government

21 Year-Old Texas Airman Jack Teixeira Arrested For Leaking Confidential Pentagon Documents On Discord

He shared confidential information for clout. The post 21 Year-Old Texas Airman Jack Teixeira Arrested For Leaking Confidential Pentagon Documents On Discord appeared first on The Latest Hip-Hop News, Music and Media | Hip-Hop Wired.

Congress may be ‘ungovernable,’ but US could see crypto legislation in 2023

The United States House of Representatives finally elected a speaker last week, concluding a four-day, 15-ballot ordeal that left many wondering if political gridlock was now the new normal in the U.S., and if so, what the consequences would be. For example, were the concessions made by Republican Kevin McCarthy to secure his election as speaker ultimately going to make it difficult to achieve any sort of legislative consensus, making it impossible for the U.S. to raise its debt ceiling and fund the government later this year? Not all were optimistic. The House of Representatives will be largely “ungovernable” in 2023, Representative Ritchie Torres, a Democrat from New York, told Cointelegraph on Jan. 6, shortly before joining colleagues for that day’s series of ballots — which final...

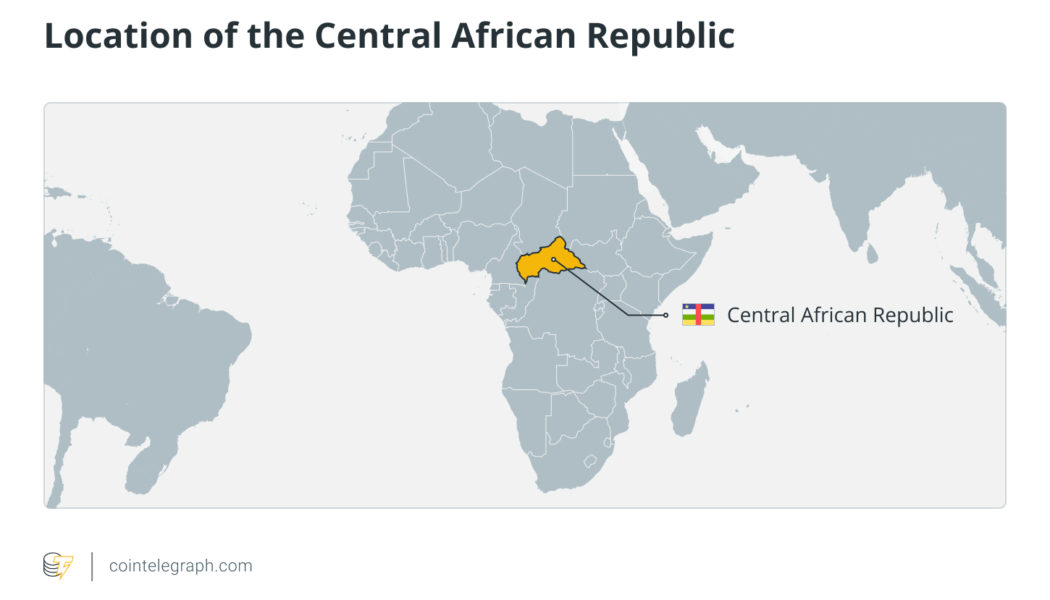

Bitcoin, Sango Coin and the Central African Republic

In the spring of 2022, the Central African Republic (CAR) became the first African country to adopt Bitcoin (BTC) as a legal tender. As the second country globally to recognize Bitcoin in such a fashion, the CAR followed in El Salvador’s footsteps. El Salvador has since boasted surging tourism numbers, a resilient economy and a healthy amount of free PR since allowing its citizens to make everyday purchases with the seminal cryptocurrency. The CAR, a substantially less economically developed economy than its Central American counterpart, would hope to emulate El Salvador’s success. Despite the nation’s vast natural resource wealth, the CAR is plagued by economic mismanagement, meager private and foreign investment, and systemic governmental issues. It is one of the poorest countries on the...

El Salvador’s Bitcoin strategy evolved with the bear market in 2022

Cryptocurrency adoption has been on the rise in El Salvador in recent years, with the country becoming the first in the world to adopt Bitcoin (BTC) as a legal tender. This landmark decision has attracted the attention of the global cryptocurrency community and has sparked discussions on the potential benefits and challenges of widespread adoption. El Salvador’s controversial move with its cryptocurrency adoption would not have been possible if it was not due to President Nayib Bukele, who garnered international attention after announcing the Bitcoin adoption plan and passed it into law. The legislation required all businesses within the country to accept Bitcoin as a form of payment for goods and services. As a legal tender, Bitcoin now has the same status as traditional fiat currencies, ...

Ripple CEO optimistic about US ‘regulatory clarity for crypto’

Ripple’s CEO, Brad Garlinghouse, shared in a Jan. 3 Twitter thread he’s “cautiously optimistic” about the United States gaining “breakthrough” regulatory clarity for the cryptocurrency industry in 2023. To mark the first day of the 118th Congress, Garlinghouse shared his hopes of 2023 being the year the U.S. gained regulatory clarity for crypto and added support for regulation is “bipartisan & bicameral.” Today is the first day of the 118th Congress. While prior efforts at regulatory clarity for crypto in the US have stalled, I am cautiously optimistic that 2023 is the year we will (finally!) see a breakthrough. A thread on why… — Brad Garlinghouse (@bgarlinghouse) January 3, 2023 Garlinghouse said the U.S. was not starting with a “blank slate” for regulation, r...

Algorand to support bank and insurance guarantees platform in Italy

Layer-1 blockchain platform Algorand has been chosen as the public blockchain to support an “innovative digital guarantees platform” to be used in Italy’s banking and insurance markets. The Algorand-supported platform is expected to be launched in early 2023. According to Algorand’s Dec. 13 announcement, this is the first time an EU Member State will use blockchain technology for bank and insurance guarantees. A bank guarantee is when a lending institution promises to cover a loss if a borrower defaults on a loan. It’s an alternative to providing a security bond or a deposit to a supplier or vendor. An insurance guarantee is similar but is offered by an insurance company rather than a bank. Algorand said that blockchain technology was ideally suited for the “Di...

$75M worth of FTX’s political donations at risk of being recalled due to bankruptcy: Report

Following the collapse of FTX and its Nov. 11 bankruptcy filing, $73 million worth of its political donations is currently at risk of being recalled to repay the failed exchange’s creditors, according to a report by Bloomberg. Speculators online allege that the former FTX CEO and his executives sought to influence industry regulations with their generous multimillion-dollar donations to politicians and super PACs. Sam Bankman-Fried and executives Ryan Salame and Nishad Singh are believed to have been high-paying donors to both the Republican and Democratic United States political parties. Many politicians who were at the receiving end of FTX’s generosity now face difficulty regarding what to do next, as they may be forced to return the money to the bankruptcy trustee. In order to...

Gensler’s approach toward crypto appears skewed as criticisms mount

Since taking over at the United States Securities and Exchange Commission (SEC), chairman Gary Gensler has repeatedly been referred to as the “bad cop” of the digital asset industry. To this point, over the past 18 months, Gensler has taken an extremely hard-nosed approach toward the crypto market, handing out numerous fines and enforcing stringent policies to make industry players comply with regulations. However, despite his aggressive crypto regulatory stance, Gensler, for the most part, has remained mum about several key issues that digital asset proponents have been talking about for a long time. For example, the SEC has still failed to clarify which cryptocurrencies can be considered securities, stating time and again that most cryptocurrencies in the market today could be classified...

FTX reportedly gets 3 more months to stop all operations in Japan

The Japanese subsidiary of the now-defunct cryptocurrency exchange FTX has received approval from local regulators to continue sorting out issues with withdrawals until next year. The Kanto Local Finance Bureau, a local financial regulator running under the Ministry of Finance of Japan, has issued a statement regarding FTX Japan operations, Reuters reported. The Japanese authority has postponed FTX’s business suspension deadline until March 9, 2023, extending the original time limit by three months. In mid-November, Japan’s Financial Services Agency (FSA) initially requested FTX Japan to suspend business orders by Dec. 9. According to the announcement, the Kanto Local Finance Bureau has ordered the extension of the deadline because FTX Japan has so far failed to return assets from custody ...