Funding

Sequoia China leads $25M equity round for DeFi wallet DeBank

DeBank, a cryptocurrency wallet focused on decentralized finance (DeFi) solutions, has closed new funding led by major venture capital firm Sequoia China. The firm announced Tuesday on Twitter that it raised $25 million, bringing DeBank’s total valuation to $200 million. Apart from Sequoia China, the funding round featured major crypto investment firms like Dragonfly, Hash Global and Youbi. The raise also included strategic funding from Coinbase Ventures, Crypto.com exchange, stablecoin provider Circle and hardware wallet maker Ledger. DeBank is a cryptocurrency wallet designed to track DeFi data, including decentralized applications or exchanges (DEX) and DeFi interest rates. It also lets users navigate and manage various DeFi assets and projects. The platform includes analytics for decen...

Crypto Biz: What’s up with Jack? Dec. 16–23

When you’re no longer at the helm of a publicly-traded company, you have more leeway to express controversial views. Former Twitter CEO Jack Dorsey took to social media this week to express his discontent over venture capital’s role in Web 3.0. Some of his Twitter followers agreed with his views, others disagreed and some even blocked him entirely. Below is the concise version of the latest “Crypto Biz” newsletter, which is sent to your inbox every Thursday. For a comprehensive breakdown of business developments over the last week, register for the full newsletter below. “You don’t own Web 3.0,” says Dorsey Dorsey’s gripe with Web 3.0 — a broad term that refers to a more decentralized and interconnected version of the internet — stems from th...

NFT-collateralized loan platform Arcade raises $15M in funding round

Arcade, a platform that allows users to utilize nonfungible tokens (NFTs) as loan collateral, has raised $15 million in a Series A funding round with participation from Pantera Capital. In a Wednesday announcement, Arcade said Pantera, Castle Island Ventures, Franklin Templeton Blockchain Fund, Golden Tree Asset Management, Eniac Ventures, Protofund, Probably Nothing Capital and Lemniscap in addition to angel investors BlockFi CEO Zac Prince and Quantstamp CEO Richard Ma were behind the investment in an effort to connect NFT-collateralized lending with the decentralized finance space. The platform is also coming out of a private release with $3.3 million in total loan volume secured on a total of $10 million in assets. Arcade co-founder Gabe Frank said NFTs account for a significant portio...

Binance VC arm leads $60M round in cross-chain protocol Multichain

Binance Labs, the venture capital and incubation arm of Binance cryptocurrency exchange, has led a financing round for the cross-chain protocol Multichain, previously known as Anyswap. Shortly after rebranding from Anyswap last week, Multichain has raised $60 million in a seed funding round led by Binance Labs, the firm officially announced on Dec. 21. Other participants in the raise included major VC firms and industry investors like Sequoia China, IDG Capital, Three Arrows Capital, Primitive Ventures, DeFiance Capital, Circle Ventures, Hypersphere Ventures, HashKey and Magic Ventures. Apart from providing capital investment for Multichain, Binance is also building a stronger relationship with the cross-chain protocol. On Dec. 20, Multichain announced that it is now officially recommended...

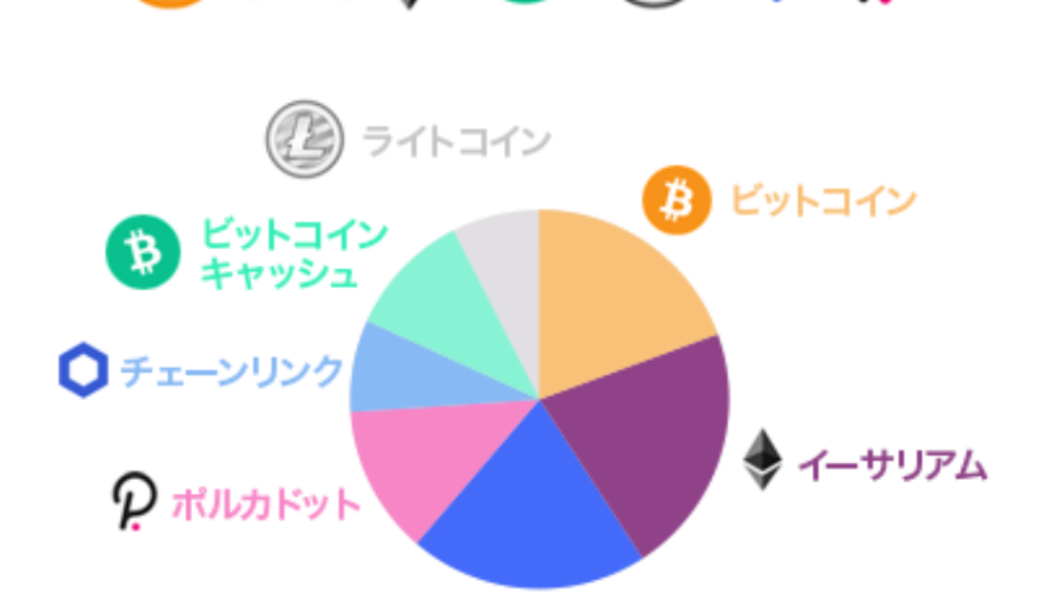

SBI Group launches crypto-asset fund for Japanese investors

Tokyo’s biggest finserv firm, SBI Group, will now allow general Japanese investors to purchase cryptocurrencies via its newly launched ‘crypto asset fund’. The fund is composed of seven cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK) and Polkadot (DOT). The crypto-asset fund, to be traded and operated by the SBI Alternative Fund, was established on Dec. 02 with a dedicated capital of 5 million yen, worth approximately $45,000 at the time of writing. However, the company may choose to release the capital in smaller break-ups of 1 million yen each. Source: SBI According to the official statement, investors will be required to go through an application process that includes an anonymous partnership agreement with SBI Al...

Crypto Biz: All I want for Christmas is Bitcoin, Dec. 9–16

On Wednesday, the United States Federal Reserve wrapped up its final policy meeting of 2021 by voting to keep interest rates at record lows. In doing so, the Fed set the stage for a series of interest rate hikes beginning in the spring, which will be accompanied by a more accelerated taper of its bond-buying program. While the Fed’s decision to reduce market liquidity could impact crypto investors in the short term, Bitcoin (BTC), Ether (ETH) and DeFi are carving out their own narratives heading into 2022. Those narratives could supersede the latest episode of central-bank tightening. Below is the concise version of the latest “Crypto Biz” newsletter. For a comprehensive breakdown of business developments over the last week, register for the full newsletter below. Block’s Cash App will all...

KKR leads $350M raise for crypto custody bank Anchorage Digital

Major cryptocurrency custody bank Anchorage Digital has closed a fresh funding round, bringing its valuation to over $3 billion. Anchorage Digital announced on Wednesday that it had raised $350 million in a Series D funding round led by equity investment giant KKR. According to the announcement, this is the first time for KKR to directly invest in equity in a company in the crypto industry. The company invested through its Next Generation Technology Growth Fund II, which is dedicated to developing equity investment in the technology space. “As a pioneer in enabling institutional investors to access digital assets, Anchorage has built a best in class, institutional-grade digital asset platform that combines the best practices of both modern security and usability,” KKR senior leader of tech...

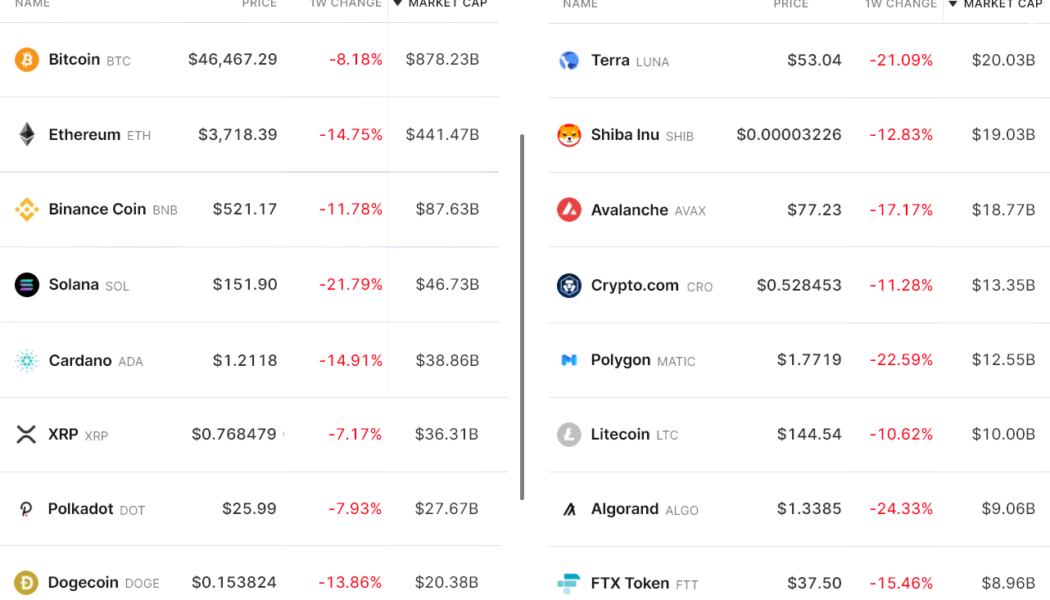

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...

UNN vice chancellor: Coronavirus pandemic most global challenge since World War II

Prof. Charles Igwe, the Vice-Chancellor of University of Nigeria, Nsukka (UNN) has said that COVID-19 pandemic is arguably the most global challenge since world war II. Igwe said this in Nsukka on Monday during UNN 1st Annual International Conference titled: “A Whole New World; Research, Development and Innovation in the Pandemic Era.” He said that COVID-19 which has killed many people across the globe as well as infected many others has affected the economy, lives, people’s ways of living in virtually every country of the world. “COVID-19 pandemic is the most serious global challenge since the world war II the world has witnessed. “As this has affected the economy, people’s ways of life and behaviour of entire people of the world,” he said. He commended federal government on handling the ...

Kwara to establish multi-billion naira cancer treatment centre

Kwara State Government has announced plans to establish a multi-billion naira Cancer treatment Centre to be situated at the Ilorin General Hospital. This is contained in a statement signed by Alhaji Bashir Adigun, the Special Adviser, Political Communication to Kwara Governor, AbdulRahman AbdulRazaq. According to him, the N2.5 billion recently donated to the state by the Abdul Samad Rabiu Initiative (ASR Africa) will form a huge chunk of funding for the modern facility. The governor said the centre along with the 12-bed intensive care unit, the modern dental and eye care facilities recently added to the general hospital was part of the huge investments. He said that these facilities would convert the General Hospital to a research facility (teaching hospital) for the take-off of the medica...