Lending

Finance Redefined: DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to leverage Pocket’s distributed network of 44,000 nodes to access on-chain data from various blockchains, and gamers are plugging in DeFi through the Razer reward partnership. The majority of the top 100 DeFi tokens traded in green, with many registering double-...

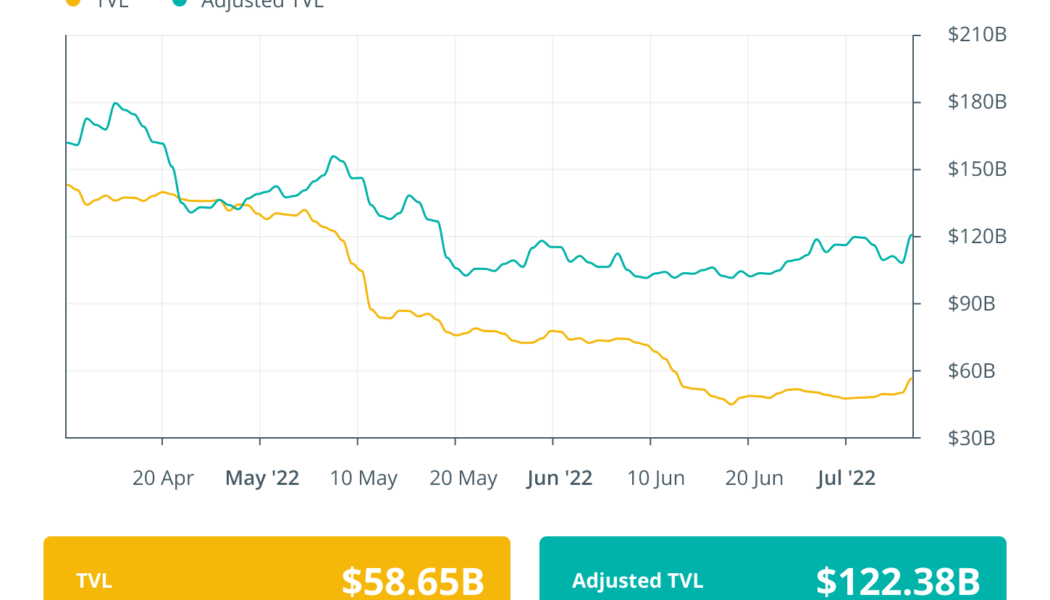

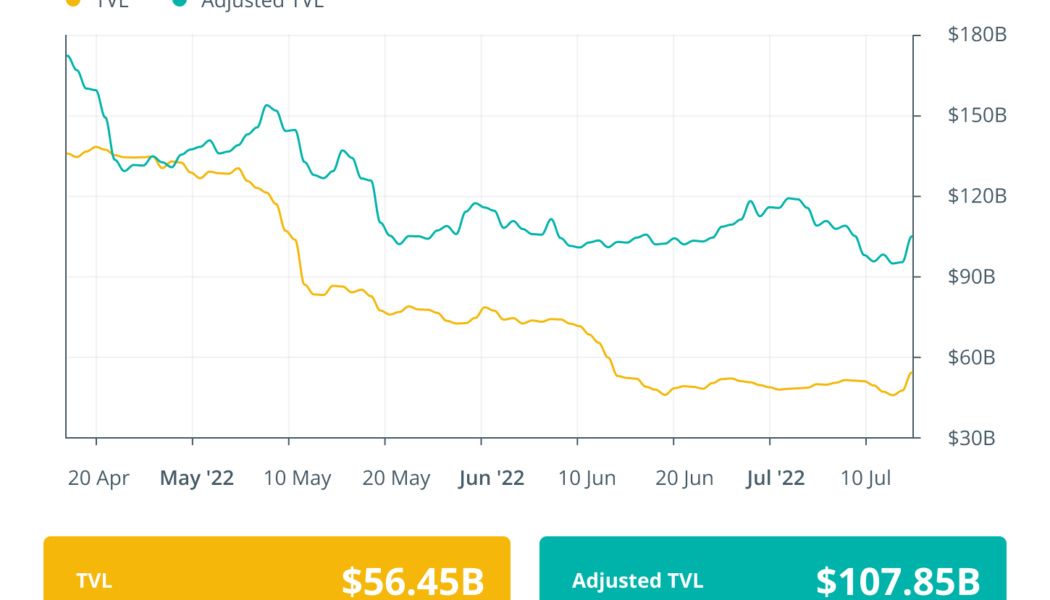

Finance Redefined: DeFi market fell off the cliff in Q2, but there’s hope

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments despite a bearish phase brought on by the lending crisis in the crypto market. Another crypto lender, Celsius, with high stakes in DeFi protocols, filed for bankruptcy. The overall DeFi market fell to new lows in the second quarter. However, a new report indicates users haven’t given up hope. BNB Chain launched a new decentralized application (DApp) platform with an alarm feature. Vermont state regulator opened an investigation into troubled crypto lender Celsius, deeming it deeply insolvent. A DeFi researcher has predicted that Ethereum proof-of-stake...

DeFi token AAVE faces major correction after soaring 100% in a month

The price of Aave (AAVE) has more than doubled in a month, but its bullish momentum could be reaching a point of exhaustion. AAVE price tests key inflection level Notably, AAVE has surged by over 103% after bottoming out locally at $45.60 on June 18, hitting almost $95.50 this July 15. Nevertheless, the token’s sharp upside retracement move has brought its price closer to the level that triggered equally sharp pullbacks since early June. In other words, AAVE has been testing an ascending trendline resistance that constitutes a “bear flag,” a bearish continuation pattern. For example, the trendline’s previous test on July 9 ended up in a 20% downside move. Similarly, a similar attempt on June 24 pushed AAVE price lower by nearly 30%. AAVE/USD daily price chart. ...

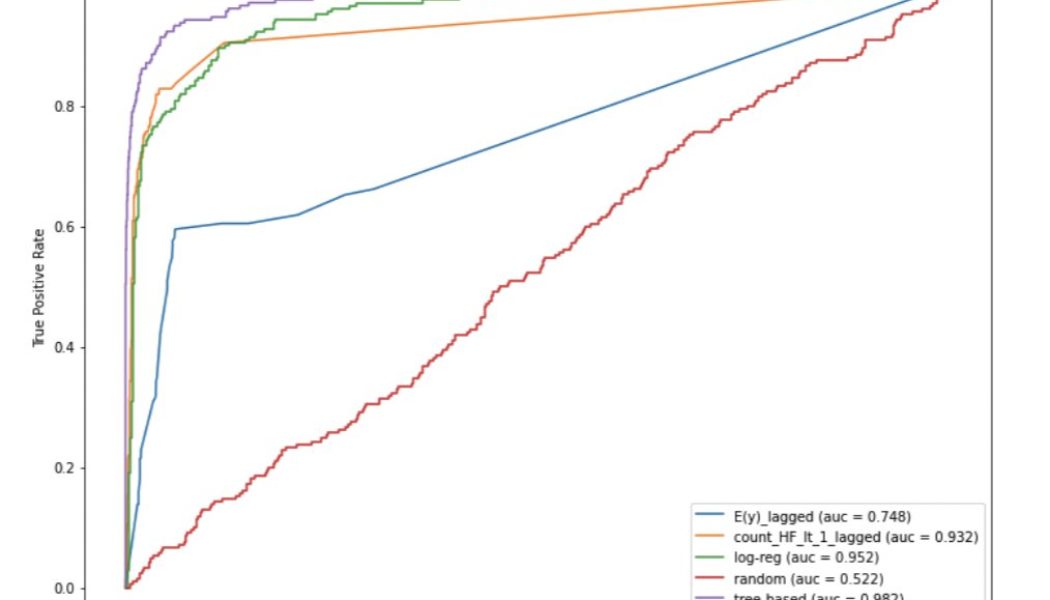

Cred Protocol unveils its first decentralized credit scores

Cred Protocol, a decentralized credit scoring startup has unveiled the results of its first automated credit scoring system for users of decentralized finance (DeFi). Cred Protocol CEO Julian Gay outlined the results in a Twitter thread, which showed how Cred successfully utilized past transaction behavior on the Aave protocol to assess the creditworthiness of future borrowers based on on-chain behavior in the DeFi space. 1/ Over the last few months, we’ve been working to build one of the first credit scores for DeFi. Today, we’re excited to share the results of our first credit score with the world! Read more below — Julian Gay (@juliangay) July 14, 2022 By using machine learning to assess time-based account attributes and analyze the user’s past transaction behavior, Cred Pro...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

Celsius denies allegations on Alex Mashinsky trying to flee US

Troubled crypto lending firm Celsius is putting their best foot forward to recover operations alongside CEO Alex Mashinsky, who currently stays in the United States, the company has claimed. A spokesperson for Celsius has denied rumors that the company’s CEO tried to flee the U.S. last week amid the ongoing liquidity crisis of the Celsius Network. The representative told Cointelegraph on Monday that the firm continues working on restoring liquidity, stating: “All Celsius employees — including our CEO — are focused and hard at work in an effort to stabilize liquidity and operations. To that end, any reports that the Celsius CEO has attempted to leave the U.S. are false.” Celsius’ statement came shortly after Mike Alfred, co-founder of the crypto analytics firm Digital Assets Data, took to T...

Not the best week for crypto lending: Law Decoded, June 20-27

Due to Celsius Network’s withdrawal suspension in mid-June, the very topic of crypto lending made its entryway to the acute issues list for the regulators. Last week, lawmakers and officials continued to raise the question of necessary action, with significant utterance belonging to one of the key European crypto skeptics, Christine Lagard. European Central Bank president got so impressed with the Celsius crisis that she coined the term “MiCa II,” referring to the main regulatory package for crypto in the European Union. Lagarde believes the new MiCa should include separate crypto-asset staking and lending guidelines. It’s not necessary to be a civil servant to discern the flaws of the current lending model, though. A hardcore Bitcoin (BTC) maximalist and Swan Bitcoin CEO...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

FTX may be planning to purchase a stake in BlockFi: Report

Crypto exchange FTX is reportedly in talks to acquire a stake in BlockFi after the company issued a $250 million credit to the lending firm. According to a Friday report from the Wall Street Journal, FTX is currently in discussions with BlockFi regarding the crypto exchange purchasing a stake in the firm, but no equity agreement has been reached. The reported ongoing talks followed BlockFi signing a term sheet with FTX to secure a $250 million revolving credit facility on Tuesday. “BlockFi does not comment on market rumors,” a BlockFi spokesperson told Cointelegraph. “We are still negotiating the terms of the deal and cannot share more information at this time. We anticipate sharing more on the terms of the deal with the public at a later date. FTX founder and CEO Sam Ban...

Celsius Network hires advisers ahead of potential bankruptcy: Report

Crypto lending platform Celsius Network has reportedly onboarded advisers from a management consulting firm in advance of the company possibly facing bankruptcy. According to a Friday report from the Wall Street Journal, Celsius hired an unknown number of restructuring consultants from the firm Alvarez & Marsal to advise the platform on potentially filing for bankruptcy. The report followed one from June 14, which said Celsius had hired lawyers in an attempt to restructure the company amid its financial issues. Steady lads https://t.co/5YAdmq5kt8 — Ben McKenzie (@ben_mckenzie) June 24, 2022 Celsius has been at the forefront of discussions in the media around significant volatility in the market amid the crypto lending platform’s decision to pause “all withdrawals, swaps and transfers b...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

ECB head calls for separate framework to regulate crypto lending

A week after the major American crypto lending platform Celsius had to freeze the withdrawal option for its users, European Central Bank (ECB) president Christine Lagarde voiced her conviction on the necessity of tighter scrutiny over this part of the crypto market. During the testimony before the European Parliament on Monday, June 20, Christine Lagarde expressed her thoughts not only about the looming inflation in Europe and around the globe but also about the increasing activities of crypto-assets staking and lending. In Lagarde’s opinion, this trend demands additional regulatory efforts from the European Union (EU). Referring to the major regulatory package, making its way through the legislative routine, Markets in Crypto-Assets (MiCa), she even coined the term “MiCa II”: “MiCA ...