investors included! With 24-7 order placement, 8am-8pm ET trading hours, near-instant deposits and promotional $0 fee trading, get started here: https://t.co/h55WEoAQMr pic.twitter.com/JasA5C7Qbx — Sec...

City-building startup Praxis secures $15M in Series A Funding

Peter Thiel-backed city-building startup Praxis has raised $15 million in Series A funding from a variety of crypto venture firms led by Paradigm Capital, Sam Bankman-Fried‘s Alameda Research and Three Arrows Capital. Dryden Brown of New York University and Charlie Callinan of Boston College co-founded Praxis, formerly Bluebook Cities, in 2019. they described their goal as: “building the city-crypto state to realize a more vital future,” according to the company website. Praxis wants to pivot away from “artificially scarce metaverses” to build a city-state that is organized around “shared values,” rather than the “labor market principles of the Industrial Age.” The cryptocurrency-run city will reportedly focus heavily on functional architecture and environmental technology. Money made from...

Ukraine accepts DOT, founder Gavin Wood donates $5.8 million

Calls from the crypto community for Ukraine to accept other cryptocurrencies have been answered. The official Ukraine Twitter account shared that it will now accept donations from Polkadot (DOT), while other cryptocurrencies will soon be added. The people of Ukraine are grateful for the support and donations from the global crypto community as we protect our freedom. We are now accepting Polkadot donations too: $DOT: 1x8aa2N2Ar9SQweJv9vsuZn3WYDHu7gMQu1RePjZuBe33Hv.More cryptocurrencies to be accepted soon. — Ukraine / Україна (@Ukraine) March 1, 2022 Gavin Wood, the co-founder of Polkadot had previously shared that if the Ukraine wallets were to add DOT, he would personally contribute $5 million. He made true on his promise, donating 298,367.2269896686 DOT, which is roughly...

Ukraine accepts Bitcoin, Ethereum, USDT donations to fund ongoing war

Within the first week of the Russia-Ukraine war, the Ukrainian government has reached out to the crypto community on Twitter for raising funds to support its civilians and troops. Ukraine has now started accepting Bitcoin (BTC), Ethereum (ETH) and Tether (USDT) as donations. As Russia threatens to take over Ukraine’s capital city of Kyiv, the government of Ukraine sought help from numerous international organizations to overpower the imminent threat. However, considering time is of the essence, the official Twitter account of Ukraine extended its call for help to Crypto Twitter. Stand with the people of Ukraine. Now accepting cryptocurrency donations. Bitcoin, Ethereum and USDT. BTC – 357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P ETH and USDT (ERC-20) – 0x165CD37b4C644C2921454429E7F9358d1...

Sequoia Capital launches crypto fund worth up to $600M

American venture capital firm Sequoia Capital has launched a new cryptocurrency fund as part of its ongoing efforts to bootstrap the next generation of promising crypto-focused startups. Bloomberg reported Thursday that Sequoia is allocating up to $600 million towards the new sector-specific fund. Shaun Maguire, a partner at Sequoia, described crypto as a “megatrend over the next 20 years” and called it “the future of money.” The new crypto fund is part of three new sub-funds that were introduced by Sequoia on Thursday. The new funds, which operate under the Sequoia Capital Fund, will rely on capital that’s already committed by the firm’s limited partners. Sequoia is no stranger to the cryptocurrency market, having financed dozens of projects in the space. As Cointelegraph reported, Sequoi...

2 key indicators cast doubt on the strength of the current crypto market recovery

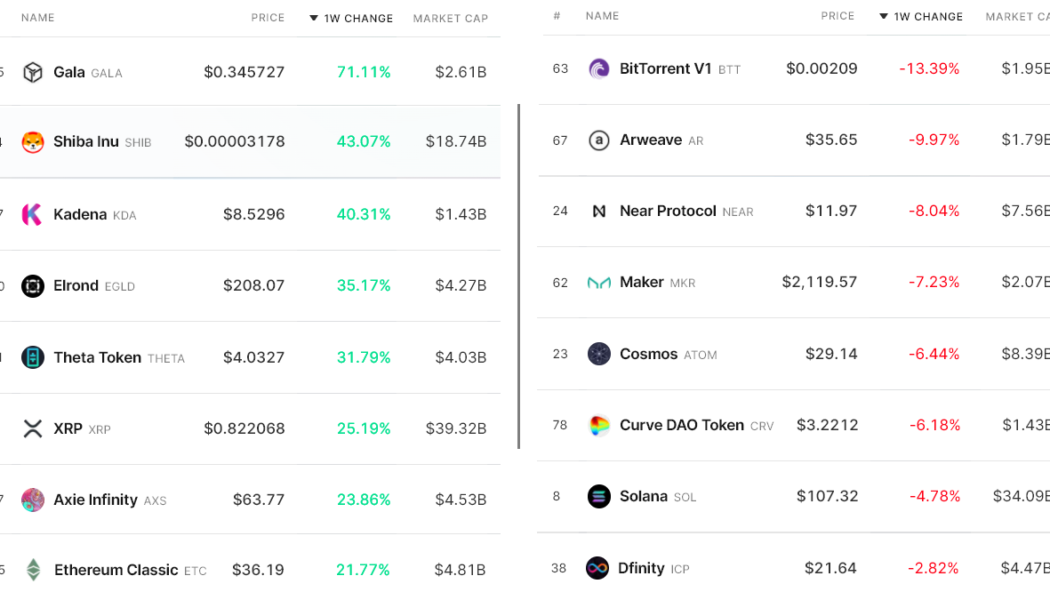

Analyzing the aggregate cryptocurrency market performance over the past 7 days could give investors the impression that the total market capitalization grew by a mere 4% to $2.03 trillion, but this data is heavily impacted by the top 5 coins, which happen to include two stablecoins. Excluding Bitcoin (BTC), Ether (ETH), Binance Coin (BNB) and stablecoins reflects a 9.3% market capitalization increase to $418 billion from $382 billion on Feb 4. This explains why so many of the top-80 altcoins hiked 25% or more while very few presented a negative performance. Winners and losers among the top-80 coins. Source: Nomics Gala Games (GALA) announced on Feb. 9 a partnership with world renowned hip-hop star Snoop Dogg to launch his new album and exclusive non-fungible token (NFT) campaign. Gala Game...

Ethereum price holds above $3K but network data suggests bulls may get trapped

When analyzing Ether’s (ETH) price chart, one could conclude that the 3-month long bearish trend has been broken for a few reasons. The current $3,100 price range represents a 43% recovery in 15 days and, more importantly, the descending channel resistance was ruptured on Feb. 7. Should Ether bulls start celebrating and calling for $4,000 and higher? That largely depends on how retail traders are positioned, along with the Ethereum network’s on-chain metrics. For instance, is the $30-plus transaction fee impacting the use of decentralized applications (dApps), or are there any other factors that will prohibit Ether’s price growth? Ether (ETH) price at FTX, in USD. Source: TradingView Since the 55.6% correction from the $4,870 all-time high to the cycle bottom at $2,...

Hashstack launches Open protocol testnet, offering under-collateralized loans

The DeFi lending and borrowing market has grown significantly in volume as new lending protocols continue to attract capital and NFT-backed loans become more popular. According to Dune Analytics, the top three platforms in terms of market capitalization are Aave (AAVE), Maker (MKR) and Compound (COMP). These platforms, however, still are facing issues when it comes to collateral requirements and volatile digital assets. Hashstack Finance is a DeFi platform whose crypto-native lending protocol, called Open, is trying to provide a solution to collateral requirements, specifically the over-collateralization of loans. Hashstack announced on Monday the release of its closed beta testnet that enables the opposite: autonomous under-collateralized loans. Built on the Harmony blockchain, ...