India

Indian crypto exchanges’ volume plunges down as 30% tax goes into effect

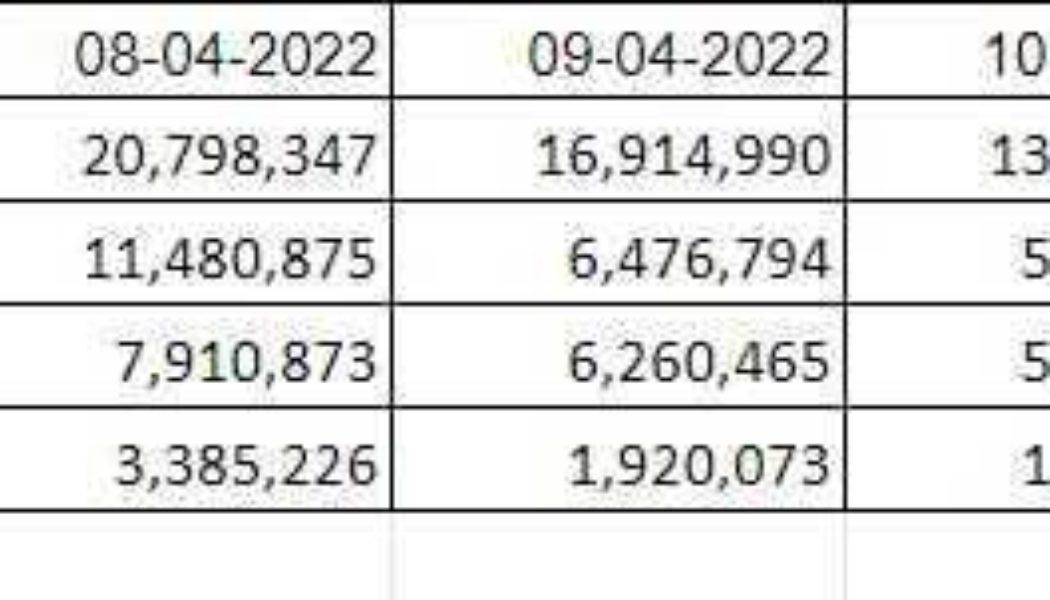

Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects. A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian crypto exchanges has declined as high as 70% in the past 10 days. Crypto Trading Volume on Major Indian Exchanges Source: Creabaco The trading volume on WazirX, the leading crypto exchange in India, declined from $47.8 million on April 1 to $13.2 million on April 10. CoinDCX’s trading volume dropped from $12.16 million to $5.76 million, ...

Museums in the metaverse: How Web3 technology can help historical sites

Metaverse events at ancient and historical sites could soon shape up to be an alternate future for tourism. Owners of physical castles and villas who have drafted up augmented reality blueprints of their properties think their ambitious plans to attract visitors in the metaverse will work, as virtual events can help them pay the hefty maintenance bills for their aging properties and also offer a chance to change historical narratives. The metaverse tourism model was expedited by downturns in tourism brought about by COVID-19, but the industry may have already been heading that way. Currently, major metaverse platforms are clunky, difficult to use and waiting for more “real estate” development, but firms are concentrating on what could be. Brands seem to be entering the metaverse en m...

How to Get Tickets to Diljit Dosanjh’s 2022 Tour

Indian superstar musician and actor Diljit Dosanjh will tour the US and Canada for the first time in three years in Summer 2022. Dosanjh’s “Born to Shine World Tour” features 10 North American concerts taking place in June and July. Get tickets here, and read on for more info including pre-sale details. What Is Diljit Dosanjh’s Next Tour? Advertisement Related Video Diljit Dosanjh’s “Born to Shine World Tour” features 10 North American dates, beginning at Vancouver’s Rogers Arena on Sunday June 19th. Additional dates include stops in Winnipeg, MB; Toronto, ON; Newark, NJ; Fairfax, VA; Dallas, TX; Houston, TX; Los Angeles, CA; and Oakland, CA. “It has been more than 2 years since I performed live with my last live show taking place in Mumbai early 2020, so I am incredibly excited for this t...

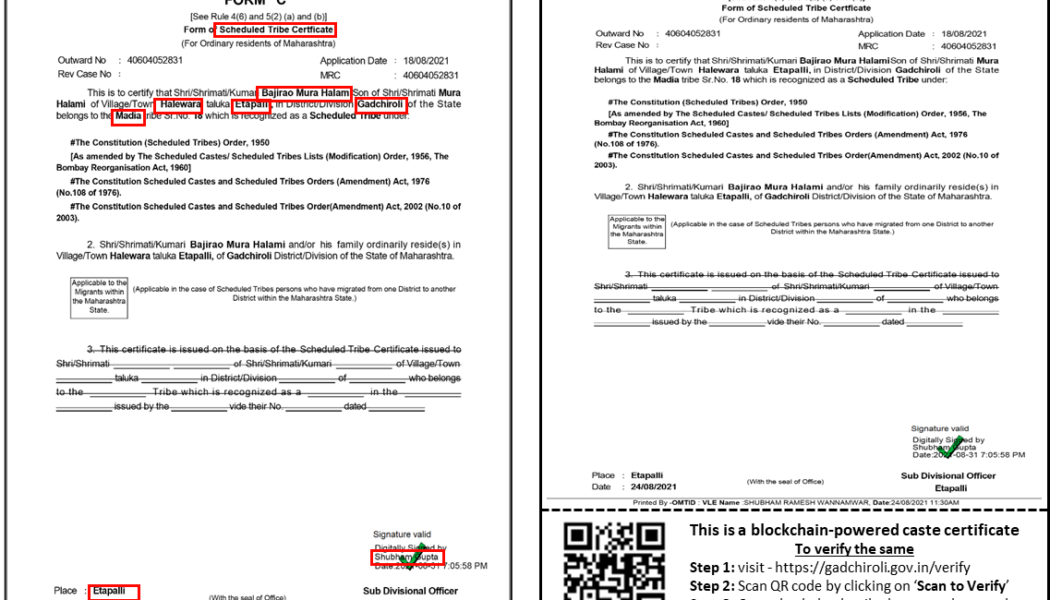

Indian state gov’t uses Polygon to issue verifiable caste certificates

The Government of Maharashtra, one of India’s state governments, has started issuing caste certificates over the Polygon blockchain to citizens residing in Etapalli village, Gadchiroli district, as a part of the Digital India campaign. In partnership with LegitDoc, a blockchain-based application, the Maharashtra state government is in the process of rolling out 65,000 caste certificates to aid the process of delivering governmental schemes and benefits. Speaking to Cointelegraph, Indian Administrative Service (IAS) officer Shubham Gupta revealed that the Indian government is always on the lookout to implement disruptive technologies that can help democratize citizen services, adding: “Web3 takes the concept of democratization to a whole new level, whereby, data/informatio...

Law Decoded: Crypto taxes and taxes on crypto, March 21–28.

It was relatively quiet in the digital asset policy department last week, as regulators and lawmakers in most key jurisdictions retreated to their offices to do the necessary homework. In the U.S., federal agencies got on with the various reports that President Joe Biden’s recent executive orders directed them to produce. Over in the United Kingdom, both the central bank and the Financial Conduct Authority also dropped position papers on crypto-related issues. After thorough deliberation, Thailand’s financial authorities spoke out against using crypto as a means of payment, while rumors of potential legal tender adoption of crypto emerged and died in Honduras. One theme that has been conspicuous throughout the week is the relationship between digital assets and taxation. Few would argue th...

Crypto tax policy framework passes India’s parliament despite pushback from lawmakers

A tax framework on cryptocurrencies introduced by India’s Finance Minister Nirmala Sitharaman will become law in the country after being passed as an amendment to the Finance Bill. On Friday, India’s lower house of parliament, the Lok Sabha, passed the 2022 Finance Bill, which included 39 amendments proposed by Sitharaman. The amendment on crypto established a 30% tax targeting digital asset and nonfungible token transactions and did not allow for deductions from trading losses while calculating income. In addition, taxpayers in India will have an additional 1% tax deducted at source, or TDS. As per the new amendment proposed in the Finance bill 2022 to sections of crypto tax. Loss cant be set off against any profit. Similar to betting tax rules. #reducecryptotax — Aditya Singh (@CryptooAd...

RBI seemingly wants to ban cryptocurrencies, but not for the reasons you might think

On Thursday, the Reserve Bank of India, or RBI, the country’s central bank, published a critical bulletin regarding the cryptocurrency industry. While the report praised the innovative distributed ledger technology associated with digital currencies, the RBI dismissed arguments calling for the regulation of such assets and called for an outright ban. RBI’s core concerns were related to cryptocurrencies threatening the country’s financial sovereignty. The RBI wrote: “Historically, private currencies have resulted in instability and therefore, have evolved into fiat currencies over centuries. The retrograde step back to private currencies cannot be taken simply because technology allows it without considering the dislocation it causes to society’s leg...

India’s social media giant Chingari debuts an in-app crypto wallet

Chingari, the TikTok rival that launched its native $GARI token last month, is bringing more integrations onboard The giant social media platform has debuted its integrated-token wallet and plans to unveil an NFT marketplace soon India’s short video platform, Chingari, has revealed it is integrating its native $GARI token and an associated Solana wallet into the social media app. The $GARI token had already launched to 500 community members in the beta testnet at the end of last year. This was followed by the token debut on the global stage to international traders last month. Growth through incentivising content Chingari hopes to foster an expanding in-app economy which would open many innovative doors on the social media platform. Users can withdraw or deposit tokens effortlessly v...

Law Decoded: Tangible wins, new menaces and the global crypto taxation drive, Feb. 1–7

Every global event or major political crisis these days can trigger a digital asset-related conversation. As China welcomes the world’s top athletes to the Beijing 2022 Winter Olympics, showing off ultra-high-tech facilities and sports infrastructure, some United States politicians have raised concerns over the Games’ potential to act as a booster to the digital yuan’s adoption. In neighboring Myanmar, the military government that had overthrown the nation’s elected leadership a year ago is now looking into launching its own digital currency, not to project economic influence but to improve the domestic payments system and the struggling economy more broadly. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the las...

Indian couple celebrates blockchain wedding with NFT vows, digital priest

A young couple from India used nonfungible tokens (NFTs) to digitize their love for each other till eternity over the Ethereum (ETH) blockchain. The recently married couple from Pune, India, Shruti Nair and Anil Narasipuram decided to take their court marriage to the next level by hosting a blockchain wedding. According to Anil, the husband: “I read some articles on how people in other countries were doing blockchain marriages and it motivated me.” Other prominent crypto entrepreneurs to follow the trend include Rebecca Kacherginsky, Coinbase’s staff product designer. Most people get married in a place of religious worship, on a beach, or in the mountains. Peter (@_iphelix) and I are NOT most people. We got married on the #blockchain. 1/7 pic.twitter.com/2ExexrlLbZ — Rebecca Kachergi...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

Crypto tax doesn’t legalize trading, says Indian tax department chief

The head of the Central Board of Direct Taxes (CBDT) in India said the recent announcement of a 30% tax on crypto holdings doesn’t necessarily make the crypto trade legal in India. The finance minister of India announced a 30% tax on crypto holdings during the budget session on Feb. 1, triggering several headlines on the lines of “India legalizes crypto” However, CBDT chief JB Mohapatra aimed to debunk these misconceptions. Mohaptra in a post-budget presser said that the new crypto tax would help the income tax department measure the depth of the digital currency market in the country. He also stressed that imposing a tax on the nascent crypto market doesn’t necessarily legalize its trade in the country. He explained: “The crypto trade or the digital assets transactions do not ipso facto b...